Table of Contents

In today’s digital world, keeping transactions secure is crucial, especially for e-commerce businesses and financial institutions. Payment cryptography ensures that sensitive data, like credit card details and personal information, remains safe during transactions.

However, with so many options at your disposal, how can you pick the ideal one for your company? Services like AWS Payment Cryptography offer an innovative approach to simplifying integration for payment processing applications, optimizing payment key management, and executing cryptographic operations efficiently.

Let’s explore how it transforms business operations and enhances payment security.

Features of AWS Payment Cryptography

AWS Payment Cryptography is designed to support e-commerce owners and other businesses by offering a variety of features tailored to meet their needs.

These consist of compliance, security, scalability, availability, elasticity, automated key management, and streamlined integration. The below section will provide an overview of its core functionalities.

Elasticity in Payment Processing

Dedicated, costly HSMs are typically used to anchor payment workloads to on-premises data centres. These are replaced with an elastic, pay-as-you-go service which is made to adhere to security regulations and compliance regimes for financial services. This means businesses can scale their operations without worrying about infrastructure constraints or costly investments in hardware.

Businesses can make sure they only pay for what they use by modifying their resource utilization according to demand with AWS. This flexibility allows companies to manage expenses more efficiently while still maintaining the necessary level of security for their transactions.

Automated Key Management

Managing cryptographic keys can be a complex and time-consuming task. This procedure is made simpler by AWS Payment Cryptography, which streamlines payment key administration. This includes importing and generating keys, automating key management tasks such as storing, rotating, backing up, recovering, and shredding keys, and exporting them when necessary.

The American National Standards Institute (ANSI) TR-31 characteristics, which specify important usage and modes of use, are implemented and enforced by the service. This ensures that businesses can maintain control over their keys and adhere to industry standards.

Compliance

Compliance with industry standards is a top priority for any business handling payment transactions. PIN Security, Point-to-Point Encryption (P2PE), Data Security Standard (DSS), and PCI 3-D Secure (3DS) are among the PCI standards that AWS Payment Cryptography is made to adhere to.

The solution supports customer compliance reporting by offering AWS CloudTrail logs for critical management actions. List key and obtain key APIs allow users to evaluate cryptographic key metadata, which includes the data required for PCI PIN, PCI P2PE, and other compliance initiatives. This ensures that businesses can maintain compliance with industry standards and avoid potential fines or penalties.

Security and Management Capabilities

AWS Payment Cryptography is built with characteristics that will help you accomplish security, which is its primary goal. Here’s a closer look:

1. Enhancing Security with AWS Shared Responsibility Model

According to this paradigm, AWS oversees managing the cloud’s infrastructure, which includes the HSM hardware that powers the service.

Companies can use Amazon CloudWatch and AWS CloudTrail to audit consumption and establish suitable access controls using AWS IAM policies. This enables organizations to monitor their operations and ensure that their data remains secure at all times.

2. Scaling and Availability

The AWS Global Infrastructure helps businesses meet their data residency requirements or regional certification standards, ensuring that transactions are processed quickly and efficiently. Businesses may manage higher transaction volumes thanks to its scalability without compromising security or performance. By leveraging AWS’s extensive network of data centres, organizations can maintain a high level of service even during peak periods.

3. Simplified Integration for Seamless Operations

Using RESTful APIs, AWS Payment Cryptography provides the cryptographic functions needed for payment applications. These APIs replace complicated and vendor-specific socket-based calls that are usually used to integrate with payment HSMs by offering succinct ways to carry out common use cases.

By simplifying the integration process, businesses can quickly and easily implement AWS Payment Cryptography into their existing systems. This reduces the time and resources needed to deploy new solutions, allowing organizations to focus on their core operations.

Benefits of AWS Payment Cryptography

1. Facilitating Cloud Migration of Payment Functions

For acquirers, payment facilitators, networks, switches, processors, and banks, migrating payment cryptographic operations to the cloud can significantly reduce dependencies on external data centres or colocation facilities.

