In today’s digital-first marketplace, every business—whether a boutique shop in New York City or a fast-growing national eCommerce brand—needs a reliable, secure, and modern payment gateway. It’s the silent engine that powers online transactions, protects sensitive payment data, and ensures that customers can pay quickly and confidently.

But despite how essential payment gateways are, many business owners still aren’t sure how they work or what makes one provider better than another. This 2026 guide breaks everything down in a clear, human way—no technical jargon, no confusing systems—just real insights to help you choose the best payment gateway for your business.

1. What Is a Payment Gateway?

A payment gateway is a secure digital bridge between your customer’s payment method and your business bank account. It authorizes, encrypts, and processes online and card-not-present transactions—ensuring payments move instantly and safely.

You can think of it as the digital equivalent of a card machine, but built for:

- Websites

- Mobile apps

- Online invoices

- Payment links

- Recurring billing

Without a payment gateway, customers wouldn’t be able to pay online using credit cards, debit cards, digital wallets, or ACH transfers.

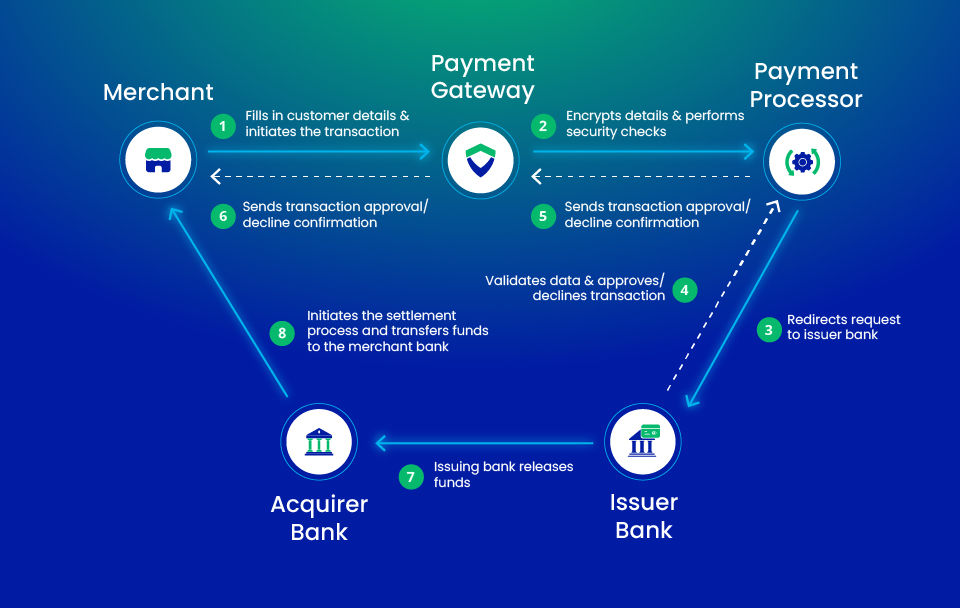

2. How a Payment Gateway Works (Simple Step-by-Step)

Payment gateways may seem complex, but here’s the simplest way to understand the workflow:

Step 1: Customer enters payment info

Card, wallet, or bank details—online, mobile, or via link.

Step 2: Data is encrypted

The gateway hides sensitive card information using tokenization.

Step 3: Gateway sends request to processor

It connects to the merchant’s payment processor.

Step 4: Bank approves or declines

Issuing banks run fraud checks in milliseconds.

Step 5: Transaction completes

Approval = payment done

Decline = another method may be requested

Step 6: Settlement

Funds are transferred to the merchant’s bank account.

All of this happens in less than 3 seconds.

3. What Happens During a Payment Gateway Transaction?

A little deeper look into the workflow:

- Customer → Merchant Website

Enters payment details. - Merchant Website → Gateway

Data gets encrypted. - Gateway → Processor → Issuing Bank

The bank validates the transaction. - Bank → Processor → Gateway → Merchant Website

The decision is sent back. - Settlement

Money is delivered to the merchant.

This process ensures security, speed, and consistency.

4. Why Every Business Needs a Payment Gateway in 2026

Whether you’re selling coffee subscriptions or enterprise software, customers expect:

✔ One-click checkout

✔ Payment by card or wallet

✔ Zero delays

✔ Top-level security

A payment gateway delivers:

- Faster online payments

- Stronger fraud protection

- Better customer experience

- Increased conversion rates

- Support for multiple payment methods

In competitive markets like NYC—where digital payments dominate—a modern payment gateway is not optional. It’s the backbone of revenue.

5. Types of Payment Gateways

Different businesses require different gateway structures.

1. Hosted Payment Gateways

Redirect customers to a secure page.

Example: PayPal, Stripe Checkout.

2. Self-Hosted / API-Driven Gateways

Payments occur directly on your site with API integration.

