In today’s fast-paced world, no one likes to wait—especially not at the checkout counter. Whether you’re buying a latte or closing a service sale, mobile payments are quickly becoming the preferred way to pay and get paid. But what exactly are mobile payments, and how can businesses make the most of them?

This guide explores the ins and outs of mobile payments in 2025—from the types and technology behind them to their benefits, use cases, and tools to help you accept mobile payments with ease.

What Are Mobile Payments?

Mobile payments refer to financial transactions made using a mobile device such as a smartphone, smartwatch, or tablet. Instead of paying with cash or a physical card, customers can pay digitally by tapping their device, scanning a code, or using a mobile app.

Common examples of mobile payments include:

- NFC (Near Field Communication): Tap-to-pay with your phone or wearable

- QR Code Payments: Scanning a code to initiate payment

- Mobile Wallets: Apps like Apple Pay, Google Pay, and Samsung Pay

- SMS/PayNow: Links sent by merchants to complete payments via smartphone browser.

These mobile payment services are no longer just “nice to have”—they’re expected by customers who want speed, convenience, and security.

Types of Mobile Payments in 2025

As the technology behind mobile payments evolves, so do the options available to consumers and merchants.

| Payment Method | Tech Used | Best For | Device Needed |

|---|---|---|---|

| NFC Tap-to-Pay | NFC | Retail, Cafés, Salons | Smartphone/Smartwatch |

| QR Code Payments | QR Code | Events, Restaurants, Low-NFC Areas | Smartphone with Camera |

| Mobile Wallets | NFC/Token | General Retail & eCommerce | Smartphone |

| PayNow Link/Text-to-Pay | SMS/Web | Services, Healthcare, Contractors | Any Phone with Browser |

| Virtual Terminals | Browser | Remote Sales, Phone Orders | Any device |

Here are the key types of mobile payment methods in 2025:

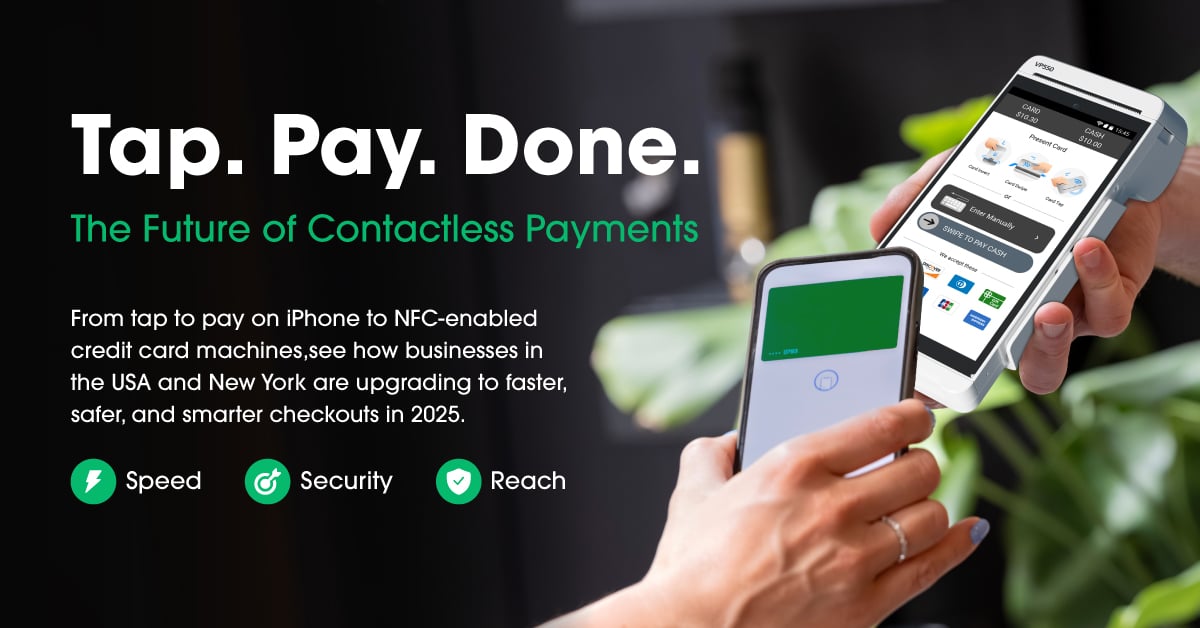

1. Contactless Payments

These rely on NFC technology, allowing users to tap to pay with phone or other devices like smartwatches. Simply hold the device near a reader, and the payment is processed in seconds.