It simplifies this migration, ensuring that you remain compliant with industry requirements.

2. Management Capabilities for Seamless Key Operations

Effective key management is essential for seamless operations, and it provides several tools to facilitate this process. Users can create, delete, list, and update aliases for keys, using aliases as user-friendly names for easy access and control.

Furthermore, keys can be tagged for identification, grouping, automation, access control, and cost-tracking purposes, ensuring a comprehensive management experience.

Cryptographic Operations and Partner Integration

AWS Payment Cryptography goes beyond basic security measures, offering advanced cryptographic operations and seamless partner integration for your business.

Performing Essential Cryptographic Operations

You can perform a wide range of cryptographic operations, including encryption, decryption, and re-encryption of data using symmetric or asymmetric keys.

The service also enables secure translation of sensitive data between encryption keys, aligning with PCI PIN rules and industry best practices. This functionality ensures that your payment data remains secure and protected throughout the transaction process.

Enhancing Partner Integration for Better Collaboration

This advanced technology enables us to encrypt sensitive data, utilize secure tokenization, and manage encryption keys effectively. By ensuring compliance with industry standards like PCI DSS, we protect cardholder information and minimize exposure to data breaches. Additionally, real-time monitoring tools allow us to detect potential security threats promptly, while the integration of Hardware Security Modules (HSM) further enhances our security posture. Utilizing AWS Payment Cryptography ensures that our clients can confidently conduct business, knowing their transactions are safeguarded by cutting-edge technology.

