Over the past decade, the payments landscape has evolved faster than at any other time in its history. Merchants expect transactions to be quick, reliable, and easy to manage, while ISOs and ISVs need solutions that are scalable, efficient, and simple to support.

Traditional payment terminals were built for a different era — one where software rarely changed, business models evolved slowly, and everything required someone being physically on-site.

Today, merchants operate across multiple channels, teams work remotely, and payment technology must adapt instantly. That’s why Cloud POS Terminals are becoming the new standard across retail, dining, hospitality, professional services, and mobile commerce.

A Cloud POS Terminal isn’t just a device – it’s part of a connected environment that keeps transactions, configurations, data, and control flowing through the cloud in real time.

This shift isn’t theoretical – it’s happening right now. And the partners who adapt early aren’t just keeping up with the future – they’re owning it.

What is a Cloud POS System and How Does it Work?

A Cloud POS System is more than just a payment terminal — it’s the full ecosystem that powers every transaction, configuration, update, and report through the cloud instead of the device itself.

Key Components:

- Cloud Management Portal: Controls settings, menus, taxes, pricing, and device behavior across all terminals.

- Cloud-Connected Terminals: Secure devices that communicate with the cloud in real time.

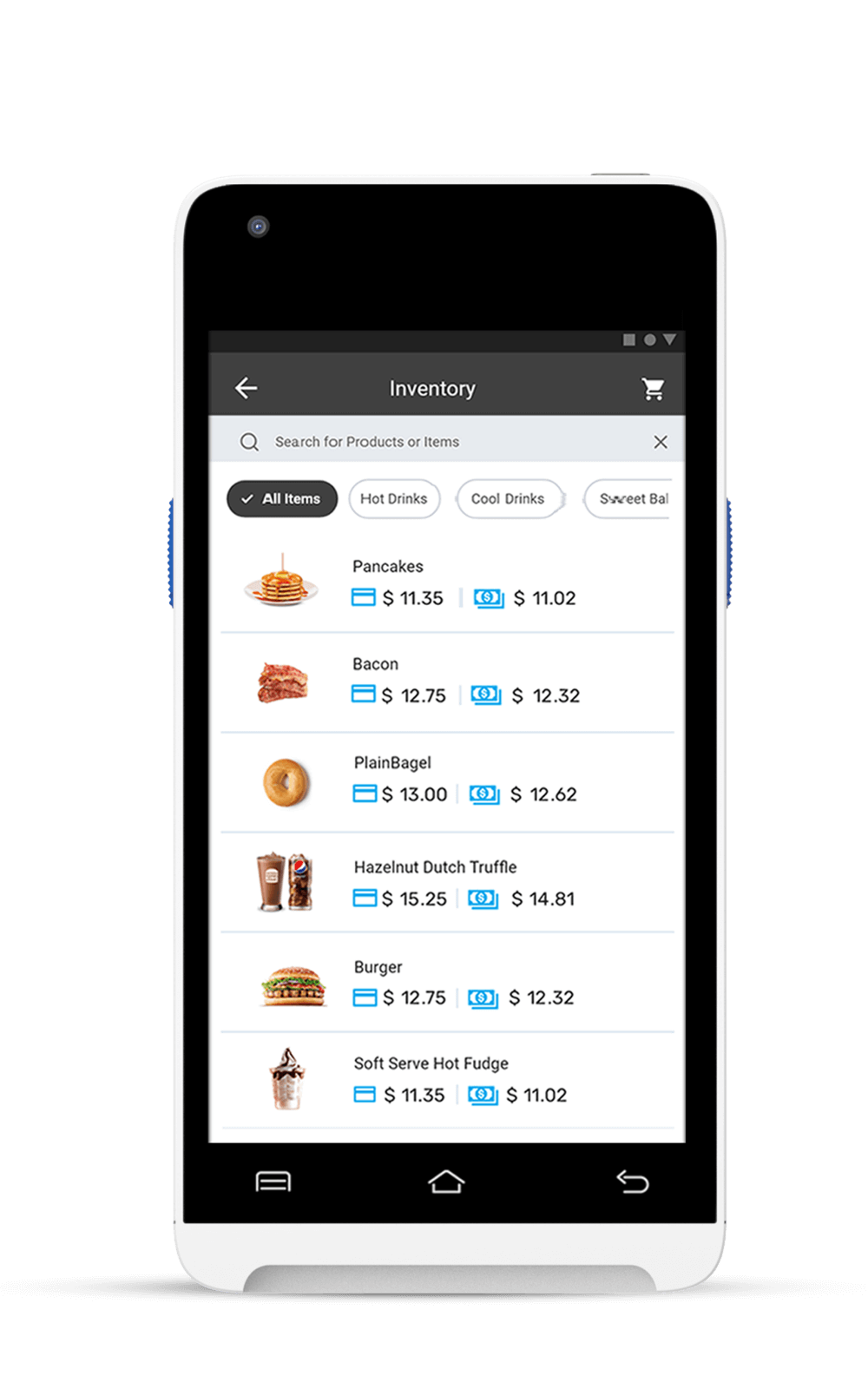

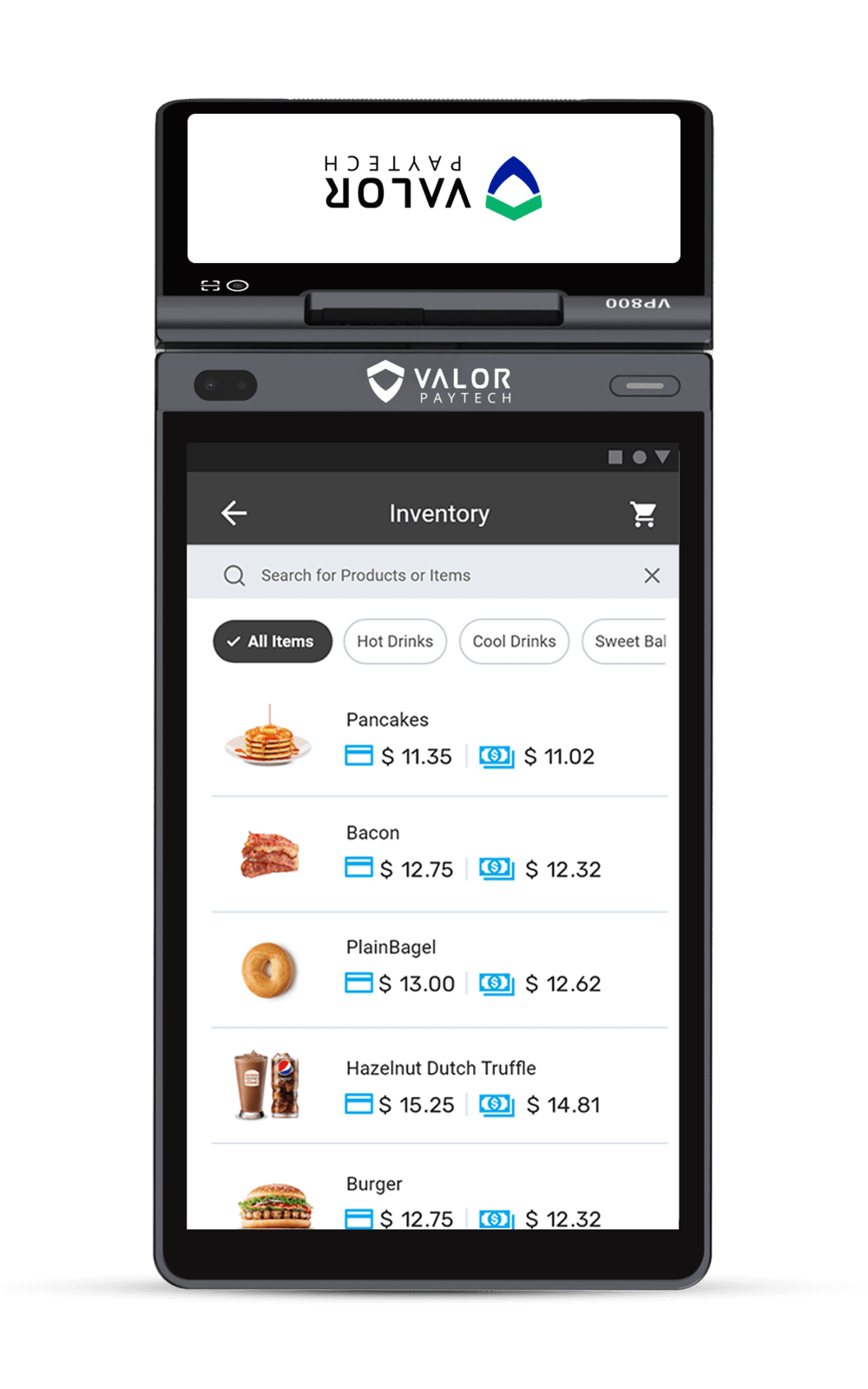

