In the fast-paced world of commerce, efficiency and innovation are everything. Point of sale (POS) terminals have become the linchpin of modern transactions, streamlining how businesses interact with customers while driving operational excellence. From processing payments to managing inventory, POS devices are essential tools that empower businesses to adapt to ever-evolving consumer demands.

This blog dives deep into the world of POS terminals, breaking down their functionality, features, and significance across industries.

What is a POS Terminal?

A point of sale (POS) terminal is a combination of hardware and software that businesses use to process payments, track sales, and manage operations. It acts as the hub for financial transactions, seamlessly integrating payment acceptance with inventory and customer data management.

More than just a cash register, today’s POS terminals offer advanced capabilities like real-time analytics, customer loyalty tools, and multi-channel integrations. They provide businesses of all sizes with the ability to enhance efficiency, make data-driven decisions, and deliver exceptional customer experiences.

How does a POS Terminal work?

A POS terminal functions through a series of coordinated steps:

- Transaction Initiation: The customer selects the goods or services they wish to purchase.

- Data Input: The terminal records transaction details via a manual entry or other input methods.

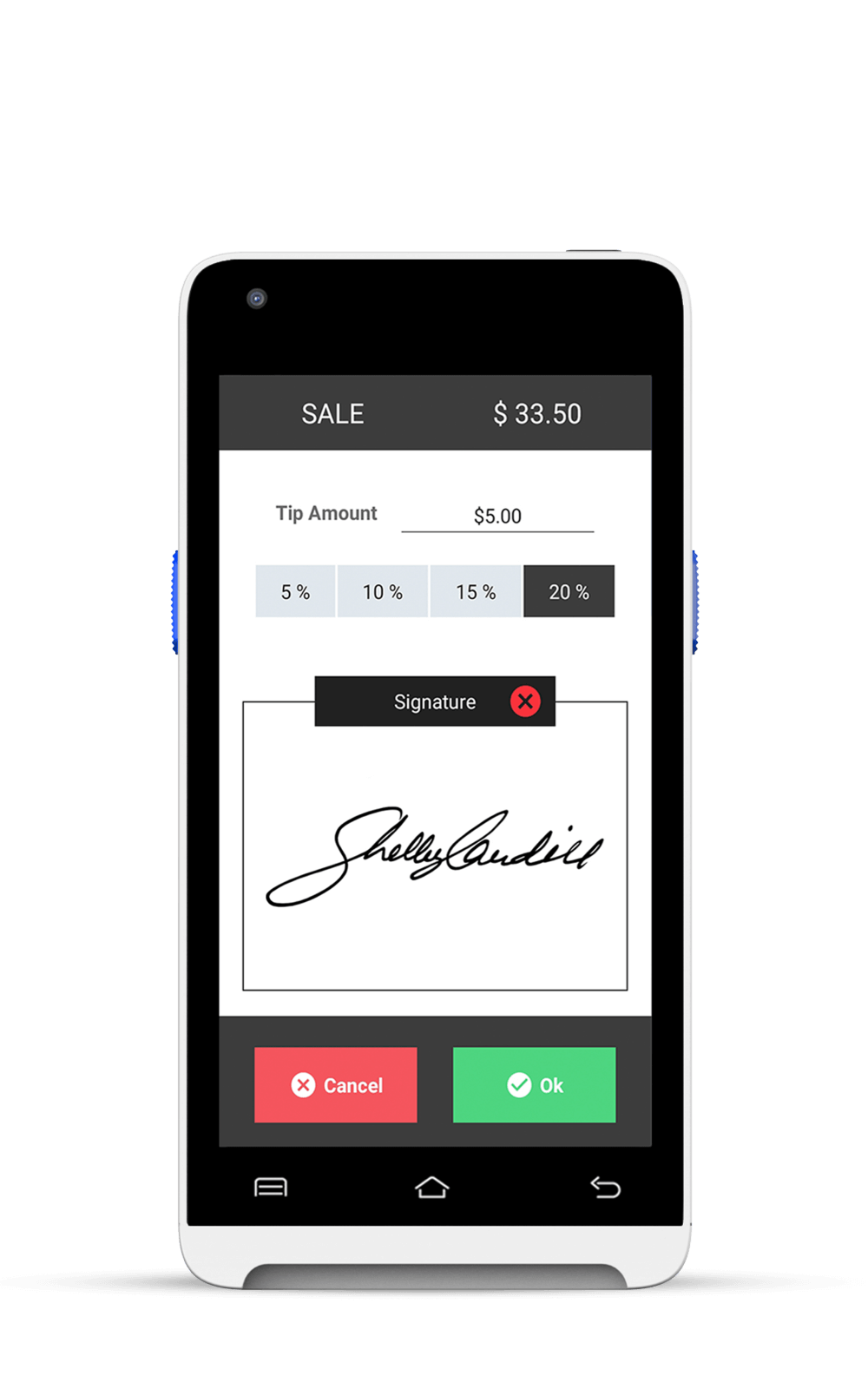

- Payment Processing: Customers pay using methods such as cash, credit/debit cards, or mobile wallets. The terminal connects to the payment gateway to authorize payments.

