We stand on the brink of another new year, eagerly awaiting 2024. The payment industry is gearing up for a captivating journey through a landscape of innovation and the latest trends.

From the humble beginnings of electronic funds transfers in 1871 to the groundbreaking introduction of the modern credit card by Bank of America in 1958 (Ayoconnect, 2022), the payment industry has aged like a fine wine. The advent of the U.S. Advanced Research Projects Agency Network in the 1960s laid the groundwork for the Internet as we know it today, unlocking a world of possibilities for the future of payments. Amidst the teacup clinks and the chatter of conversations, the subtle sound of credit card swipes, mobile transfers, QR code scans, and various other non-cash transactions quietly paints our daily routine.

In this blog post, we will explore the top 5 payment industry trends in 2024 that are anticipated to redefine the financial landscape—a journey worth keeping a close eye on.

1. Convenience is the choice Mobile payments and digital wallets will dominate 2024

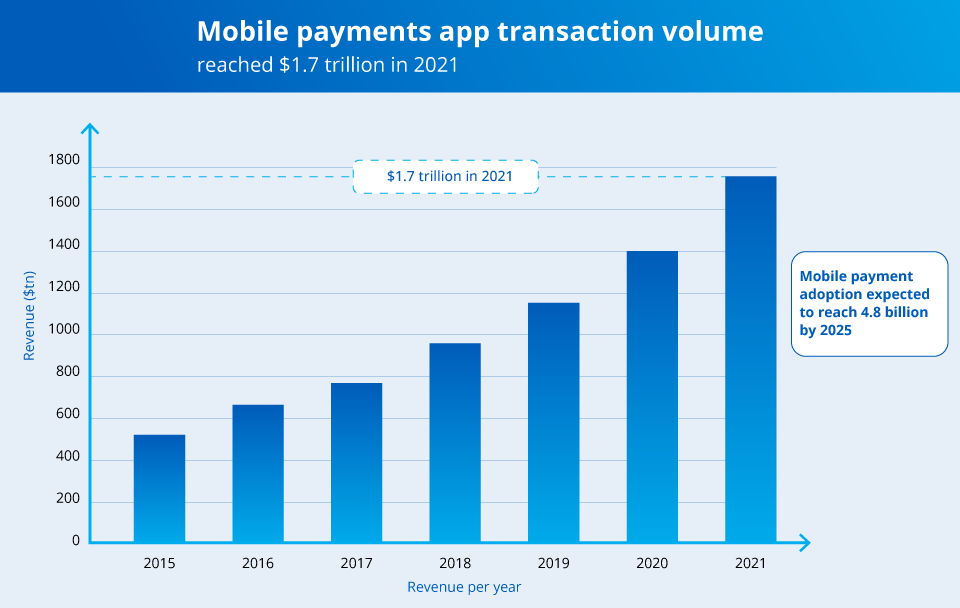

In 2024, we witness a paradigm shift as convenience takes the forefront. With mobile payment adoption expected to reach 4.8 billion by 2025, leaders in a specific country or region could see remarkable revenue growth, especially as many mobile apps are heavily integrated into the provider’s other financial services. Statistics show that the volume of mobile payment transactions reached $1.7 billion in 2021, a 27% annual increase. Over two billion people used mobile payments in 2021. (Curry, 2023) This growth can be attributed to the convenience and security digital wallets offer.

Mobile payments have revolutionized people’s transactions, allowing them to pay for goods and services quickly and easily using their smartphones. With the increasing popularity of e-commerce, digital wallets have become a preferred payment method for many consumers. Not only do they provide a secure way to store payment information, but they also offer additional features such as loyalty programs and rewards. Digital wallets have also gained traction in offline retail, with more and more businesses accepting mobile payments through platforms like Apple Pay and Google Pay. As technology advances, we can expect digital wallets to become even more prevalent, transforming how we handle our finances.

