Introduction to AI in Payments

Artificial Intelligence (AI) is quietly revolutionizing the world of payments, promising faster, safer, and smarter transactions. From fraud detection to hyper-personalized experiences, AI in payments is reshaping financial services in profound ways. Here’s how AI is creating a smarter, more secure, and seamless payment ecosystem.

Fraud Detection and Prevention

Security remains a top priority, and AI in payments enables real time fraud detection by analyzing data for suspicious patterns. Machine learning models continuously improve fraud detection by learning from past data and adjusting to emerging fraud trends. Major payment players leverage AI technology, ensuring more secure transactions. The integration of advanced AI techniques like deep learning has further enhanced fraud prevention capabilities.

Smarter Risk Management

Risk assessment is another key application of AI in payments. Using algorithms to process diverse data sources, AI improves risk evaluations, making lending and underwriting faster and more accurate. By minimizing reliance on manual processes, AI provides timely, reliable risk assessments for businesses and consumers. The fusion of AI and blockchain offers transparent and tamper-proof risk management solutions.

Predictive Analytics and Insights

AI-driven predictive analytics offer businesses data-driven insights, forecasting customer behavior, optimizing processes, and identifying new revenue streams. By harnessing vast data sets, AI in payments allow businesses to provide tailored payment solutions based on real-time insights. With AI evolving, these analytics are becoming even more accurate and instantly accessible. The integration of AI with big data and IoT devices provides deeper insights and more precise forecasts.

Real-Time Payments and Settlements

AI facilitates faster, more efficient payment processing, allowing real-time settlements that boost liquidity and transaction speed. By automating payment processes, AI eliminates delays associated with manual steps.

Advancements like the Fed Now program aim to bring real-time payments mainstream. The adoption of blockchain technology has also streamlined real-time payment processing and settlements, reducing friction and enhancing transparency.

