In 2026, businesses across the United States—from local cafés in New York City to fast-growing national retailers—are shifting toward modern payment solutions that offer more speed, more flexibility, and more security. With customers expecting frictionless checkout experiences both online and in-store, choosing the right payment solution can significantly impact your sales, customer satisfaction, and operational efficiency.

Whether you’re a small business owner, an ISO, a merchant in NYC, or an eCommerce brand, this guide breaks down everything you need to know about the best payment solutions, the technologies shaping the industry, and how to choose the right platform for your business in 2026.

1. What Is a Payment Solution?

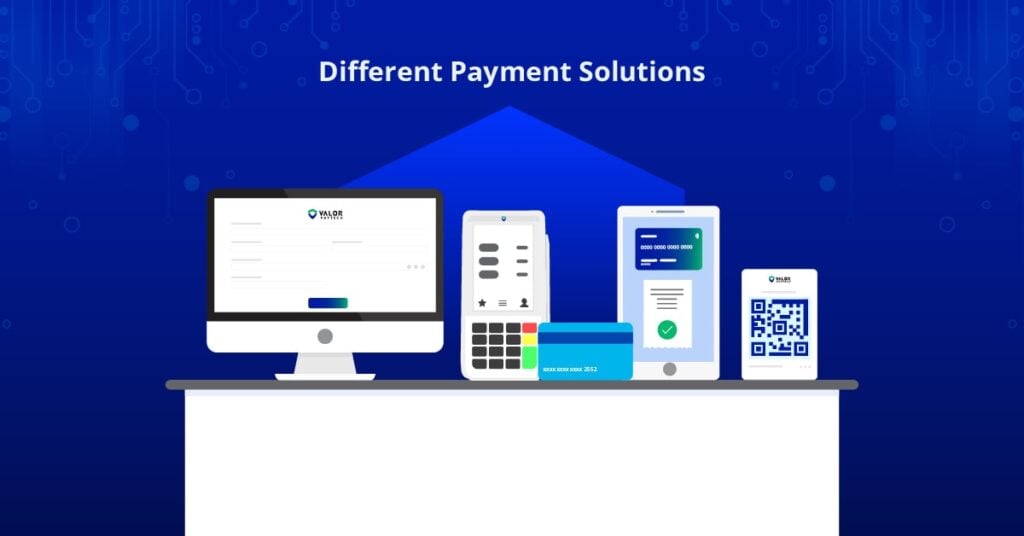

A payment solution is any system that allows businesses to accept payments—whether in-store, online, or via mobile devices. It includes:

- Payment processing

- POS systems

- Mobile and contactless payments

- Online payment gateways

- Invoicing & recurring billing

- Digital wallets

- ACH/bank transfers

- Fraud detection & security tools

Modern payment solutions combine hardware, software, and cloud-based technology to create a seamless checkout experience.

2. Why U.S. & NYC Businesses Need Modern Payment Solutions

Today’s consumers expect:

✔ Fast checkout

✔ Contactless options

✔ Mobile-friendly payments

✔ Online payment links

✔ Digital receipts

✔ 24/7 convenience

For NYC specifically—where speed matters and customer volume is high—an outdated payment setup can result in:

- Slow lines

- Customer drop-off

- Lost revenue

- Higher fraud exposure

Modern payment solutions help businesses overcome these challenges with:

- Faster transaction approvals

- Flexible payment methods

- Better cash flow

- Lower fraud rates

- Automated reporting

3. Types of Payment Solutions (2026 Overview)

Payment solutions have expanded beyond traditional card terminals. In 2026, the most common types include:

1. Traditional POS Systems

Used in retail, restaurants, salons, and small businesses.

