Online payments have become the backbone of modern business. Whether you’re running an eCommerce brand, a subscription business, or a local service company looking to expand online, choosing the right online payment services can shape your customer experience, conversion rates, and cash flow.

In 2026, customers expect businesses to offer fast, secure, and flexible digital checkout options—from credit cards and digital wallets to instant bank transfers, BNPL, and mobile payments. This comprehensive guide breaks down the best online payment platforms, how they work, why they matter, and how you can choose the ideal system for your business.

What Are Online Payment Services?

Online payment services allow businesses to accept digital payments through:

- Credit and debit cards

- Digital wallets

- ACH & instant bank transfers

- BNPL installments

- Online invoicing

- Checkout links

- Subscription billing

- Recurring payments

These services act as a bridge between the customer’s payment method and the merchant’s bank account—managing authorization, security, settlement, and reporting.

With digital commerce and mobile shopping booming in the U.S., online payments are no longer optional—they’re the standard.

Why Modern Businesses Need Online Payment Services

Customers expect frictionless digital payments. Businesses that offer flexible online payment options benefit through:

✔ Convenience

Shoppers can pay anytime, anywhere.

✔ Faster Cash Flow

Online payments settle quickly, improving liquidity.

✔ Better Checkout Experience

Less friction = higher conversion rates.

✔ Scalability

Whether selling in one state or globally, online systems adapt easily.

✔ Better Security

Tokenization, encryption, 3D Secure, and fraud detection protect businesses.

✔ Automated Operations

Online platforms can handle recurring billing, subscriptions, invoicing, routing, and analytics.

Online Payment Platforms vs. Online Payment Services

The terms sound similar, but they serve different functions.

1. Payment Gateways

Connect your website/app to the processor.

Examples: Authorize.net, PayPal Gateway

2. Payment Processors

Move funds between issuing and acquiring banks.

Examples: TSYS, First Data

3. Payment Aggregators

Provide easy merchant onboarding under shared infrastructure.

Examples: Stripe, Square, PayPal

4. Digital Wallets

Store encrypted payment data for fast checkout.

