Part 1

Dual Pricing is a transparent pricing model that gives customers two distinct options at checkout. Customers opting to pay with a credit or debit card pay the list price, while cash-paying customers receive the lower discounted price. This model not only enhances pricing clarity but also empowers customers with a choice that suits their payment preferences.

Dual Pricing was designed to provide the same financial benefits as surcharge and fee-based cash discount programs, but with a more straightforward and customer-friendly approach. By ensuring that what customers see on the shelf matches the price at the point of sale, merchants can build trust and improve the overall shopping experience. This transparency is essential for fostering loyalty and driving long-term business growth.

Why Should You Consider It?

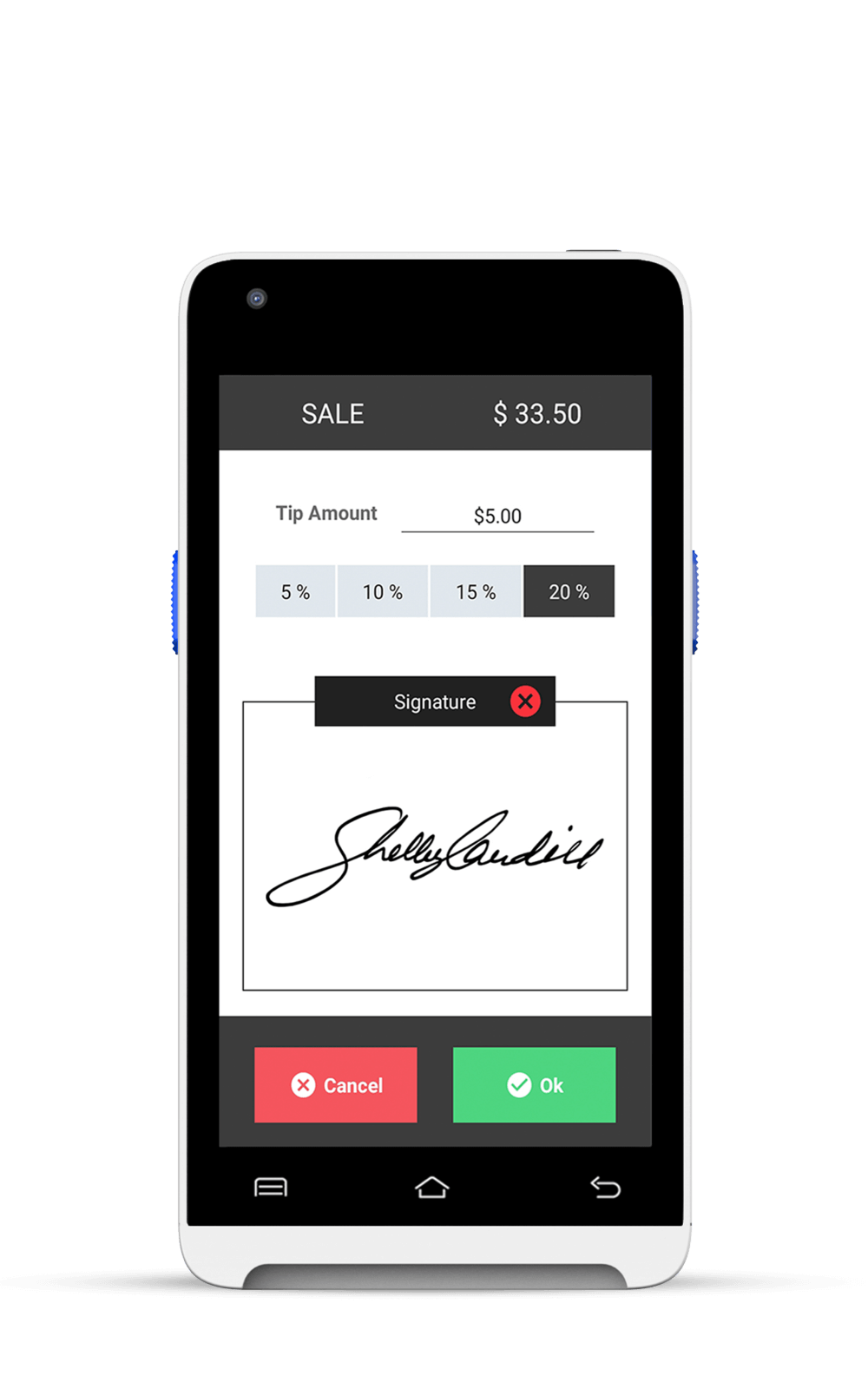

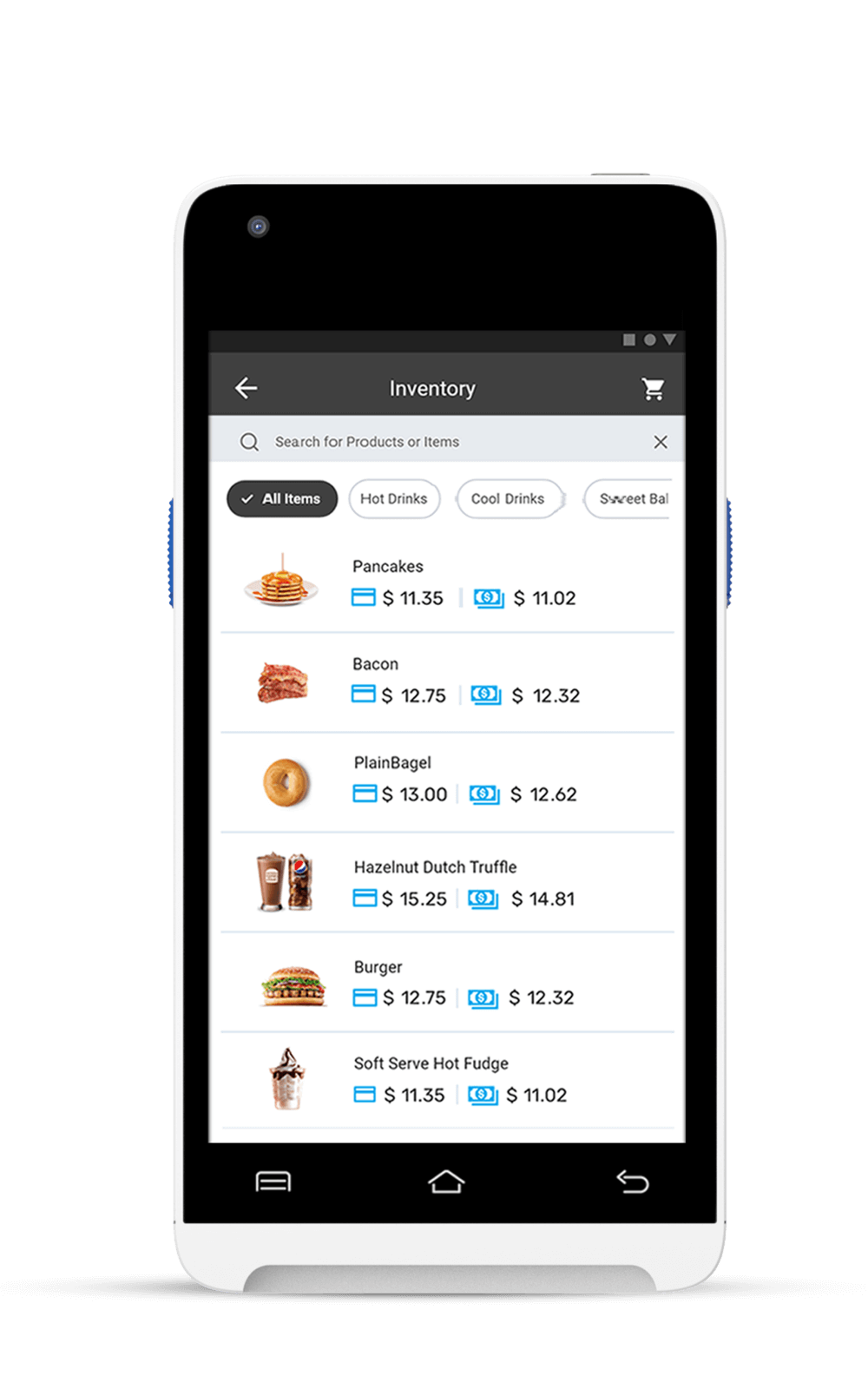

