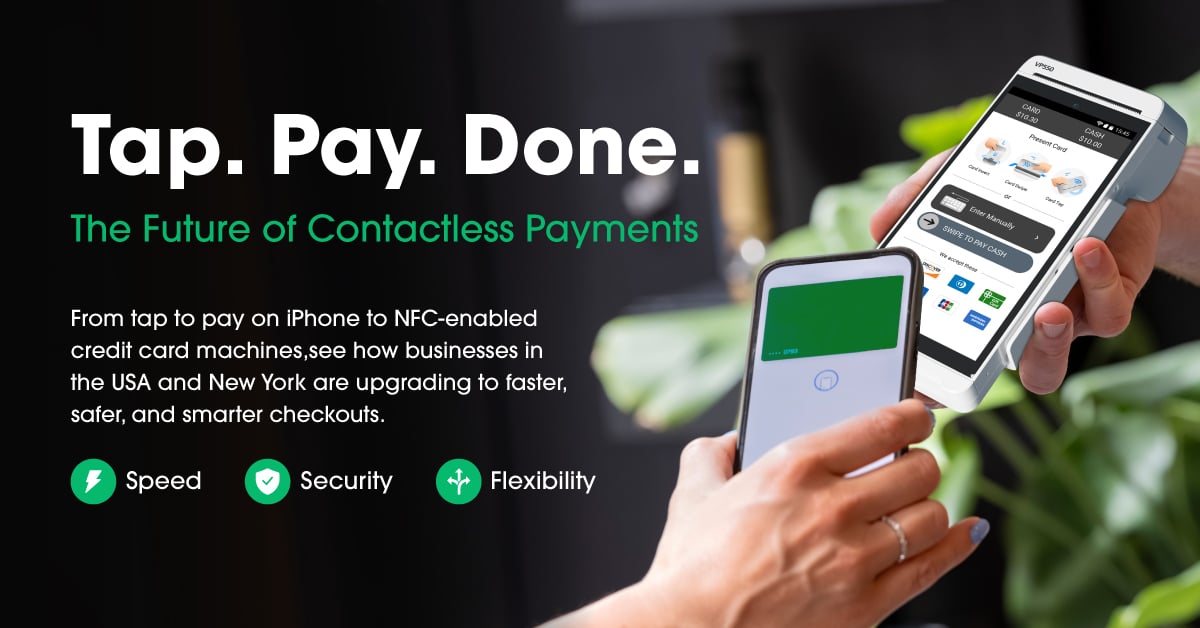

In 2026, tap-to-pay isn’t just convenient — it’s the new standard. Across the U.S., shoppers expect to pay instantly with a tap of their phone, smartwatch, or contactless card. And if your business isn’t offering that? You’re losing customers, slowing down your checkout, and falling behind competitors.

The good news? Upgrading to a contactless payment terminal has never been easier or more affordable.

This guide breaks down everything U.S. businesses need to know — what a contactless terminal is, how it works, which devices are best, setup steps, security, and the top contactless payment solutions for different industries.

Let’s get started.

What Is a Contactless Payment Terminal?

A contactless payment terminal is a POS device that allows customers to pay without inserting or swiping a physical card. Instead, it uses NFC (Near Field Communication) to securely exchange encrypted payment data in seconds.

How Contactless Payments Work

Tap or Hover

Customer holds their card or phone close to the reader.Secure NFC Exchange

The terminal and card communicate via encrypted EMV data.Authorization

The issuer validates the tokenized credential.Instant Approval

The terminal displays “Approved” within seconds.

Accepted Payment Methods

Contactless EMV cards

Apple Pay

Google Pay

Samsung Pay

Smartwatches & NFC rings

Tap-enabled accessories

Tap to Pay with Phone

Whether you run a food truck, boutique, salon, or enterprise store, contactless terminals are now essential for fast, frictionless checkout.

Why U.S. Businesses Must Upgrade in 2026

onsumers across America now expect tap-to-pay everywhere — even at small businesses, kiosks, and home-service appointments. Here’s why:

1. Faster Checkout (3–5 Seconds)

Speed is the #1 reason contactless is dominating retail. Faster checkout = more customers served per hour.

2. Stronger Security

Contactless terminals use tokenization + EMV cryptograms, making them safer than swipes.

