When it comes to choosing a payment technology partner, especially for Independent Software Vendors (ISVs), the stakes are high. A seamless and secure payment experience not only enhances customer satisfaction but also bolsters your reputation in the market. So, what should you consider when selecting the right payment partner? Here are some key factors to keep in mind:

Easy-to-use APIs and SDKs

A cornerstone of any solid payment partnership is the availability of easy-to-use APIs and SDKs. When evaluating potential partners, look for well-documented, flexible solutions that integrate seamlessly into your existing software. A robust API not only saves time during the setup process but also reduces the likelihood of errors that can lead to costly downtime.

With comprehensive documentation and step-by-step guides, developers can easily implement payment functionalities into their applications. This approach allows for a quicker go-to-market strategy while ensuring that your software is equipped with the latest payment features. Furthermore, consider partners that provide SDKs for various programming languages.

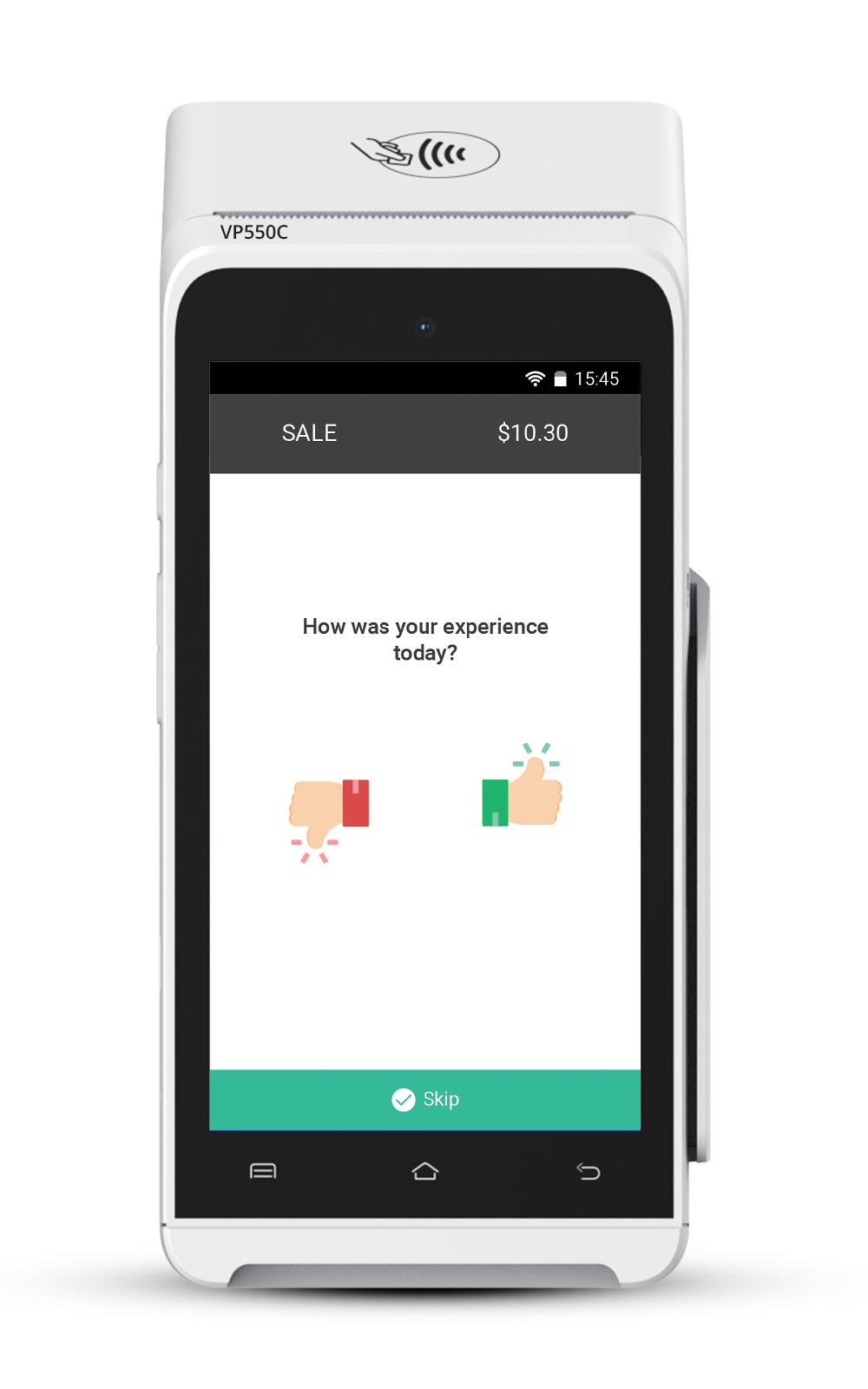

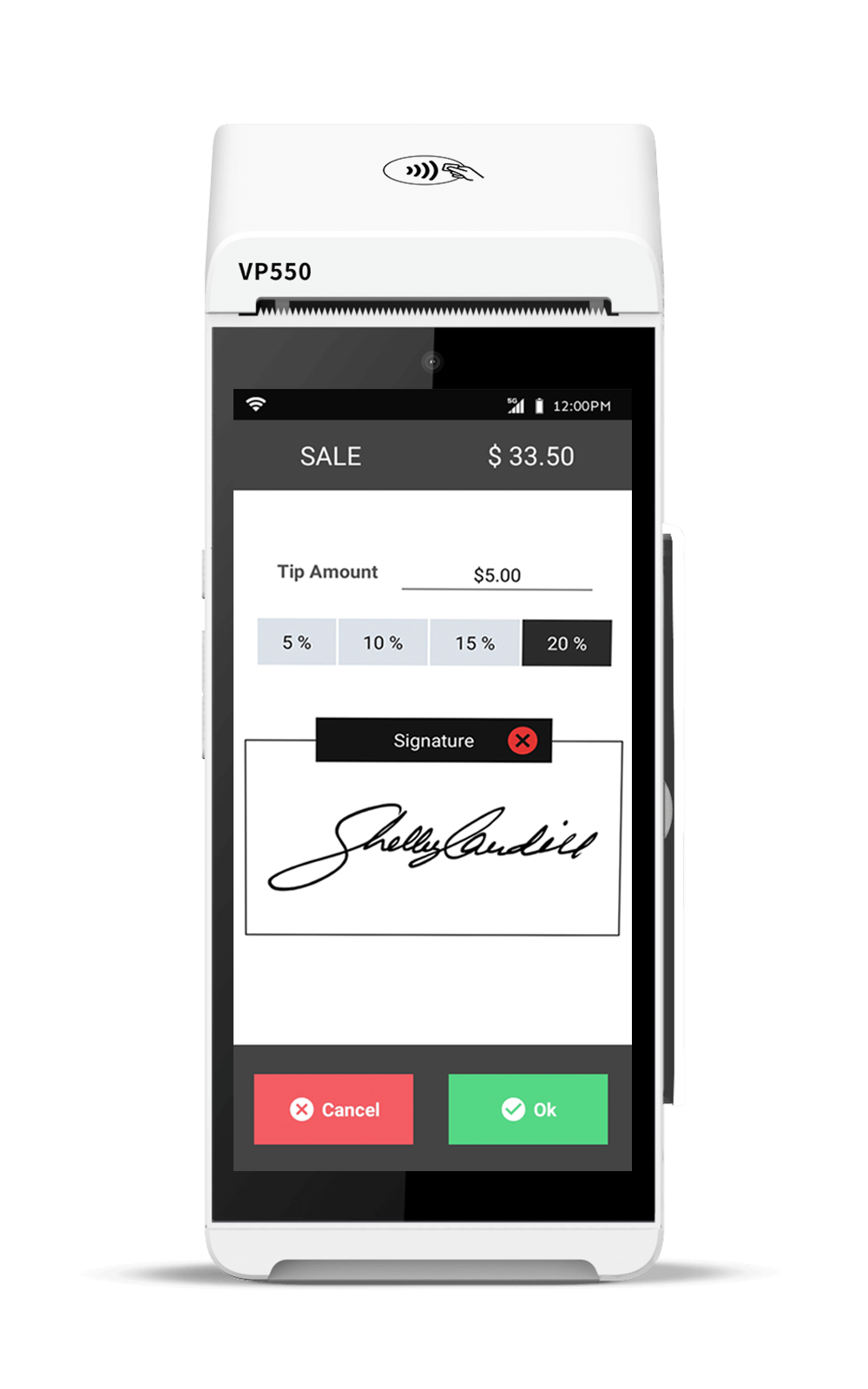

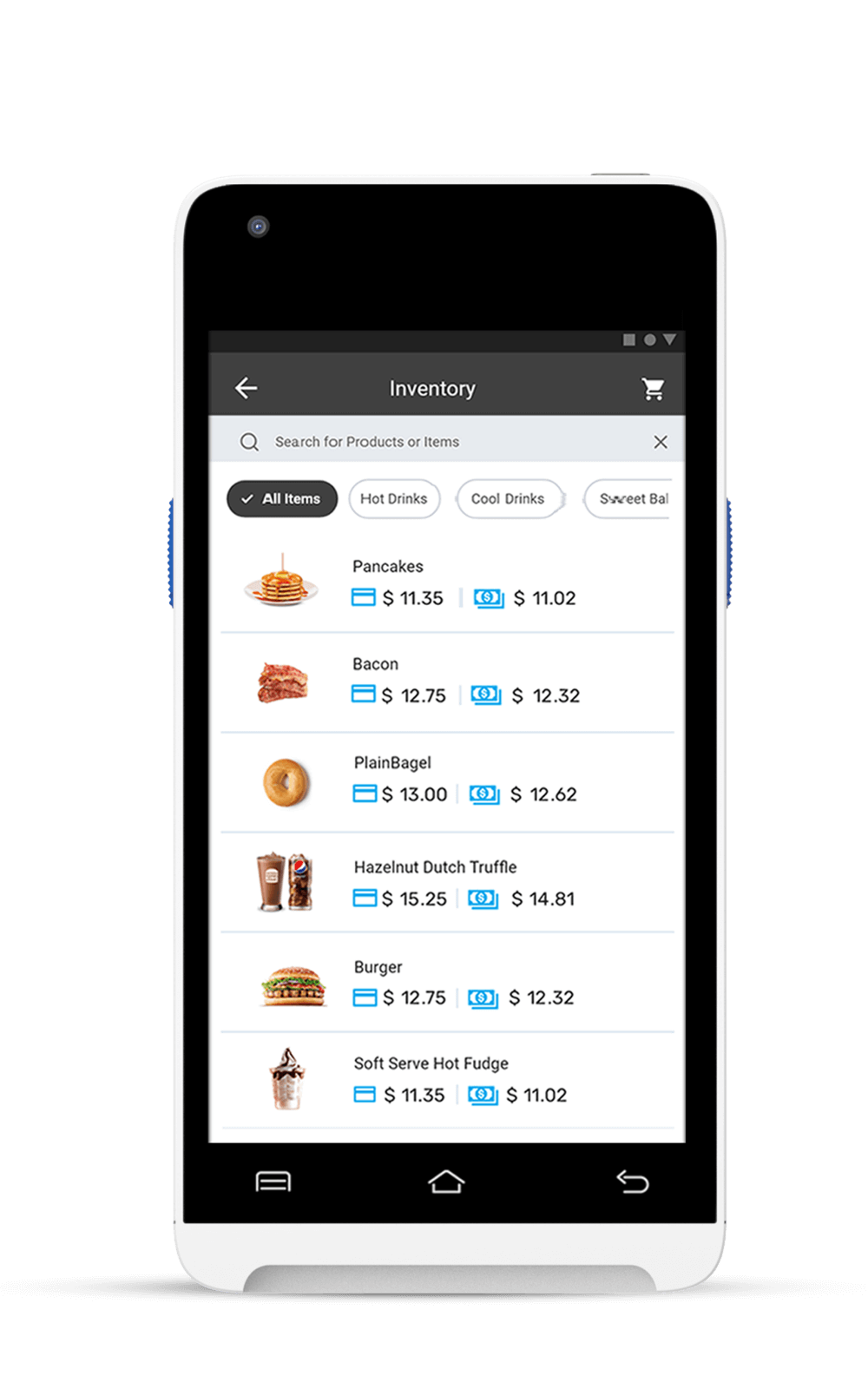

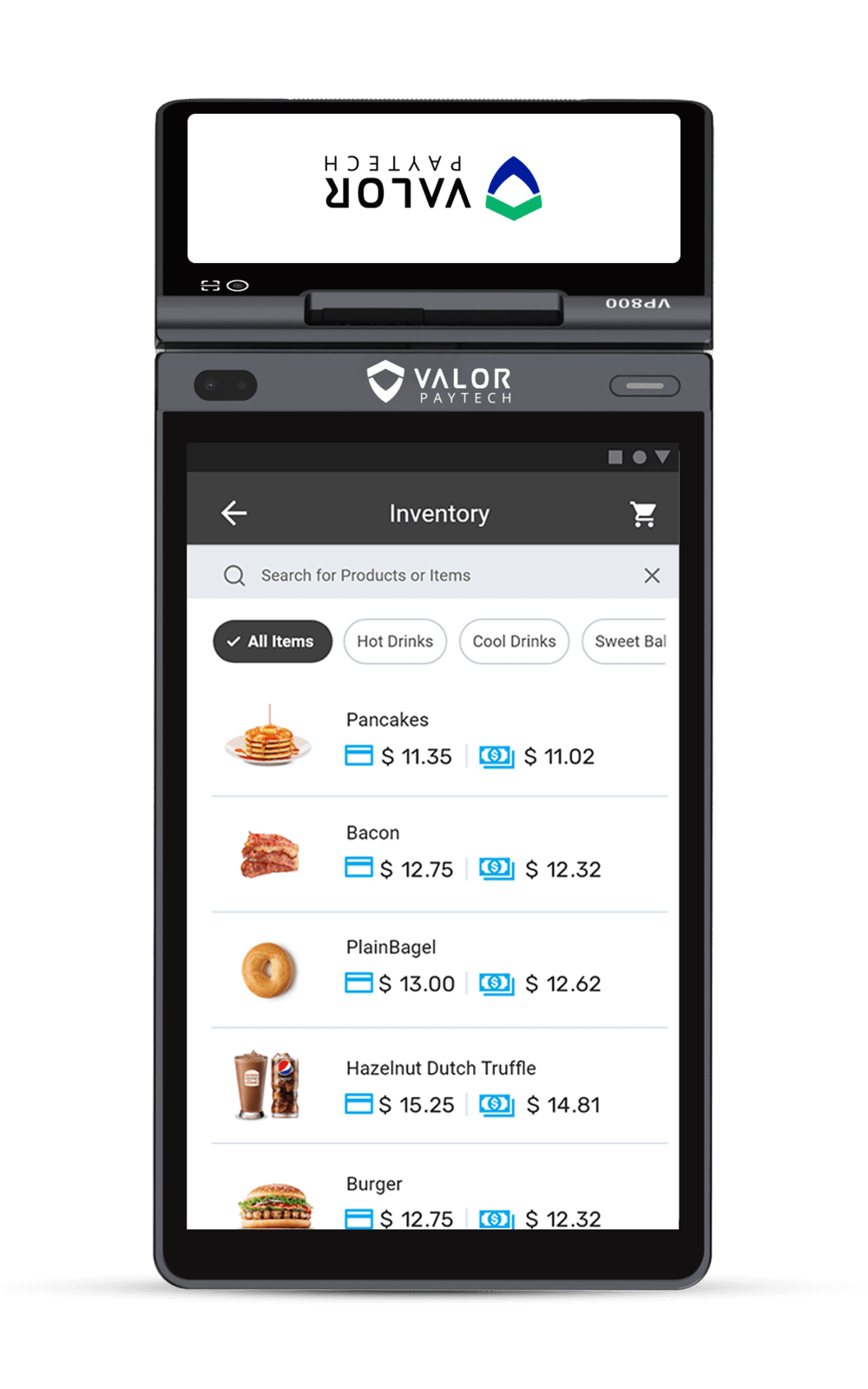

Range of Payment Devices

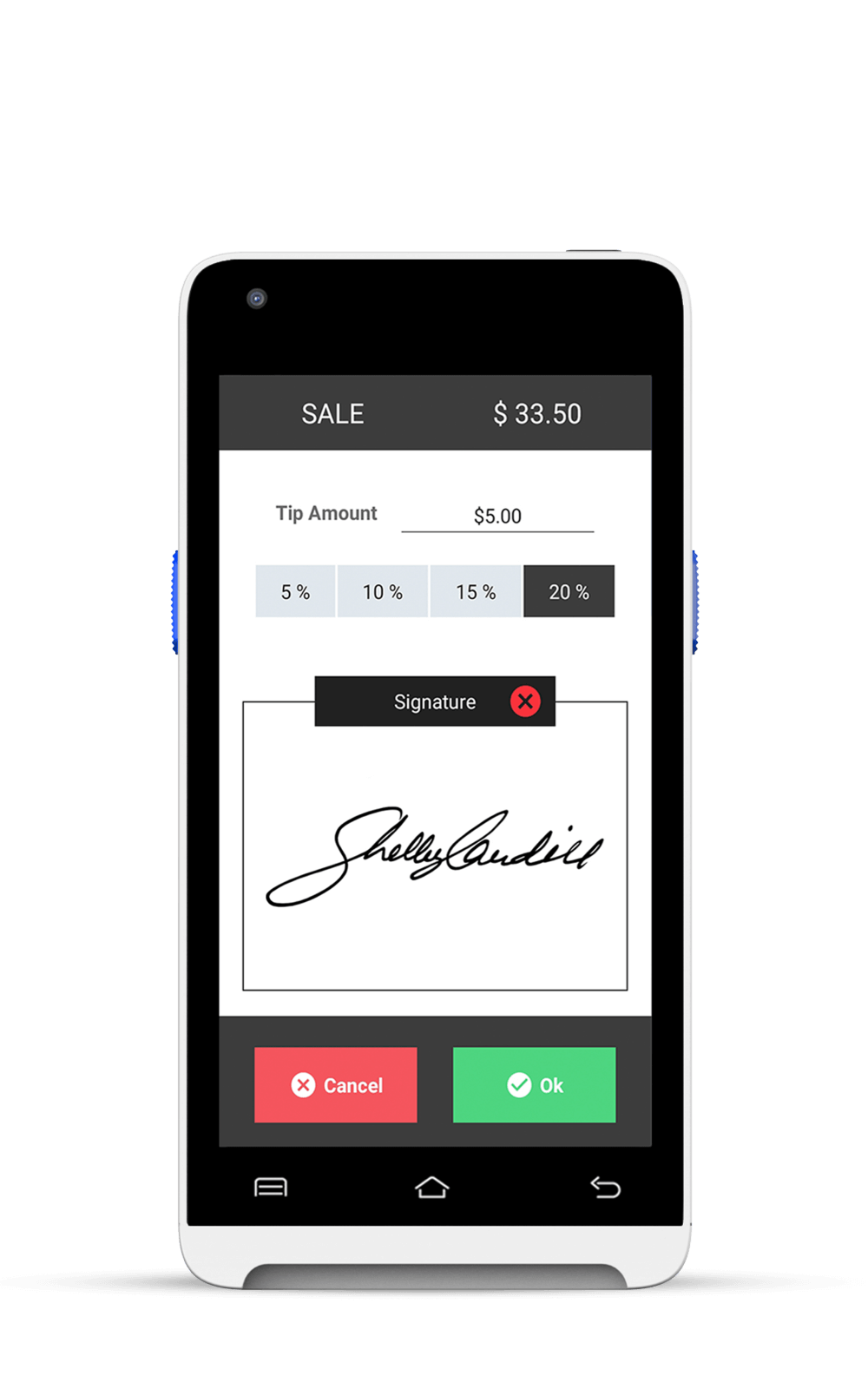

The right payment partner should offer a variety of payment devices. This includes card readers, POS terminals, and mobile payment solutions. By providing diverse