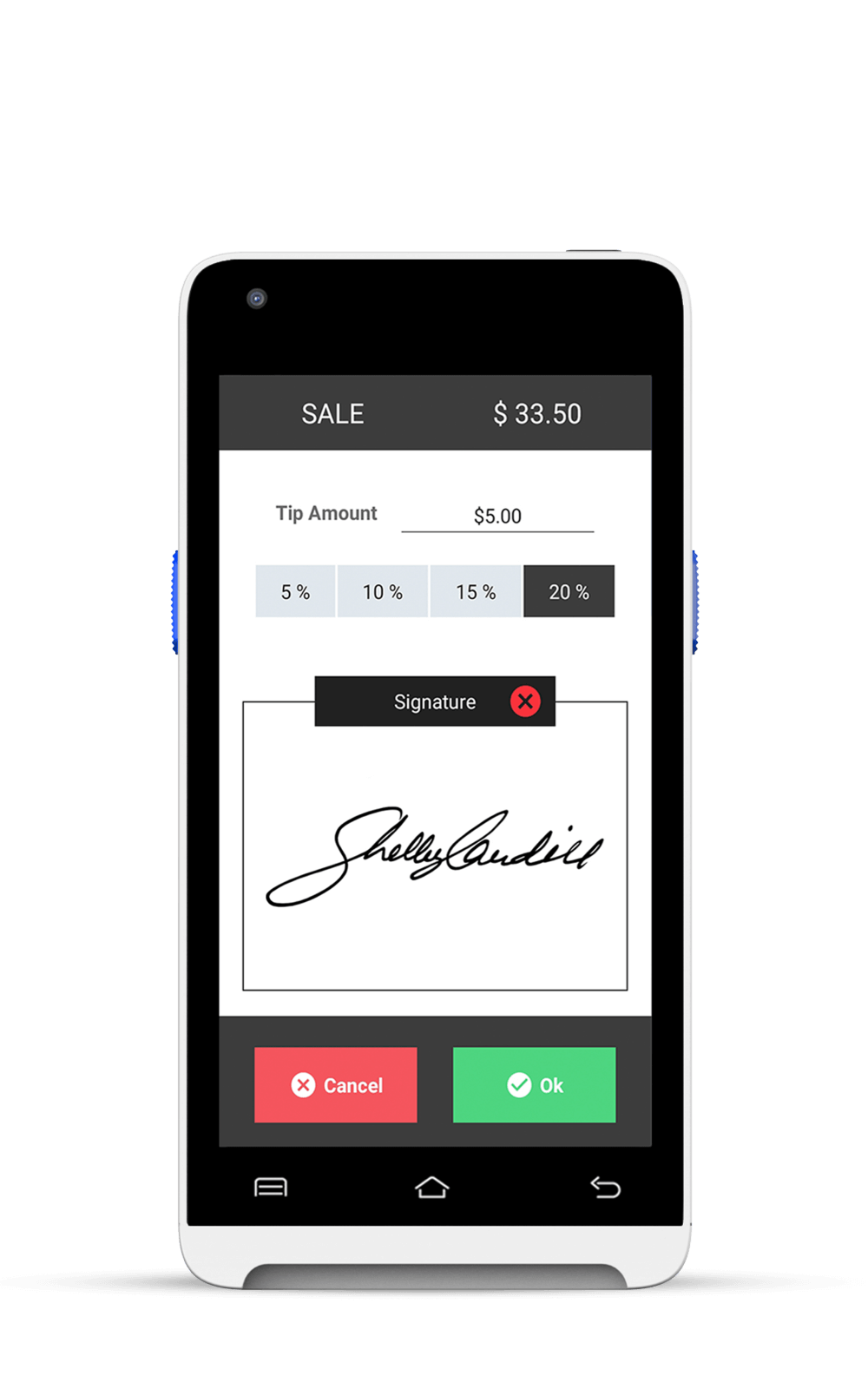

2. Smart POS Terminals

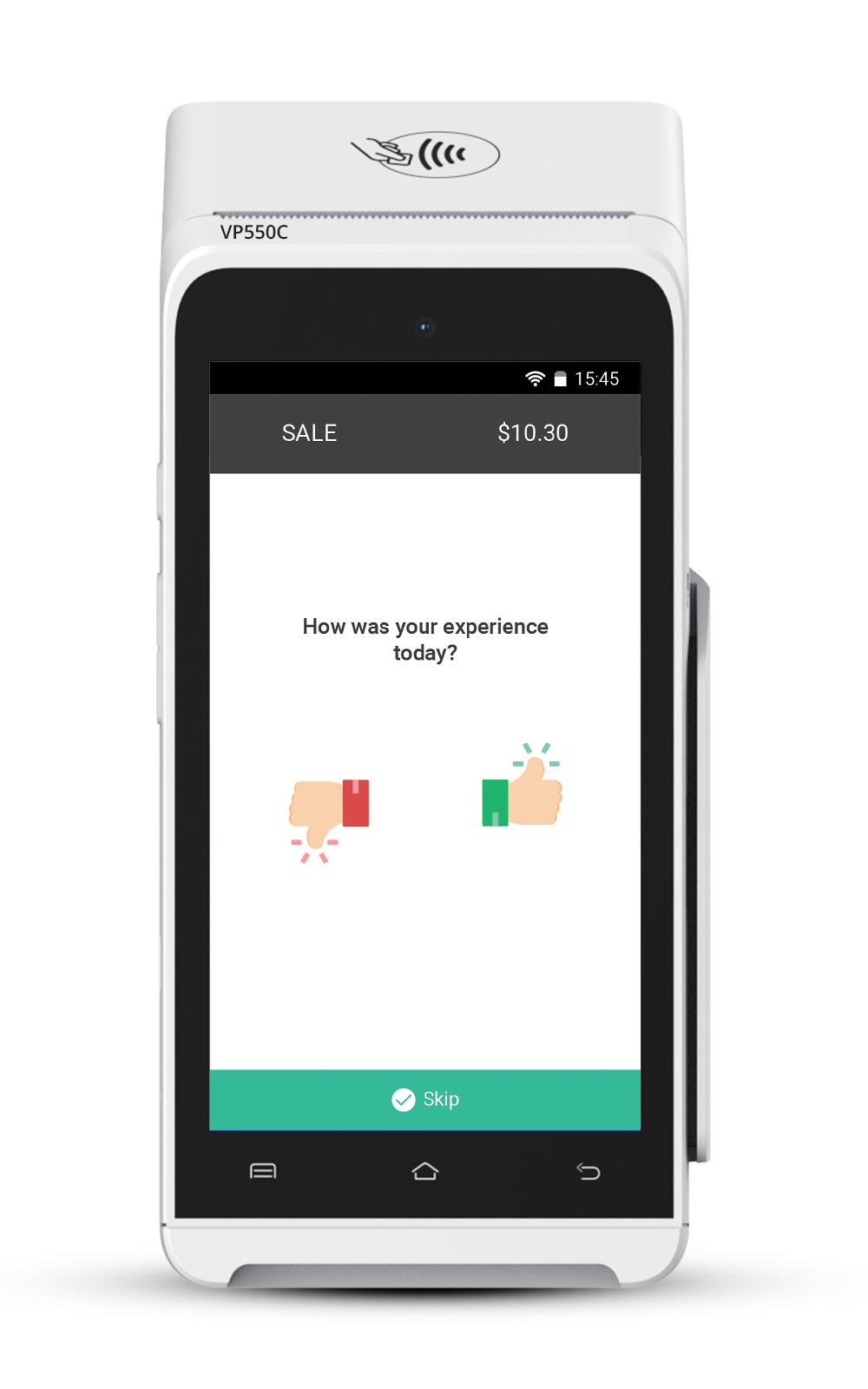

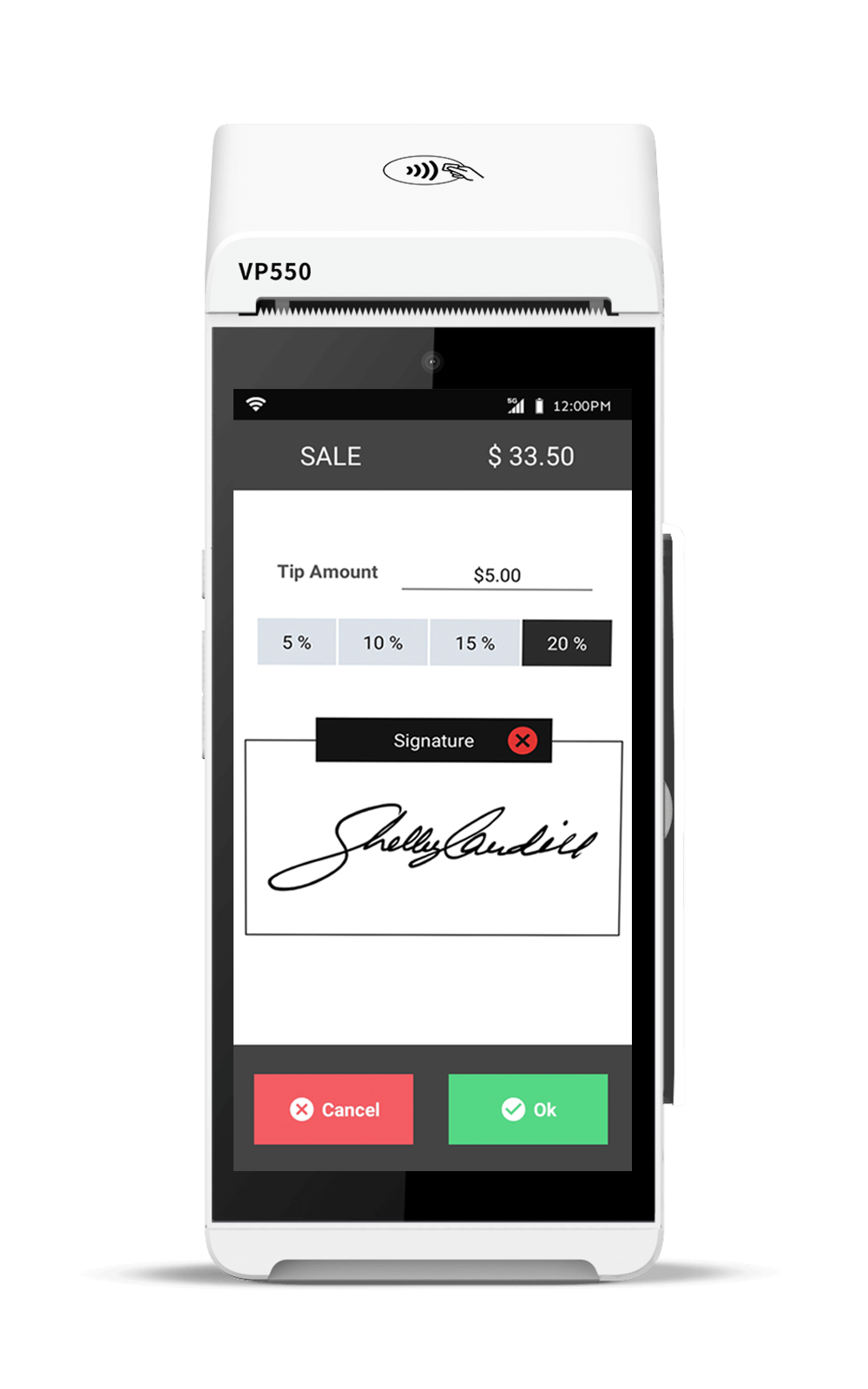

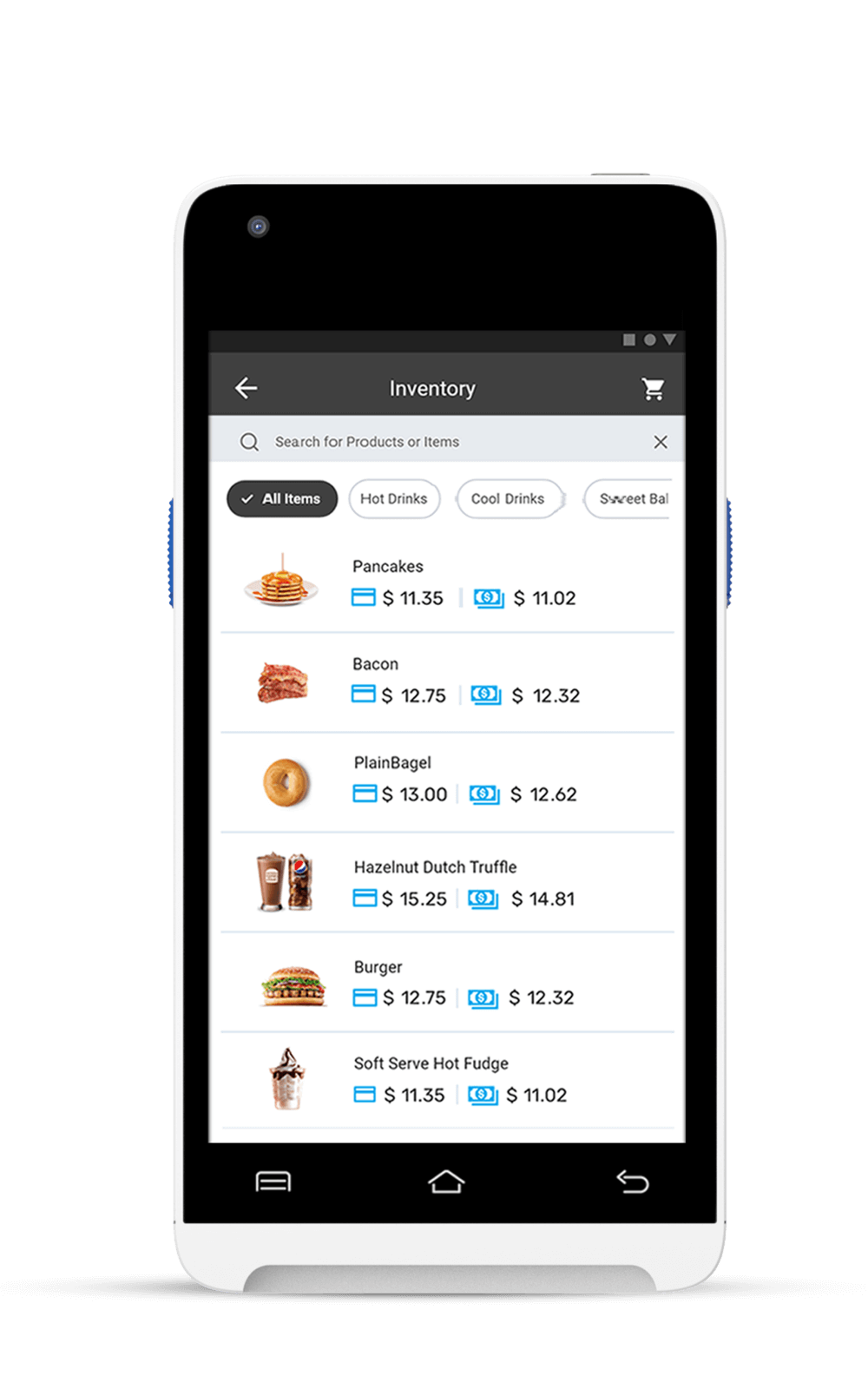

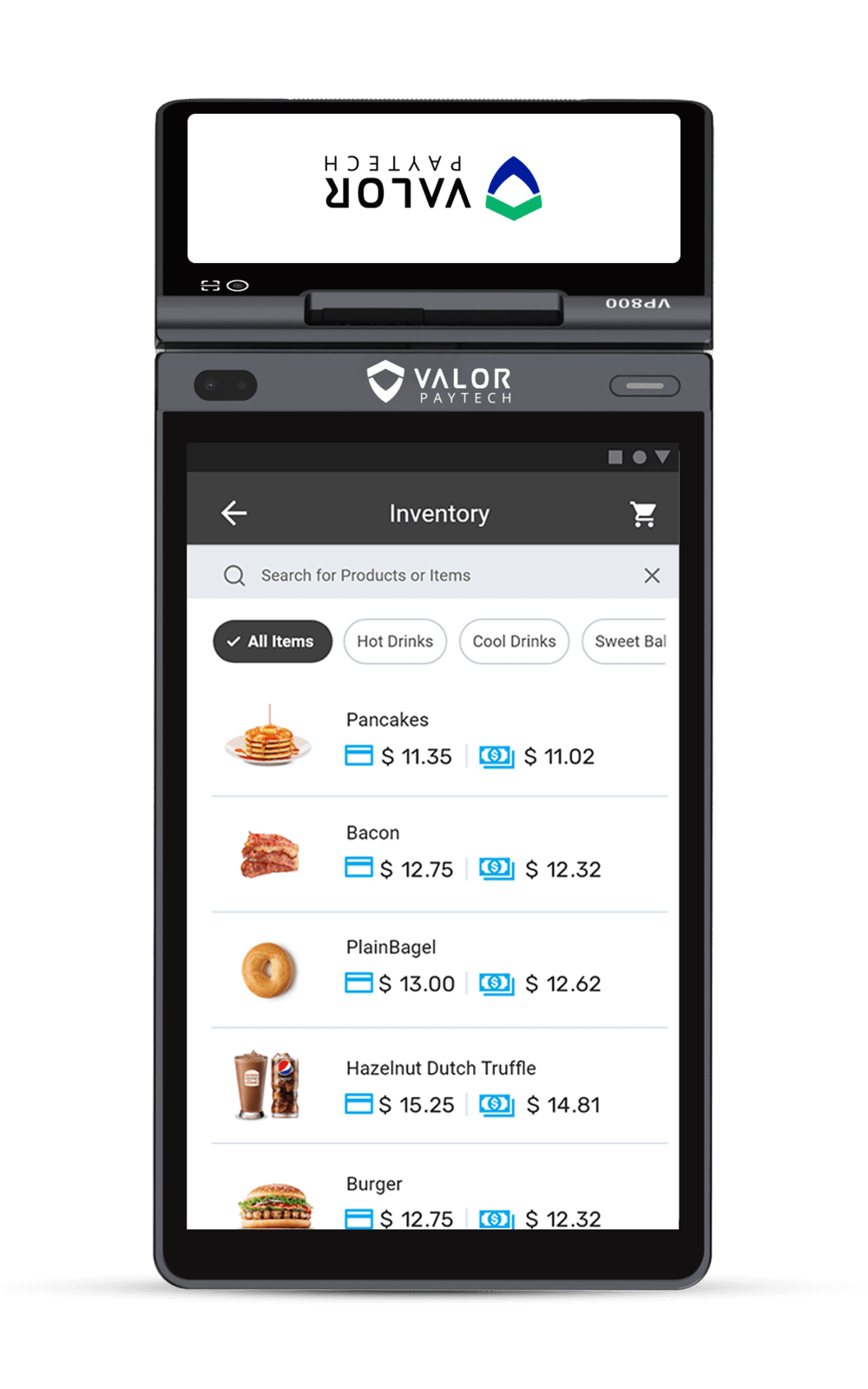

Touchscreen devices with apps, inventory, tips, loyalty & analytics.

(Example: Valor PayTech smart terminals)

