The payment industry is evolving at a rapid pace, and 2026 promises to bring even more groundbreaking innovations. These trends will shape the future of financial transactions and redefine how businesses and consumers interact with payments.

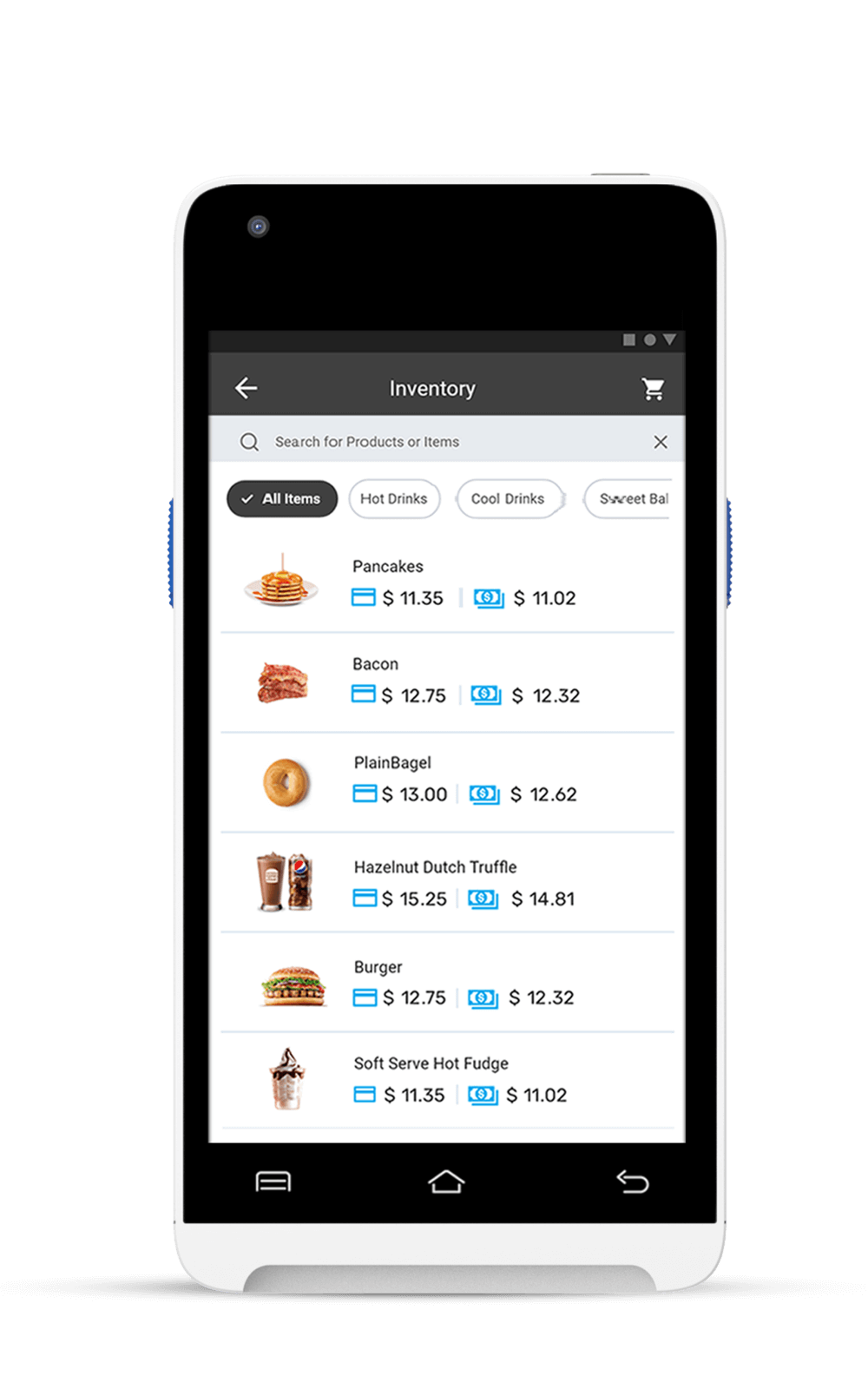

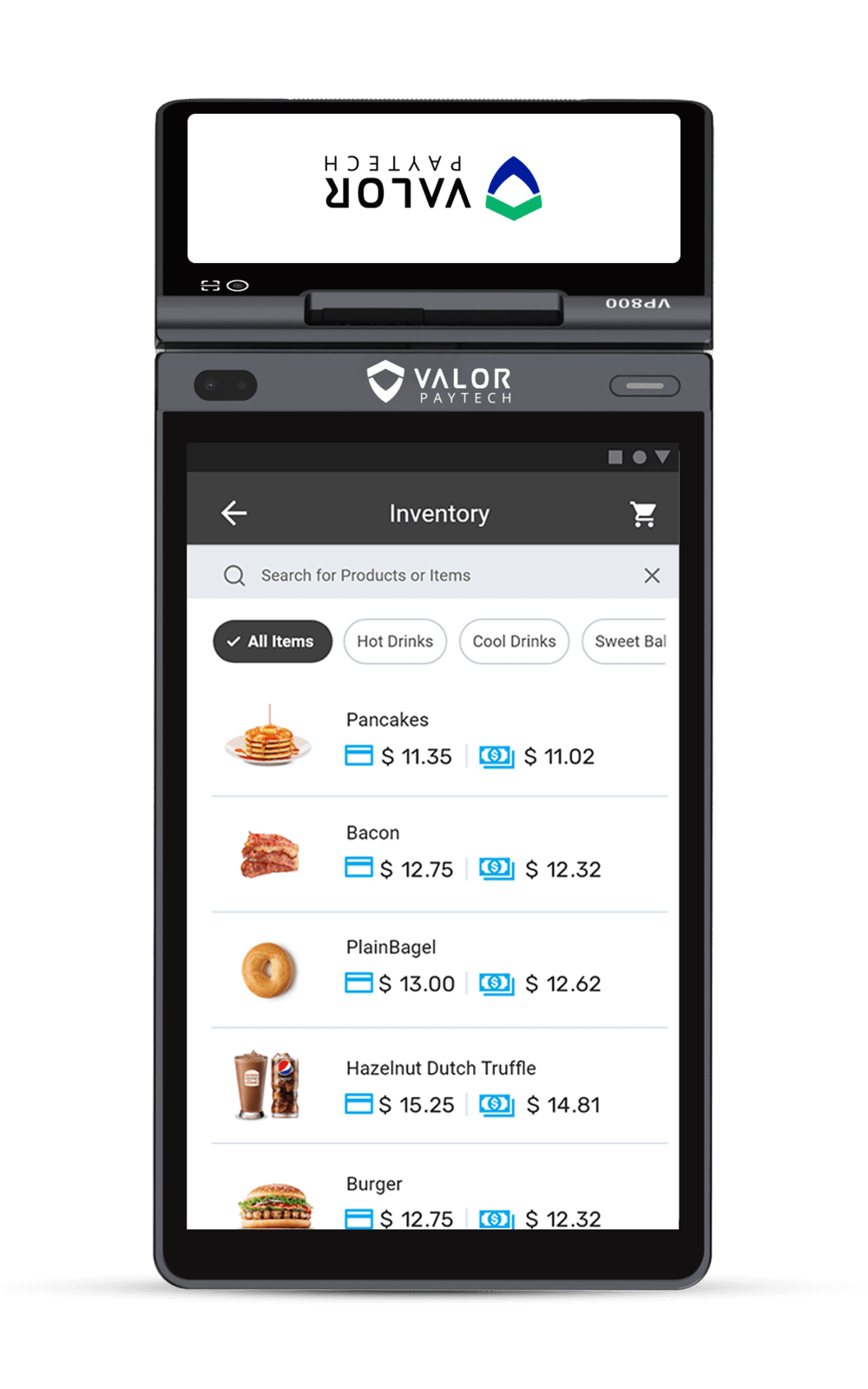

1. The Rise of Digital Wallets

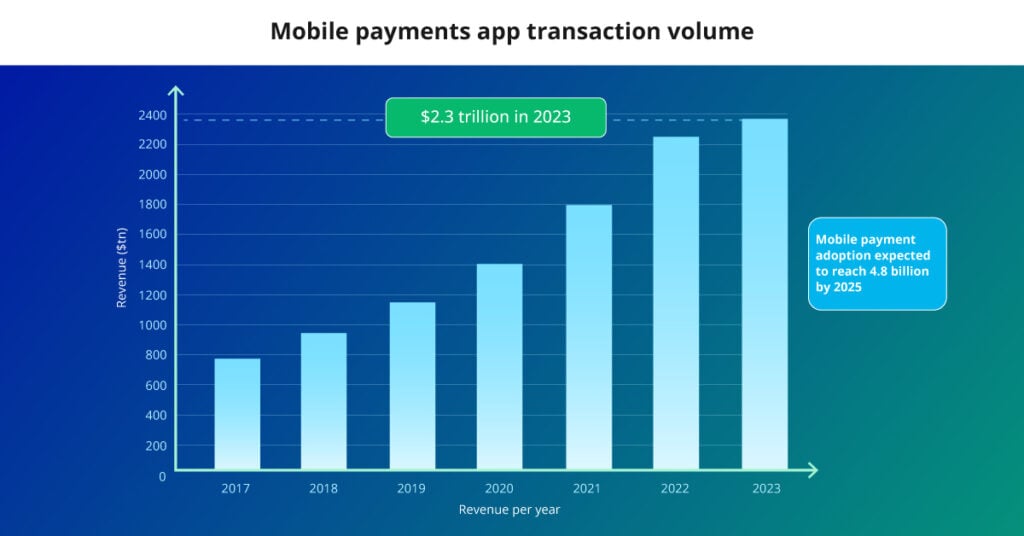

Digital wallets are revolutionizing how consumers make transactions, offering convenience, security, and speed. As mobile and digital payment options continue to grow in popularity, more consumers and businesses are shifting to digital wallets.

This trend is expected to accelerate in the coming years, particularly as mobile phone usage and digital banking continue to expand so let’s dig into the advantages:

- Seamless Transactions: Digital wallets enable consumers to make purchases directly from their smartphones, reducing the need for physical cards and the hassle of carrying cash.

- Advanced Security: Most digital wallets are equipped with sophisticated encryption and biometric authentication features, reducing the risk of fraud and enhancing user security.

- Loyalty and Rewards Integration: Many digital wallets integrate with loyalty programs, allowing consumers to easily manage reward points, special offers, and discounts directly from the wallet, creating a seamless shopping experience.

Digital wallets are no longer just for tech-savvy users—they’ve become an everyday payment method for millions of people worldwide. As businesses embrace mobile payment solutions, digital wallets are becoming a must-have for any modern merchant.

Survey Data: Mobile payment transactions reached $1.7 billion in 2021, growing by 27% annually (Curry, 2023).