- Receipt Generation: A receipt is issued – either printed or sent electronically.

- Data Storage: Transaction information is stored securely, enabling reporting, inventory updates, and customer insights.

These steps occur within seconds, offering both speed and reliability to businesses and their customers.

Types of POS Devices

With a wide range, one must choose the best point of sale terminal for small business. These POS machines come in various configurations to suit different business models:

1. Traditional POS Terminal for Restaurants and Cafes

- Stationary terminals are typically found at checkout counters.

- Common in retail stores, supermarkets, and full-service restaurants.

2. Mobile POS (mPOS) Devices

- Portable solutions operating on smartphones or tablets.

- It is ideal for businesses on the go, like food trucks, pop-up shops, or delivery services.

3. Cloud-Based POS Terminal for Retail Stores

- Store data on cloud servers, offering remote access and easy scalability.

- Designed for multi-location businesses needing centralized control.

4. Self-Service Kiosks

- Allow customers to place orders and make payments independently.

- Frequently used in fast-food outlets, cinemas, and retail stores to reduce wait times.

5. Integrated POS Devices

- Combine hardware and software for tailored business solutions.

- Feature integrations with accounting tools, CRM platforms, and more for a seamless experience.

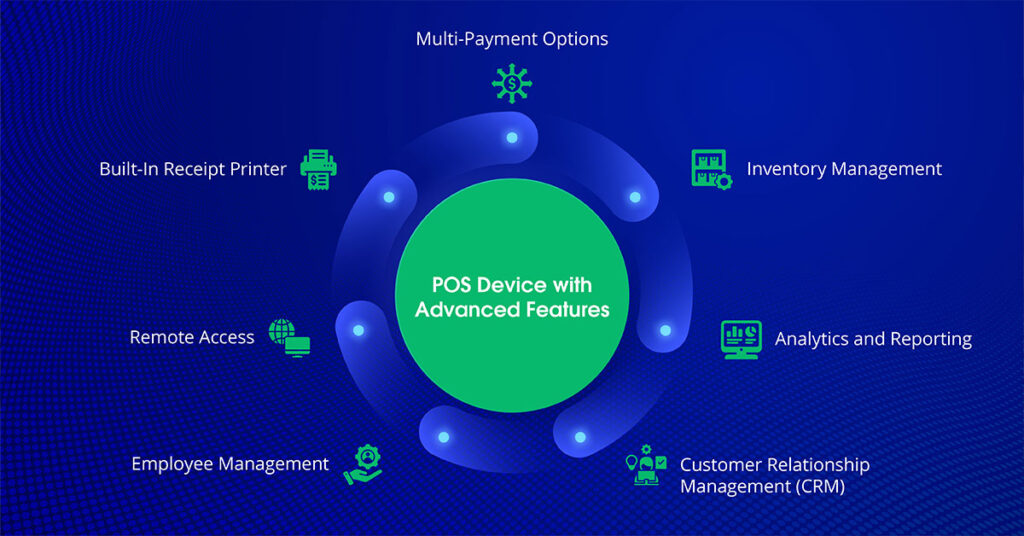

Key Features of a Modern POS Device

Modern and affordable POS Device with advanced features should be equipped with the functions below:

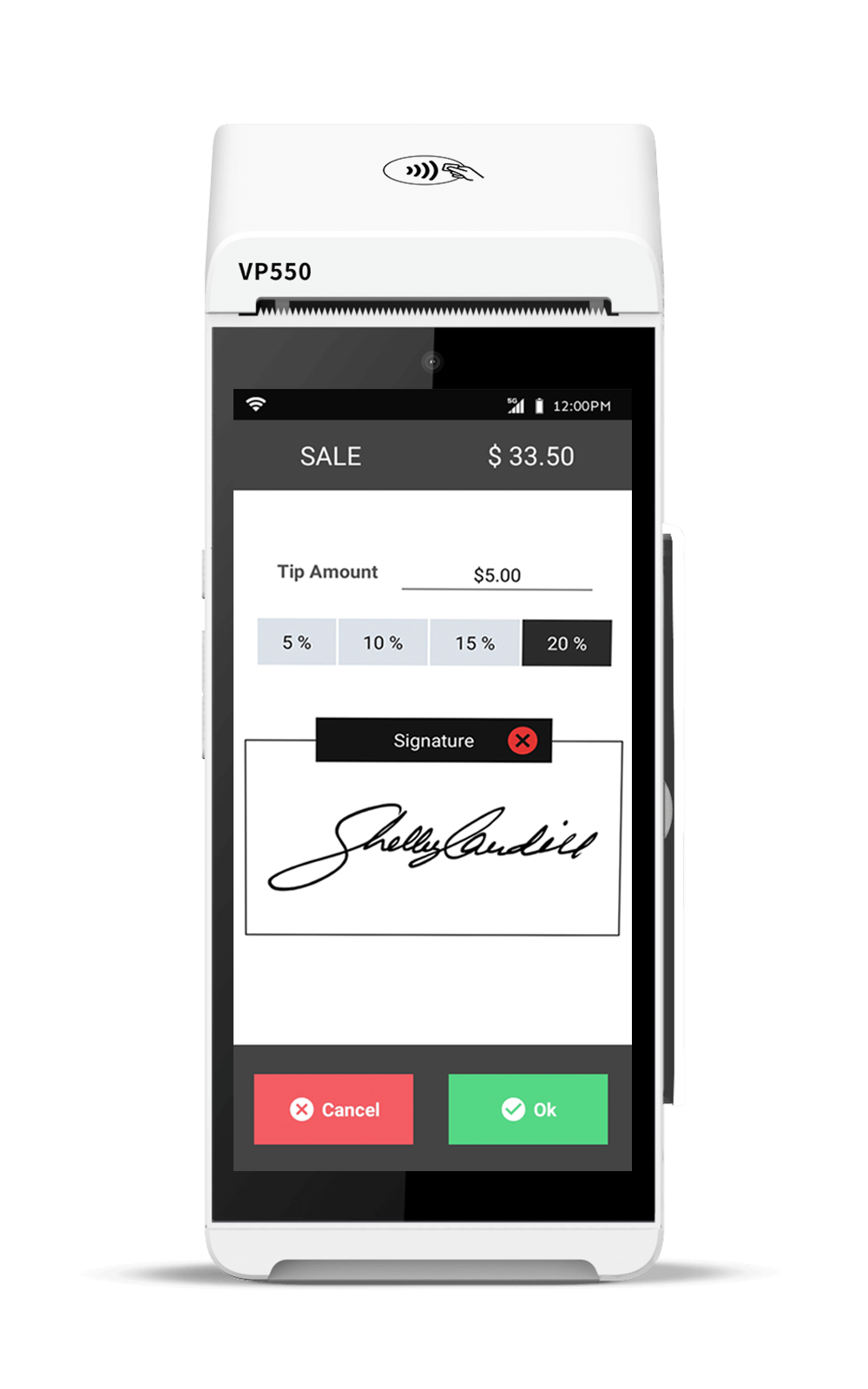

- Multi-Payment Options: Support for cash, credit cards, mobile wallets, and contactless payments.