Examples: Apple Pay, Google Pay

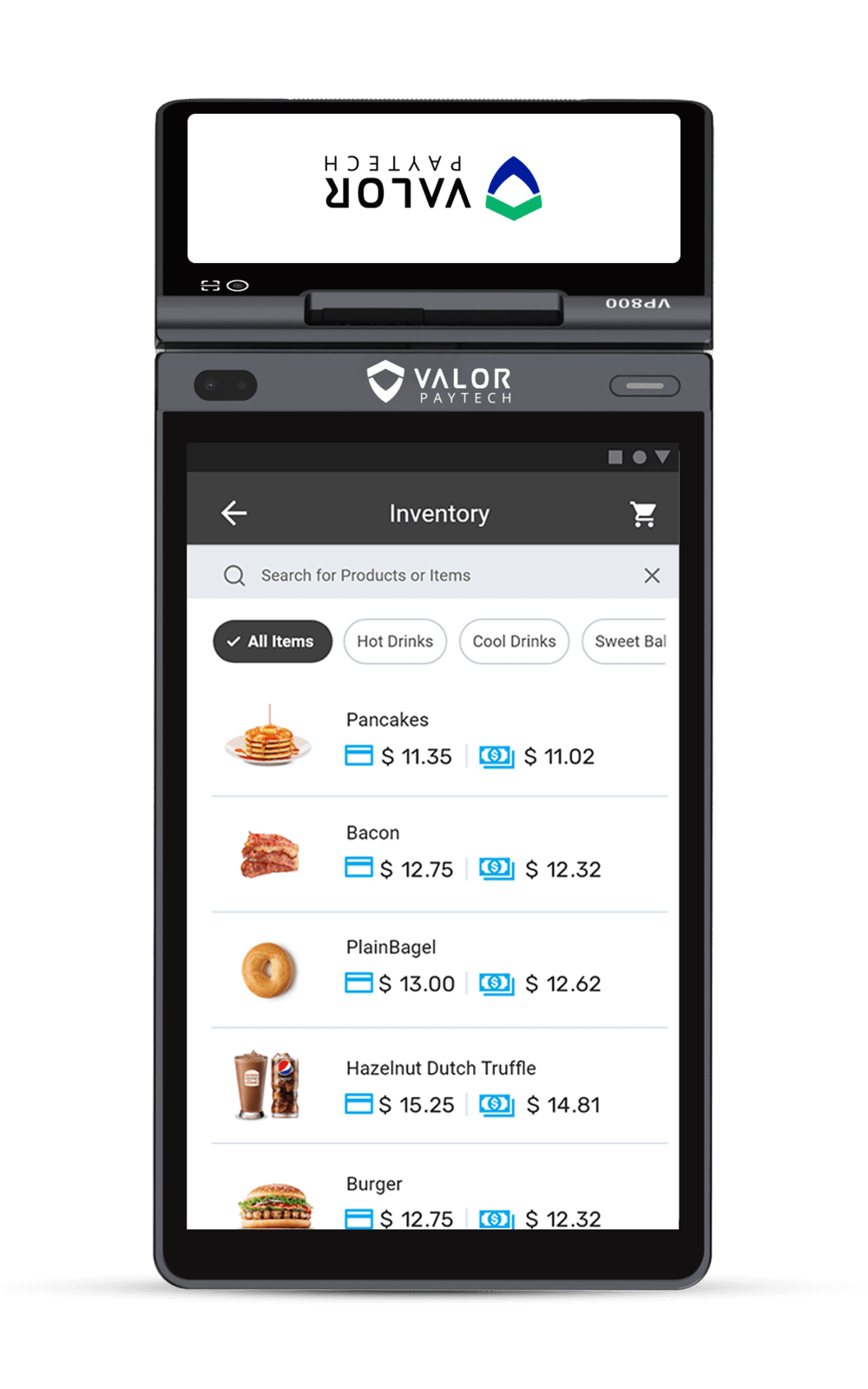

5. Unified Online Payment Platforms (All-in-One)

Modern systems like Valor PayTech combine:

- Gateway

- Processor

- Reporting

- Fraud tools

- Smart routing

- Invoicing

- Online checkout

A unified system reduces complexity and helps businesses scale more efficiently.

How Online Payment Systems Work

Here’s the simplified flow of an online payment:

- Customer enters payment details

- Payment gateway encrypts and sends data

- Processor communicates with issuing bank

- Fraud tools verify authenticity

- Payment is authorized or declined

- Funds settle to the merchant

This takes seconds, enabled by advanced encryption, tokenization, and instant verification technologies.

Types of Online Payment Services in 2026

1. Card Payment Processing (Visa, Mastercard, Amex)

Still the most widely used online payment method.

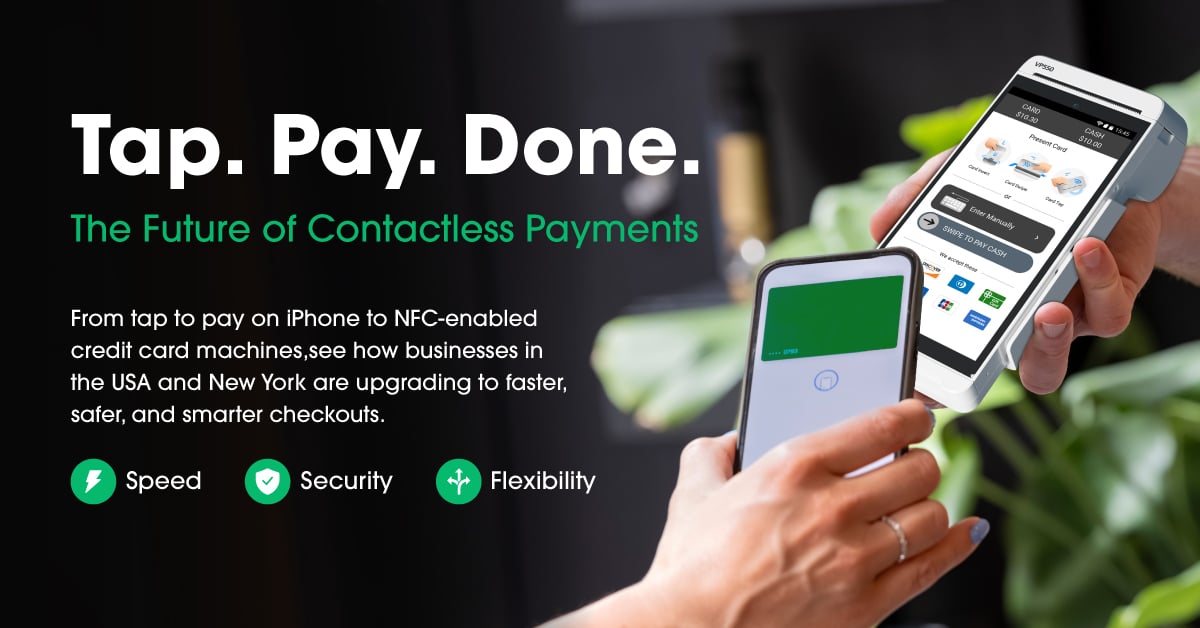

2. Digital Wallet Payments

Apple Pay, Google Pay, Samsung Pay, PayPal, Venmo.