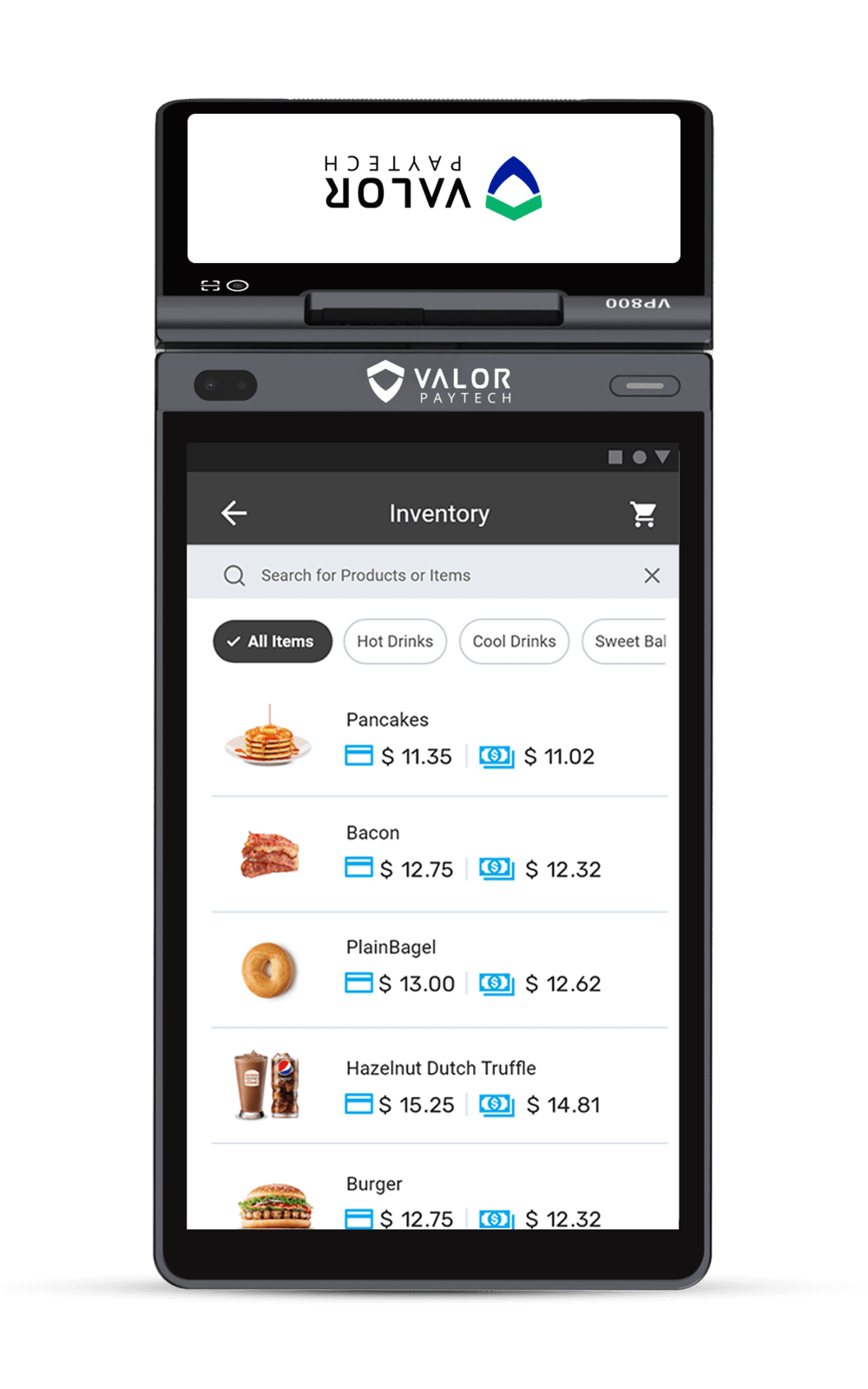

If your business is grappling with high credit card processing fees, Dual Pricing might be the solution you’ve been searching for. It allows businesses to reduce their exposure to these fees without overhauling their pricing displays. Implementing Dual Pricing simply requires compatible payment terminals that can display two prices – one for cash and one for card payments – making it a practical strategy for many merchants.