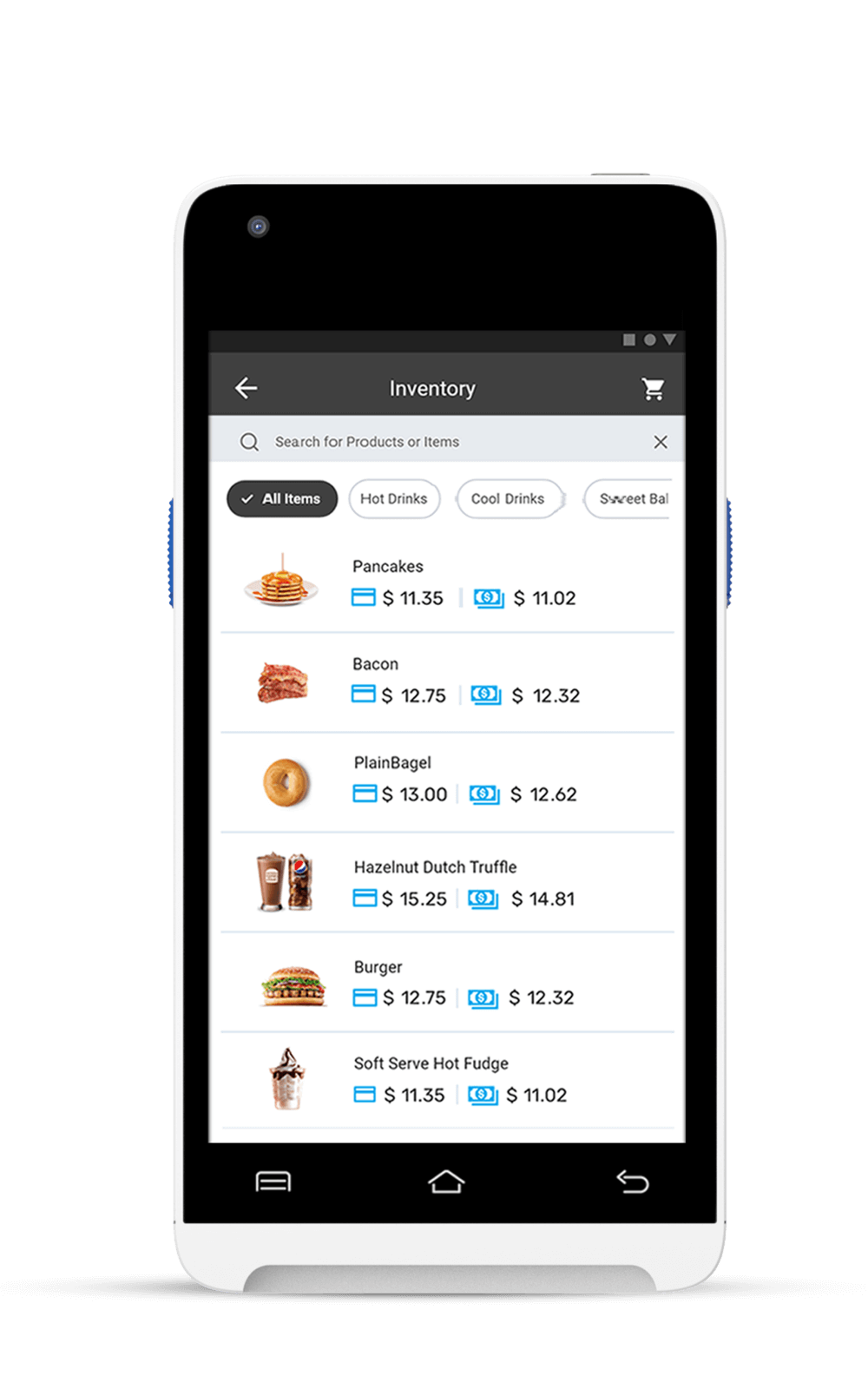

- Inventory Management: Real-time tracking, restocking alerts, and low-stock notifications.