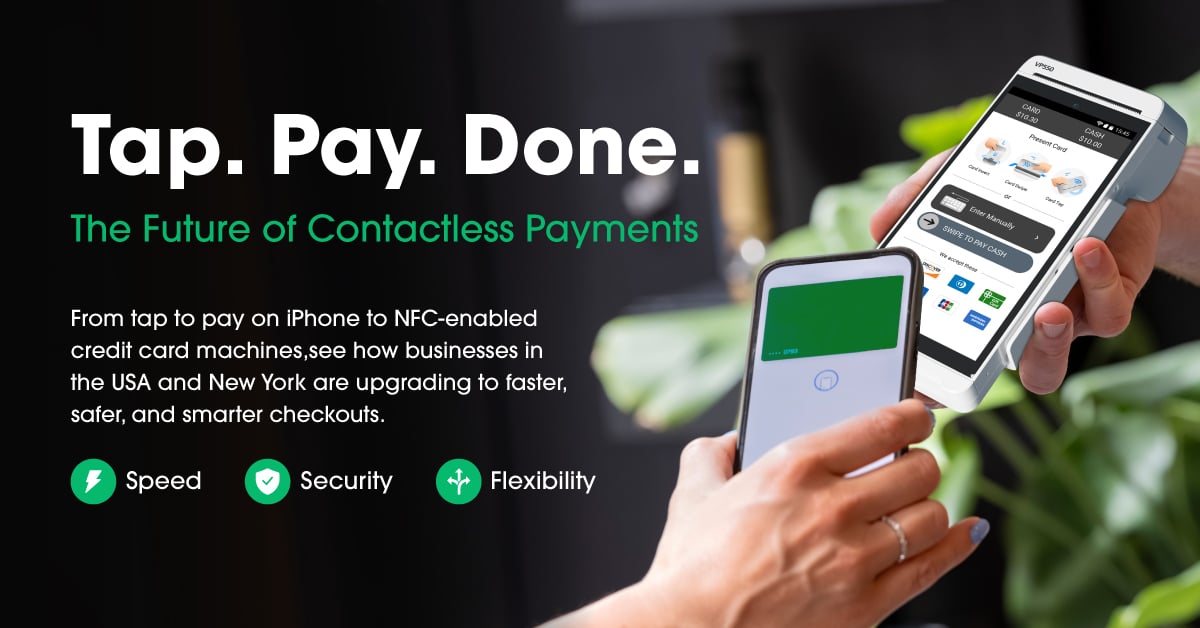

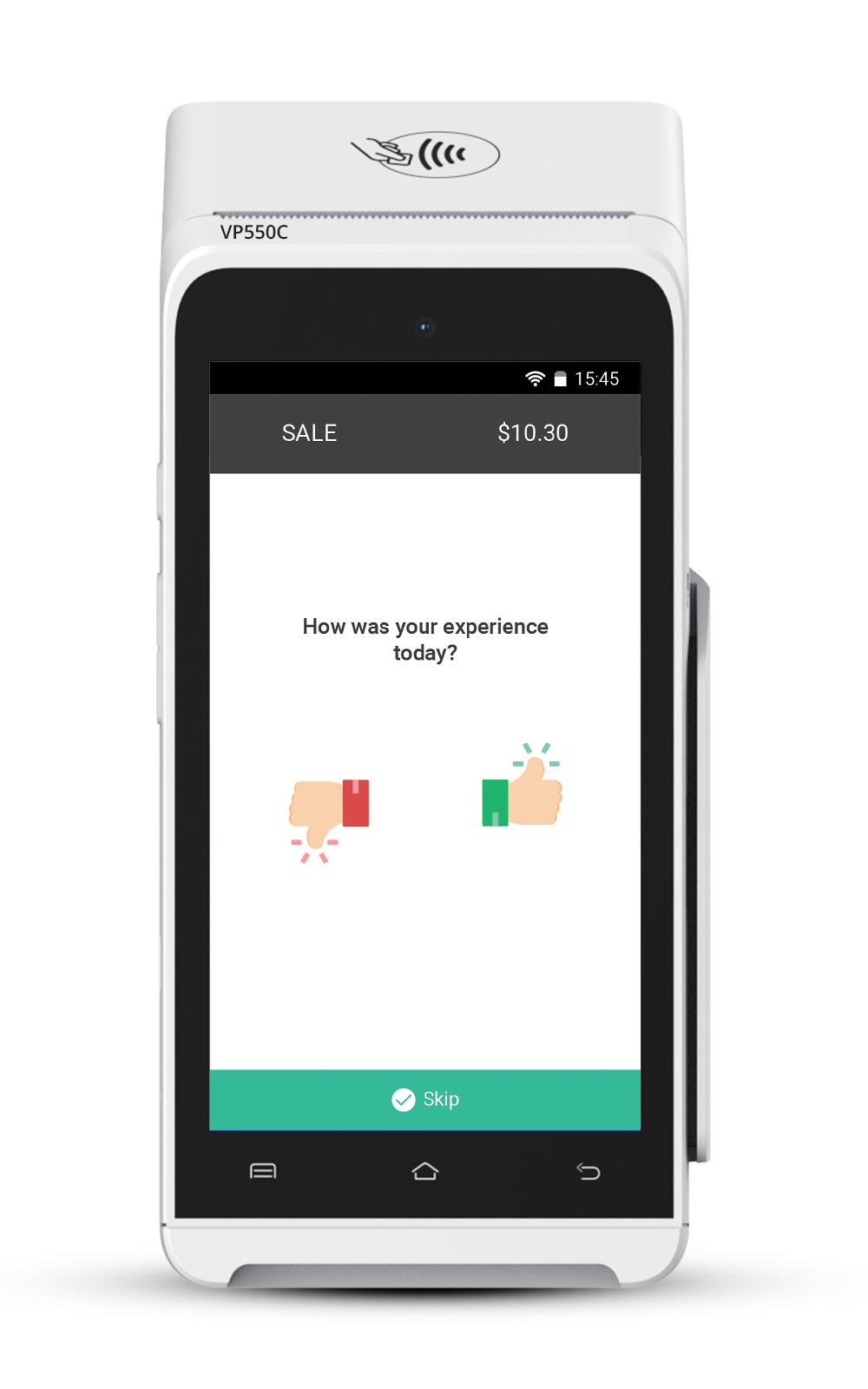

2. Contactless Payments

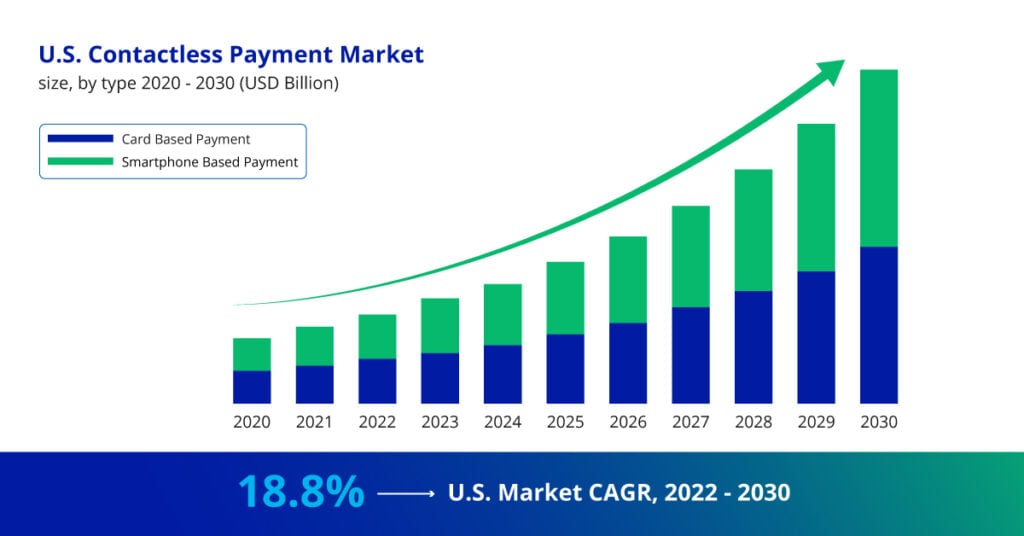

Contactless payments are quickly becoming the preferred choice for consumers and merchants alike.

With no need for physical contact or pin numbers, contactless payments are faster, more convenient, and, in many ways, more secure than traditional payment methods. Some of the main features are:

- Speed and Convenience: Contactless payments take just seconds to process, offering a faster, more convenient transaction experience. Consumers simply tap their card or mobile device at the point of sale to complete a payment.

- Increased Security: Tokenization technology, which replaces sensitive card data with a unique identifier, makes contactless payments highly secure. This reduces the risk of fraud associated with traditional card swipes or swiping on a POS device.

- Global Acceptance: With the increasing number of merchants accepting contactless payments worldwide, it’s now easier than ever for consumers to use this method wherever they shop.

Contactless payments are becoming the standard in many regions and will likely continue to grow in popularity globally. As more merchants and consumers adopt this payment method, it will continue to redefine the payment landscape.

Survey Data: The global contactless payment market is projected to grow at a 19.1% CAGR from 2022 to 2030 (Contactless Payment Report, 2030).

3. Blockchain-Powered Payments

Blockchain technology has already made waves in the financial industry, and its applications in payments are becoming more apparent.

As the demand for faster and more secure transactions grows, blockchain technology offers a decentralized solution that reduces the need for intermediaries, and speeds up processing times.

Blockchain has impacted the payment industry in many ways but some of the important effects are:

- Enhanced Security: Blockchain’s distributed ledger ensures that every transaction is stored securely and is immutable, meaning it cannot be altered or tampered with once confirmed. This makes it an ideal solution for ensuring the integrity of payment transactions.

- Faster Transactions: Unlike traditional payment systems, which can take days to clear transactions, blockchain enables real-time transaction settlements. This helps eliminate delays and reduces the need for clearing houses or third-party intermediaries.

