Credit card surcharging is a pricing strategy many merchants adopt to offset the rising costs of credit card processing fees. In simple terms, when a customer pays with a credit card, the merchant adds a fee to the transaction. This surcharge is meant to help cover the cost of card processing fees, which merchants incur when accepting credit card payments. However, it’s important to note that the fee cannot be applied to Debit, EBT, or Gift Card transactions.

Legal Considerations

While surcharging is legal in most U.S. states, merchants need to follow the rules set by major credit card networks like Visa, Mastercard, and American Express, as well as state laws regarding surcharges. These rules typically require merchants to disclose the fee to customers before they make a purchase and limit the surcharge to a certain percentage of the transaction amount (usually up to 4%). Staying compliant with these regulations is key to avoiding fines or legal complications.

Benefits and Challenges

Surcharging can be a valuable tool for merchants to recover costs, but it comes with its own set of challenges. On the one hand, businesses can save significantly by passing the processing fees to customers. On the other hand, adding a fee might not sit well with some customers, potentially driving them to competitors who don’t impose such fees.

One way to soften the impact is to educate customers about why the surcharge exists. By explaining that the fee helps cover the cost of card transactions and offers customers the flexibility of credit card payments, merchants can build trust and transparency. Moreover, offering loyalty programs, rewards, or other incentives can encourage customers to continue shopping with the merchant, even with the fee in place.