3. ACH & Instant Bank Transfers

Ideal for B2B, subscriptions, and high-ticket transactions.

4. BNPL (Buy Now Pay Later)

Increases conversions and average cart value.

5. Subscription Billing Platforms

Automated recurring payments with invoicing + reminders.

6. Online Invoicing Tools

Payment links embedded directly inside invoices.

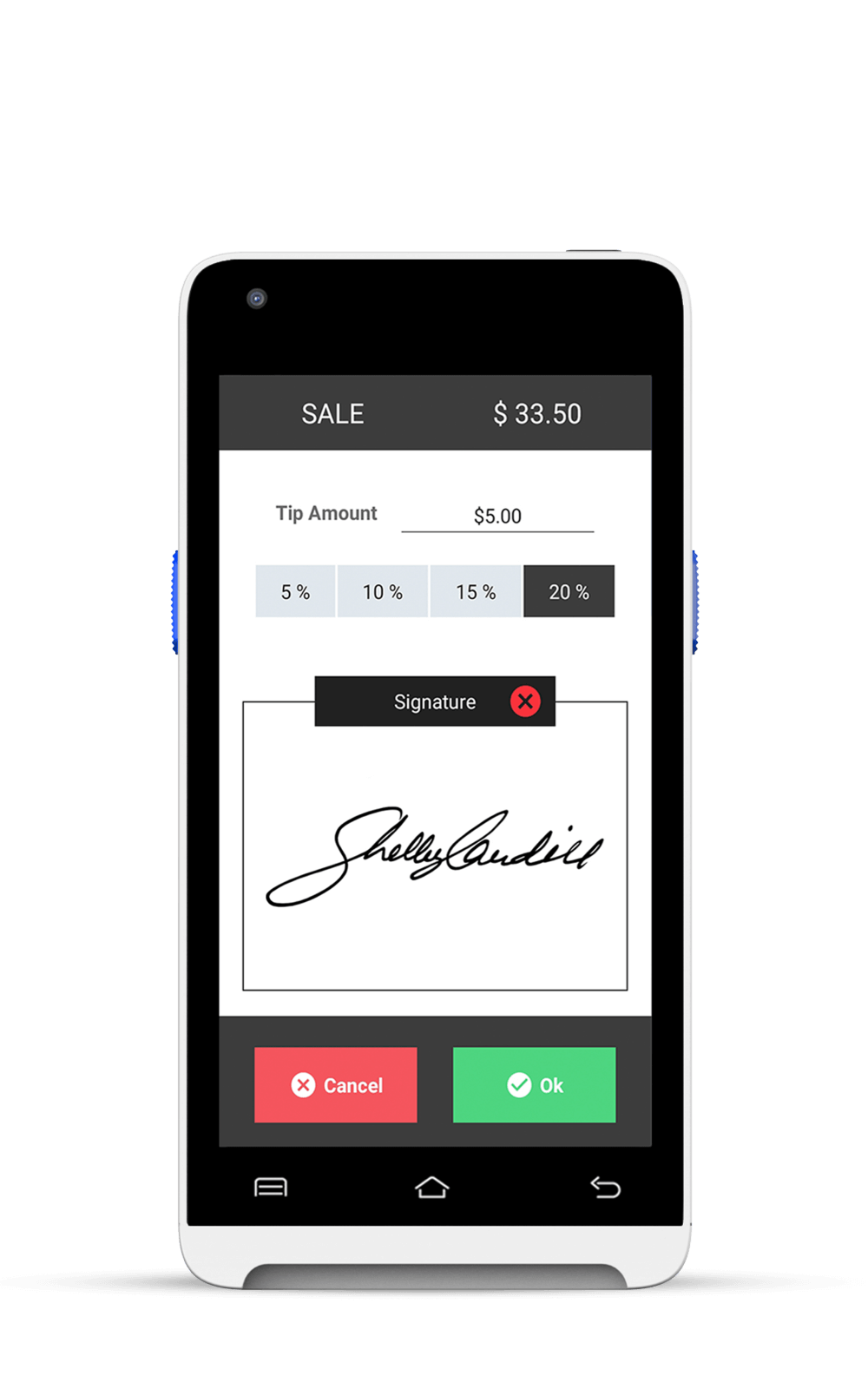

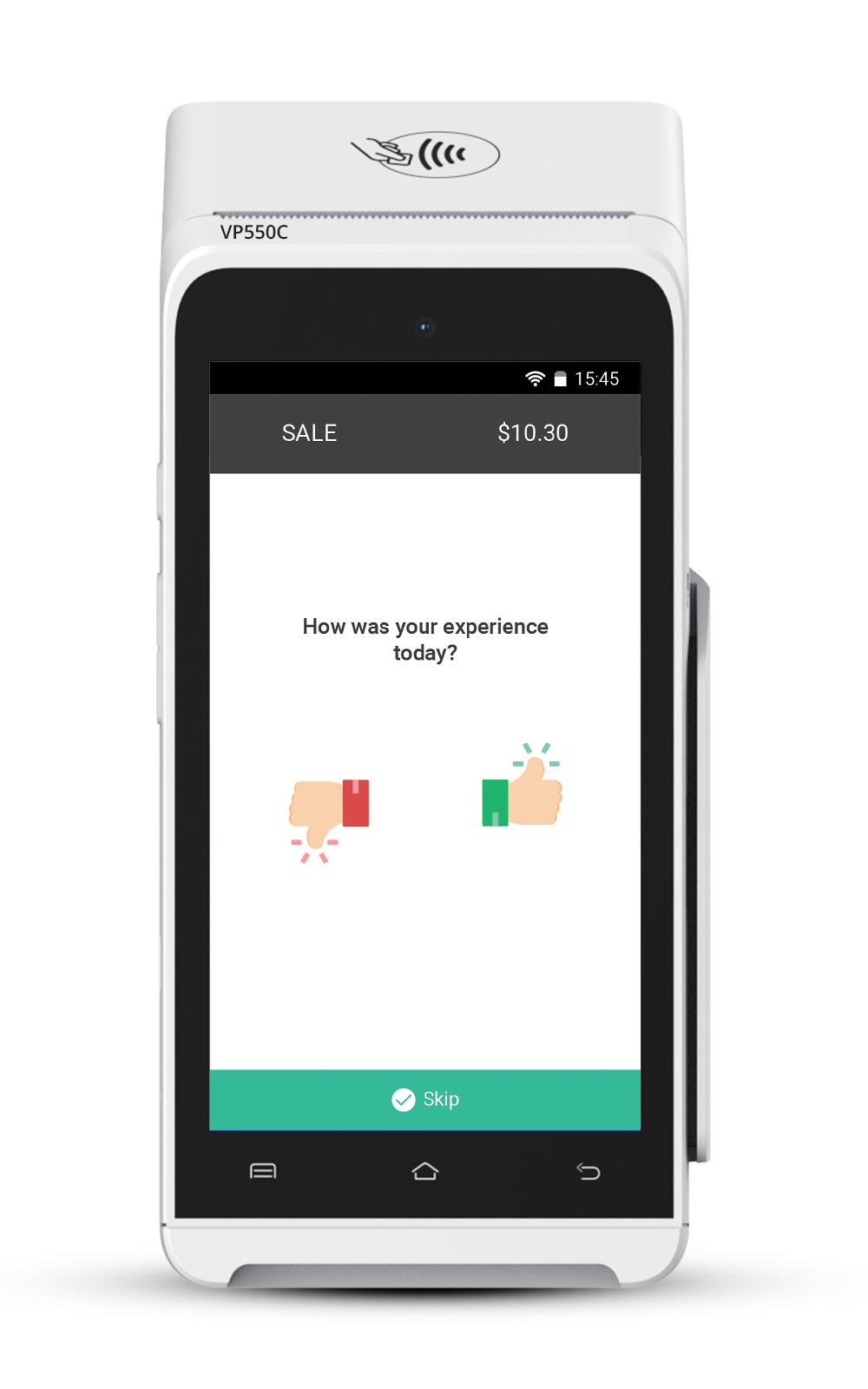