- Unified Product & Pricing Catalog: Ensures every device uses the same data — no version mismatches

- Real-Time Reporting Tools: Tracks sales, payments, tips, modifiers, taxes, and more across locations.

- API & Integrations Layer: Allows software platforms and ISVs to embed payments into their workflow.

| Function | Traditional Terminals | Cloud POS Terminals |

|---|---|---|

| Updates | Must be installed manually on-site | Updates are automatic and remote |

| Settings | Configured on each device individually | Configured centrally in the cloud |

| Data Storage | Stored locally | Stored securely in the cloud |

| Support | Requires technician visits | Managed remotely through dashboards |

This means merchants get greater reliability, ISOs reduce support cost, and ISVs gain seamless integration points for embedding payments in their software ecosystems.

What Features Should You Look for in the Best Cloud POS System?

When evaluating Cloud POS solutions, ensure the system includes:

- Centralized configuration management.

- Real-time reporting and analytics.

- Remote terminal provisioning.

- API-first integration approach.

- Multi-location device syncing.

- Fallback connection support (Ethernet/Wi-Fi/LTE).

- End-to-end encryption + tokenization.

Why Traditional POS Terminals Are No Longer Enough

Let’s be fair — traditional terminals did their job.

But they were built for a world where:

- Business locations didn’t change frequently

- Loyalty and analytics weren’t expected as standard

- Software rarely needed updates

- Support teams were local

Today:

- Merchants are multi-location and mobile.