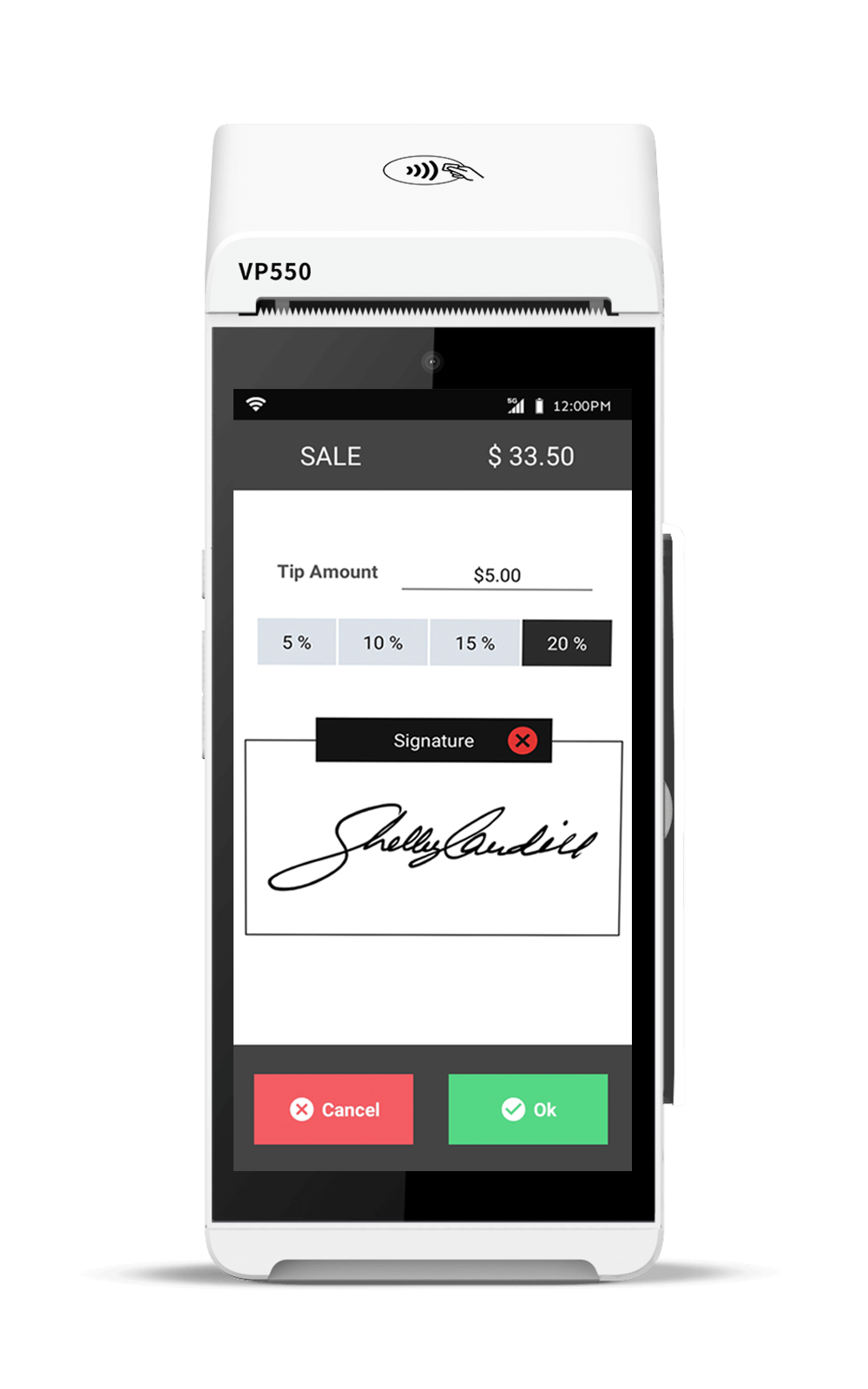

2. Contactless payments: Transforming the face of payment technology

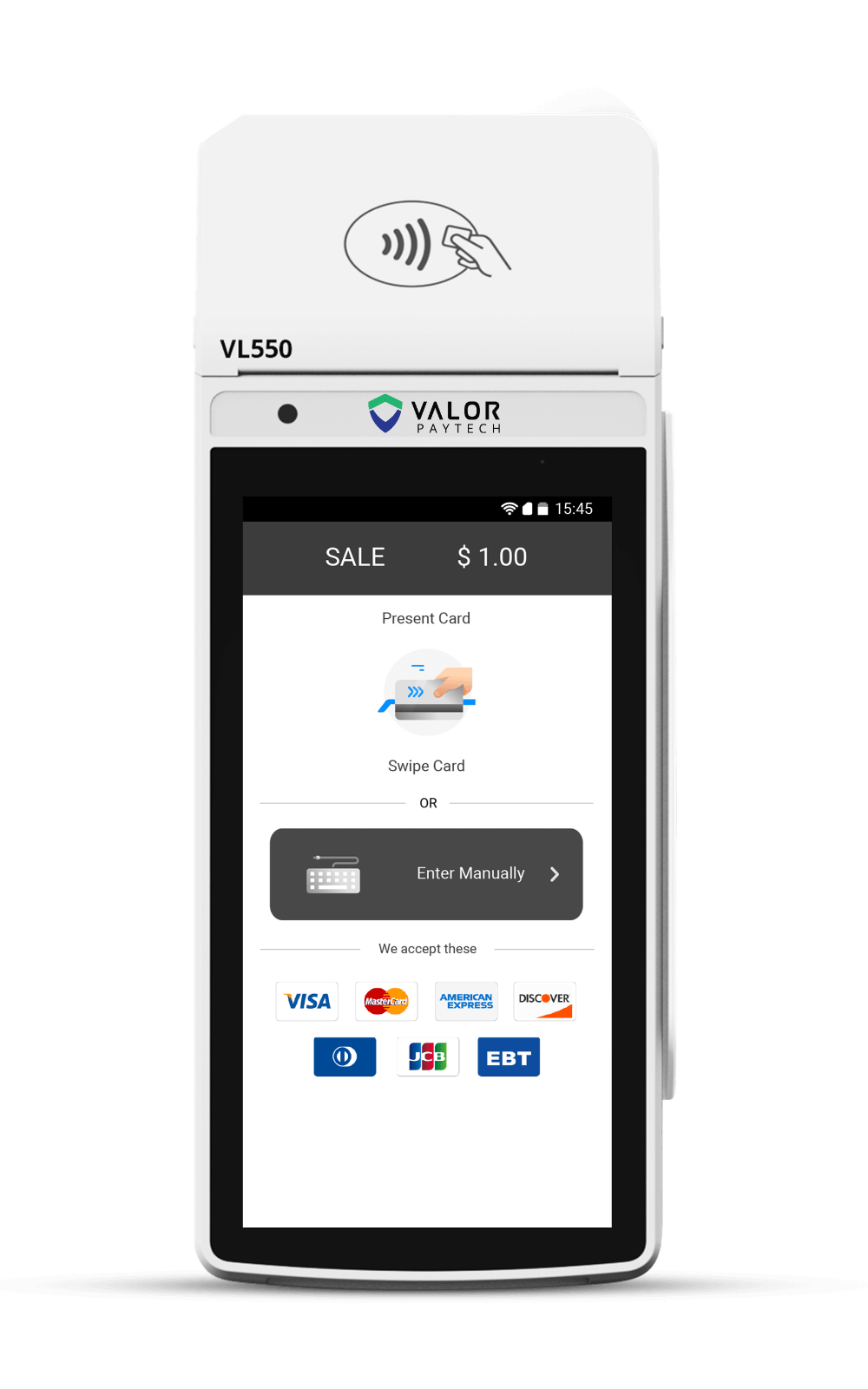

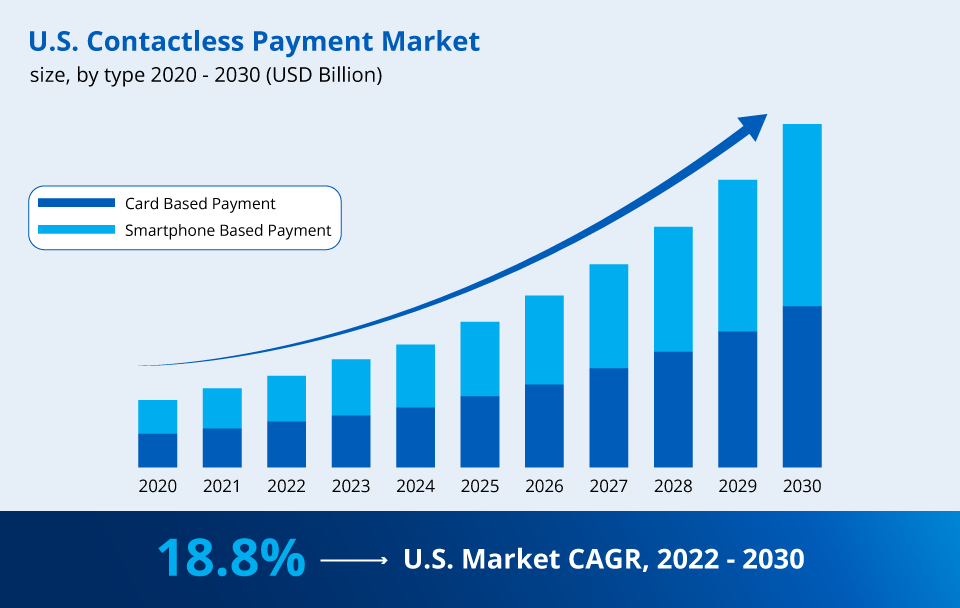

The global contactless payment market was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030. The growth is attributed to the increasing global adoption of digital payment platforms for faster payments (Contactless Payment Report, 2030). This surge in popularity can be attributed to the convenience and security offered by contactless payments, allowing consumers to tap their devices to complete transactions quickly and securely without any physical contact or the hassle associated with carrying cash.