3. Online Payment Gateways

Used by eCommerce & subscription-based businesses.

4. Mobile Payment Solutions

Accept payments on smartphones or tablets using NFC or card readers.

5. Contactless Payment Solutions

Tap-to-pay, Apple Pay, Google Pay, Samsung Pay.

6. QR Code Payment Solutions

Growing rapidly for cafés, events & food trucks in NYC.

7. ACH / Bank Transfer Solutions

Ideal for B2B, healthcare, legal, real estate, and service industries.

8. Integrated Payment Solutions

Sync payments with POS, CRM, accounting tools & inventory.

4. How Payment Solutions Work (Simple Breakdown)

Every payment follows these steps:

- Customer pays with card, phone, wallet, or online

- The payment solution encrypts the data

- The processor & bank authorize the transaction

- Funds are deposited into the merchant’s account

- Reporting & analytics update automatically

This entire workflow happens in 1–3 seconds.

5. Best Payment Solutions for Small Businesses (2026)

Small businesses need payment solutions that are:

- Affordable

- Fast to set up

- User-friendly

- Mobile-first

- Secure

- Scalable

Top Small Business Payment Solutions (2026):

✔ Valor PayTech

✔ Square

✔ Stripe

✔ Clover

✔ PayPal Zettle

Valor PayTech stands out for U.S. small businesses because it offers:

- Smart terminals

- Online payments

- Mobile tap-to-pay

- Invoicing

- Fraud tools

- Real-time reporting

All in one ecosystem.