- Customers expect fast, seamless payment experiences.

- Chargebacks and fraud conditions evolve constantly.

- Regulations and compliance requirements update frequently.

- ISVs need hardware that integrates, not hardware that limits.

Traditional payment terminals struggle here.

They require:

- Manual software upgrades

- On-site installation

- Time-consuming troubleshooting

- Separate configurations per device

Which leads to:

- Higher ISO support costs

- Longer merchant onboarding cycles

- Reduced merchant satisfaction over time

Cloud POS Terminals solve all of this by design.

What is the Difference Between Traditional POS Systems and Cloud POS Systems?

| Capability | Traditional POS System | Cloud POS System |

|---|---|---|

| Provisioning | Configure on-site, one device at a time | Provision remotely; ship ready-to-use |

| Software Updates | Requires tech scheduling + merchant downtime | Updates push automatically in real time |

| Feature Enhancements | Limited or hardware-locked | Cloud-driven, continuously improving |

| Multi-Location Support | Each location must be set independently | Configure once → replicate everywhere |

| Data Sharing & Reporting | Stored locally; limited visibility | Centralized dashboards across all devices |

| Troubleshooting | Must dispatch support staff | Diagnose + fix remotely from portal |

| Scalability | Requires more hardware + service labor | Add devices instantly, no local IT needed |

| Merchant Experience | Static, slow to evolve | Dynamic, monitored, optimized constantly |

In simple terms:

Traditional systems react.