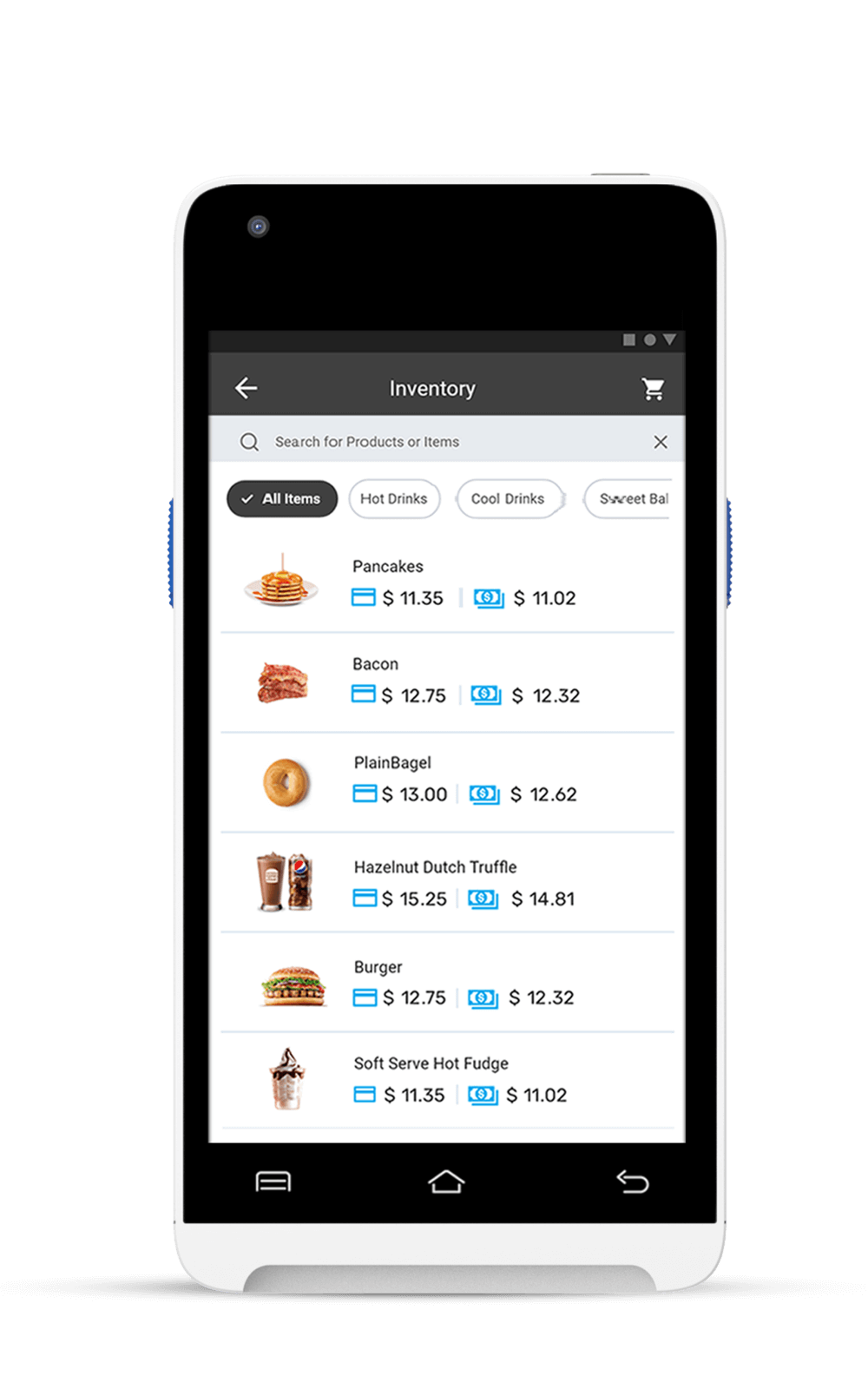

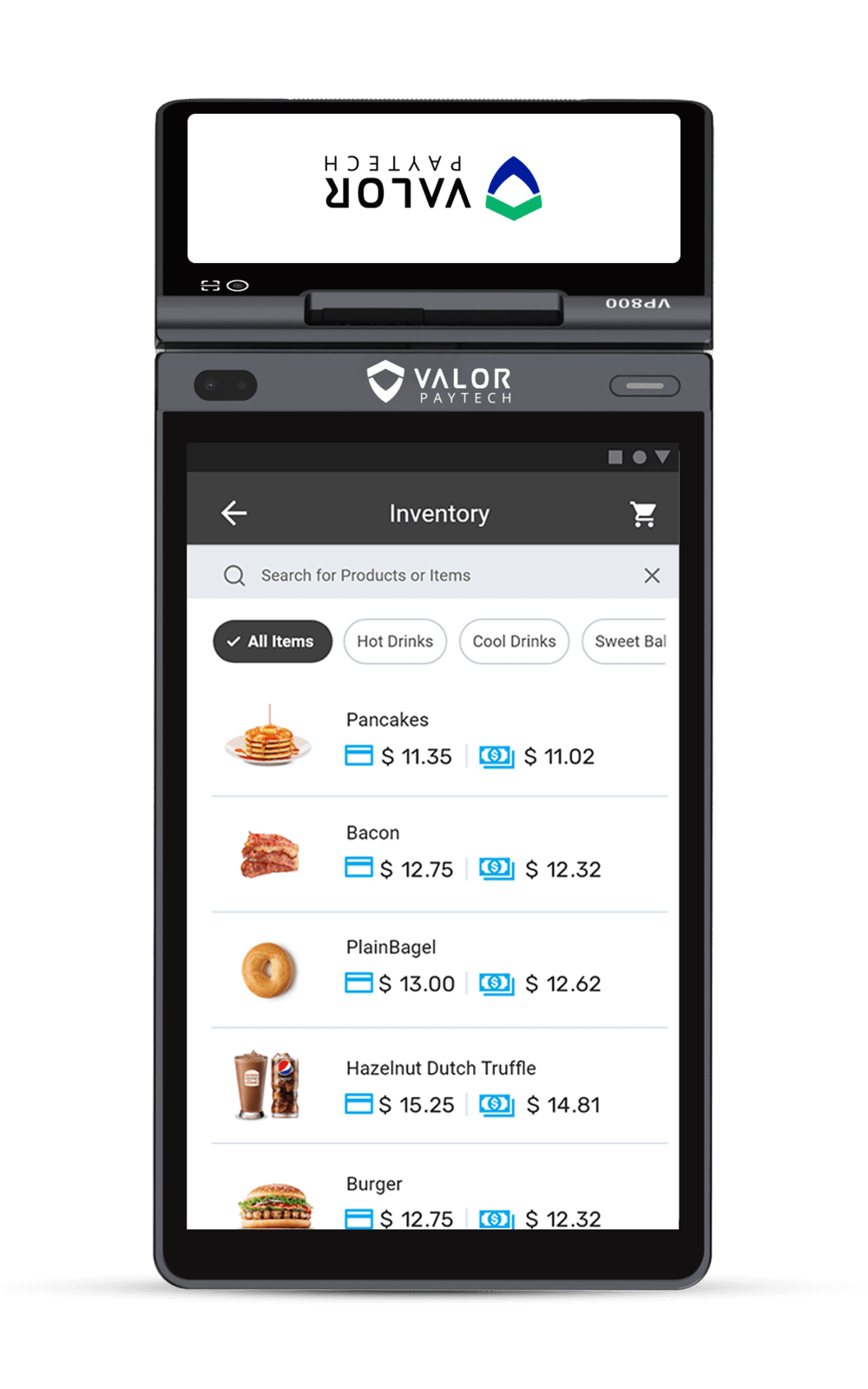

Implementing a Surcharge Program

Deciding to implement this program is ultimately in the hands of the merchant. The potential savings from surcharging can be significant, but it’s important to weigh that against customer reactions and the overall shopping experience. Before diving in, merchants need to ensure they comply with all relevant rules and regulations and have a clear communication plan for customers.