Ideal for SaaS, enterprise, and eCommerce.

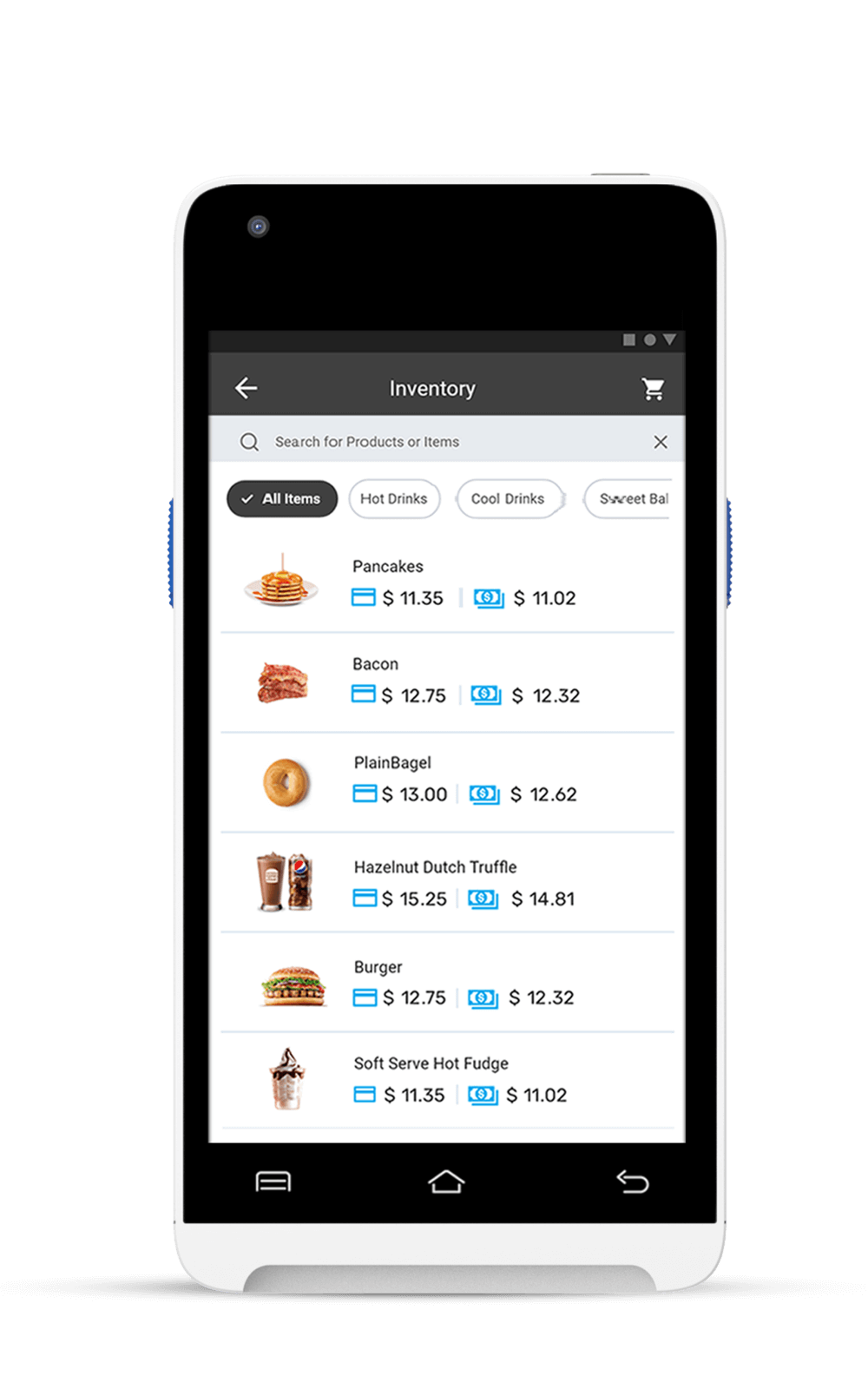

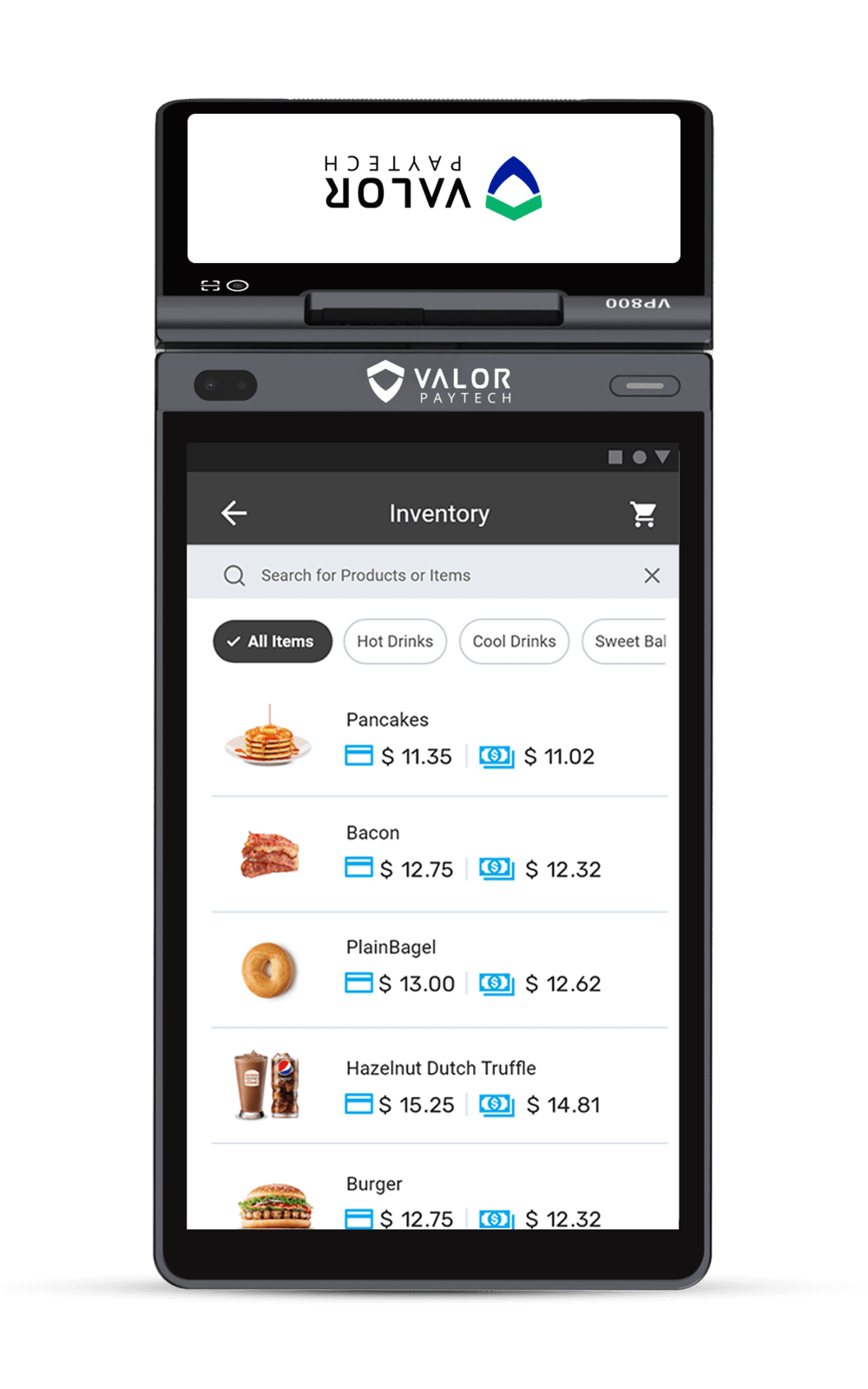

3. Integrated Payment Gateways

Built into POS or business management systems.

Example: Valor PayTech.

4. Local vs. International Gateways

International platforms support multi-currency, ideal for global brands.

6. Payment Gateway vs. Payment Processor

Many confuse these terms. Here’s the difference:

| Payment Gateway | Payment Processor |

|---|---|

| Authorizes the payment | Moves funds between banks |

| Handles encryption & tokenization | Manages settlement |

| Customer-facing | Bank-facing |

| Needed for online payments | Needed for all card payments |

A business typically uses both.

7. Key Features to Look for in a Modern Payment Gateway

To compete in 2026, your payment gateway should offer:

✔ Tokenization & encryption

✔ Fraud detection (AI-driven)

✔ Fast approval routing

✔ Mobile & digital wallet support

✔ Recurring billing options

✔ Multi-currency support (optional)

✔ Instant or same-day payouts

✔ Easy integration (API, plugins)

✔ Chargeback management

✔ Real-time reporting

NYC merchants especially need fast, reliable approvals due to high customer volume.

8. Benefits of Using a Payment Gateway

✔ Higher Payment Success Rates

Smart routing minimizes declines.

✔ Enhanced Security

Tokenization, encryption, PCI compliance.

✔ Better Customer Experience

Faster checkout → higher conversions.

✔ Supports All Payment Methods

Cards, wallets, ACH, BNPL, QR, etc.

✔ Helps Prevent Fraud

AI and machine learning detect suspicious activity.

✔ Works for Any Business Size

Freelancers → Startups → Enterprise.

9. Payment Gateway Security & Compliance

A trustworthy gateway must offer:

- PCI DSS Level 1 compliance

- End-to-end encryption

- Tokenization

- AVS & CVV checks

- 3D Secure authentication

- Fraud detection algorithms

- Chargeback tools

These are non-negotiable in 2026’s threat-heavy digital landscape.