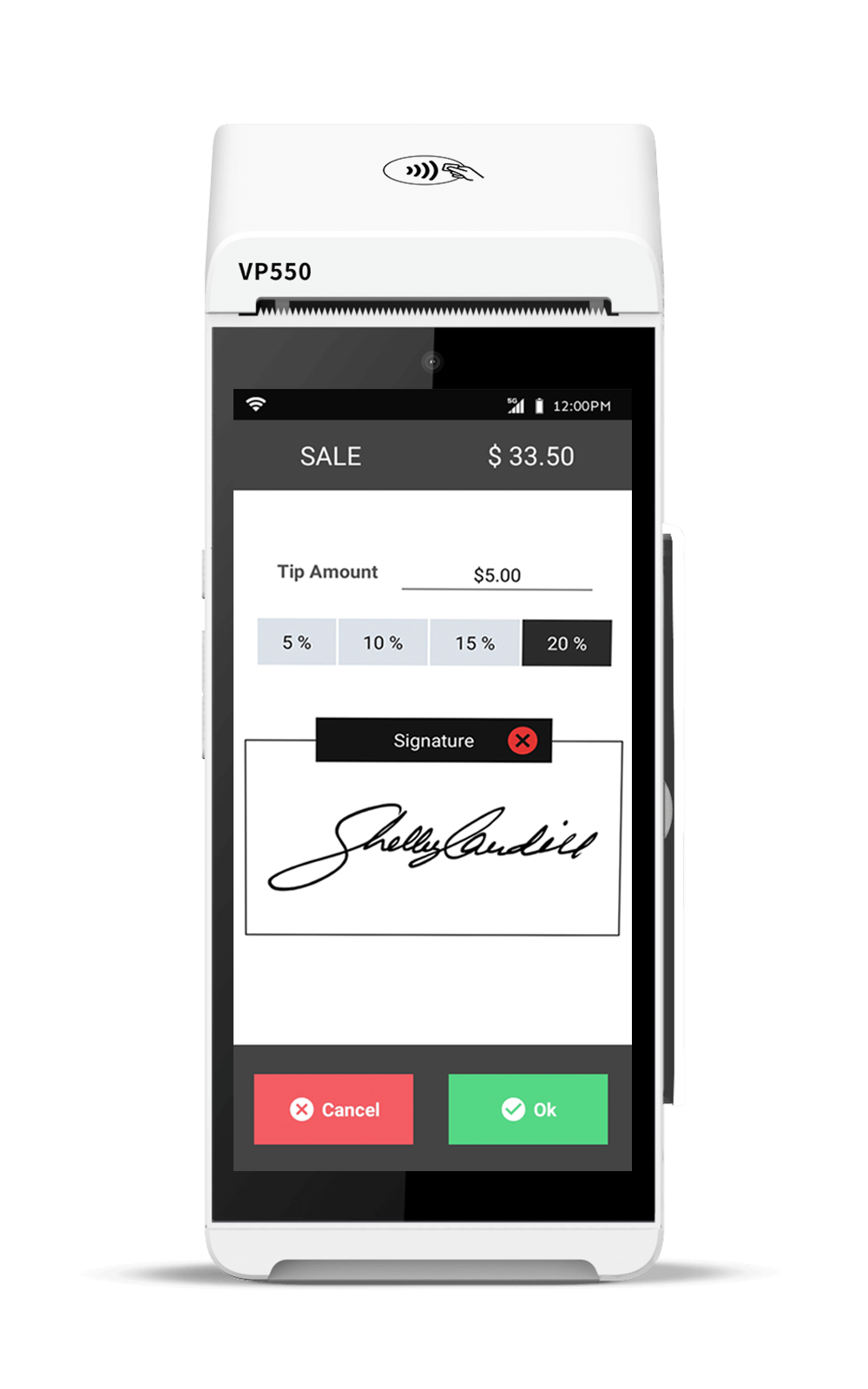

7. Online POS & Virtual Terminals

Accept payments manually from any device.

8. Crypto Payment Gateways

Optional but growing among digital-first brands.