Popular examples:

- Apple Pay

- Google Pay

2. QR Code Payments

Scannable QR codes are generated by merchants or payment apps. The customer scans the code using their mobile camera and is redirected to a payment page.

Use case:

Widely used in restaurants, farmer’s markets, and countries with lower NFC adoption.

3. Mobile Payment Apps

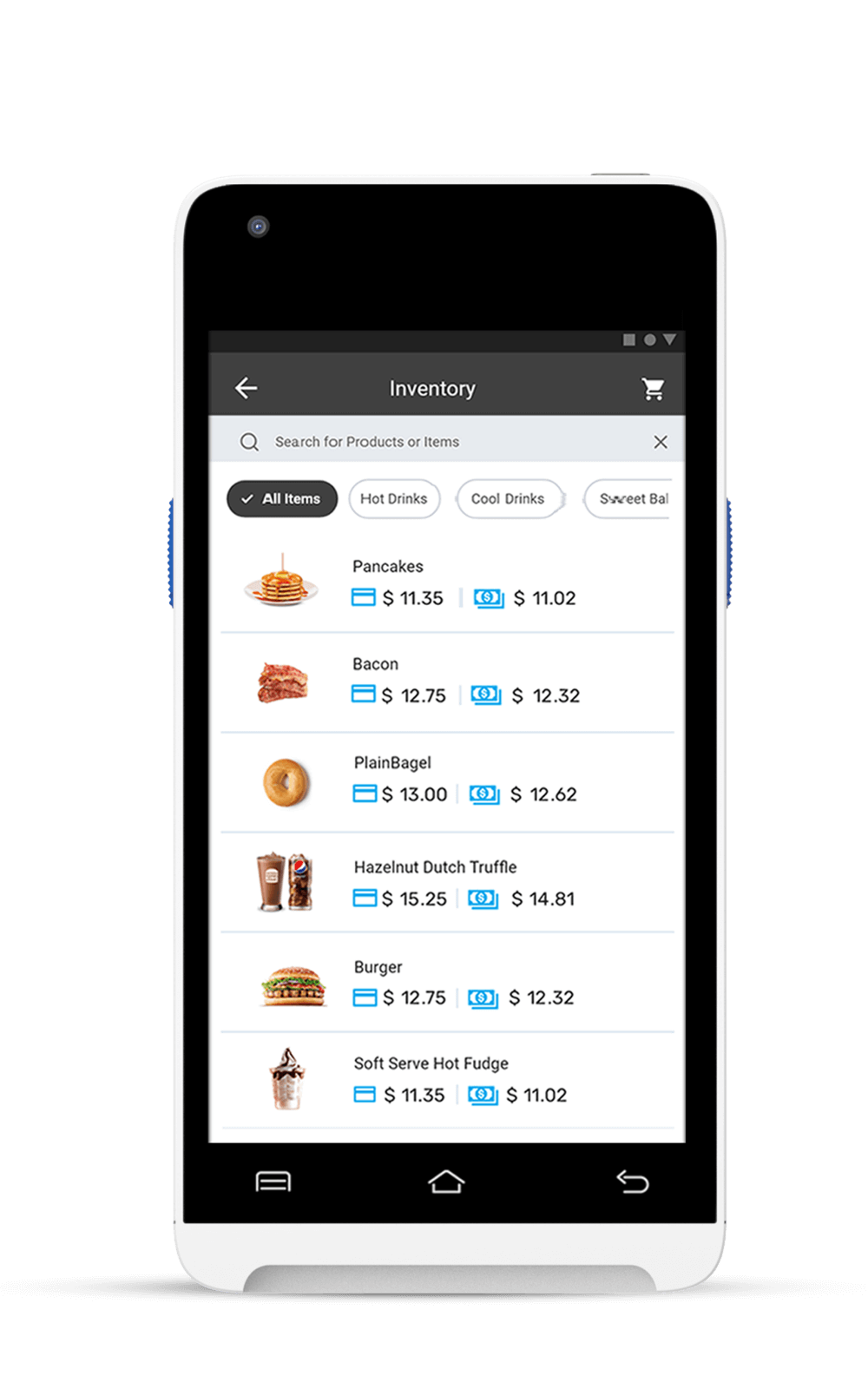