6. Best Payment Solutions in the U.S. vs. NYC

NYC businesses have unique challenges:

- High foot traffic

- Fast service expectations

- Tourists needing multi-payment methods

- Street vendors & mobile operators

- High fraud risk

Best Payment Solutions for NYC Businesses:

✔ Mobile tap-to-pay

✔ Contactless POS terminals

✔ QR-based ordering

✔ Fast approval routing

✔ Multilingual receipts

✔ Instant tipping

✔ NFC-based transit-style payments

Valor PayTech’s NYC presence + fast routing is a strong match for local businesses.

7. Contactless, Mobile & Online Payment Solutions

Contactless Payments:

The fastest-growing method in the U.S.

Examples: Apple Pay, Google Pay, tap cards.

Mobile Payment Solutions:

Accept payments on the go using a smartphone.

Perfect for plumbers, contractors, events, food trucks & delivery.

Online Payment Solutions:

Used for:

- eCommerce

- Invoicing

- Subscriptions

- Services

- Bookings

A good online payment solution includes:

- Hosted checkout

- Payment links

- Recurring billing

- Fraud screening

8. Integrated POS & Omnichannel Payment Systems

Businesses today use multiple channels to sell products:

✔ In-store

✔ Online

✔ Mobile

✔ Social media

An omnichannel payment solution connects all payment data into one dashboard.

Benefits:

- Single reporting

- Unified customer profiles

- Consistent receipts

- Faster disputes

- Better insights

9. Benefits of Modern Payment Solutions

✔ Faster Transactions

A customer in NYC expects to pay in under 5 seconds.

✔ Reduced Checkout Lines

Tap-to-pay speeds up operations.

✔ Higher Customer Satisfaction

Flexible payment options = happier customers.

✔ Reduced Fraud

Tokenization + encryption + AI fraud prevention.

✔ Better Cash Flow

Faster deposits and instant approvals.

✔ Detailed Reporting

Business insights in real time.

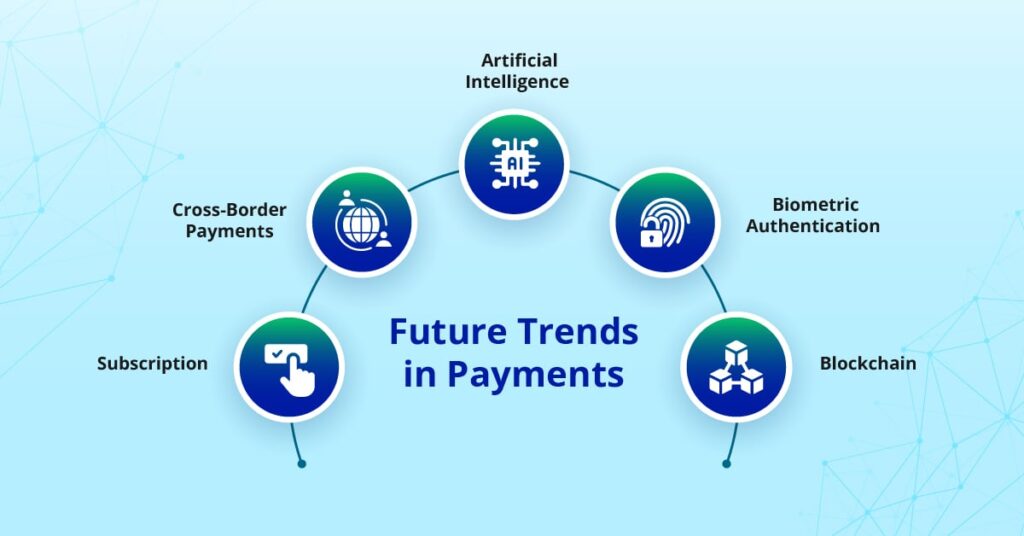

10. Trends Shaping Payment Solutions in 2026

1. AI-Driven Fraud Prevention

Smarter detection, fewer false declines.

2. Biometric Authentication

Face ID, fingerprints, and behavioral biometrics.

3. Tap-to-Pay on iPhone & Android for Merchants

No hardware needed.

4. Digital Wallet Dominance

Especially among younger U.S. customers.