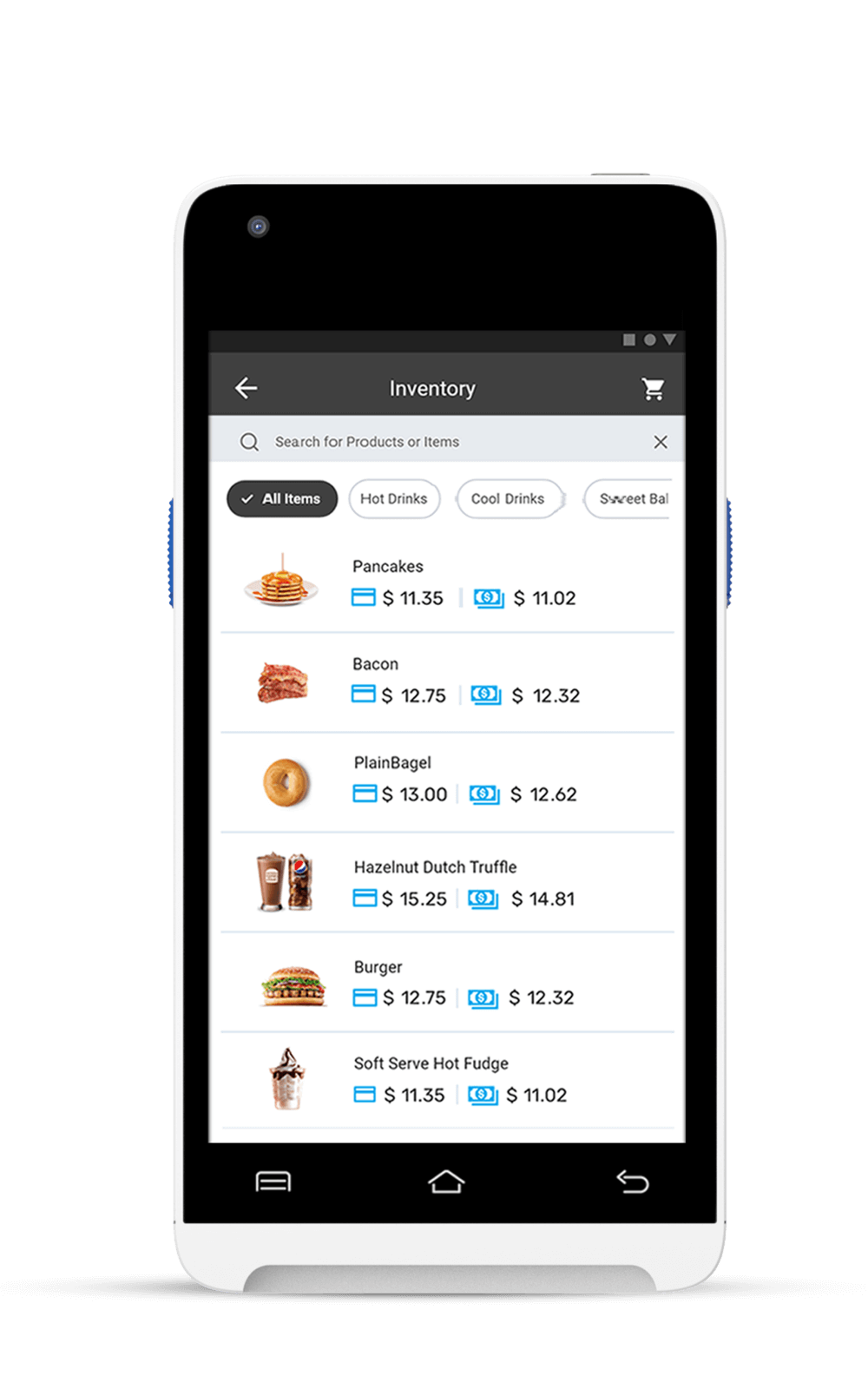

9. Unified Commerce Platforms

Hybrid online + in-store + mobile checkout from one system.

Businesses often mix 2–4 types depending on their model.

Online Payments vs. Traditional Payments

While traditional payment methods like cash or direct bank transfers still exist, they come with limitations – especially in the fast-paced digital economy.

| Feature | Traditional Payments | Online Payment Services |

|---|---|---|

| Speed | Delayed (1–3 days) | Instant or same-day |

| Convenience | In-person only | 24/7 global access |

| Fraud Protection | Limited | Advanced encryption & tokenization |

| Reporting & Analytics | Manual | Automated & real-time |

| Customer Experience | Slower checkout | Fast, frictionless, mobile-friendly |

The digital shift is driven by convenience, speed, and data-backed insights.