Cloud POS systems adapt.

(need content about the difference)

How Secure Is a Cloud POS Terminal?

Cloud POS Terminals use:

- End-to-end encryption (E2E)

- PCI DSS compliant data handling

- Tokenization to prevent card storage in plain text

- Private and secure AWS-backed environments

Because no card data lives on the terminal itself — risk is drastically reduced.

Why Cloud POS Terminals Matter for ISOs

ISOs profit through long-term merchant retention.

Merchant churn is expensive — and usually avoidable.

Top reasons merchants churn:

- Slow support response times

- Outdated payment experiences

- Confusing reporting

- Downtime during peak hours

Cloud POS terminals drastically reduce these friction points.

Benefits for ISOs:

- 70–90% fewer field service visits

- Faster merchant onboarding

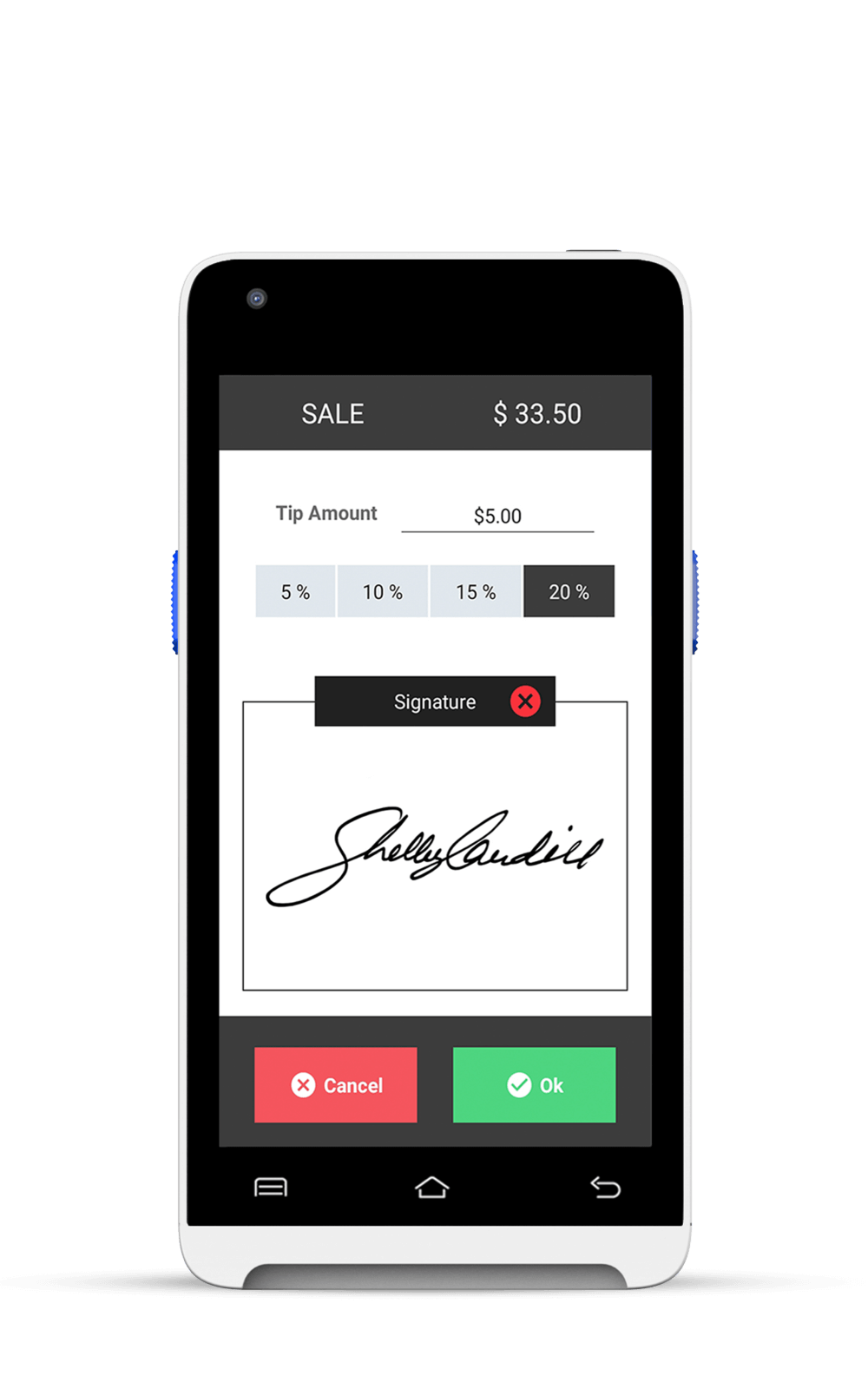

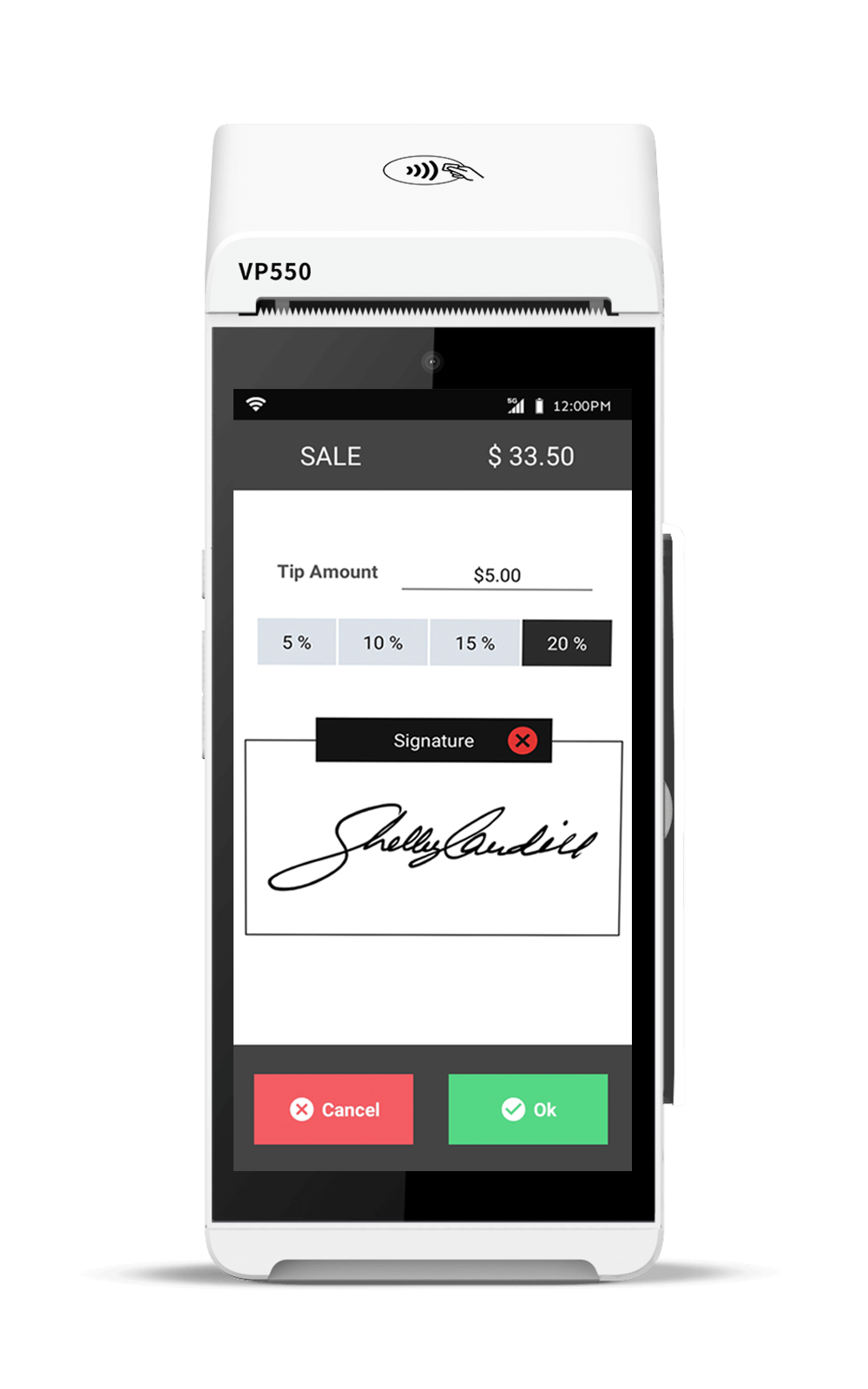

- Instant configuration changes (tips, taxes, surcharges, receipts)

- A superior merchant experience that improves retention

The result?

Higher lifetime value per merchant — without increasing workload.

Why Cloud POS Terminals Matter for ISVs

ISVs don’t just compete on product — they compete on platform maturity.

Your customers don’t want hardware that conflicts with your software or complicates your rollout model. They want integrated, cloud-connected, ready-to-deploy terminals that fit naturally inside your workflow.

Cloud POS terminals enable:

- API-driven integration

- Unified customer profiles

- Embedded payment workflows

- Consistent merchant experience across devices

Which means:

- Faster product adoption

- Stronger stickiness

- Less support dependency

- Higher recurring revenue per merchant

Cloud terminals transform payments from “a requirement” into “a feature that enhances your platform.”

Why are Merchants Switching to Cloud POS in 2026?

Merchants are choosing Cloud POS because it aligns with how modern businesses operate:

- Menu, price, and tax changes need to update instantly

- Support needs to be remote-first, not technician-dependent

- Uptime must be guaranteed across locations

- Data should drive decisions — not guesswork

Most importantly:

Cloud POS systems help merchants run smarter — not harder.

Key Advantages of Cloud POS Terminals

1. Centralized Configuration Control

Change terminal settings across one merchant — or 500 — instantly.

This isn’t just convenience. This is scale.

2. Data-Connected Decision Making

Every transaction becomes intelligence — not just a receipt line.

3. Zero-Downtime Updates

Merchants keep operating.

ISOs don’t schedule maintenance windows.

Everyone wins.

4. Cloud-Backed Security

End-to-end encryption + tokenization + no card data stored locally = dramatically lower risk.

5. Remote Diagnostics

Fix issues before the merchant even knows something is wrong.

6. Plug-and-Grow Scalability