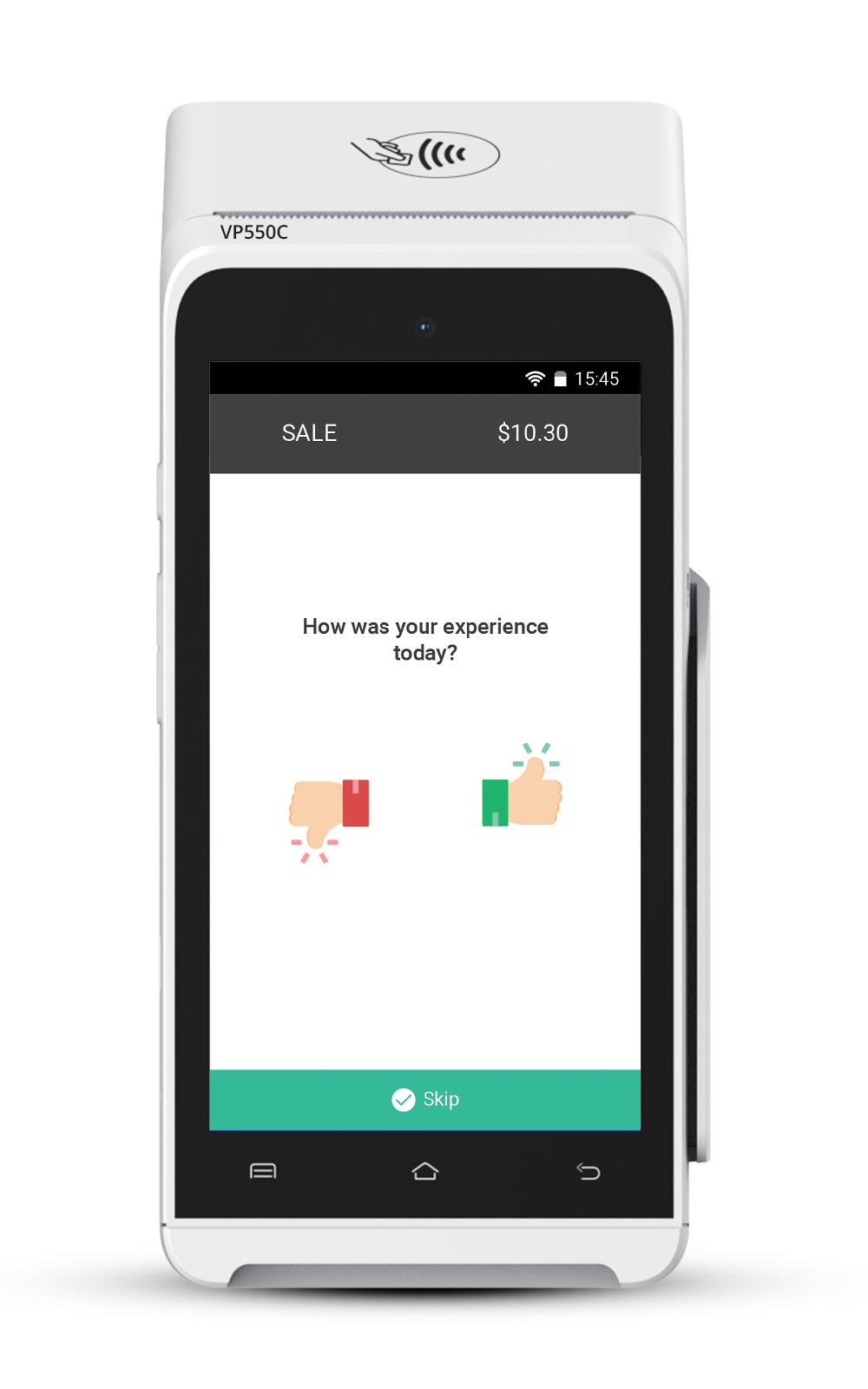

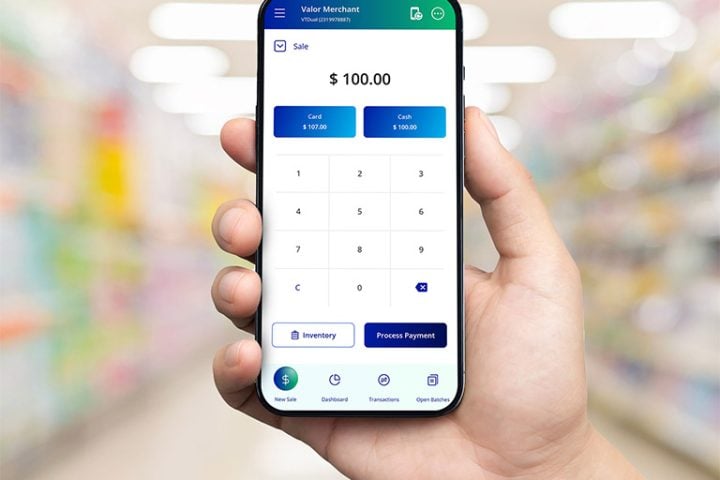

Hyper-Personalization with AI in Payments

AI enables hyper-personalized payment experiences by tailoring transactions based on individual behavior and preferences. From custom promotions to flexible payment methods, AI in payments deliver a user-centric experience. Soon, virtual AI assistants could manage complex payment requests, offering support and guiding customers through transactions with almost humanlike understanding. Integration with smart home devices and wearables enhances the level of personalization, providing seamless payment experiences.