5. QR Ordering + Payments

Common in NYC restaurants, bars & quick-service.

6. Subscription Billing Everywhere

Fitness, wellness, coaching, ecommerce.

7. Faster Payouts

Same-day or instant merchant payouts.

8. Data-Driven Checkout Optimization

AI analyses customer behavior to reduce drop-offs.

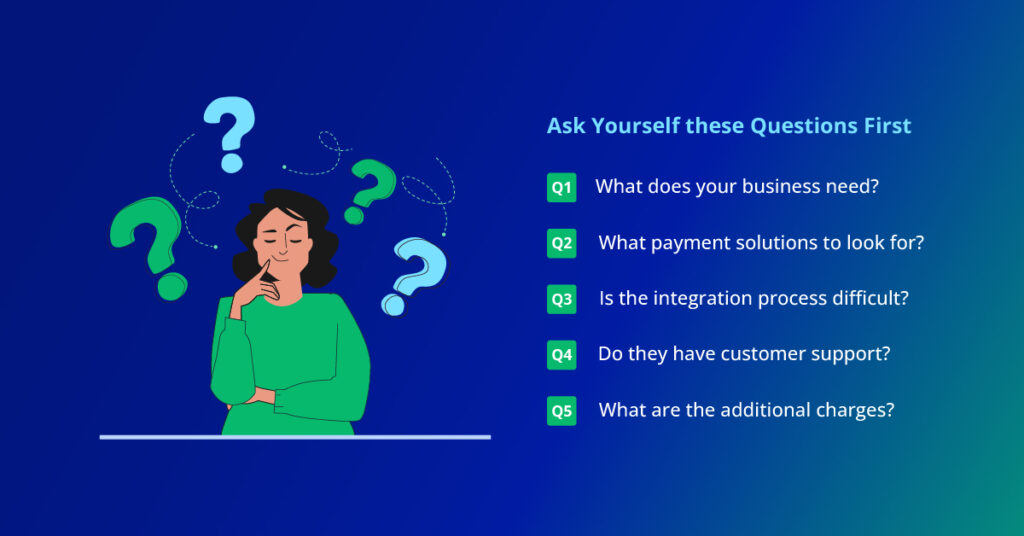

11. How to Choose the Right Payment Solution

Look for:

- High approval rates

- Transparent pricing

- Multi-channel support

- Strong security

- Mobile-first design

- NYC + USA customer support

- Real-time analytics

- Smart routing features

- POS & accounting integrations

Avoid providers with:

✘ Long-term contracts

✘ Hidden fees

✘ Slow deposits

✘ High decline rates

✘ Poor NYC support

12. Payment Solution Checklist (2026 Buying Guide)

Before choosing a provider, confirm it includes:

✔ Contactless payments

✔ NFC + EMV + QR support

✔ Online payments

✔ Fraud prevention tools

✔ P2PE encryption

✔ Real-time reporting

✔ Mobile tap-to-pay

✔ Invoicing & recurring billing

✔ POS hardware options

✔ API integrations

Conclusion

Payment solutions in 2026 are smarter, faster, and more secure than ever. Whether you’re operating a busy retail shop in New York City, running a service-based business nationwide, or growing an online brand, choosing the right payment solution can dramatically improve your checkout experience, customer satisfaction, and overall revenue.

Valor PayTech, with its unified payment ecosystem, stands out as one of the most complete solutions for businesses looking to modernize their payment experience and future-proof their operations.

FAQ

1. What is the difference between a payment gateway and a payment processor?

A payment gateway captures online payments; a payment processor handles the actual approval between banks and card networks.

2. Are mobile payment solutions secure?

Yes—NFC, tokenization, and encryption make mobile payments extremely secure.

3. What’s the best payment solution for small businesses?

POS + mobile payments + an online gateway + ACH support give most U.S. SMBs complete flexibility.

4. How do I reduce payment fraud?

Use AI-based fraud detection, tokenization, PCI compliance, and secure authentication.

5. Can I integrate my payment system with my existing software?

Yes—modern providers offer integrations with POS, CRM, accounting, eCommerce, and inventory tools.

Ready to get started?

Become a Partner Today!

Complete the form below.