Add new locations, terminals, features, and merchant accounts immediately — without friction.

How Can Small Businesses Migrate from a Traditional POS to a Cloud POS?

Migrating to Cloud POS is simpler than most merchants expect.

Steps to Transition:

- Choose Terminal Models

Select mobile, countertop, or wireless devices based on the business environment. - Import Menus / Products / Catalog

Upload price lists, modifiers, tax rules, and tip preferences into the cloud portal. - Power On the Terminals

Once connected to Wi-Fi or LTE, terminals sync automatically. - Train Staff (Optional)

Because cloud terminals behave predictably, training is minimal and intuitive.

No data loss. No downtime. No service disruption.

What Are the Top Cloud POS Providers in the USA (2025 Update)?

Here are some trusted Cloud POS providers widely used across industries:

| Provider | Best For | Key Strength |

|---|---|---|

| Valor PayTech | ISOs, ISVs, and merchants | Cloud-first terminals, remote management, integrated data + payments |

| Clover | Small retail and foodservice | App marketplace and device variety |

| Toast | Restaurants & hospitality | Deep restaurant workflow tools |

| Square | Mobile and micro-businesses | Simple setup and easy onboarding |

| Lightspeed | Multi-location retail & golf | Advanced inventory and analytics |

Valor stands out because it is built cloud-first — not retrofitted — which means instant updates, scalable control, and enterprise-grade portfolio management.