10. Best Payment Gateway Providers in 2026 (USA + NYC)

Here are the top platforms businesses trust:

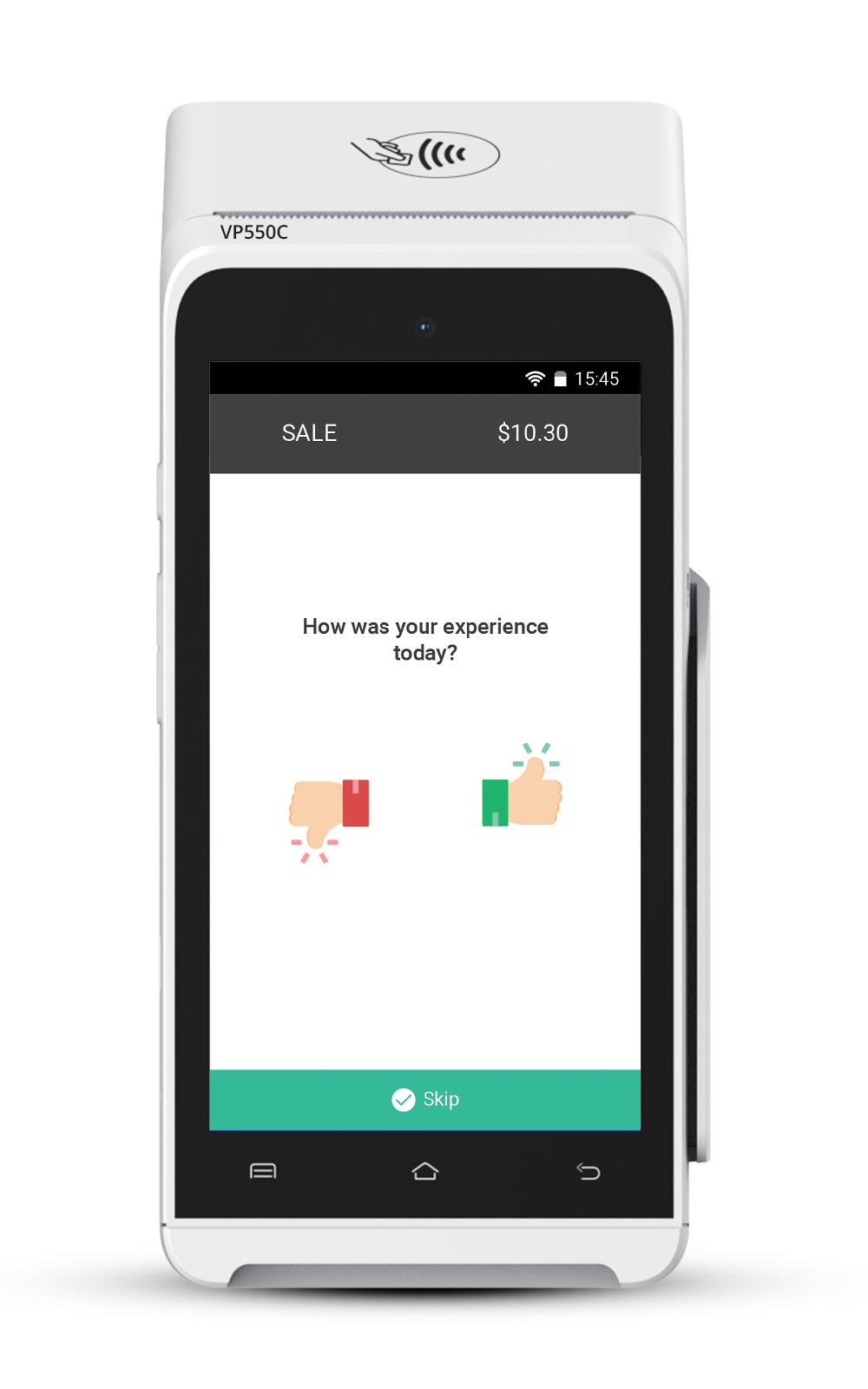

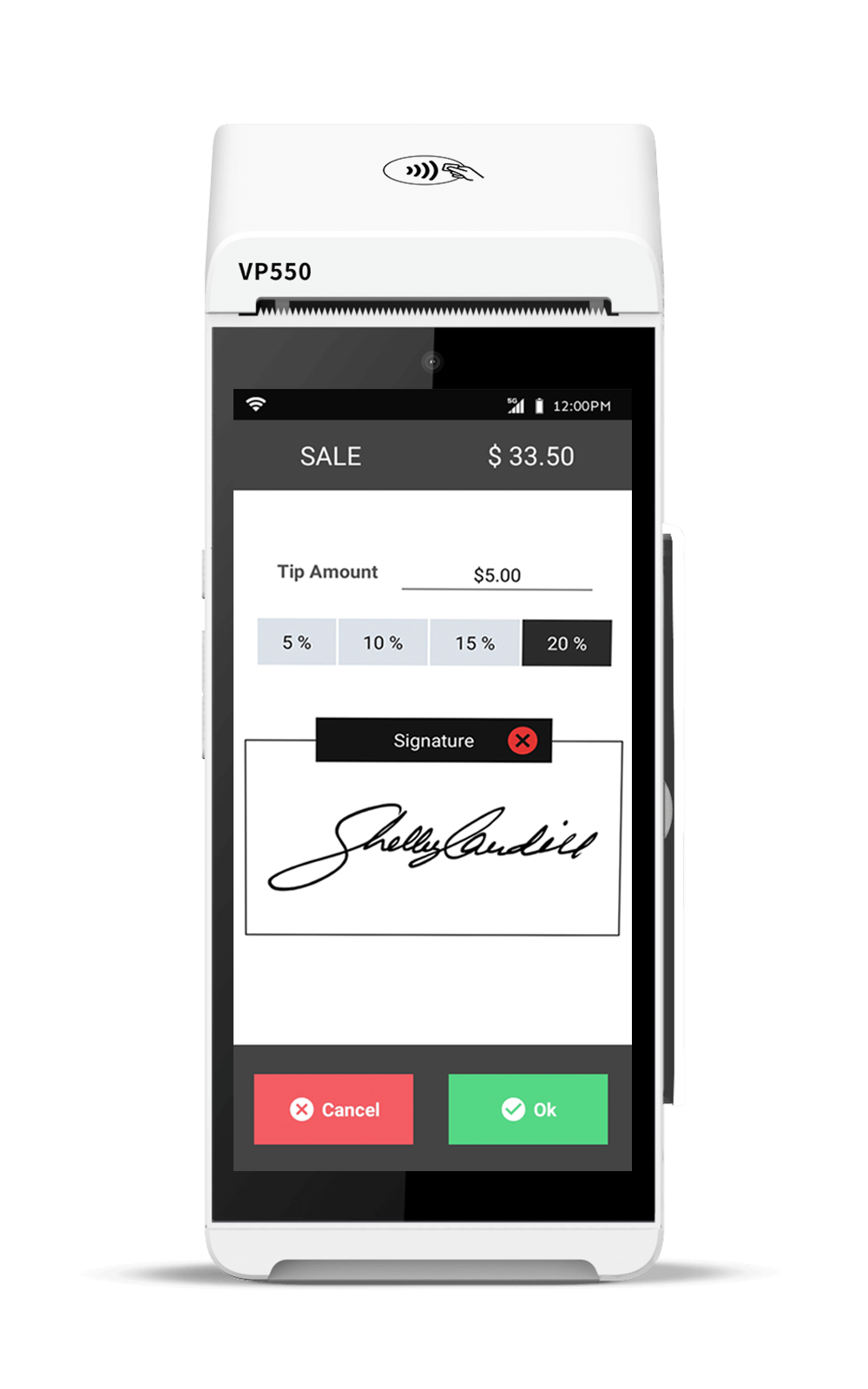

1. Valor PayTech

- Best for omnichannel merchants

- Smart terminals + online gateway

- NYC-first approval routing

- Mobile wallets, QR, ACH

- Real-time reporting

2. Stripe

- Best for developers

- API-focused

- Subscriptions + SaaS billing

3. PayPal

- Best for fast setup

- Global reach

- Easy integrations

4. Authorize.net

- Best for traditional merchants

- Stable, reliable gateway

5. Square

- Best for retail + POS

- Unified POS + online payments

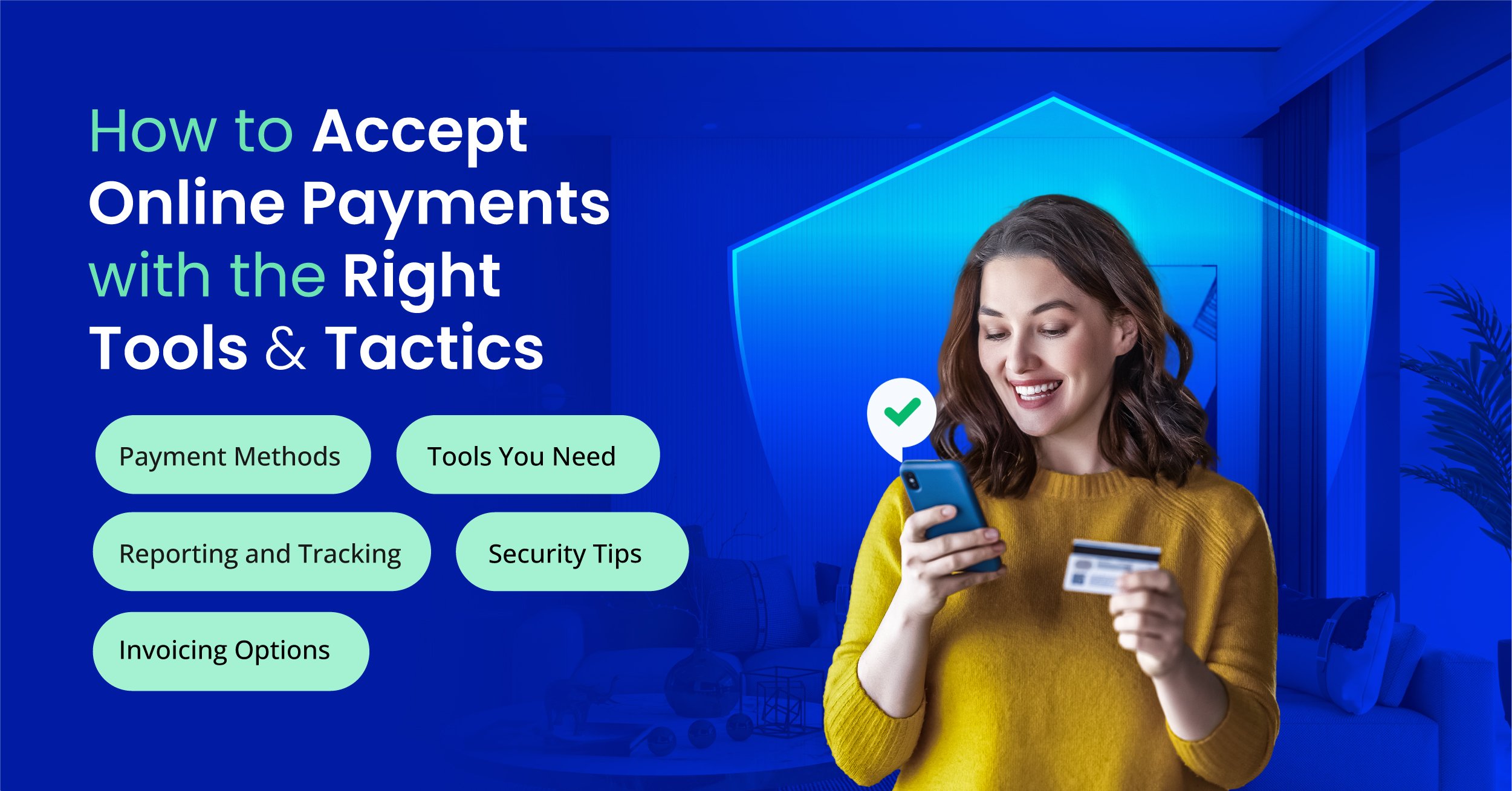

11. Payment Gateway for Online Business

Online businesses rely on a payment gateway to power secure and seamless digital checkout. It must support cards, wallets, and recurring payments while integrating easily with platforms like Shopify, WooCommerce, or Magento.