options, you can cater to different business models and customer preferences, ensuring a secure and reliable payment experience across various platforms.

Moreover, make sure that the devices are compliant with security standards and are compatible with your software. The last thing you want is to have a cutting-edge application that can’t process payments due to hardware limitations. Consider also the ease of setup and maintenance for these devices; the simpler the process, the quicker you can focus on what matters most – growing your business.

Modular Payment Processing

A modular payment processing approach is essential for businesses that want flexibility and scalability. Look for a payment partner that allows you to select specific payment services tailored to your needs, whether that be card processing, ACH payments, or fraud prevention. This flexibility not only reduces costs but also ensures that you’re only paying for what you use, avoiding the pitfalls of one-size-fits-all solutions.

Additionally, inquire about the partner’s ability to integrate with other payment solutions or tools you might be using. The capacity to easily add or remove services as your business evolves can save you time and money in the long run.

Stellar Support

In the ever-evolving terrain of payment technology, having stellar support can be a game-changer. Your payment partner should offer a dedicated support team available 24/7 to assist with any issues that may arise. This support should not only be reactive but proactive, helping you to navigate potential pitfalls before they affect your business operations.

Check for customer reviews and case studies to gauge their reputation for providing excellent customer service. A partner with a proven track record of reliability can save you from a world of trouble down the line. Moreover, having access to a knowledge base, community forums, and tutorials can empower your team to troubleshoot common issues independently.

Payment Processing Experts

The right payment partner will have experience working in your specific industry, enabling them to provide tailored solutions that meet your unique needs. They should be able to offer guidance on compliance issues, ensuring that you are always aligned with industry standards and regulations.