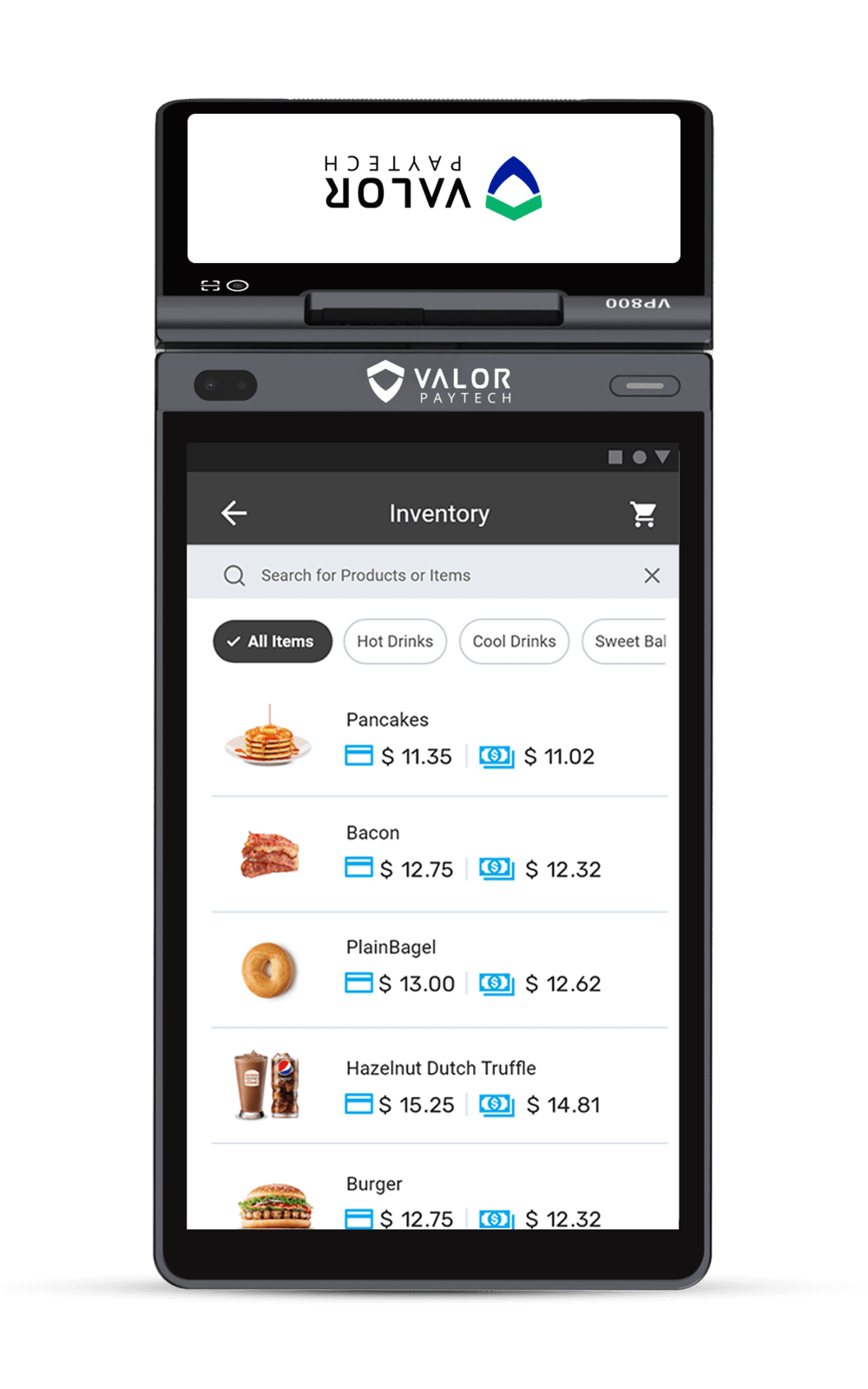

Whether you’re a solo entrepreneur or managing multiple locations, choosing the best mobile payment app for small business can transform how you get paid. Today’s top mobile payment apps go beyond simple transactions—they offer features like customer profiles, loyalty tracking, sales analytics, and integrations with your CRM or accounting tools.