Important features include:

- High approval rates

- Fast checkout

- Fraud protection

- API or plugin integration

A strong gateway improves conversions and reduces cart abandonment across all types of online businesses.

12. Payment Gateway for Service Businesses

Service businesses often need flexible, mobile-friendly payment options because payments happen after service, on-site, or remotely. A reliable payment gateway helps these businesses accept payments through invoices, payment links, mobile wallets, or recurring billing.

The right gateway should offer:

- Fast mobile checkout

- Text-to-Pay or Email Pay links

- Secure customer card storage

- Recurring billing options

This ensures faster payments, fewer delays, and a smooth customer experience.

13. How to Choose the Right Payment Gateway

Ask these questions:

✔ Does it support omnichannel payments?

✔ Does it offer strong fraud protection?

✔ Is it fast enough for NYC’s pace?

✔ What payment methods does it support?

✔ Are fees transparent?

✔ Does it work with your website builder or POS?

✔ Are payouts fast?

✔ How good is customer support?

14. U.S. vs. NYC Payment Gateway Needs

NYC businesses typically need:

- Extremely fast authorization

- Contactless wallet support

- QR ordering

- High uptime

- Local routing reliability

USA-wide businesses focus more on:

- Multi-state tax handling

- Supported processors

- High approval consistency

- Affordable fees

- Valor PayTech works exceptionally well for both markets.

15. Future Trends in Payment Gateways (2026 & Beyond)

AI-Driven Approvals

Real-time fraud detection + smart routing.

Biometric Payments

FaceID, fingerprint, behavioral biometrics.