Moreover, these experts can help you navigate the complexities of international payments if your business is looking to expand globally. Their insights can lead to improved strategies and smoother transactions across borders. If you’re operating in a fast-paced market like New York, having region-specific expertise is invaluable. Don’t hesitate to ask potential partners about their past experiences and how they’ve helped similar businesses achieve their goals.

Security and Compliance

In an age where data breaches are all too common, security and compliance should be a top priority when choosing a payment partner. Ensure that your potential partner complies with industry standards such as PCI DSS (Payment Card Industry Data Security Standard). This compliance not only protects your business but also instills confidence in your customers.

Look for features such as end-to-end encryption, tokenization, and regular security audits to safeguard sensitive data. The more layers of security a partner provides, the better you can protect your business and your customers. Additionally, inquire about their incident response plan; a solid plan demonstrates preparedness for handling security breaches efficiently.

Integration and Customization

Every business is unique, and your payment solution should reflect that. Look for partners that offer integration and customization options, allowing you to tailor the payment experience to fit your brand and operational needs. Whether it’s custom checkout flows, branded payment pages, or unique reporting features, the ability to customize can significantly enhance user experience and engagement.

Furthermore, the ease of integration with your existing systems – such as accounting, CRM, and inventory management – is crucial for seamless operations. A payment partner that provides integration services or plugins for popular platforms can save you significant time and effort.

Payment Processing Fees

Understanding the payment processing fees is essential for maintaining profitability. Different partners offer different fee structures, including flat rates, percentage-based fees, and hidden charges. Always read the fine print to ensure there are no surprise fees that could affect your bottom line.

Evaluate your transaction volume and payment methods to find the most cost-effective payment partner for your business. This assessment can help you select a partner that not only meets your service needs but also aligns with your financial goals. A transparent fee structure will allow you to forecast your expenses more accurately and budget effectively.

Additional Features

Don’t overlook the additional features that your payment partner may offer. For instance, value-added services like loyalty programs, analytics tools, and reporting features can provide your business with valuable insights and enhance the customer experience.

Moreover, consider whether the payment partner supports emerging payment technologies such as mobile wallets and cryptocurrency. As the payment landscape evolves, staying ahead of the curve can give your business a competitive edge. Look for partners that are continuously innovating and adapting to industry trends.

Scalability for New York’s Future Growth

A crucial factor in your decision-making should be the scalability of the payment solutions offered. Your business may grow, or its needs may change over time, so it’s essential to join hands with a payment partner that can scale alongside you. This means they should offer services that can handle increased transaction volumes and can adapt to new business models or market demands.

Ask the potential payment partner about their plans for future enhancements and how they envision supporting your business as it grows. A partner that invests in its technology will likely invest in your success as well.

Industry Reputation and Reviews

Last but not least, consider the industry reputation and customer reviews of potential partners. A partner with a solid reputation is more likely to provide a reliable service. Look for case studies or testimonials from other ISVs and businesses in your industry; these insights can give you a clearer picture of what to expect.

Additionally, don’t hesitate to reach out to existing customers for their feedback. This first-hand information can be invaluable in assessing the overall reliability and quality of the partnership. Many successful ISVs in New York attribute their growth to selecting a payment partner that understands local market demands.

FAQ

1. How to choose a payment service provider?

Look for a payment service provider with easy integration, robust security, scalable solutions, and transparent pricing that aligns with your business needs.

2. Who is the payment partner?

A payment partner provides technology and support to help businesses process payments securely and efficiently.

3. Can I scale with this payment partner as my business grows?

Yes, the right payment partner offers scalable solutions to handle increased transactions and adapt to new business demands.

4. How well does the payment partner integrate with my existing systems?

The best payment partner will provide seamless integration with your software, including accounting, CRM, and inventory tools.

5. How do payment processing fees impact my business?

Payment processing fees can significantly impact your business. These fees, typically charged by payment processors such as credit card companies or banks, are a percentage of each transaction.

Ready to get started?

Choosing the right payment partner is crucial for the success of your business. By considering these factors – easy-to-use APIs and SDKs, a range of payment devices, modular processing, stellar support, expertise, security, customization, costs, additional features, scalability, and reputation – you can make an informed decision that aligns with your business goals.

If you’re ready to take your payment processing to the next level, become a partner today! Complete the form below to get started and enhance your payment experience for both you and your customers.