Fruilt solutions like ValorPay, you can connect with customers faster, reduce checkout time, and streamline reporting.

Looking for Android-specific solutions?

Valor PayTech supports NFC-based transactions, making it a strong choice for those seeking the best contactless payment app for Android—with built-in security and unmatched flexibility.

4. PayNow / Text-to-Pay Solutions

These are a rising trend, especially in service industries. Businesses send a secure link via SMS, and the customer completes the payment from their mobile browser. Tools like Valor PayTech’s PayNow link allows frictionless billing for merchants.

How Mobile Payments Work

Mobile payments may seem like magic, but they follow a secure, streamlined process behind the scenes:

- Payment Initiation: The customer taps their device or clicks a link to begin the transaction.

- Authentication: The app or wallet may request biometric verification (like Face ID or fingerprint) or a passcode.

- Tokenization: Instead of transmitting card details, a unique token is sent to the processor – protecting sensitive information.

- Authorization & Settlement: The payment is authorized by the card issuer, and the funds are transferred to the merchant.

This system ensures data privacy and minimizes fraud, which is why even security-conscious consumers now prefer contactless payment apps.

Best Mobile Payment System

The best mobile payment systems combine speed, security, and flexibility. Look for platforms that offer multiple payment methods, real-time tracking, PCI compliance, and seamless integration with POS and e-commerce tools. Systems like

- Valor PayTech

- Square

- Stripe lead in this category.

Best Mobile Payment App for Small Business

Small businesses need mobile apps that are easy to use, affordable, and loaded with features like invoicing, inventory, and sales tracking. Apps like

- Valor PayTech

- PayPal Zettle

- Square Point of Sale offer robust solutions tailored for SMBs.

Best Contactless Payment App for Android

Android users benefit from apps that support tap-to-pay, QR payments, and NFC functionality.

- Google Pay

- Samsung Wallet

are among the best contactless apps, offering secure and smooth payment experiences for Android devices.

Benefits of Accepting Mobile Payments

Still wondering why you should adopt mobile payment options? Here’s how they help your business stay competitive:

1. Speed and Convenience

Mobile payments reduce checkout time significantly—customers don’t have to pull out a wallet or wait for change. Transactions are often completed in under 3 seconds.

2. Higher Customer Satisfaction

Fast, flexible payment options lead to happier customers. Many expect businesses to accept mobile wallets or offer pay with phone options.

3. Lower PCI Scope

By using tokenization and third-party gateways, some mobile payment solutions reduce your PCI DSS compliance burden.

4. Future-Ready Brand Perception

Embracing mobile payments shows your business is modern and customer-first—especially important for younger, tech-savvy buyers.

According to recent research, businesses are turning to faster or instant payments for key reasons:

- 48% say it helps reduce costs

- 39% appreciate the flexibility to pay and be paid as customers prefer

- 35% value the 24/7 nature of instant payment services

This makes mobile and instant payments not just convenient—but essential.

Mobile Payment Options for Merchants

Not all businesses have the same needs, which is why mobile payment acceptance should be flexible. Here are a few ways merchants can get started:

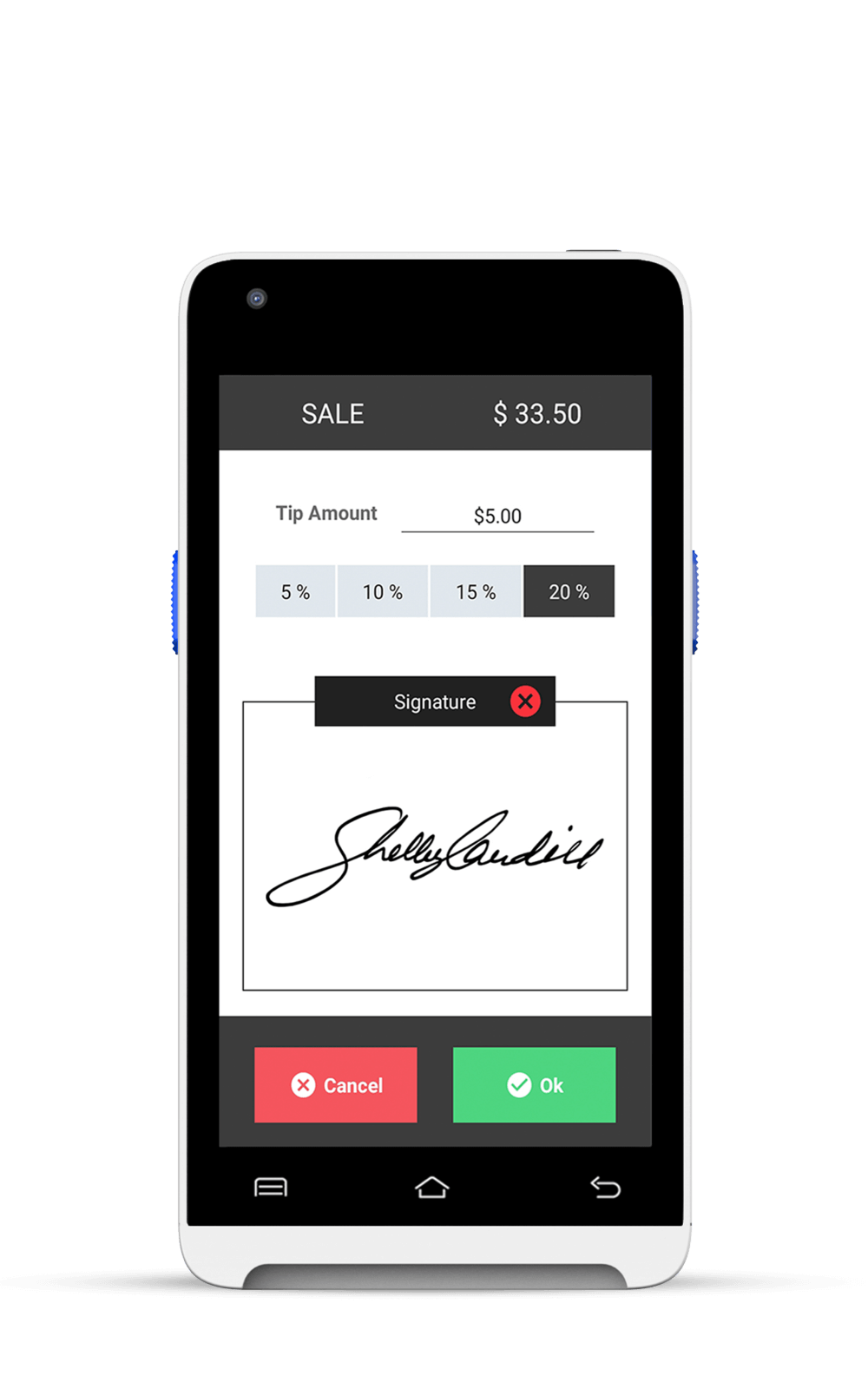

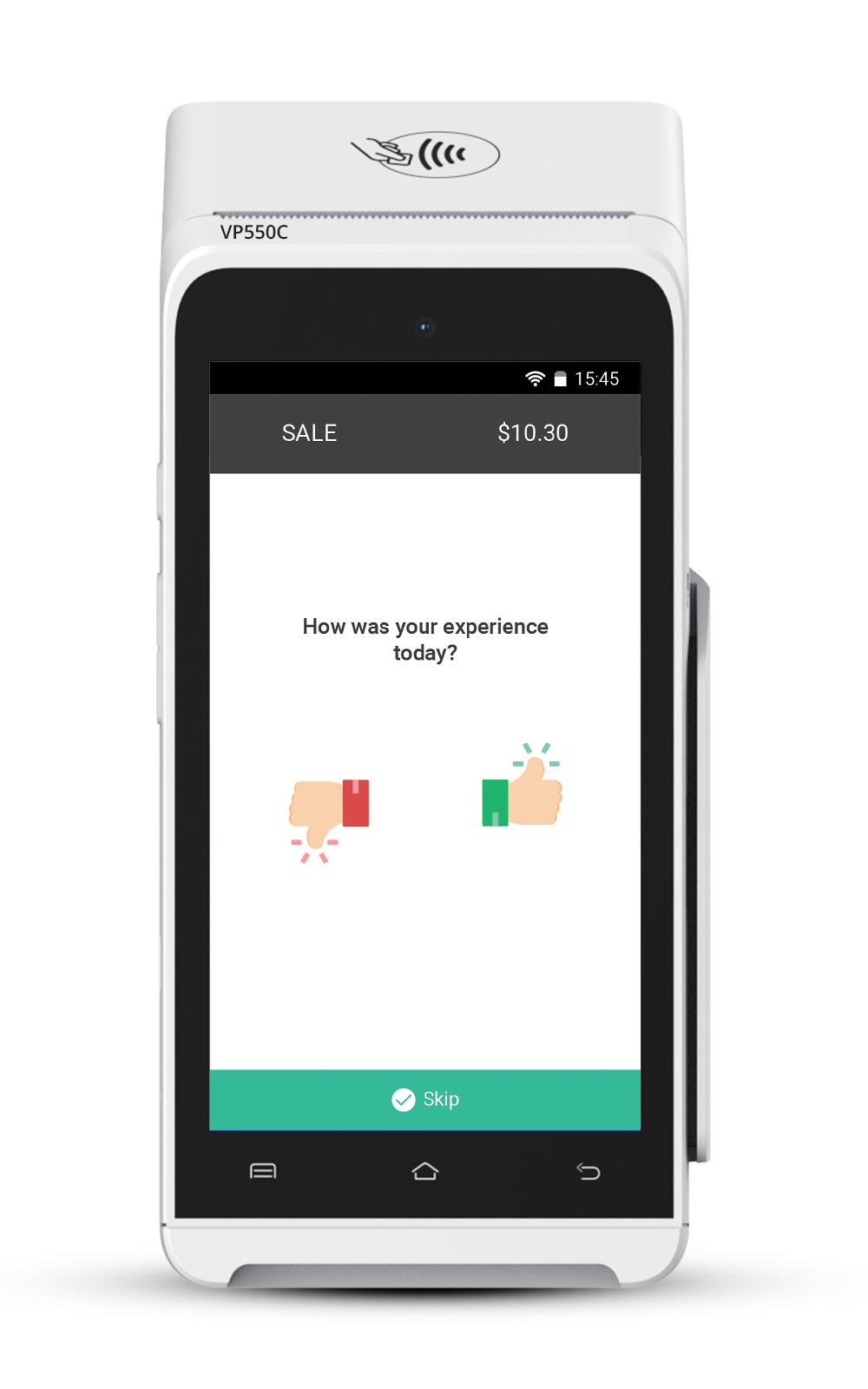

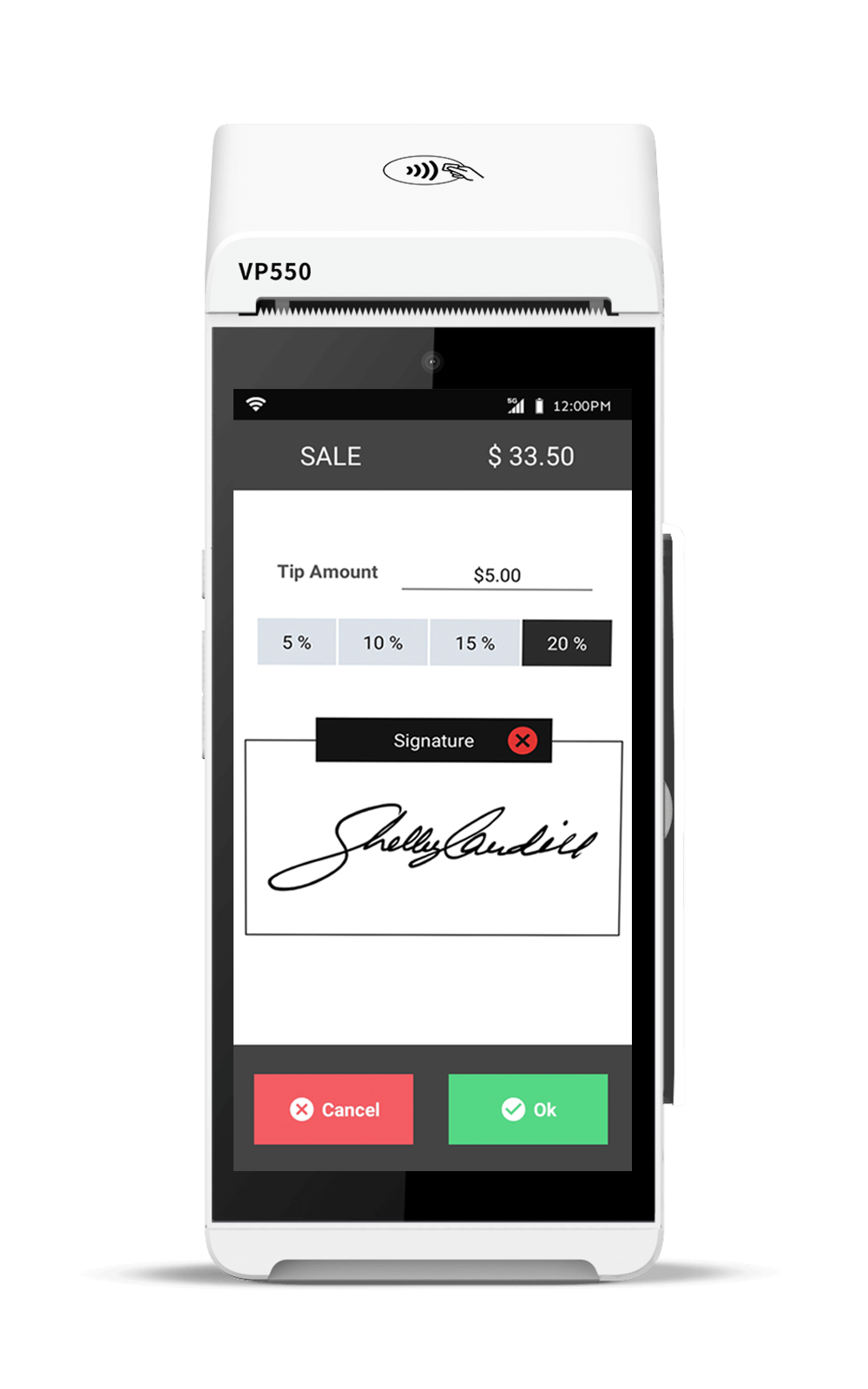

1. Mobile Terminals

Smart terminals like the Valor VL550 or VP800 let you accept contactless, chip, and swipe payments – all with wireless connectivity and built-in reporting.

These mobile payment terminals are ideal for busy storefronts, kiosks, or events.

2. Virtual Terminals

Log in from any browser to accept payments manually – great for phone orders or recurring billing.

3. PayNow / Text-to-Pay Tools

Send payment links to customers via SMS and get paid from anywhere. Perfect for field services, salons, or healthcare providers.

4. Standalone Mobile Readers

Use mobile credit card readers that connect to your phone or tablet. They’re ideal for vendors, food trucks, or businesses that travel often.

With so many options, it’s easier than ever to accept credit card payments on phone—no bulky setup needed.

Mobile Payment Adoption by Industry

Mobile payments aren’t just for tech startups. Here’s how different industries are embracing them:

- Retail

From big box stores to boutiques, retailers use mobile card payment to shorten queues, reduce cash handling, and connect loyalty programs to mobile wallets.

- Restaurants & Cafes

Tap-to-pay speeds up the dining experience. Add QR menus and tip prompts, and you’ve got a seamless operation.