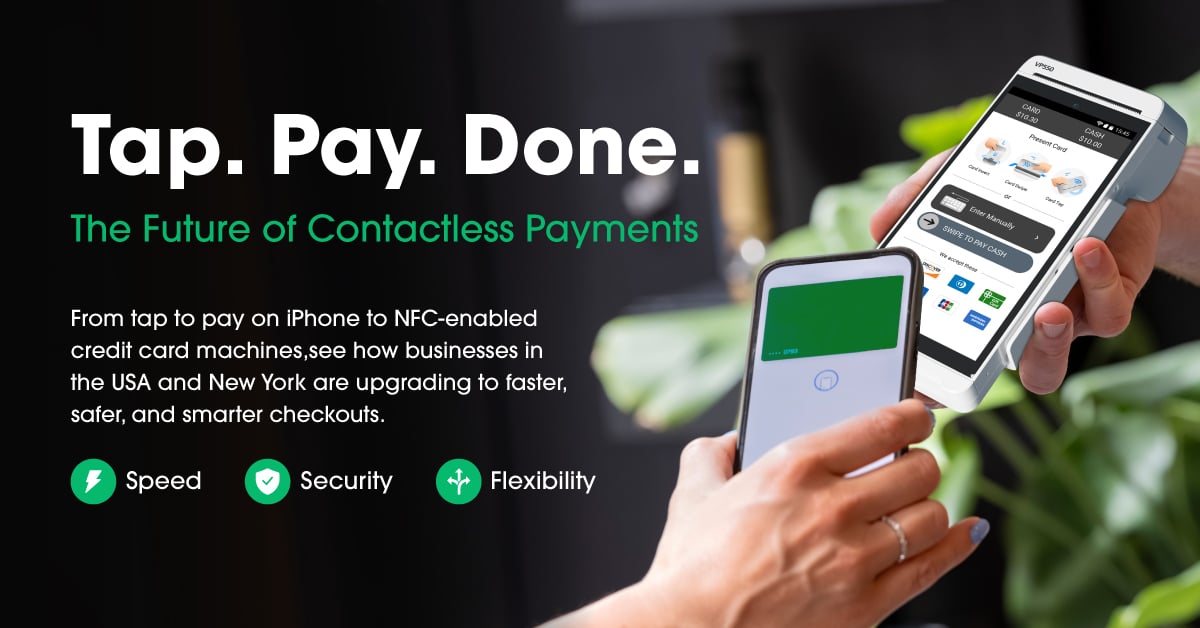

Tap-to-Pay for Merchants

Accept cards directly on iPhone or Android.

Voice-Activated Payments

Growing in smart home commerce.

Invisible Checkout Experiences

No checkout page—automatic billing.

Unified Commerce Platforms

Everything in one place: POS, online, mobile.

16. Conclusion

A payment gateway isn’t just a tool—it’s the infrastructure behind every successful online transaction. Whether you’re serving customers in NYC’s fast-paced retail environment or running a national online store, choosing the right payment gateway dramatically impacts conversion rates, customer trust, and business growth.

Platforms like Valor PayTech continue to push the standards higher with smarter routing, advanced security, and seamless omnichannel capabilities. In 2026, businesses that invest in modern gateway technology will stay ahead—faster, safer, and more competitive.

FAQs

1. What is a payment gateway?

A payment gateway is a secure system that authorizes, encrypts, and processes online or digital payments between customers and businesses.

2. What is the best payment gateway for startups?

Startups benefit from Valor PayTech’s quick onboarding, low-friction setup, fast payouts, and scalable features designed to grow with early-stage businesses.

3. Which is the best payment gateway for small businesses in 2026?

Top options include Valor PayTech, Stripe, PayPal, Square, and Authorize.net. They offer secure payments, modern checkout tools, recurring billing, and strong fraud protection for SMBs.

4. What’s the difference between a payment gateway and a processor?

A gateway authorizes transactions; a processor moves the funds between banks.

5. What payment methods do gateways support?

Gateways support credit cards, debit cards, digital wallets, ACH, QR payments, and recurring billing.

6. Which payment gateway offers fast payouts?

Valor PayTech provides fast and reliable payouts, helping businesses improve cash flow and reduce waiting time between transactions and settlement.

7. How much does a payment gateway cost?

Most gateways charge 2.3%–3.5% per transaction, depending on the provider.

8. What is the best payment gateway for retail stores?

Valor PayTech is great for retail stores because it combines online and in-store payments, supports contactless checkout, and includes real-time reporting.