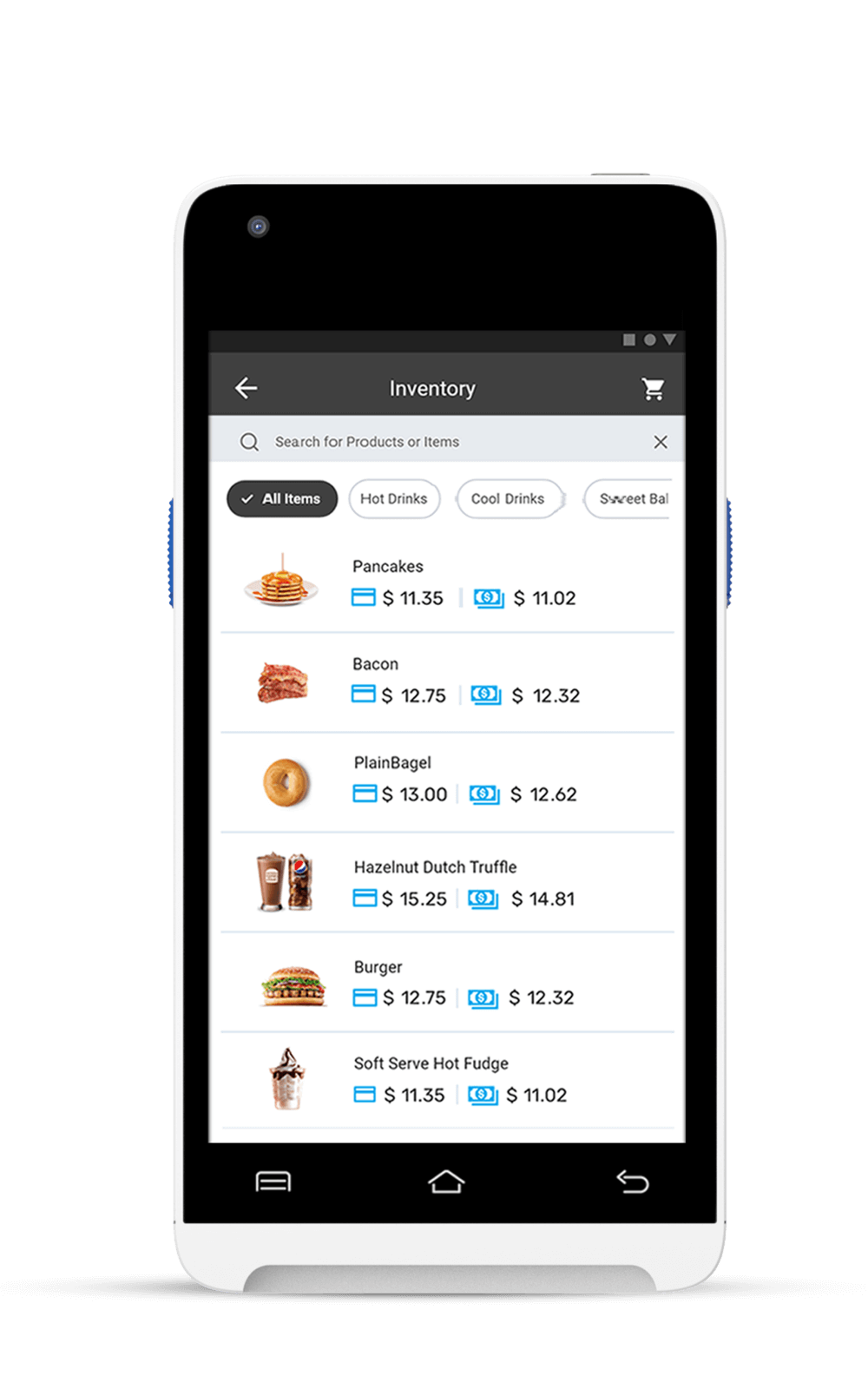

Contextual Purchasing via AI in Payments

AI is driving personalized shopping experiences. By analyzing purchase history and preferences, AI can predict and suggest items a user might want, often in real-time.

Beyond recommendations, AI understands location data, time, and social media activity to suggest relevant offers. Imagine receiving a discount alert for a nearby store you frequent AI is making this a reality. Enhanced with AR and VR technologies, AI in payments offer immersive and contextually aware shopping experiences.

Regulatory Compliance

AI in payments automate regulatory tasks such as Anti-Money Laundering (AML) and Know Your Customer checks, analyzing data for compliance risks while reducing manual workload. Though still developing, AI compliance solutions are anticipated to become standard practice across financial services, aiding businesses in maintaining stringent security protocols. AI-driven compliance monitoring ensures real-time adherence to evolving regulations, significantly reducing the risk of non-compliance.