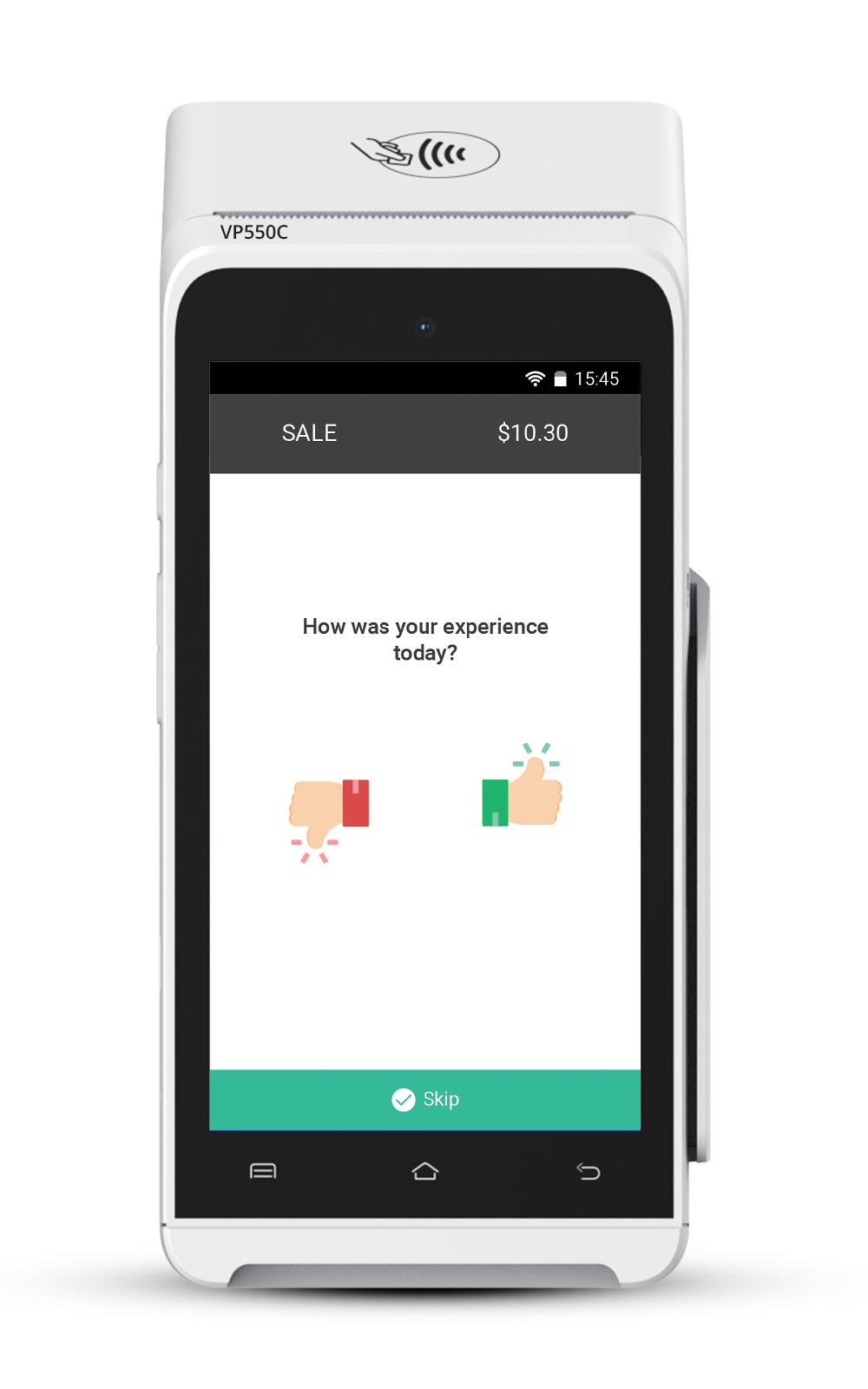

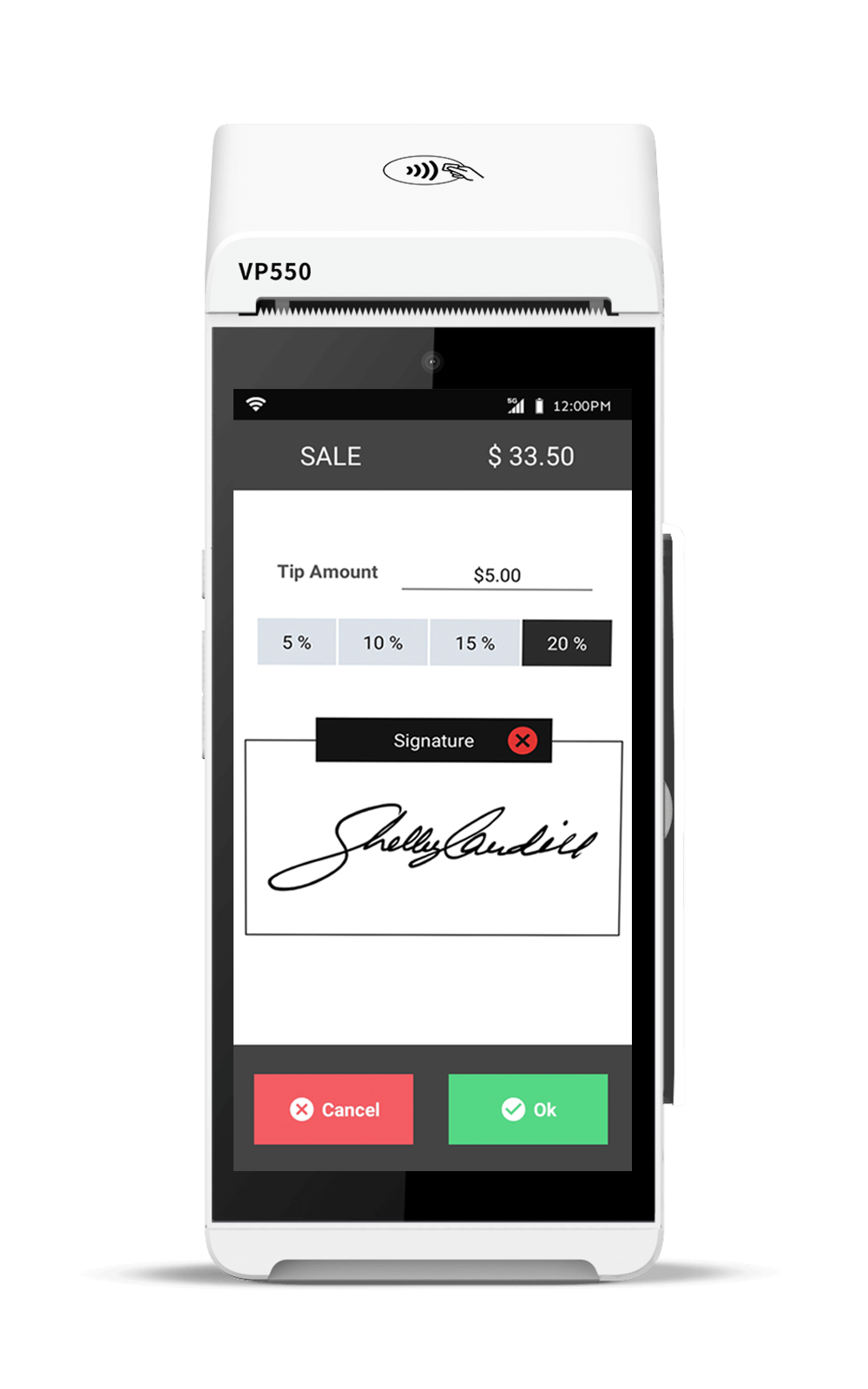

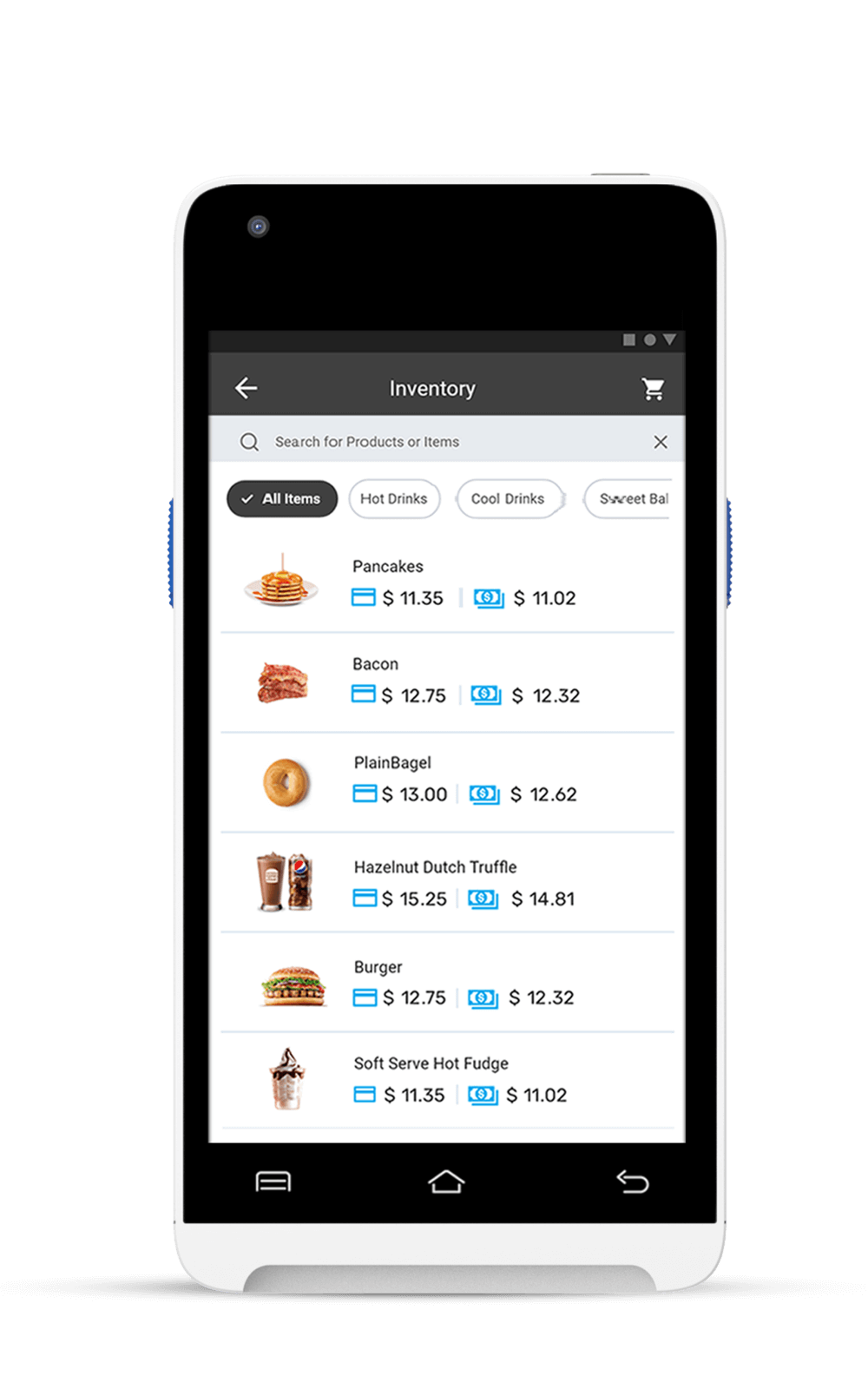

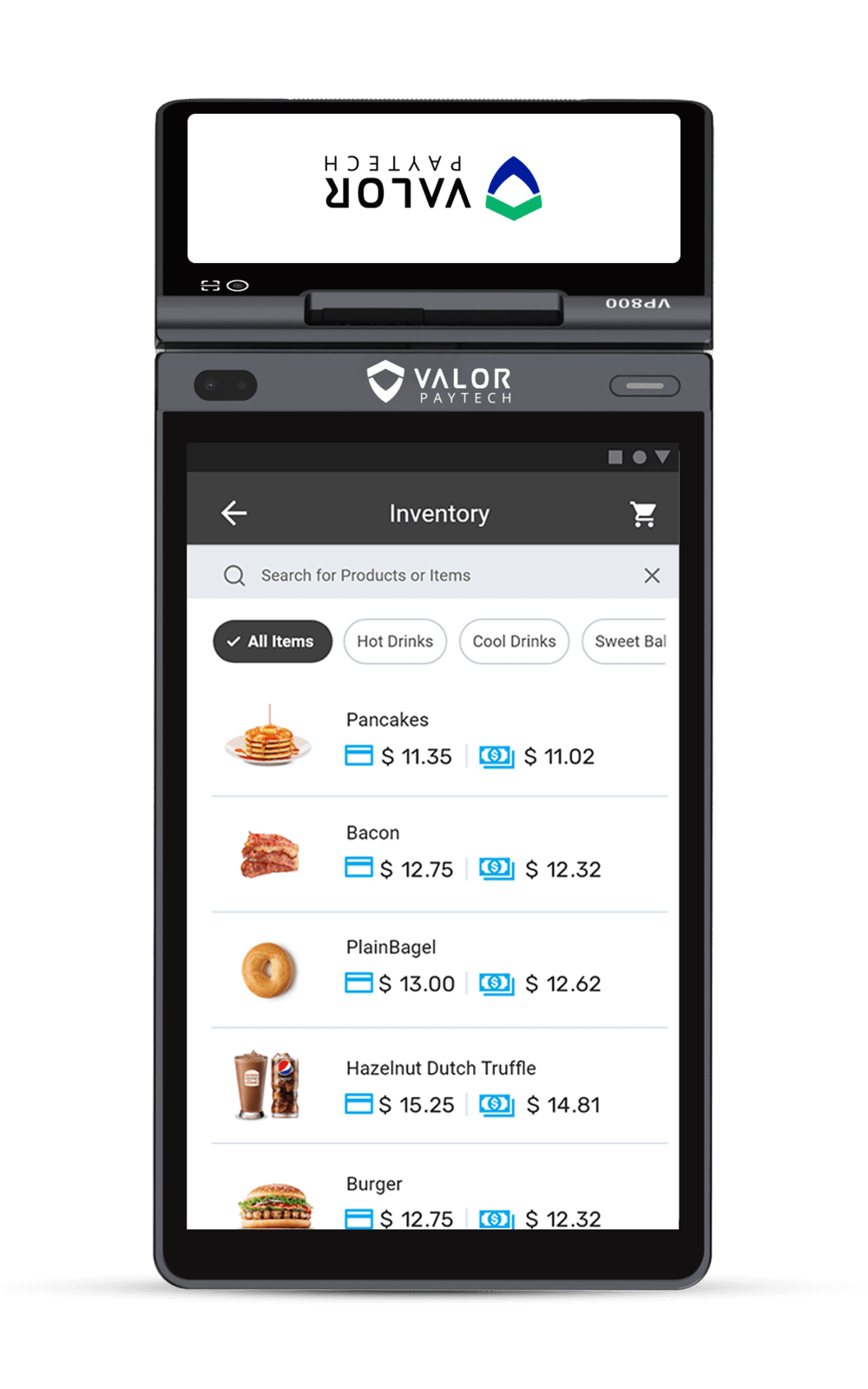

How Does Valor PayTech Use AWS Payment Cryptography?

This advanced technology enables us to encrypt sensitive data, utilize secure tokenization, and manage encryption keys effectively. By ensuring compliance with industry standards like PCI DSS, we protect cardholder information and minimize exposure to data breaches.

Additionally, real-time monitoring tools allow us to detect potential security threats promptly, while the integration of Hardware Security Modules (HSM) further enhances our security posture. Utilizing AWS Payment Cryptography ensures that our clients can confidently conduct business, knowing their transactions are safeguarded by cutting-edge technology.