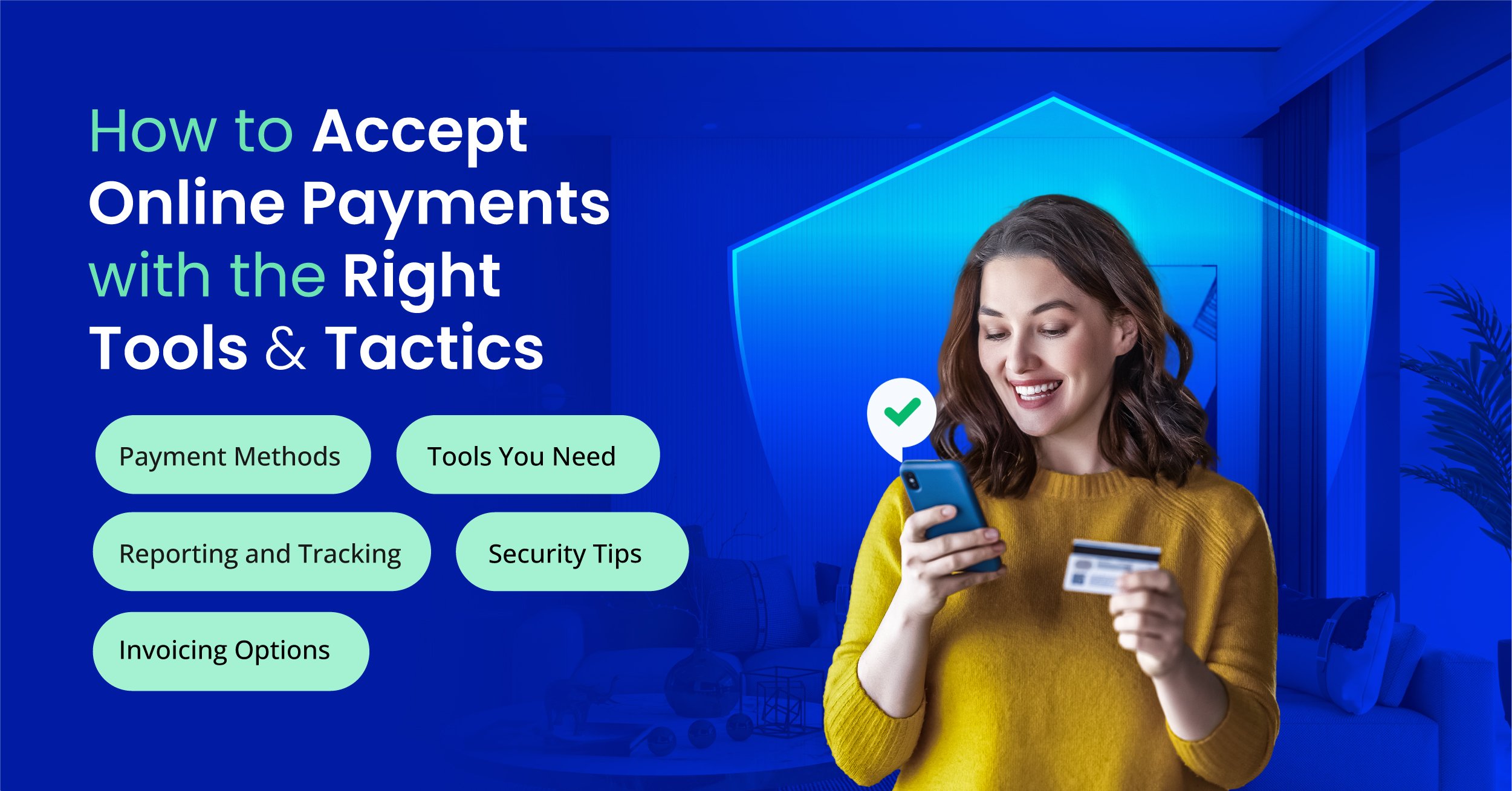

Key Features to Look for in an Online Payment Provider

1. Security & Compliance

Must include:

- PCI-DSS Level 1

- Tokenization

- 3D Secure

- Encryption

- Fraud monitoring

2. Integration Capabilities

Compatible with:

- Shopify

- WordPress/WooCommerce

- Wix

- QuickBooks

- CRMs

3. Multi-Channel Support

Website, POS, mobile, invoicing, subscription billing.

4. Transparent Pricing

Avoid providers with hidden fees, reserves, or long-term contracts.

5. Fast Approvals & Low Declines

Smart routing increases approval rates.

6. Real-Time Reporting

Batch history, settlements, analytics.

7. Customer Support

24/7 support is essential for online businesses.

Best Online Payment Service Providers (2026)

Here’s a quick overview of top platforms businesses are using in 2026:

| Platform | Best For | Notable Features |

|---|---|---|

| Stripe | Developers & SaaS | Custom APIs, subscriptions, invoicing |

| PayPal | Small businesses | Buyer protection, global reach |

| Valor PayTech | ISOs & retail/eCommerce | Smart terminals, real-time reporting |

| Square | Brick-and-mortar + online | POS integration, inventory tools |

| Razorpay | Indian businesses | UPI support, local tax compliance |

| Adyen | Large enterprises | Unified commerce, global processing |

Each provider offers a different mix of functionality, pricing, and scalability. The right fit depends on your business model, geography, and technical needs.