AI will further revolutionize risk assessment and underwriting processes. Advanced algorithms will analyze a wide range of data sources, including non-traditional data, to provide more accurate risk assessments, enabling faster and more efficient lending and underwriting decisions and reducing the reliance on manual processes.

Autonomous Payment Ecosystems

AI supports the development of autonomous ecosystems, where devices handle transactions without intermediaries. Smart contracts powered by AI enable secure, automated peer-to-peer transactions. The potential for decentralized, self-executing systems makes AI essential to the future of commerce. AI-driven autonomous systems, combined with IoT, facilitate machine-to-machine payments, opening new avenues for industrial automation and efficiency.

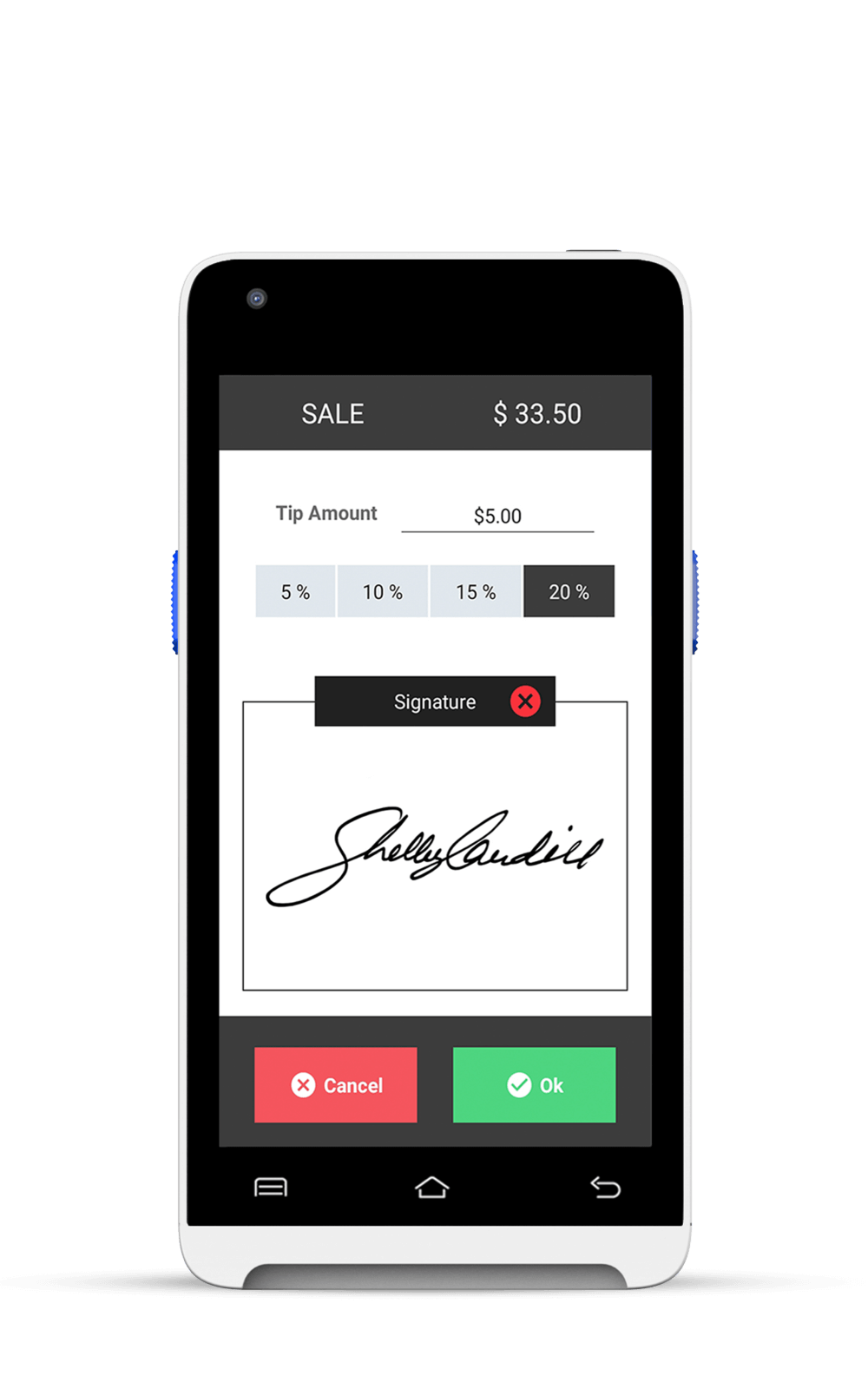

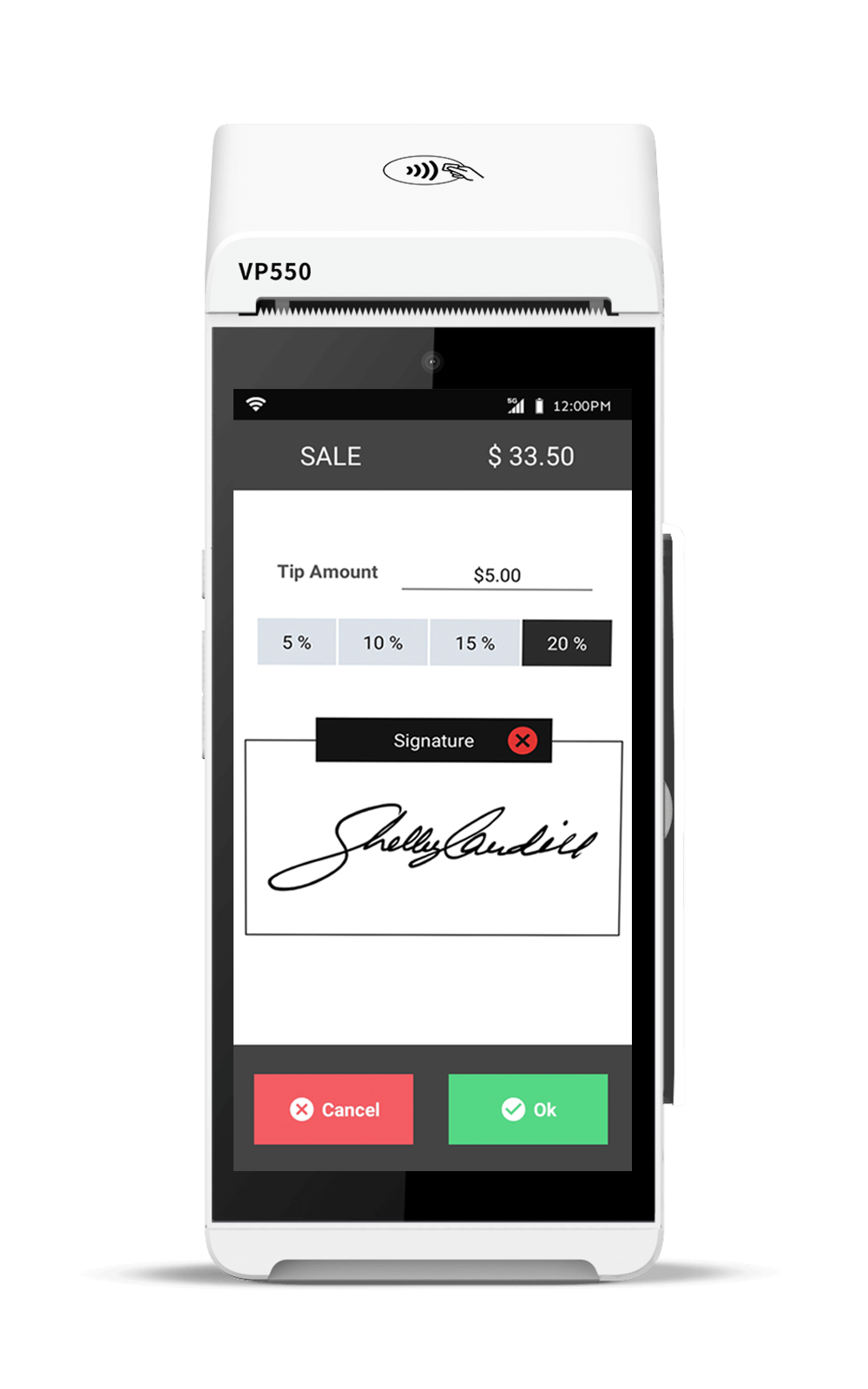

Biometric-Driven Identity and Security

AI in payments enhances security through biometric data like facial recognition and iris scans. This approach ensures frictionless transactions, securing payments with high accuracy. With AI, identity verification is becoming increasingly sophisticated, providing a seamless yet secure user experience. Multi-modal biometric systems, integrating fingerprint, voice, and facial recognition, offer robust security measures, reducing the risk of identity theft.

AI-Powered Smart Contracts

By using real time data, AI in payments enables dynamic, self-executing contracts. Smart contracts streamline business processes by automatically triggering actions based on pre-set conditions, ensuring that obligations are met, and payments are made as agreed. Integration with blockchain technology enhances the security and transparency of AI-powered smart contracts, ensuring trust and accountability.

