In this second part of our pricing series, we dive into the Cash Discount model, a simple yet effective strategy businesses use to offset credit card processing costs. If you’ve been following our blog, you know we’ve already covered Dual Pricing. Now, let’s break down the concept and its impact on businesses.

What is a Cash Discount?

It is exactly what it sounds like – an incentive for customers who pay in cash. Businesses offer a discount to customers who choose cash instead of card payments, essentially avoiding those pesky credit card processing fees. This way, merchants don’t lose out on margins, and customers feel rewarded for paying with cash. A win-win!

The Problem with Non-Cash Adjustments

Early attempts to implement programs often led to confusion. The so-called “cash discount” in its initial form added a fee for non-cash transactions and waived it if customers paid in cash. This led to unclear pricing practices and the rise of non-cash adjustment charges, which were eventually categorized as surcharges. Surcharging comes with strict regulations, and businesses must adhere to them carefully.

This confusion led to businesses adopting true cash discount models that adhere to legal standards. With clear rules in place, merchants can now confidently use it as a transparent way to save on transaction costs while still providing value to their customers.

How Does It Work?

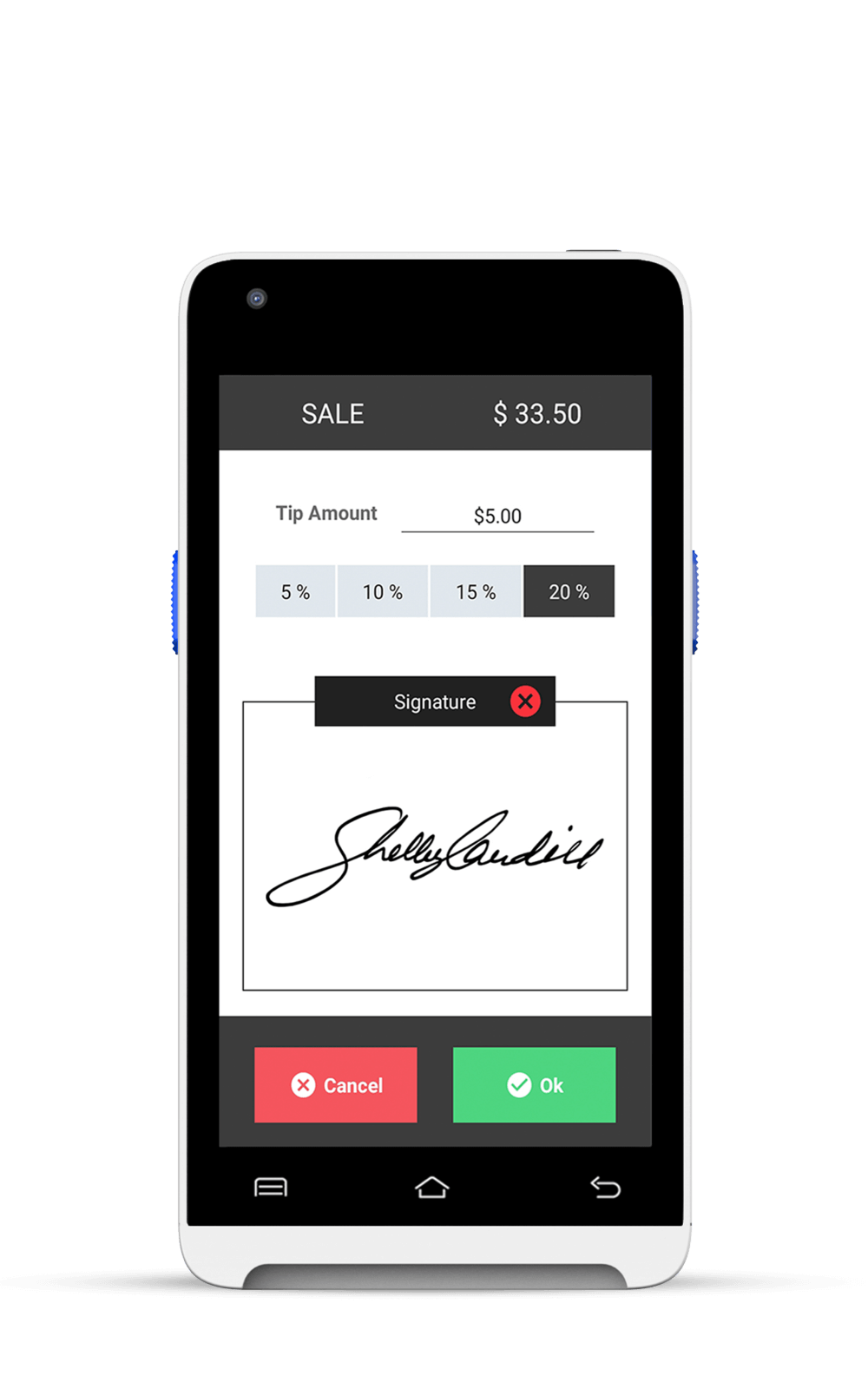

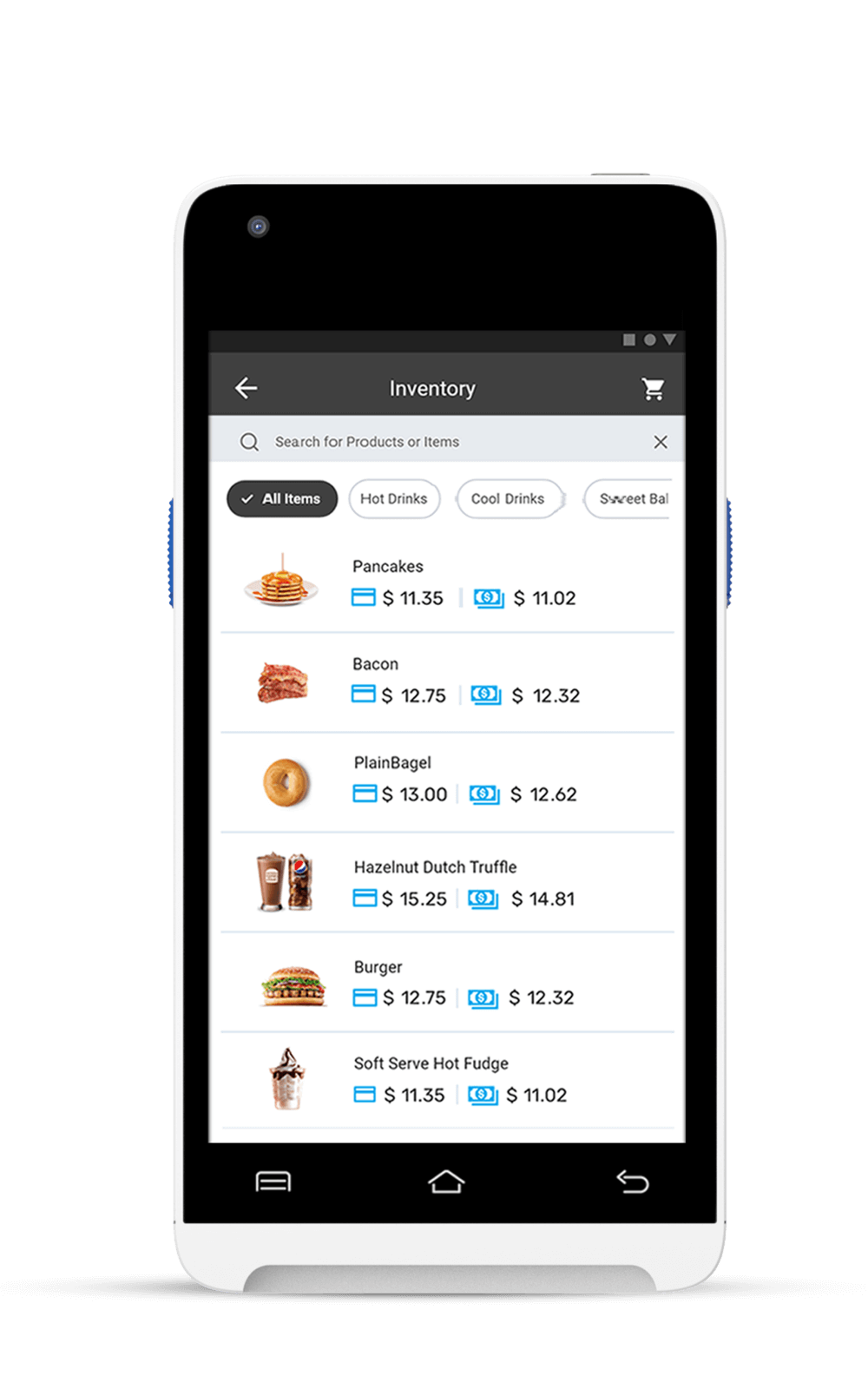

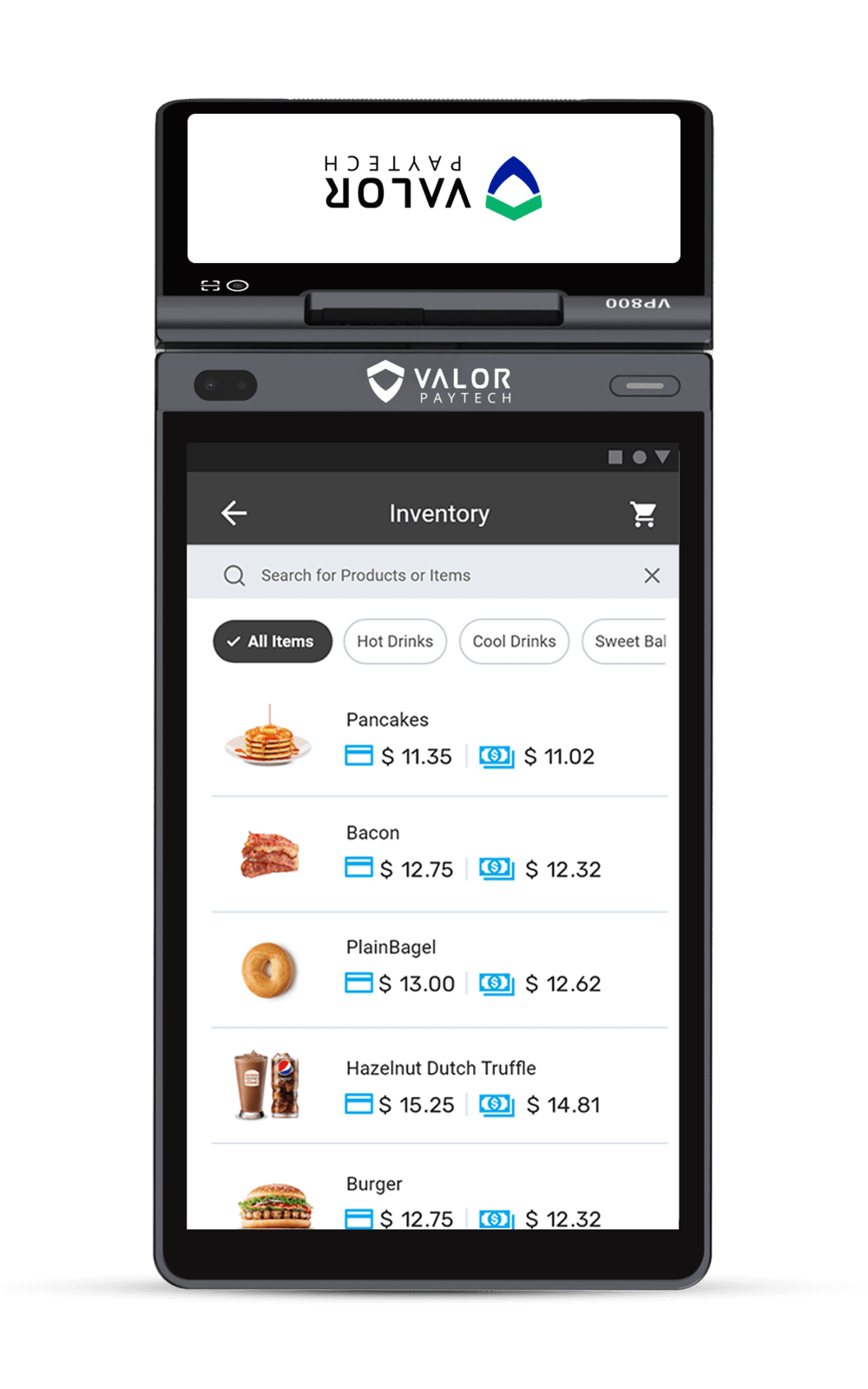

A cash discount program is straightforward. The listed price for any product or service includes the processing fee for card payments. However, when a customer opts to pay with cash, the business offers a discount – typically the equivalent of the processing fee that would’ve applied if a card had been used.

For instance, if you’re selling an item for $100 and the card processing fee is 3%, the price would be listed as $103 for card transactions. Customers paying in cash would get the item for $100, enjoying that 3% cash discount.

Benefits for Businesses

These programs are a game-changer for small to medium-sized businesses, especially those with high transaction volumes. Not only does it reduce processing fees, but it also encourages customers to use cash, potentially improving cash flow and reducing the risk of chargebacks.

Chargebacks – when a customer disputes a transaction and requests a refund, it can be a costly burden for businesses that rely heavily on credit card payments. With cash transactions, there’s no third party (like a bank) involved, which means there’s no chargeback risk.

Moreover, these programs can become a marketing tool. It may attract new customers, especially those who prefer to avoid extra fees when using credit cards. This can foster loyalty, bringing customers back for the added benefit of saving a little extra on each transaction.

Conclusion

As previously explained, a cash discount refers to a business offering an incentive in the form of a discount for cash transactions. A business will always list the non-discounted price on its shelves, signifying a true discount for using cash.

In part 3, we’ll cover the Surcharge pricing model.

Missed part 1 of the Evolution of Pricing series? Read more about Dual Pricing.

FAQ

1. What is an example of a cash discount?

A store may offer a 3% discount on the total purchase price for customers who pay with cash instead of using credit or debit cards. For instance, if the total is $103 ($100+$3), including the processing fee, the cash−paying customer would only pay $100.

2. Who gives these discounts for cash transactions?

The merchant offers customers these discounts.

3. How is a cash discount different from a card surcharge?

A cash discount reduces the price of a product or service when paid with cash, while a card surcharge increases the price of a product or service when paid with a credit or debit card.

4. Can businesses accept both cash and card payments while offering discounts for cash?

Yes, businesses can accept both cash and card payments, but the discount is not applicable in this case.

5. Is a cash discount program legal?

Yes, the program is legal.