- Cost Savings: By eliminating the need for multiple intermediaries (such as banks or payment processors), blockchain significantly reduces transaction fees, offering cost savings for both businesses and consumers.

Blockchain-based payments can make international transfers faster and cheaper while also eliminating risks such as fraud and chargebacks. As adoption grows, more businesses will look to leverage blockchain technology to streamline their payment processes and improve customer experience.

Survey Data: Blockchain’s potential is expected to disrupt the payment industry by offering tamper-proof and traceable transactions (Blockchain and AI, n.d.).

4. AI and Machine Learning in Payment Processing

Artificial intelligence (AI) and machine learning are increasingly being incorporated into payment systems to enhance payment processing, detect fraud, and improve customer service.

These technologies are helping businesses automate their operations, analyze vast amounts of transaction data, predict consumer behavior with incredible accuracy and do just more than that like:

- Fraud Prevention: AI analyzes transaction patterns and flags any irregular activity, helping to identify fraudulent transactions before they occur. Machine learning algorithms can continuously improve and adapt to new threats, making fraud prevention even more effective.

- Predictive Analytics: AI can predict consumer behavior based on past transactions, helping businesses to optimize their payment processing systems and target specific customer needs more effectively.

- Chatbots and Customer Support: AI-powered chatbots are transforming customer service in payment processing by providing 24/7 assistance, answering inquiries, and resolving issues without human intervention, enhancing the overall customer experience.

AI in payments isn’t just about automation; it’s about creating smarter, safer, and more efficient systems. Businesses that harness the power of AI will be better positioned to stay ahead of the competition.

Survey Data: The use of AI in payment processing is projected to reduce fraud by 30% in the next 3 years (source: industry report).

5. A2A Payments Will Drive Profits

Account-to-account (A2A) payments are gaining traction for their simplicity, cost-effectiveness, and security. A2A payments are processed directly between accounts, eliminating the need for traditional card networks, and offering consumers and businesses an efficient way to transfer funds.

Some of the key features of A2A payments are:

- Lower Transaction Fees: A2A payments avoid high transaction fees typically associated with card payments and third-party processors, enabling businesses to save on costs while offering competitive pricing.

- Instant Transfers: Real-time processing is a major benefit of A2A payments. This method eliminates the days-long settlement periods associated with traditional banking transactions.

- Increased Merchant Adoption: With merchants facing increasing payment processing costs, A2A is a compelling alternative that provides businesses with a faster, cheaper, and more reliable way to collect payments.

The rise of A2A payments is driven by both cost savings and faster, more secure transactions, making it an appealing solution for businesses of all sizes.

Survey Data: By 2029, global A2A transactions will grow from $1.7 trillion to $5.7 trillion, a 230% increase (Juniper Research).