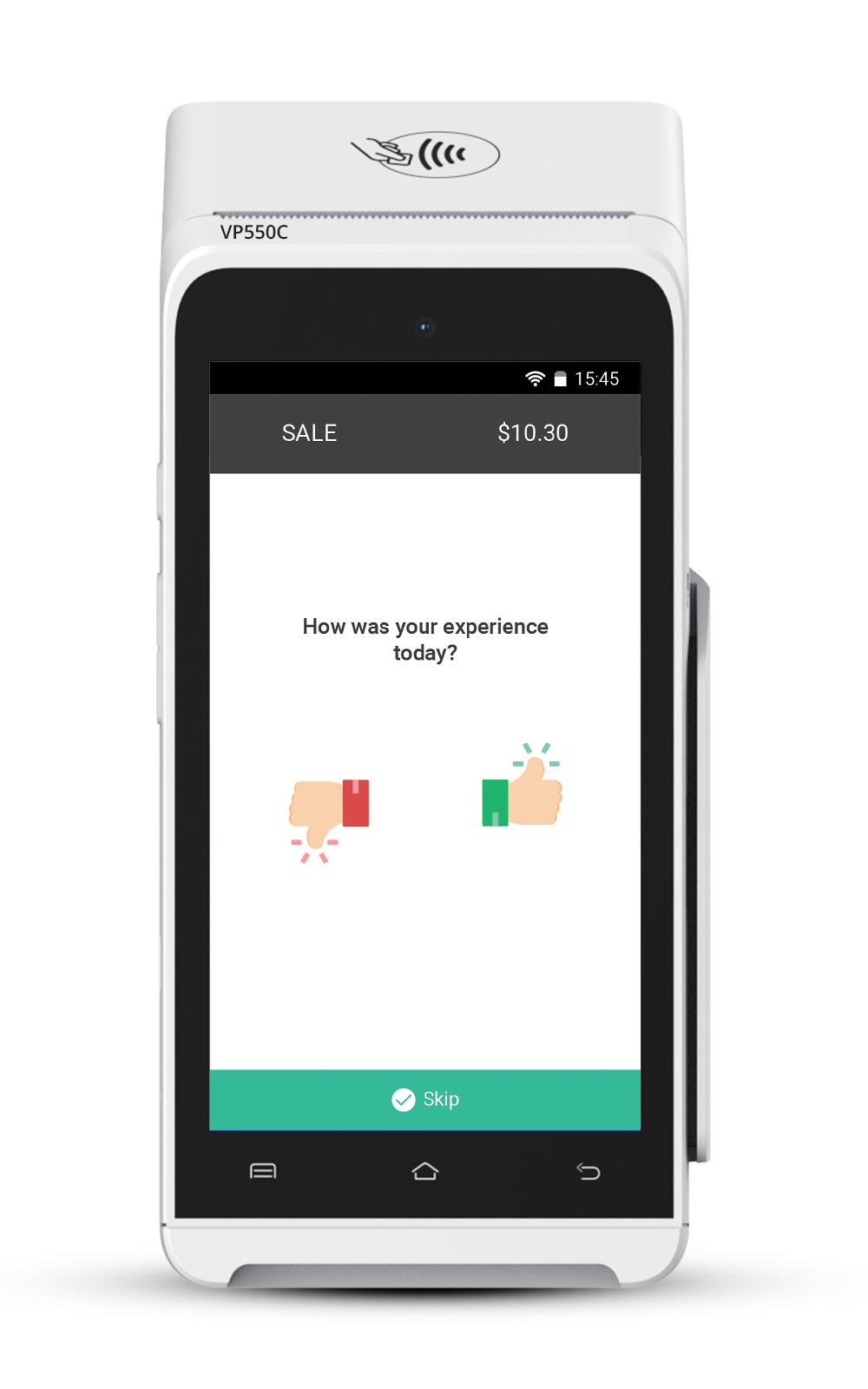

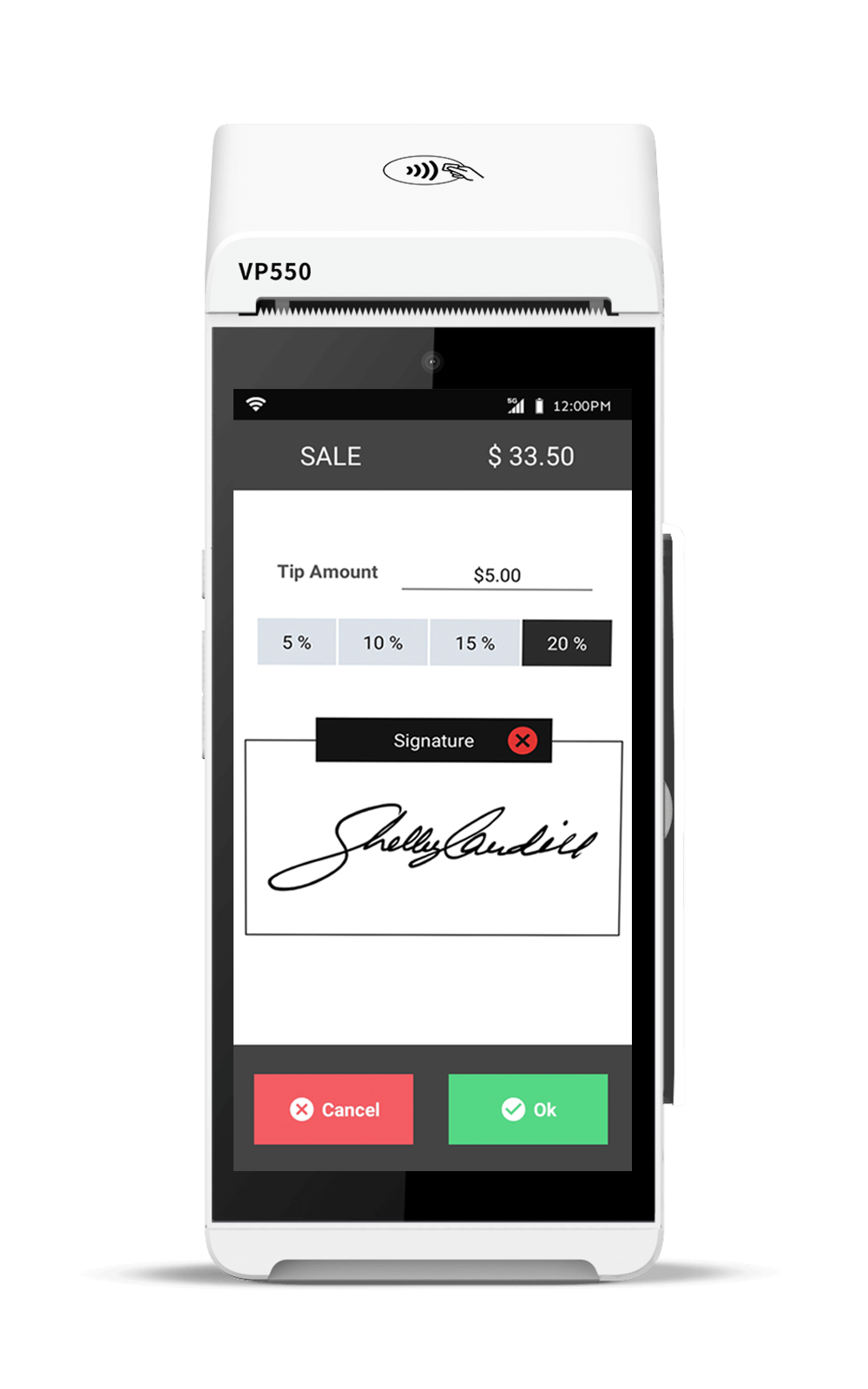

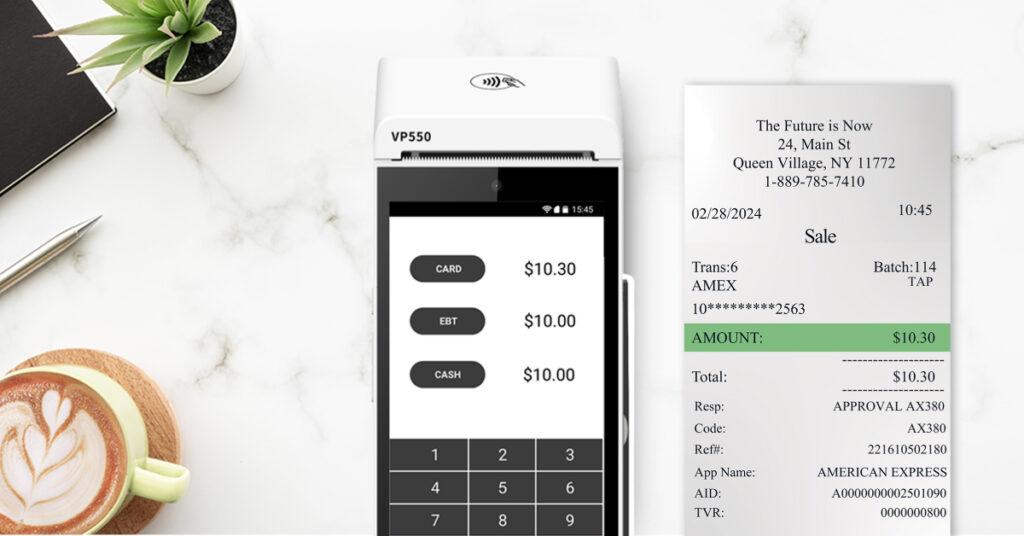

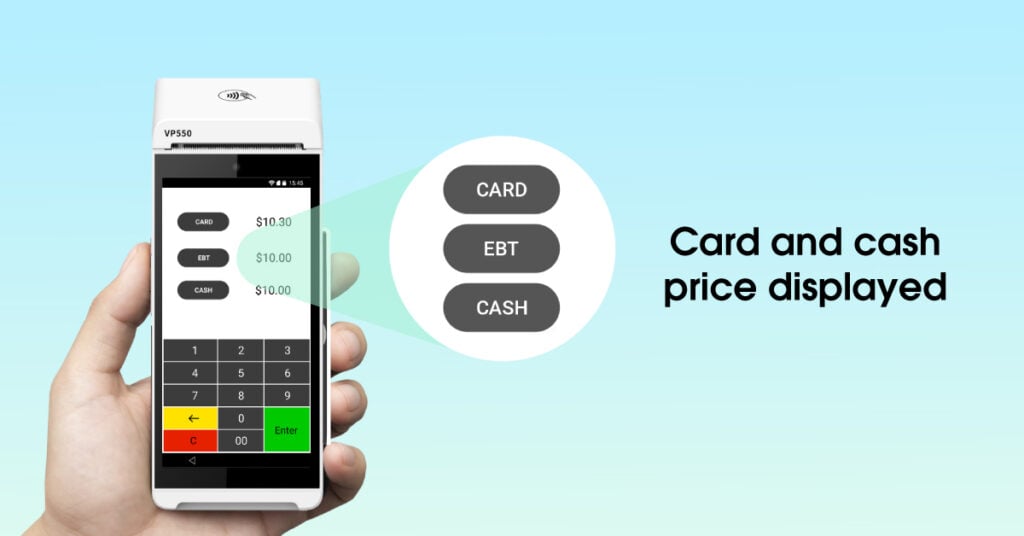

However, it’s vital to communicate the model clearly to customers. Every purchase should show both cash and credit prices, whether on a display, terminal, or receipt. This approach not only promotes transparency but also avoids any confusion that might arise from terms commonly associated with surcharging.

Dual Pricing and Cash Discount

While Dual Pricing and Cash Discount pricing aim to encourage cash transactions, they operate differently. Dual Pricing allows customers to choose their payment method freely, offering savings on processing fees when paying with cash. In contrast, Cash Discount pricing directly incentivizes cash payments by lowering the list price. Importantly, both models are legal in all 50 states, giving businesses the flexibility to choose what works best for them.

Dual Pricing and Surcharging