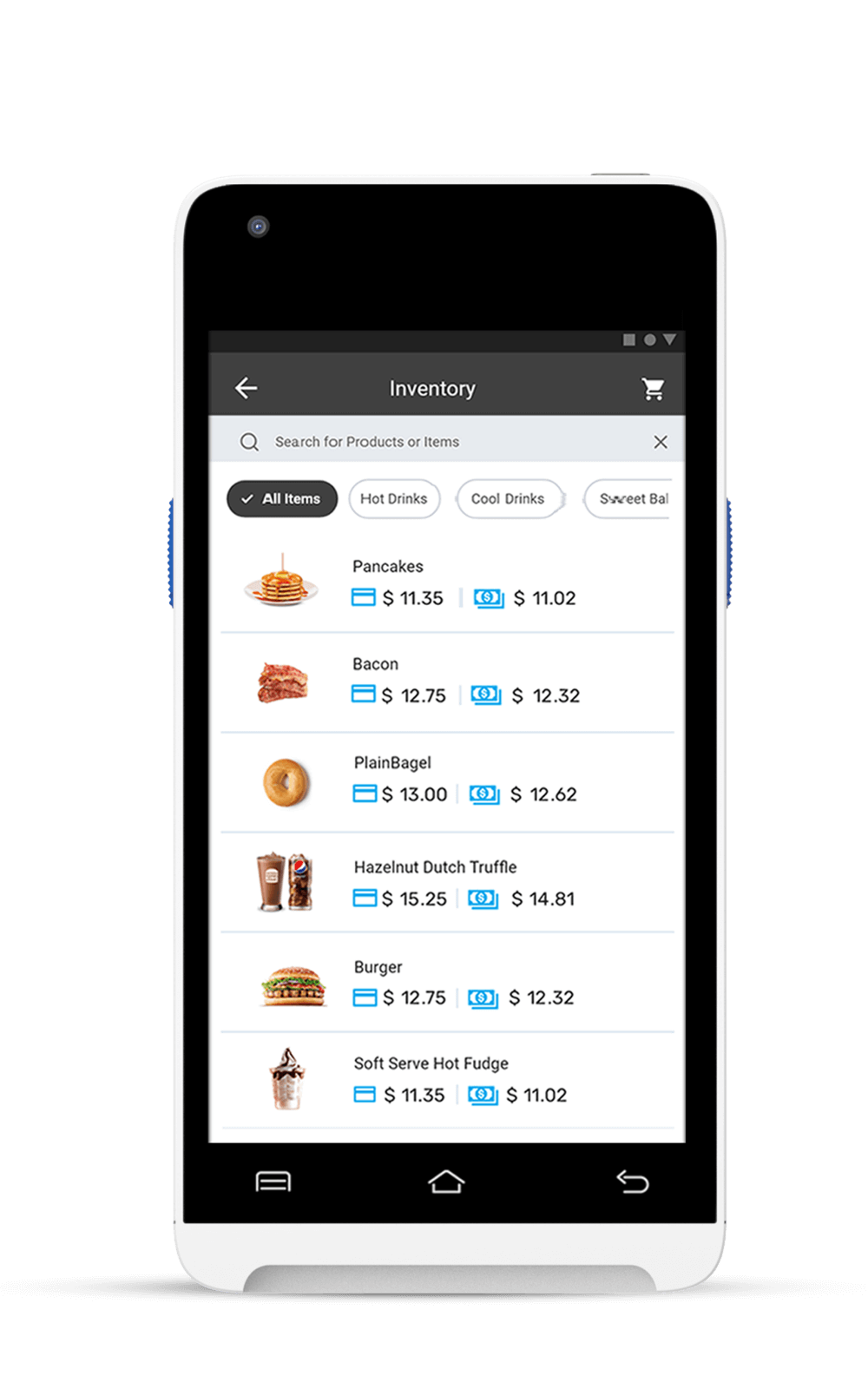

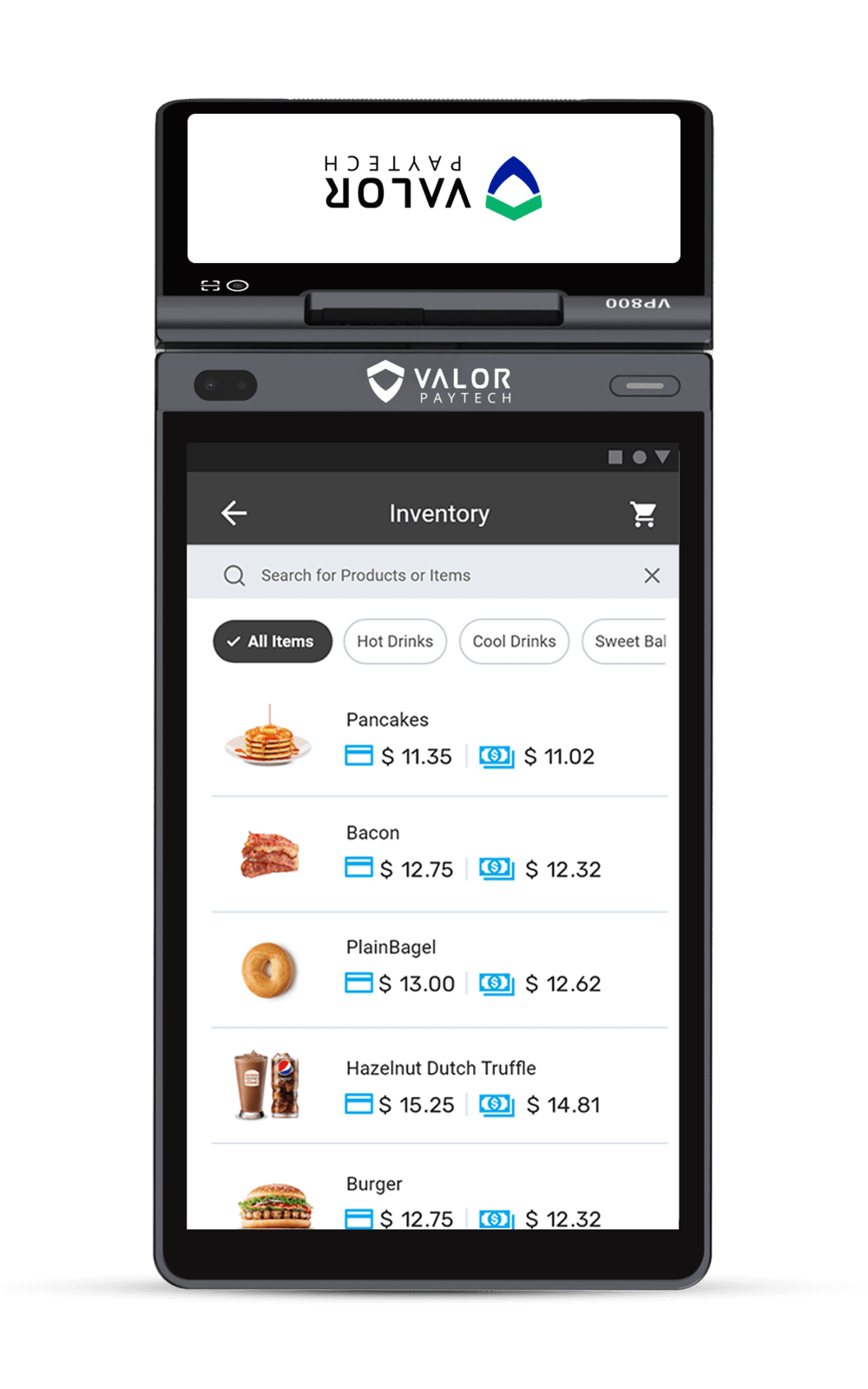

Card issuers are increasingly implementing contactless mechanisms for payment cards across the globe, thereby contributing to the market’s growth. Valor Paytech continues to focus on the ease of payment acceptance for all methods across all POS terminals. The contactless payments are offered by all our POS terminals, as well as the security features.

The Vault makes transactions more accessible and secure for merchants by providing a safe and compliant way to store and access customer card information. Valor Updater keeps your payment card data accurate and minimizes declined transactions and authorization fees by providing timely updates on Visa®, Mastercard®, American Express®, and Discover® cardholders. Valor Shield and certified processors add multiple transaction security levels, helping prevent problematic transactions.

3. B2B Excellence and Innovative Partner Programs Reshaping Business Transactions