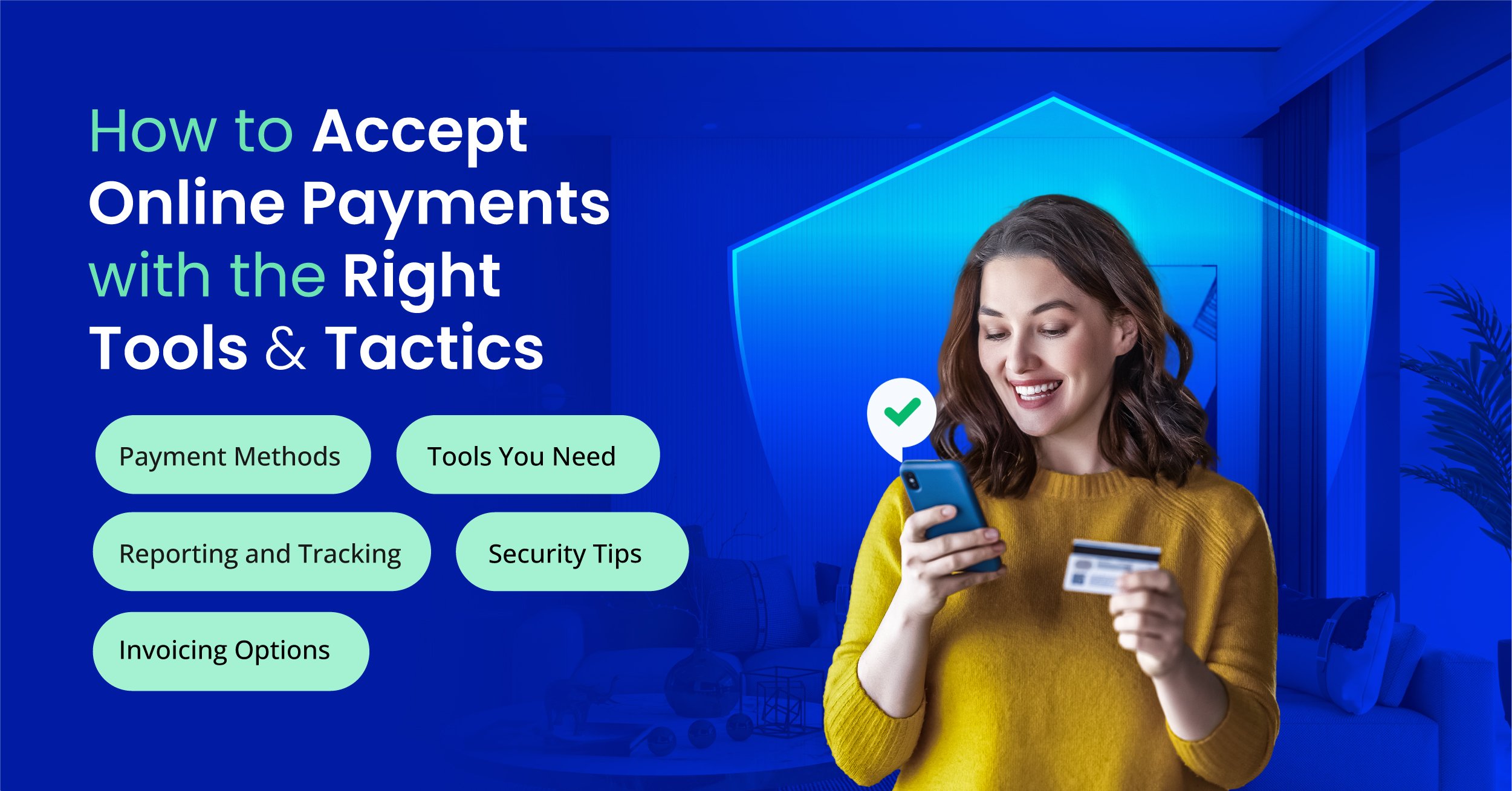

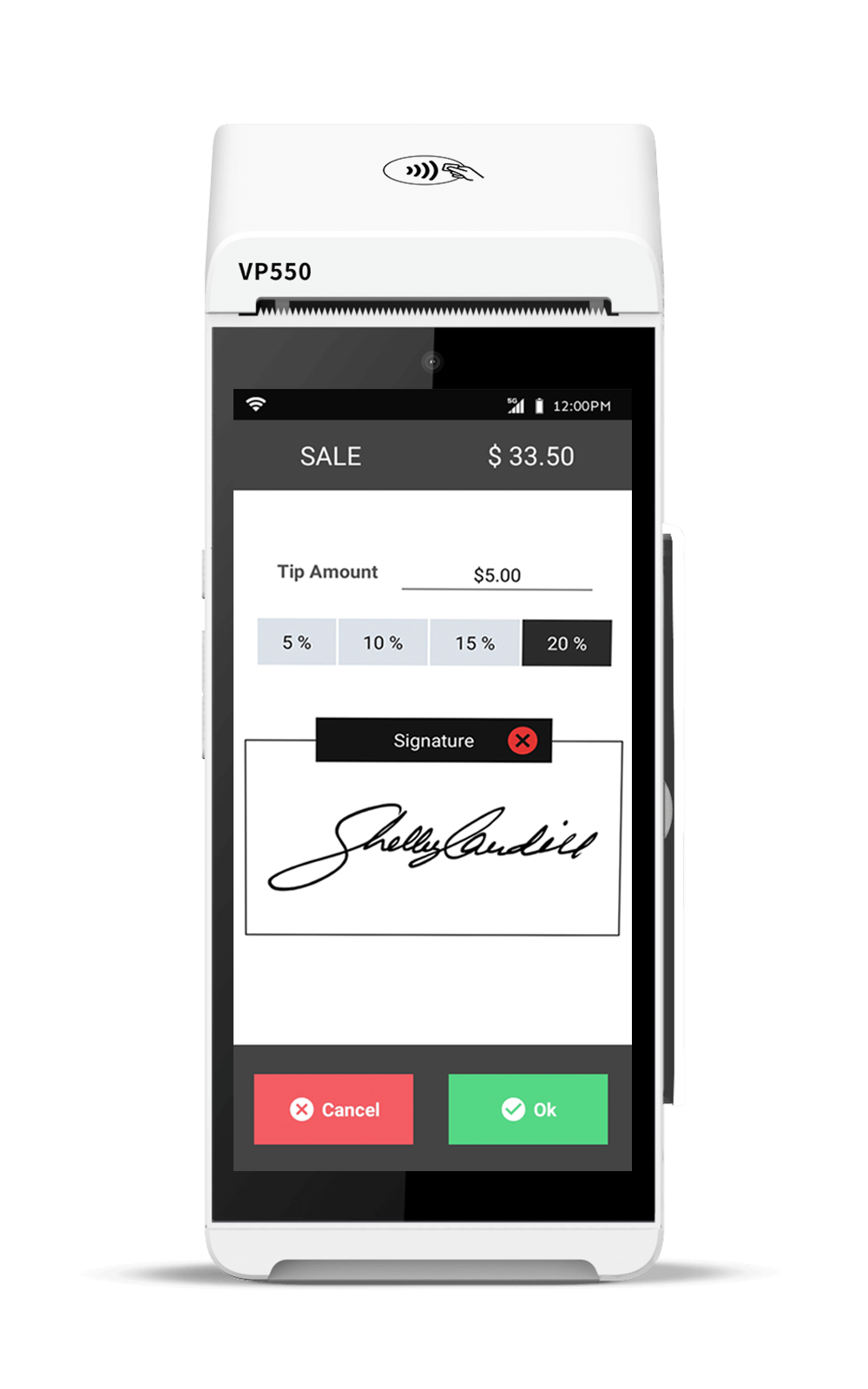

Another One of the Top Growing Trends - Biometric Authentication

Biometric payment methods, such as fingerprint scans, facial recognition, and voice authentication, are gaining momentum as secure and convenient alternatives to traditional PINs and passwords.

As the demand for frictionless and secure transactions increases, biometric authentication is stepping in to offer consumers and businesses the best of both worlds. Some of the key advantages are:

- Enhanced Security: Biometrics are unique to each individual, making it nearly impossible for fraudsters to replicate. This provides a higher level of security compared to passwords or PINs, which can be easily stolen or guessed.

- Faster Checkout: With biometric methods, consumers can authorize payments within seconds – just a quick scan or face recognition, and they’re done. This speed is invaluable for both in-store and online purchases.

- Reduced Fraud Risk: Biometric data is much harder to steal or fake than traditional authentication methods, ensuring that only the legitimate user can make a payment.

Biometric authentication methods are set to become mainstream in the next few years, providing businesses with an easy way to enhance security while simplifying the payment process for customers.

Survey Data: 70% of consumers are interested in using biometric payment methods for better security and convenience (source: industry survey).

Conclusion

As 2026 approaches, these trends will continue to redefine the payment landscape. From mobile wallets to AI-powered fraud prevention and blockchain’s transformative capabilities, the future of payments promises increased convenience, security, and speed. Embracing these trends will help businesses stay competitive and meet the demands of today’s fast-evolving digital economy.

FAQ

How will blockchain impact the payment industry?

Blockchain will provide secure, transparent, and efficient transaction processing with reduced fees and fraud.

Which industry uses biometric payment systems?

Biometric payment systems are used in banking, retail, hospitality, healthcare, e-commerce, and so on to enhance security and customer convenience during transactions.

What is an example of artificial intelligence in payments?

Artificial intelligence in payments enhances the customer experience by analyzing consumer behavior and preferences.

Are digital wallets secure?

Digital wallets use encryption and multi-factor authentication, making them secure for transactions.

What is driving the rise of A2A payment methods?

A2A payment offers faster, cheaper alternatives to traditional payment methods, reducing the processing fees for card payments.

Ready to get started?

Become a Partner Today!

Complete the form below.