Online Payment Security & Compliance

Top online platforms include:

- PCI-DSS Level 1 compliance

- Tokenization

- Encryption

- AI fraud scoring

- 3D Secure 2.0

- MDRP & SOC-2 controls

Merchants should also enable MFA and use hosted checkout to reduce PCI scope.

2026 Trends Transforming Online Payments

1. AI-Powered Fraud Prevention

LLM-based fraud detection analyzes real-time behavior.

2. Instant Bank Transfers

U.S. adoption is growing rapidly.

3. Biometric Authentication

Face ID + fingerprint scans for faster checkout.

4. Voice-Assisted Payments

Voice shopping continues rising on smartphones and smart homes.

5. Embedded Finance

Payments + lending + BNPL inside checkout.

6. Smart Routing for Higher Approvals

Platforms like Valor intelligently re-route declined transactions.

7. Unified Commerce Systems

One dashboard for online, in-store, and mobile.

Online Payment Solutions for Small Businesses

Small businesses need:

- Simple setup

- Low fees

- Fast payouts

- Mobile-friendly checkout

- Invoicing + Pay-by-Link

- Unified reporting

Valor PayTech and Square are ideal for SMBs.

Online Payment Tools for eCommerce Brands

eCommerce sellers rely heavily on:

- One-click checkout

- Stored cards

- BNPL payments

- Multi-currency

- High approval rates

- Integrated fraud detection

Stripe, Valor PayTech, and PayPal lead this category.

Online Payment Fees Explained

Typical fees:

- Card payments: 2.3% – 3.5%

- ACH: 0.5% – 1%

- Cross-border: 1% – 2% extra

- Chargeback fee: $15–$25

Always review:

✔ Setup fees

✔ Monthly fees

✔ Gateway fees

✔ International fees

Some platforms offer blended pricing; others use interchange-plus.

How to Choose the Best Online Payment Service

Evaluate:

- What payment methods your customers prefer

- Whether you need recurring billing

- Your volume and business model

- Required integrations

- Security & compliance requirements

- Support availability

- Reporting depth

There is no “one-size-fits-all,” but unified platforms like Valor PayTech give the widest flexibility.

Final Thoughts

Online payment services are essential for any business operating in today’s digital-first economy. The right platform helps you improve conversions, accelerate cash flow, and deliver a seamless checkout experience.

Whether you’re a small business, SaaS company, eCommerce brand, or enterprise, choosing a reliable and secure online payment system can power long-term growth and customer satisfaction.

FAQ

1. What are online payment services?

Digital tools that allow businesses to accept payments over the internet—via cards, wallets, bank transfers, or invoicing.

2. What’s the difference between an online payment platform and a payment service?

A payment service typically handles the processing of transactions, while an online payment platform offers a broader set of tools—like invoicing, analytics, fraud protection, and multi-channel support. Some providers (like Stripe or Valor PayTech) offer both in a single solution.

3. How do I choose the best online payment system for my business?

Look for features that match your business needs: security standards, integration options, transaction fees, customer support, and global capabilities. Whether you're a startup or an enterprise, the best system should scale with your growth.

4. Are online payments secure?

Yes. Modern systems use encryption, tokenization, and AI-based fraud detection.

5. What is the best online payment platform?

Valor PayTech, Stripe, PayPal, and Square lead the U.S. market.

6. Can I integrate online payment services with my existing website or app?

Yes, most modern platforms offer plug-ins or APIs compatible with website builders like Shopify, WooCommerce or custom apps.

7. What is the average cost of using an online payment platform?

Costs vary by provider but typically include transaction fees (1.5%–3.5%), setup fees, and possible monthly charges. Always review the full pricing structure.

8. Do online payments require a merchant account?

Aggregators like Stripe/Square don’t; others bundle it.

9. Are there options for recurring billing or subscriptions?

Yes - platforms like Stripe, Valor PayTech, and Razorpay offer built-in tools for managing recurring payments and subscriptions.

10. How fast do I receive payouts from online transactions?

It depends on the provider. Some offer same-day payouts; others take 1–3 business days. Faster settlement usually comes at a fee.

Ready to get started?

Become a Partner Today!

Complete the form below.