Which Businesses Benefit Most from Cloud POS Systems

Retail chains: Standardize brand experience instantly

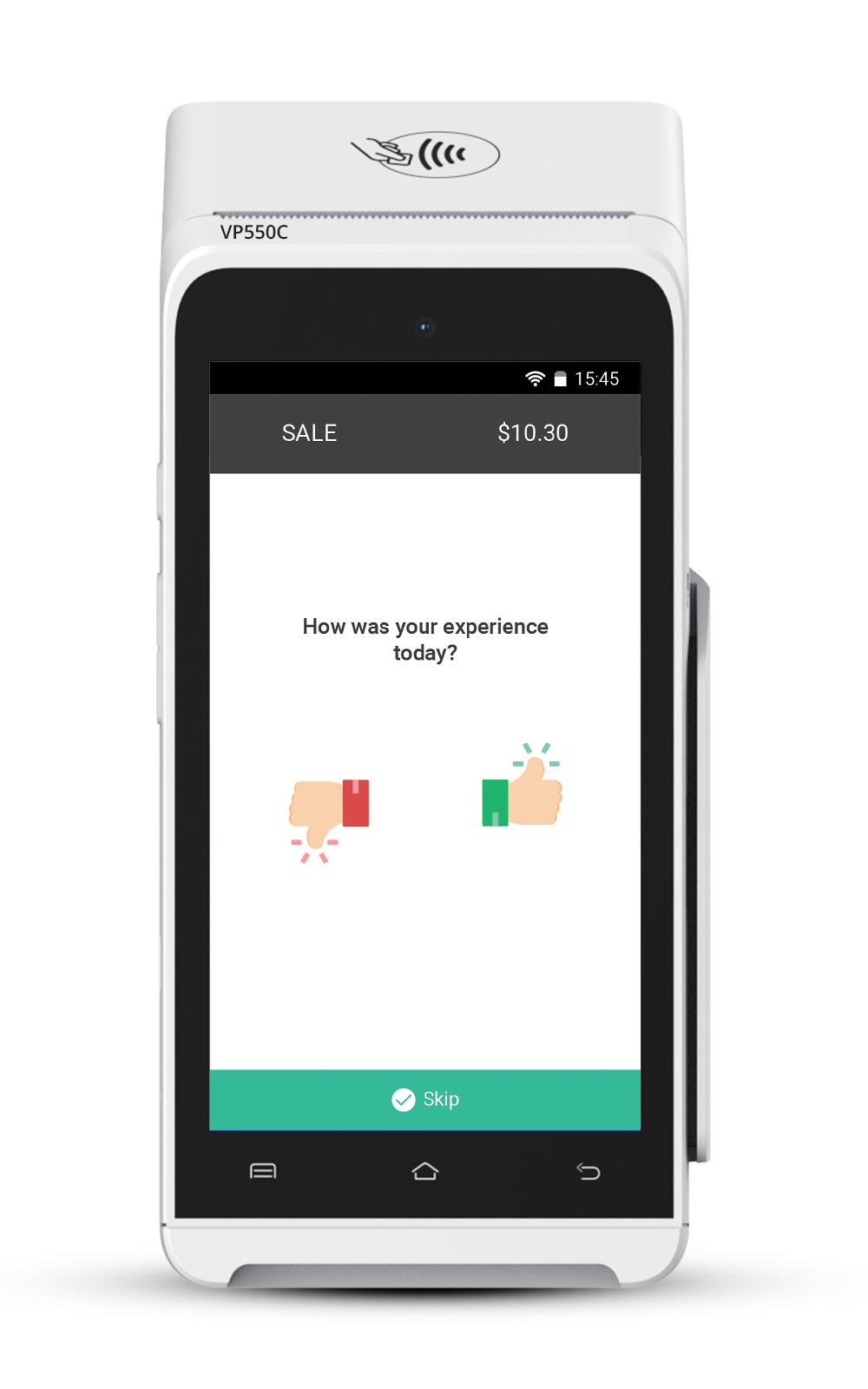

Quick service restaurants: Update tip flow + surcharges anytime

Mobile/service merchants: Take payments anywhere — instantly synced

Franchises: Corporate visibility + local flexibility

Anywhere consistency, control, and uptime matter — cloud terminals excel.