- Analytics and Reporting: Insights into sales trends, customer behavior, and employee performance.

- Customer Relationship Management (CRM): Tools to manage loyalty programs, store purchase history, and offer personalized promotions.

- Employee Management: Tracks schedules, performance metrics, and access permissions for staff.

- Remote Access: Enables business owners to monitor operations anytime, anywhere.

- Built-In Receipt Printer: A POS terminal with built-in receipt printer provides businesses with a more efficient, cost-effective, and customer-friendly solution.

These features not only streamline operations but also provide businesses with the tools to enhance customer satisfaction and drive revenue.

Benefits of Using a POS Device

The advantages of adopting a POS terminal are vast:

Enhanced Efficiency

Speeds up checkout processes and reduces waiting times, improving overall customer experience.

Improved Accuracy

Minimizes human error in billing and inventory updates, leading to more reliable operations.

Data-Driven Decisions

Provides actionable insights through detailed analytics, helping businesses optimize operations and strategies.

Customer Satisfaction

Enables faster service and supports diverse payment preferences, catering to modern consumer needs.

Scalability

Easily adapts to the growing needs of a business, whether it’s adding new locations or handling increased customer traffic.

Cost Savings

Automates routine tasks, reducing the need for extensive manual labor and saving operational costs.

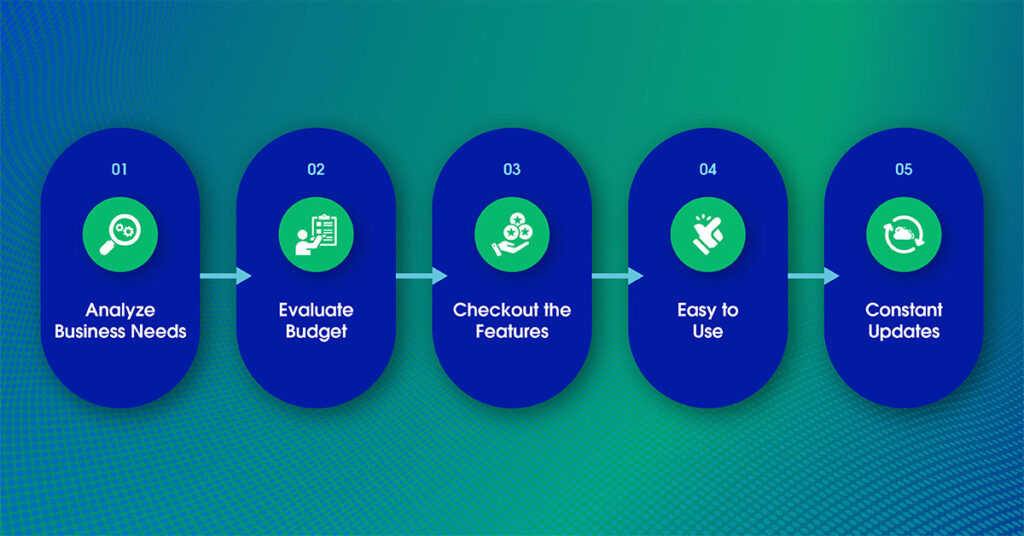

How to Choose a Secure and Reliable POS Solution in USA?

Selecting a POS terminal requires careful consideration of these factors:

STEP 1: Business Needs

A boutique shop may need features that are different from those of a multi-location restaurant or an e-commerce business.

STEP 2: Budget

Evaluate costs for hardware, software, installation, and ongoing support. Look for options that offer the best value for money.

STEP 3: Feature Set

Ensure the terminal covers essential operations like inventory management, analytics, and CRM.

STEP 4: Ease of Use

User-friendly interfaces reduce training time and enhance productivity.

STEP 5: Scalability

Choose a solution that grows alongside your business, allowing for additional features and integrations as needed.