Conclusion

AWS Payment Cryptography presents a comprehensive solution for businesses seeking to enhance their payment security while streamlining operations. Its features, including elasticity, automated key management, compliance with industry standards, and advanced security measures, make it an ideal choice for financial institutions and payment service providers.

By adopting it, businesses can reduce their reliance on traditional on-premises HSMs and streamline their operations, resulting in cost savings and improved efficiency. With its robust security and compliance features, and it ensures that sensitive data remains protected, allowing businesses to focus on their core operations.

For organizations looking to enhance their payment processes and improve overall efficiency, Valor PayTech has integrated with AWS offering a reliable solution that meets industry standards and provides a range of benefits. Take the first step towards a more secure and efficient payment ecosystem by contacting us.

FAQ

1. What is AWS Payment Cryptography used for?

It improves the security and efficiency of payment transactions for businesses, particularly in e-commerce and financial services.

2. Can small businesses use AWS Payment Cryptography?

Yes, small businesses can effectively utilize AWS to enhance their payment security.

3. How does AWS Payment Cryptography enhance payment security?

It enhances payment security through strong encryption, automated key management, compliance with industry regulations, and real-time monitoring.

4. Is AWS Payment Cryptography cost-effective?

To determine whether AWS Payment Cryptography is cost-effective, you need to consider a few key factors: the pricing structure, usage levels, and your business's overall needs.

5. How does AWS Payment Cryptography help businesses scale operations?

AWS helps business scalability by providing an elastic, cloud-based infrastructure that supports high transaction volumes, automates key management, ensures compliance with industry standards, and so on.

Sources:

Ready to partner with Valor PayTech?

Become a Partner Today!

Complete the form below.