Surcharging and Customer Loyalty

For businesses concerned about how a surcharge might affect customer loyalty, transparency and communication are key. Rather than surprising customers at checkout, merchants should clearly indicate the fee upfront, ideally on both in-store signage and digital channels.

Customers who understand why the surcharge exists may be more willing to accept it, especially if they value the convenience of using a credit card. However, merchants should also emphasize alternative payment methods, like cash or debit cards, which don’t carry the additional fee. Offering customers a choice can help mitigate any negative feelings and promote long-term loyalty.

Conclusion

Surcharging is a powerful tool for businesses looking to offset the cost of credit card transactions. However, careful consideration of legal, customer service, and communication aspects is crucial. By complying with state laws and credit card network rules and focusing on transparency, businesses can implement a surcharging program that benefits both them and their customers.

Missed parts 1 or 2 of the Evolution of Pricing series?

Read more about Cash Discount & Dual Pricing.

FAQ

1. What is credit card surcharging?

Credit card surcharging is a pricing strategy where merchants impose an additional fee on customers who pay with a credit card. This surcharging is intended to help cover the rising costs of credit card processing fees that merchants incur.

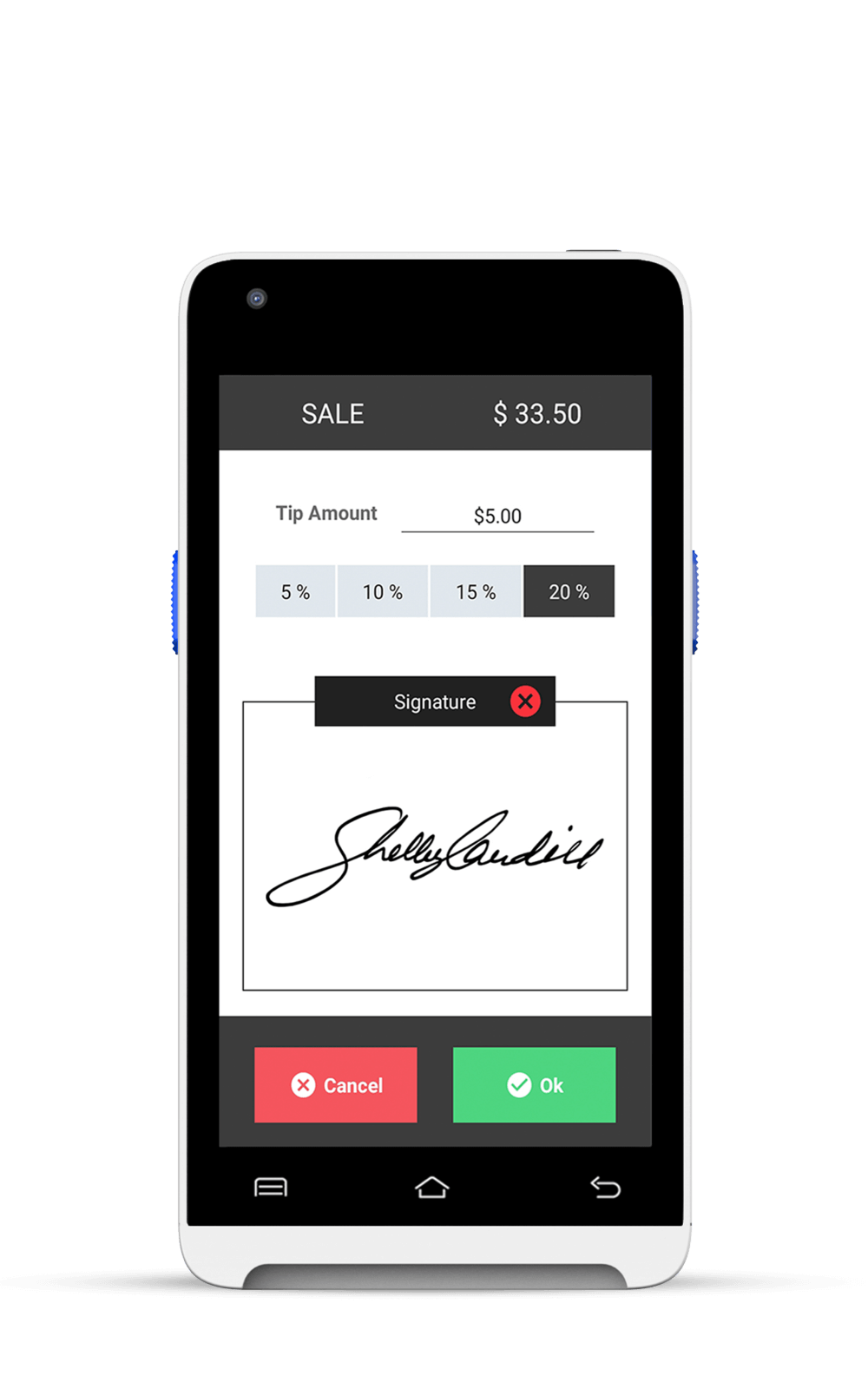

2. How should I inform customers about the surcharge?

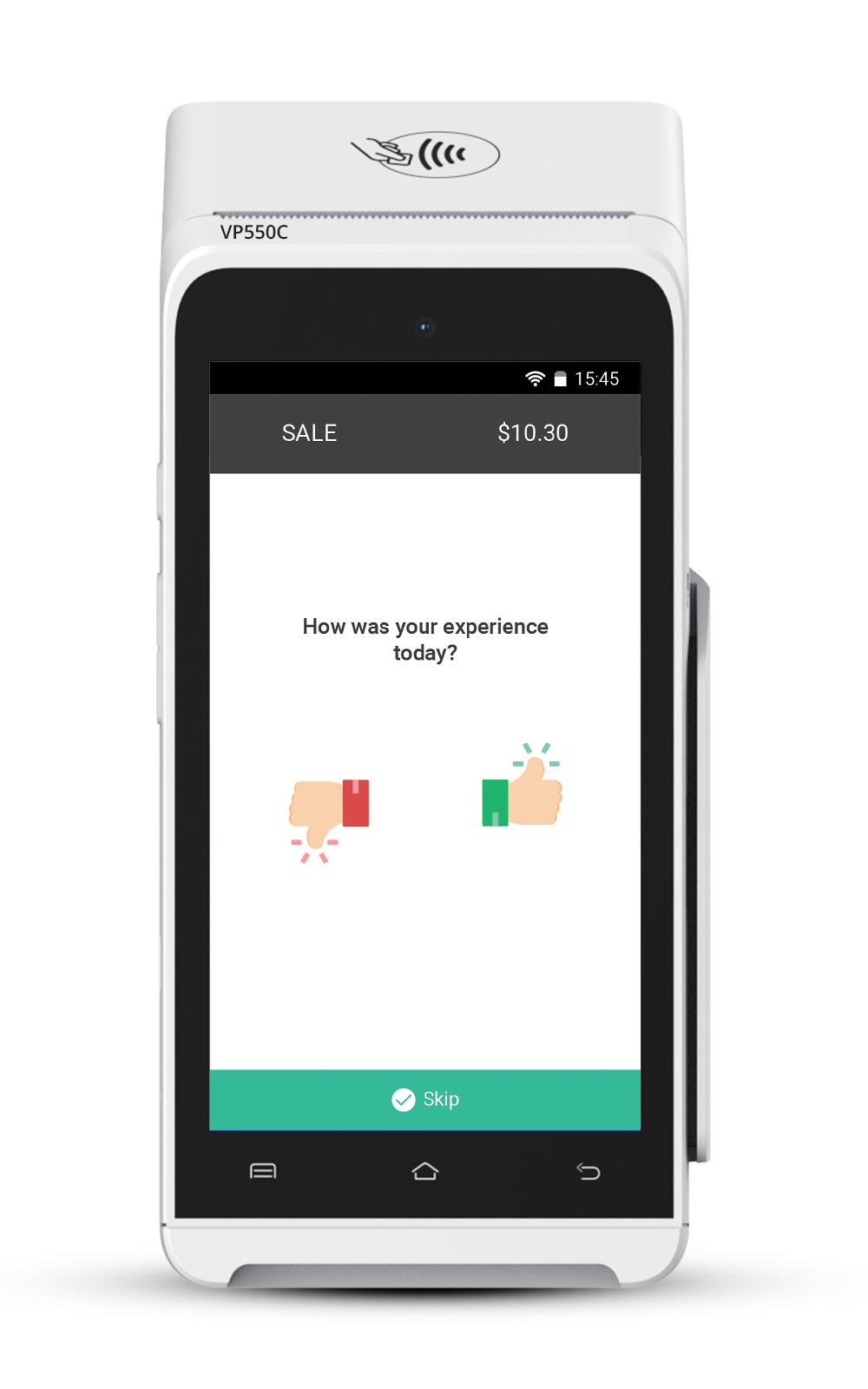

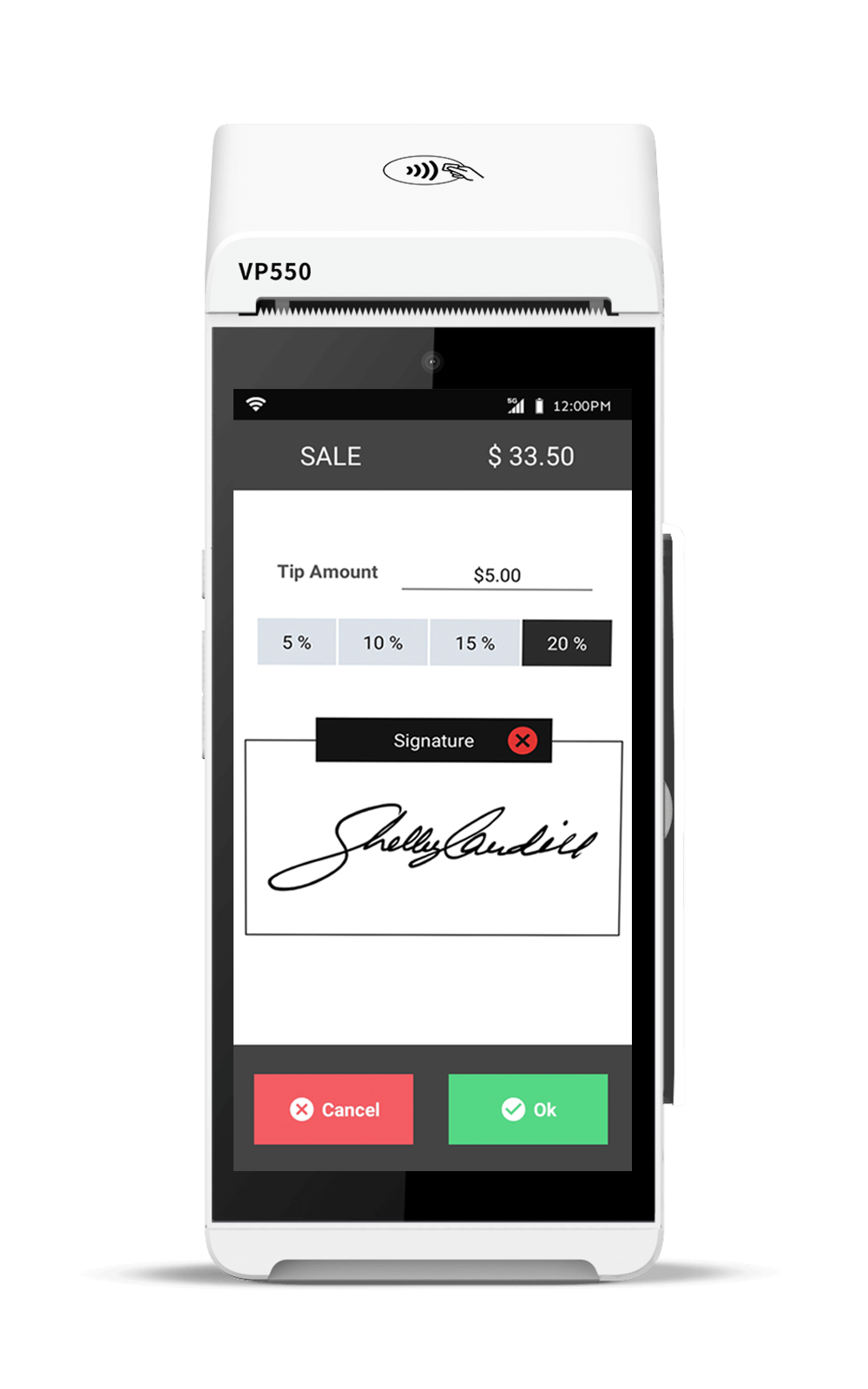

You should ensure the fee is communicated with the customer properly before the final transaction and is ideally visible on payment terminals and receipts.

3. What is an example of a surcharge fee?

An example of the fee is when a merchant adds a 3% fee to transactions paid with a credit card.

4. Why do I have to pay a surcharge?

You may be required to pay in certain situations, such as when using a credit card for a purchase. This is often due to the higher processing fees associated with credit card transactions compared to other payment methods.

5. Is credit card surcharging legal?

The legality of credit card surcharging varies by jurisdiction. In the United States, surcharging is generally allowed (legal) in most states, but it is prohibited in some states, including California, Michigan, and Texas.