Industries That Benefit from Payment Devices

POS terminals play a pivotal role in numerous industries, such as:

- Retail: Simplify inventory tracking, sales analytics, and loyalty program management, helping businesses stay competitive. Whether it’s a boutique in SoHo, New York or a nationwide chain, POS devices are critical to retail success.

- Hospitality: Optimize order accuracy, streamline billing, and enhance guest experiences in restaurants, cafes, and hotels.

- Healthcare: Facilitate patient billing, appointment scheduling, and inventory management for medical supplies.

- Entertainment: Manage ticket sales, concessions, and merchandise efficiently at venues like theaters and sports arenas.

- Transportation: Streamline ticketing, fare collection, and payment processing for public and private transit systems.

- E-Commerce: Integrate online and offline operations for a seamless omnichannel experience.

The Role of Security

Security is a critical component of POS devices, protecting both businesses and their customers. Key measures include:

- Encryption: Safeguards cardholder data during transactions, ensuring it cannot be intercepted.

- Tokenization: Replaces sensitive data with unique tokens, preventing breaches and fraud.

- PCI Compliance: Adheres to strict industry standards for secure data handling.

- Fraud Detection: Monitors for suspicious activities and provides real-time alerts to mitigate risks.

A secure POS terminal builds trust with customers, safeguarding their data and ensuring seamless transactions.

What’s the Future?

The evolution of POS devices is shaped by emerging technologies and shifting consumer expectations. Here’s what lies ahead:

- AI Integration: Offers predictive analytics, personalized customer experiences, and smarter inventory management.

- IoT Connectivity: Links multiple devices for streamlined operations and enhanced efficiency.

- Contactless Innovations: Expands NFC and mobile wallet capabilities, ensuring faster and safer payments.

- Blockchain Security: Enhances transparency, security, and trust in payment processes.

- Sustainability Features: Incorporates eco-friendly options like digital receipts and energy-efficient hardware.

As businesses continue to innovate, POS terminals will remain at the forefront of driving seamless and secure transactions, fostering growth across industries.

Payment devices are more than just payment tools. They’re the backbone of efficient, customer-focused businesses. By adopting the right POS solution, businesses can stay ahead of the curve, adapt to trends, and exceed customer expectations. From bustling New York storefronts to remote service providers, there’s a POS device tailored to meet all the needs.

FAQ

1. Why is a POS machine important for my business?

It’s vital for streamlining transactions, offering multiple payment methods, and enhancing customer experiences while providing valuable business insights.