- Salons & Spas

PayNow links allow busy professionals to pay before or after their appointment—no waiting at the counter.

- Field Services & Contractors

With mobile credit card readers, home repair professionals can collect payment on-site, reducing delays and improving cash flow.

- Coaching, Consulting & Remote Services

Virtual terminals and payment links help service providers accept mobile payments from clients across the country.

Security and Compliance in Mobile Payments

Digital convenience should never come at the cost of security. Fortunately, mobile payments are often more secure than traditional card use due to:

1. Tokenization & Encryption

Card details are never transmitted directly. Instead, temporary tokens are used to complete the transaction.

2. Biometric Authentication

With Face ID, fingerprint scanning, or passcodes, stolen devices are unlikely to be misused.

3. PCI DSS Compliance

All major mobile payment services and processors adhere to global payment security standards like PCI DSS.

4. Reduced Fraud Risk

Built-in fraud detection systems and restricted access through apps help detect and block suspicious activity faster than ever before.

Even as technology evolves, secure mobile payment methods will remain a top priority for processors and business owners alike.

The Road Ahead for Mobile Payments

As consumer expectations evolve, mobile payments are no longer optional—they’re essential. Whether you run a brick-and-mortar shop, a service-based business, or an eCommerce store, integrating mobile payment solutions gives you a modern edge.

With options like tap to pay, digital wallets, and NFC payment apps, you can cater to more customers while increasing transaction speed, boosting security, and improving satisfaction.

Conclusion

Mobile payments aren’t just about accepting money—they’re about delivering a better experience. From mobile wallet transactions at a POS terminal to contactless payment app options on the go, they open the door to smoother, smarter commerce.

If you’re looking to simplify checkout, accept mobile payments, and reduce friction in every sale, now’s the time to act. Solutions like Valor PayTech’s POS and Text-to-Pay tools make it easier than ever to upgrade your payment experience – on your terms.

FAQ

1. What are mobile payments and how do they work?

Mobile payments are transactions made using a smartphone, tablet, or wearable device. They use technologies like NFC, QR codes, or PayNow links to securely transfer payment information and complete purchases without needing cash or a physical card.

2. Are mobile payments safe for my business and customers?

Yes. Mobile payments use advanced security features like tokenization, encryption, and biometric authentication (Face ID or fingerprint), making them more secure than traditional card swipes or manual entry.

3. What do I need to start accepting mobile payments at my business?

You’ll need a mobile-compatible POS system, a virtual terminal, or a mobile credit card reader. Valor PayTech offers terminals and tools that support contactless, text-to-pay, and app-based transactions.

4. Can I accept mobile payments without a physical store?

Absolutely. Service providers, remote workers, and mobile vendors can use virtual terminals or text-to-pay tools to send secure payment links and get paid from anywhere.

5. What’s a mobile wallet vs. a payment app?

A mobile wallet stores digital versions of credit/debit cards (e.g., Apple Pay). A mobile payment app can include wallets but may also offer peer-to-peer transfers, loyalty tracking, and in-app payments.

6. How do I enable NFC for mobile payments on my phone?

You can usually enable NFC through your device’s settings. Navigate to “Connections” or “Wireless Settings” and toggle NFC on. Ensure your POS system supports NFC payments.

7. What’s the best mobile payment app for small businesses?

It depends on your needs, but apps like Valor PayTech, Square, and PayPal offer excellent features like invoicing, analytics, and mobile POS compatibility.

8. How do I integrate mobile payments into my e-commerce site?

You can use APIs or payment gateways like Stripe, Valor Pay, or Shopify Payments to add mobile-friendly options like Apple Pay or Google Pay to your checkout page.

9. Which mobile payment options are best for New York retailers?

Popular options include Valor PayTech, Square, and Apple Pay. Ensure the processor is compatible with New York sales tax and compliance regulations.

10. Are mobile payments secure for online transactions?

Yes. Look for solutions offering PCI DSS compliance, tokenization, and real-time fraud detection—like Valor PayTech’s platform with secure API and virtual terminal support.

Ready to get started?

Become a Partner Today!

Complete the form below.