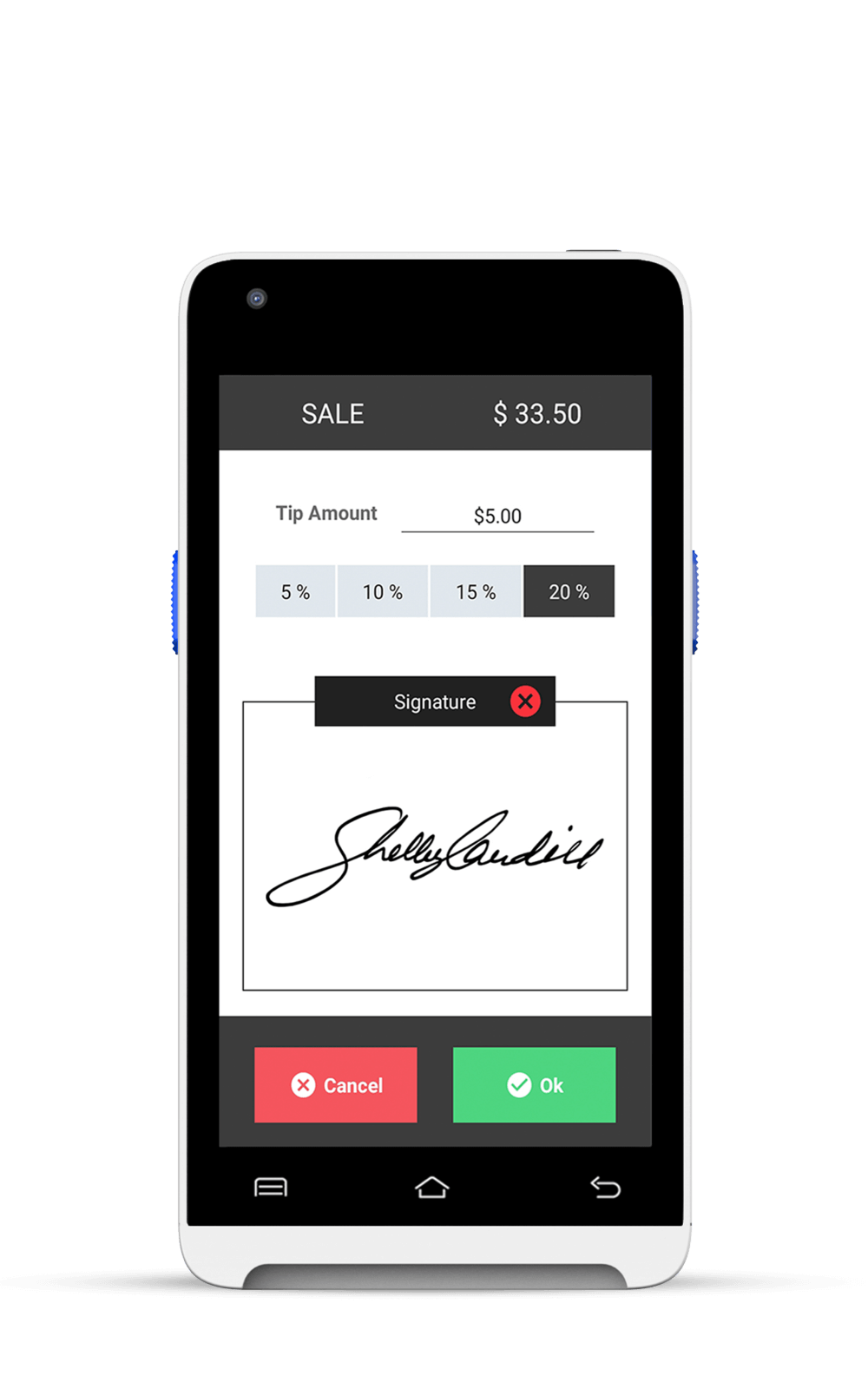

9. What payment gateway is best for restaurants?

Restaurants choose Valor PayTech for its QR ordering, tip options, contactless checkout, tableside payments, and fast, secure transaction routing.

10. Which payment gateway has strong fraud protection?

Valor PayTech offers robust fraud protection with tokenization, encryption, AI risk scoring, and 3D Secure authentication to safeguard every transaction.

11. Who is the best payment gateway provider in NYC?

Valor PayTech is a leading NYC payment gateway provider offering fast approvals, secure payments, and local support tailored to New York merchants.

12. What are the best New York payment gateway solutions?

Valor PayTech delivers New York businesses secure online payments, mobile checkout, smart terminals, and fast routing optimized for high-volume NYC commerce.

13. Which payment gateway is best for New York businesses?

Valor PayTech works exceptionally well for New York businesses thanks to its quick approvals, smart POS systems, and omnichannel payment capabilities.

13. What is the best NYC merchant payment gateway?

NYC merchants prefer Valor PayTech for its reliable uptime, wallet support, fast processing, and tools designed for busy metro-area retailers.

13. Is there a payment gateway company in NYC that supports omnichannel payments?

Yes—Valor PayTech, based in the U.S., supports omnichannel payments for NYC businesses, including online, mobile, contactless, and POS transactions.

References

- https://financesonline.com/online-payments-statistics/

- https://www.bigcommerce.com/articles/ecommerce/payment-gateways/

Ready to partner with Valor PayTech?

Become a Partner Today!

Complete the form below.