Security and Ethical Concerns in AI-Powered Payments

With all its benefits, AI in payments comes with considerations around security, privacy, and fairness. Here are some crucial areas where AI must exercise caution:

1. Data Privacy

AI systems rely on massive data sets, making data protection a priority. Payment providers must secure customer data with encryption, anonymization, and storage protections to maintain trust and regulatory compliance. Implementing strong data governance frameworks is essential to ensure ethical and secure data usage.

2. Vulnerabilities and Attacks

The design of AI systems must guard against adversarial attacks. Regular audits, testing, and monitoring are critical to protecting AI algorithms from exploitation. Enhancing AI systems with robust cybersecurity measures and ensuring continuous monitoring can mitigate potential threats.

3. Bias and Fairness

Since AI algorithms are trained on historical data, they may inadvertently reflect biases. Ensuring fairness requires developers to implement checks that prevent discriminatory practices and improve decision making transparency. Continuous assessment and updating of models of AI in payments can help address biases and promote fairness.

4. User Consent and Control

AI must prioritize transparency. Customers should understand how their data is used, with accessible controls and privacy protections in place. Transparency fosters trust and aligns AI practices with ethical standards. Educating users about AI systems and their data rights is crucial for fostering an environment of trust and responsibility.

AI is shaping a future where transactions are fast, personalized, and secure. By embracing AI in payments, the industry can enhance customer experiences while maintaining stringent security. Whether it’s fraud prevention, hyper-personalization, or autonomous payments, AI offers transformative potential for both consumers and businesses.

FAQs

1. What is the role of AI in the fintech industry?

The role of AI in the fintech industry enables fintech companies to automate manual processes, enhance customer experiences, and improve financial risk management.

2. How is AI used in the payment industry?

The payment industry has significantly leveraged AI to enhance security, efficiency, and customer experience. AI is also applied in various ways, such as anomaly detection, payment processing, customer service, risk management, personalization, and so on.

3. How does AI in payments industry help prevent fraud?

AI plays a significant role in preventing fraud in payments by analyzing patterns and behaviors that may indicate suspicious activity.

4. Can AI detect and fix biases in payment algorithms?

Yes, AI can detect and potentially mitigate biases in payment algorithms. Machine learning models can identify patterns and anomalies in data that may indicate bias, such as discriminatory lending practices or unequal payment processing.

5. How does AI protect user data in payment systems?

AI-powered systems can continuously monitor and analyze user behavior, enabling real-time identification of anomalies that may indicate data breaches. This proactive approach ensures that user data remains secure and protected within payment systems.

Sources:

Ready to get started?

Become a Partner Today!

Complete the form below.