In business transactions, the future unfolds with B2B excellence and innovative partner programs. According to HubSpot’s 2022 survey, almost half of organizations attribute at least 26% of their revenue to partners, with 12.6% deriving over half of their revenue from partner relationships. (Fostering B2B Loyalty). B2B organizations acknowledge the growing significance of brands, with approximately 6 in 10 B2B marketing leaders globally noting the importance of brand building in response to economic conditions. Moreover, there’s a reported uptick in spending among B2B marketing leaders to enhance brand awareness. (Fostering B2B Loyalty Through Partner Programs, n.d.)

Navigating the future of business-to-business (B2B) interactions, Valor PayTech brings B2B programs and innovative partner solutions to the forefront. Embracing the future of financial transactions, Valor PayTech has ACH processes, sustainable e-invoicing solutions, exclusively customized white-labeled brochures, and marketing materials for our Independent sales organization (ISO) partners and independent software vendor (ISV) partnerships. Our commitment extends to hosted payment pages and shopping cart integrations, ensuring a comprehensive and streamlined experience.

Moreover, our compatibility with QuickBooks adds a layer of efficiency to financial operations. Valor PayTech is not just keeping pace with industry trends but setting new standards for the B2B landscape, offering a diverse array of programs and integrations to meet the evolving needs of businesses.

At Valor PayTech, our partners can take advantage of L2 and L3 transactions, which offer significant benefits in increased savings and interchange. L2 transactions refer to level 2 data, which includes additional information beyond the basic transaction details. This additional data allows for better categorization and analysis, resulting in potential business cost savings. L3 transactions, on the other hand, involve even more detailed line-item data, enabling enhanced reporting and analysis capabilities. By utilizing L2 and L3 transactions, businesses can optimize their interchange rates, reducing costs and increasing savings in the long run.