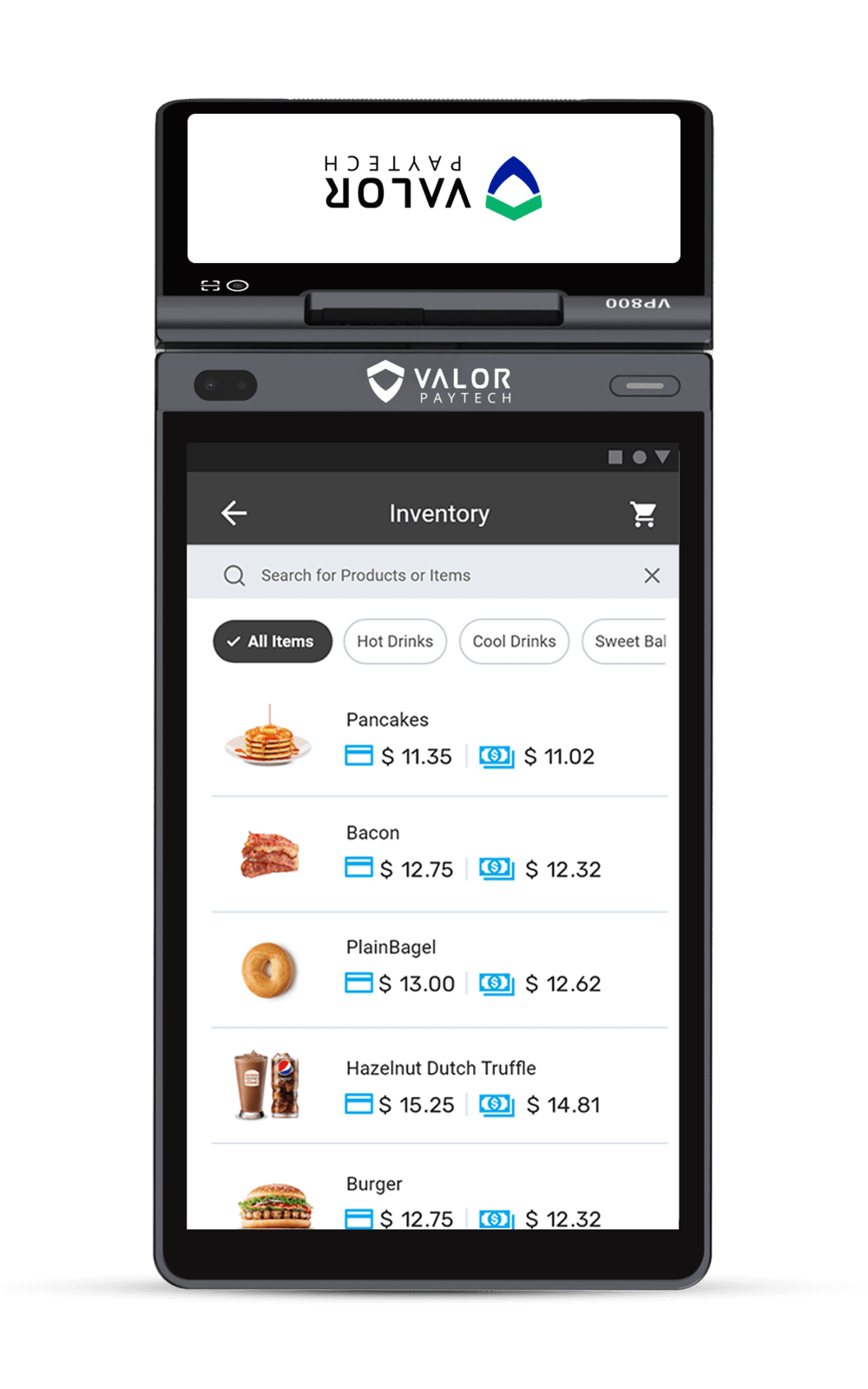

2. Which is the latest POS terminal for grocery stores?

The latest one designed for grocery stores is VP800 from Valor Paytech. This all-in-one POS solution features dual displays, enabling both staff and customers to interact easily during transactions.

3. How do POS devices process payments?

POS devices process payments by recording the transaction details, connecting with payment gateways or banks to authorize the payment, and securely storing the data.

4. How to upgrade your POS terminal?

To upgrade your POS, you must go through these five steps: Assess your terminal, choose a new terminal, check compatibility, update your payment processor (if necessary), and train your staff.

5. How do payment devices enhance my business' efficiency?

By automating tasks like inventory updates, and sales reporting, payment devices reduce errors, speed up transactions, and free up time for employees to focus on customer service and other critical operations.

6. Can I use mobile POS (mPOS) in multiple locations?

Yes, mPOS devices are portable and can be used across various locations. Paired with cloud-based POS solutions, they allow centralized control and real-time updates for multi-location businesses.

7. Do I need internet access to use a POS device?

While many modern POS devices require internet access for real-time updates and cloud connectivity, some terminals offer offline modes to ensure transactions can be processed even during outages.

8. Why is a POS terminal with NFC and EMV card reader necessary?

A payment device with NFC and EMV card reader is necessary because NFC technology enables contactless payments, and EMV card readers provide enhanced security and protection against card skimming.

9. What is the most cost-effective POS terminal for small retailers?

Valor PayTech provides the best cost-effective payment devices suited for small retailers, hospitals, restaurants, cafes, and various other industries.

10. How to choose the best POS terminal in 2026?

Choose a POS terminal based on business needs, budget, scalability, payment options, real-time analytics, security, and ease of use to support growth and seamless operations.