Why Valor PayTech Leads in Cloud POS Terminals

Valor doesn’t “support the cloud.”

Valor is built on it.

Our cloud-native terminal ecosystem delivers:

| Capability | Valor Cloud POS Terminal Advantage |

|---|---|

| Architecture | Cloud-first, not legacy retrofitted |

| Deployment | Ship → Power On → Transact |

| Updates | Instant, automatic, over the air |

| Visibility | Real-time across every device |

| Control | Centralized merchant + portfolio-level management |

| Integration | API-driven for ISVs and partners |

| Support | Remote diagnostics → lower ISO service cost |

This aligns with what merchants expect — and what ISOs and ISVs need to win.

How Is Cloud Technology Changing the Future of Point of Sale?

Businesses aren’t slowing down.

Commerce isn’t simplifying.

Expectations aren’t lowering.

Cloud POS terminals aren’t just a technology upgrade —

They’re the new foundation for how merchants run, how partners scale, and how payment ecosystems stay competitive.

The future of the point of sale is:

- Connected

- Configurable

- Data-driven

- Remotely managed

- Always improving

And that future is already here — with Valor.

Conclusion

Cloud POS terminals deliver control, flexibility, and intelligence that traditional terminals simply can’t match.

For ISOs, that means lower overhead and stronger merchant retention.

For ISVs, it means a platform that grows and adapts with your software.

And for merchants, it means everything just works — the way it should.

With Valor PayTech, Cloud POS isn’t an add-on.

It’s the foundation. It’s the advantage. It’s the future.

FAQ

1. What is a cloud POS terminal?

A cloud POS terminal is a payment terminal that connects to and syncs with the cloud, allowing pricing, receipts, reporting, and settings to update in real time — without storing data locally.

2. How is a cloud POS terminal different from a traditional POS terminal?

Traditional terminals store data and configurations locally and require manual updates. Cloud POS terminals pull everything from the cloud, which means updates, configurations, and fixes happen instantly and remotely.

3. Does a Cloud POS System require constant internet?

Yes — but Cloud POS is designed with network redundancy. If the primary connection fails, terminals can automatically switch to Ethernet, Wi-Fi, or LTE to stay online.

4. Can cloud POS terminals support multiple locations and devices?

Yes. With cloud syncing, all terminals stay aligned — whether it’s one store or hundreds. You can add new terminals or locations without reprogramming each device manually.

5. Are cloud POS terminals secure?

Yes. Cloud terminals use encrypted transactions and secure data handling. With Valor PayTech, terminals run on AWS-backed infrastructure with PCI-compliant security built in.

6. How do updates work in a Cloud POS System?

Updates are automatic and happen remotely. Software features, tax changes, menus, and pricing can be pushed instantly — no physical access needed.

7. Do Cloud POS Systems reduce support and maintenance?

Yes. Most support can be handled remotely — no waiting for technicians. This means faster resolutions and significantly lower service overhead for both merchants and ISOs.

8. Are cloud POS terminals suitable for both retail and restaurants?

Absolutely. Whether it’s menu changes, price shifts, tax rules, product modifiers, or multi-location catalogs, cloud syncing keeps everything consistent.

9. What happens if a merchant wants to switch processors or change pricing?

With cloud terminals, configurations are managed centrally. Changing processors, adding new pricing models, or adjusting fees is quick and doesn’t require touching each device.

10. How does Valor PayTech support cloud POS terminals?

Valor provides fully cloud-connected terminals powered by AWS. Merchants and partners get real-time device management, centralized configuration tools, transaction analytics, and remote troubleshooting — all through our portal.

Ready to get started?

Become a Partner Today!

Complete the form below.