4. Empowering customer experiences with loyalty programs & recurring payments

Loyalty rewards programs and gift card offerings both play a role in keeping customers coming back to their stores. On average, U.S. consumers belong to 16.6 loyalty rewards programs and actively use about half of them. Additionally, Oracle research found that 77 percent of millennials redeem loyalty rewards at least once per quarter. (Dougherty, 2023)

Gift cards also encourage return visits. Research shows gift cards are likely to bring in additional revenues. Blackhawk Networks research shows consumers spend $31.75 more on average than the face value of a gift card. (Get the Facts on Gift Cards, n.d.) According to Oracle, millennials are most willing to pay for premium loyalty programs. 70% of millennials understand the value of loyalty programs and are more willing to pay a premium in exchange for valuable perks such as the free shipping provided by Amazon Prime. (Oracle, 2020)

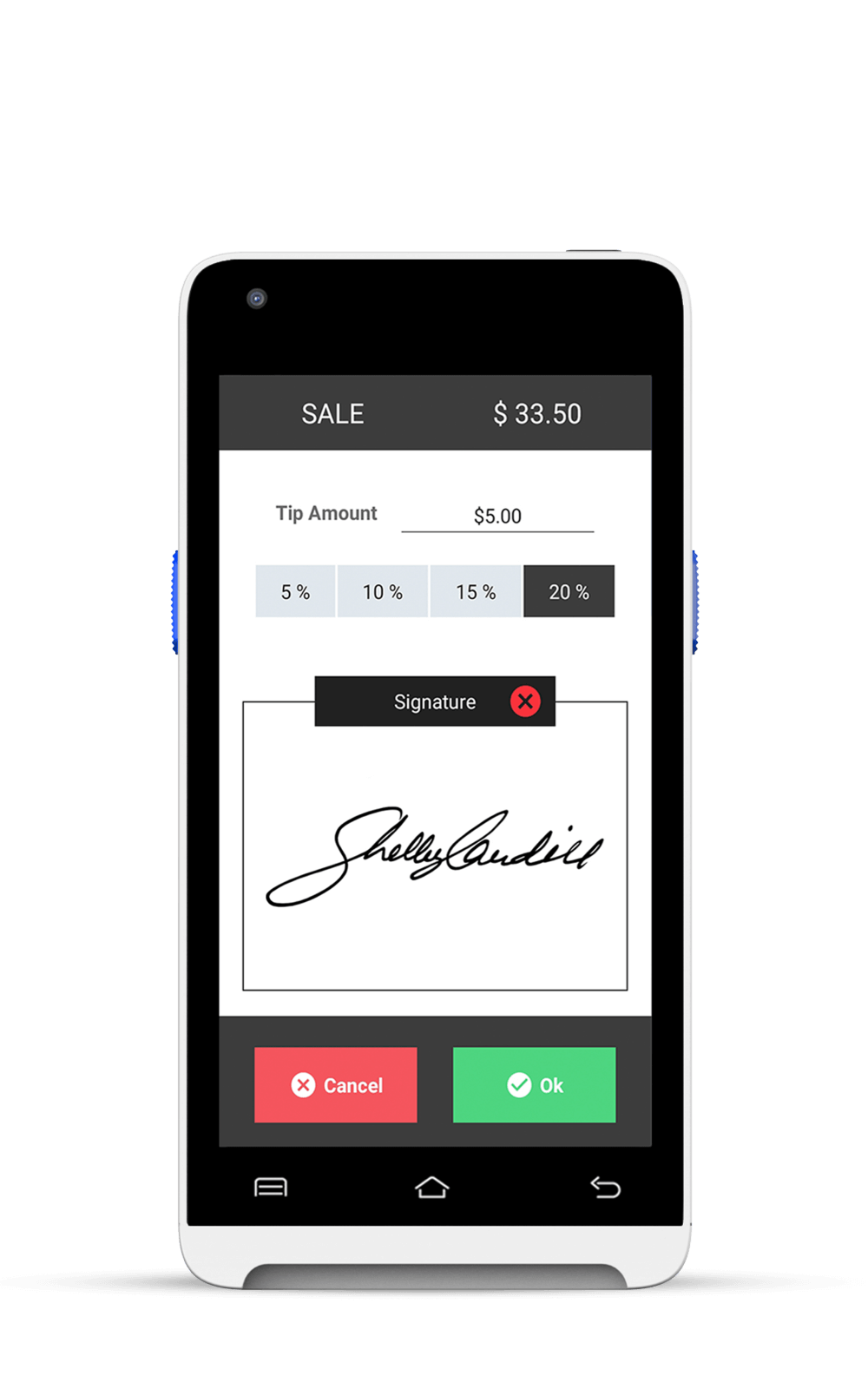

Valor PayTech’s Engage My Customer™ feature reinvents customer engagement with the changing payment landscape. Driven by customizable filters like VIP status and shopping patterns, it empowers businesses to create personalized marketing campaigns. It ensures multi-channel communication with SMS, email, and paper receipt marketing options. Not only does it enhance customer retention by addressing negative feedback instantly, but it also targets VIPs and large spenders, fostering loyalty. Embracing the wisdom that customer satisfaction is worthless while loyalty is priceless, we now offer a tool to hold the priceless under your wraps securely.

Offering secure and easy recurring payments is becoming the new norm for a positive customer experience. Tools to ensure the card information remains safe and up-to-date, like Valor Updater and The Vault, will continue to drive innovation. Valor Updater streamlines business operations by updating expired card details, whereas The Vault protects and encrypts card information, keeping it safe and ready for frequent, recurring transactions

5. The Confluence of AI and Blockchain: Reshaping Financial Horizons

Artificial Intelligence and its advancements in machine learning algorithms utilize sophisticated tools to optimize and secure financial transactions. AI advancements in predictive data analysis play a vital role in fraud detection, predicting consumer spending patterns, and streamlining transaction processes. Natural Language Processing (NLP) powers chatbots, enhancing customer service by understanding and responding to inquiries. As the saying goes, it’s not magic; it’s the power of artificial intelligence, and we are on the brink of witnessing its enchanting possibilities unfold in the global payment landscape.