11. What is the best modern POS terminal for retail & restaurants?

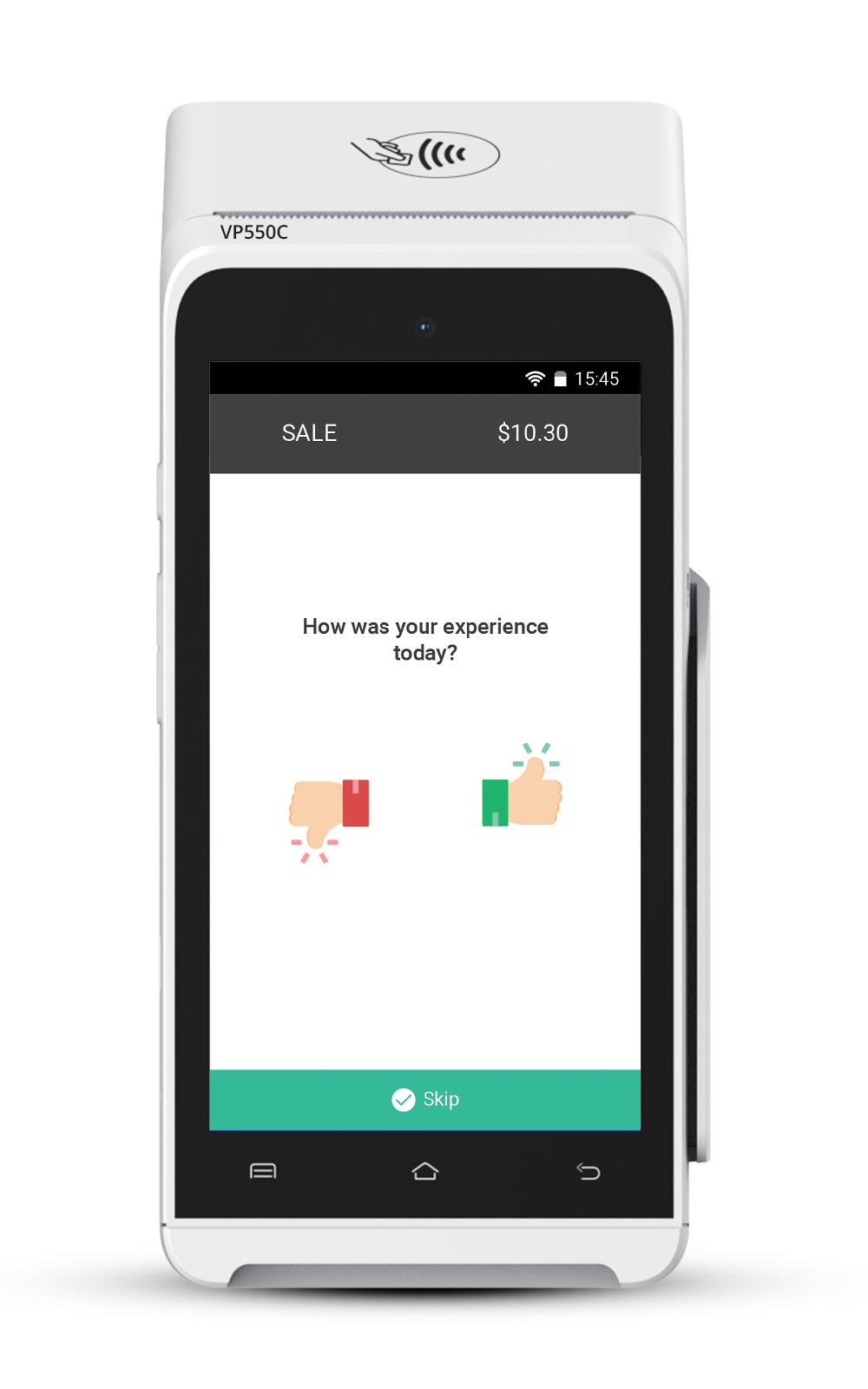

The VP550C offers a 5" touchscreen, Android 12, fast processing, versatile payments, and secure connectivity, making it perfect for retail and restaurant environments needing efficiency and seamless transactions.

Ready to get started?

Become a Partner Today!

Complete the form below.