These two allow merchants to pass processing fees onto customers, but they do so in fundamentally different ways. Dual Pricing promotes cash payments by offering a lower price for cash transactions, thereby improving cash flow. On the other hand, Surcharging applies an additional fee solely for credit card transactions, which can vary significantly by state and comes with its own legal challenges.

With major credit card companies, like Visa, increasing their scrutiny of surcharges, this presents a safer alternative. By encouraging cash transactions while providing customers with clear pricing options, Dual Pricing positions businesses for success in a competitive landscape.

Experience the Future of Payments

At Valor, we are dedicated to achieving the highest level of excellence. We strive to maintain our position at the forefront of this rapidly-evolving industry and will continue to push the boundaries of what is possible. Our goal is to work with regulators, not against them. Anytime there is regulation, it opens the door to making improvements and advancements in our communities.

To learn more about Dual Pricing from Valor PayTech, consider the following:

– Transparency at the register and the shelf

– Clarity before the transaction

– Allows the customer to make a choice

– No fees after the card transaction

By adopting this method, businesses can provide a superior customer experience that fosters loyalty and drives growth. Contact Valor PayTech today to learn how this pricing model can benefit your business.

FAQ

1. What is the difference between dual pricing and cash discount?

Dual pricing differentiates prices based on payment methods, while a cash discount reduces the price for those who pay with cash.

2. What are the rules for dual pricing?

The rules include maintaining transparency by clearly displaying both prices and accurately reflecting card processing costs.

3. Why is Dual Pricing considered customer-friendly?

It is considered customer-friendly because it offers consumers transparency in pricing, allowing them to choose their payment method based on their preferences.

4. How do merchants display Dual Pricing to customers?

Merchants display to customers through a clear display in the POS device.

5. Why is Dual Pricing gaining popularity among merchants?

It is gaining popularity among merchants as it helps mitigate rising credit card processing fees, encourages cash transactions, increases customer transparency, and improves cash flow.