Inspired by the human brain, neural networks identify anomalies in large datasets, particularly crucial in fraud detection. Predictive analytics leverages statistical algorithms to forecast transaction volumes, aiding resource management during peak periods. Blockchain is another technology that has the potential to reshape the financial sector and emerge as the most populist payment industry trend in 2024.

Blockchain is a secure, unalterable ledger facilitating real-time, transparent data exchange among multiple parties during transactions. This network seamlessly tracks various elements like orders, payments, and production. With members sharing a unified view, trust and confidence in transactions are bolstered, leading to enhanced efficiencies and new opportunities. (Blockchain and Artificial Intelligence (AI), n.d.)

Blockchain technology synergizes with AI and offers decentralized and secure transaction ledgers. Know Your Customer (KYC) processes benefit from AI’s natural language processing, enhancing identity verification. Automated transaction analysis simplifies spending tracking, enabling businesses to forecast revenue and analyze market trends effectively. Personalized customer experiences, driven by AI, improve satisfaction and loyalty. AI’s real-time risk assessment is pivotal in lending, making informed decisions, and reducing errors. To learn more about AI and payments at AI & Payments | Valor PayTech.

Conclusion

As we traverse the payment industry trends in 2024 and beyond, it becomes evident that technological innovations and out-of-the-box thinking, coupled with a focus on customer experience and satisfaction, are the guiding forces behind the evolution of payment technology. The convergence of cutting-edge technologies, from AI to blockchain, multiple payment industry trends reshapes how transactions unfold. Mobile payments, contactless transactions, B2B excellence, customer loyalty programs, and the dynamic duo of AI and blockchain collectively define the future of financial transactions.

Embracing these trends positions businesses at the forefront of a rapidly evolving industry, where adaptability and forward-thinking pave the way for unprecedented possibilities. The journey into the future of payments is exciting and transformative, promising a seamless blend of convenience, security, and personalized experiences. In this era of technological brilliance, Valor PayTech is bringing out its best from the arsenal to set the stage for a new era of financial interactions and payment technologies.

Ready to get started?

Become a Partner Today!

Complete the form below.