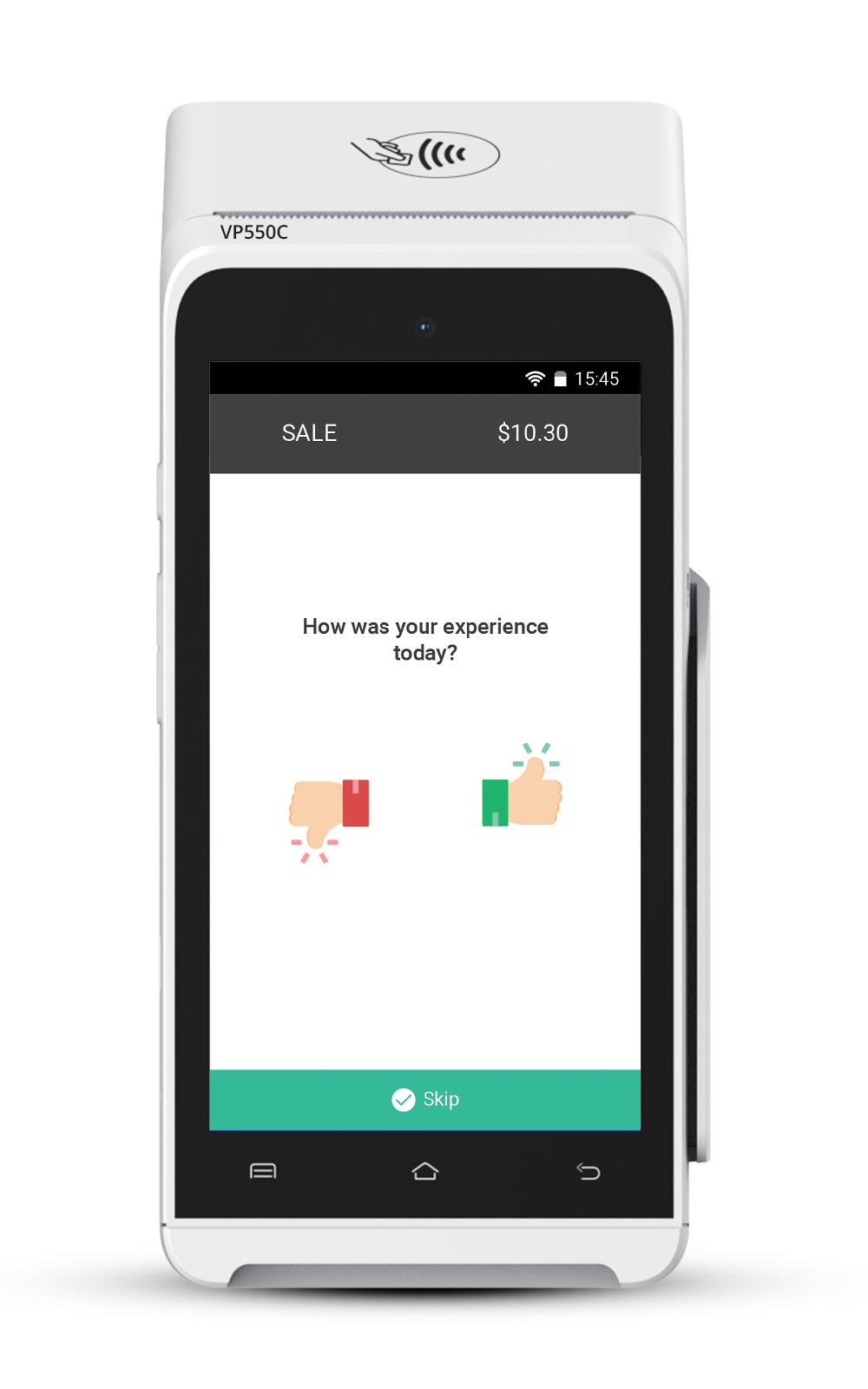

3. Higher Customer Satisfaction

People love tap-to-pay. It feels modern, clean, and effortless.

4. Future-Proof Compliance

Many card issuers are phasing out magstripe cards by 2030.

5. Flexible Payments

Accept:

- Tap

- QR

- Mobile wallet

- Digital rewards

- Digital receipts

Upgrading now keeps your business competitive, compliant, and ready for the future.

Key Features to Look for in the Best Contactless Payment Terminals

When choosing the right NFC terminal, focus on features that actually impact your daily business operations.

1. Security

- EMV Level 2 certified

- PCI DSS compliant

- Point-to-point encryption

- Tokenization protection

2. Payment Flexibility

- Tap & pay

- QR code acceptance

- Apple/Google/Samsung Pay

- SoftPOS (tap to pay with phone)

3. Connectivity

- Wi-Fi

- 4G LTE

- Bluetooth

- Offline mode options

4. Portability

For mobile vendors, handheld terminals with long battery life are essential.

5. Business Integrations

Look for terminals that integrate with:

- POS systems

- CRM

- Loyalty programs

- Inventory tools

- Reporting dashboards

6. Custom Branding

Add your brand logo, offers, or return policies on digital & printed receipts.

Top Contactless Payment Terminals in the USA (2026 Edition)

Here are the top NFC payment terminals used by American businesses today:

1. Valor PayTech VL110 — Best Handheld Mobile Contactless Terminal

Best for: On-the-go businesses, cafés, service providers

Features:

- 4G + Wi-Fi + Bluetooth

- Full NFC support

- QR payments

- Long battery life

Pros: Fast, lightweight, advanced features

Cons: More power than micro-merchants may need

2. Valor PayTech VL100 Pro — Best Countertop Terminal

Best for: Retail, grocery, high-traffic stores

Features:

- Tap, chip, swipe, QR

- Level 3 data support

- Custom receipt branding

- Large touchscreen

Pros: Stable, durable, enterprise-grade

Cons: Stationary form factor

3. Square Terminal — Simple All-in-One

Pros: Easy UI, clean design

Cons: Higher processing fees, limited customization

4. Clover Flex — Best for Restaurants

Pros: Portable, apps marketplace, QR menus

Cons: Processor lock-in

5. Ingenico Move/5000 — Global Compatibility

Pros: Excellent security

Cons: Outdated interface

6. PAX A920 Pro — Android Smart Terminal

Pros: Large display, advanced apps

Cons: Overkill for low-volume merchants

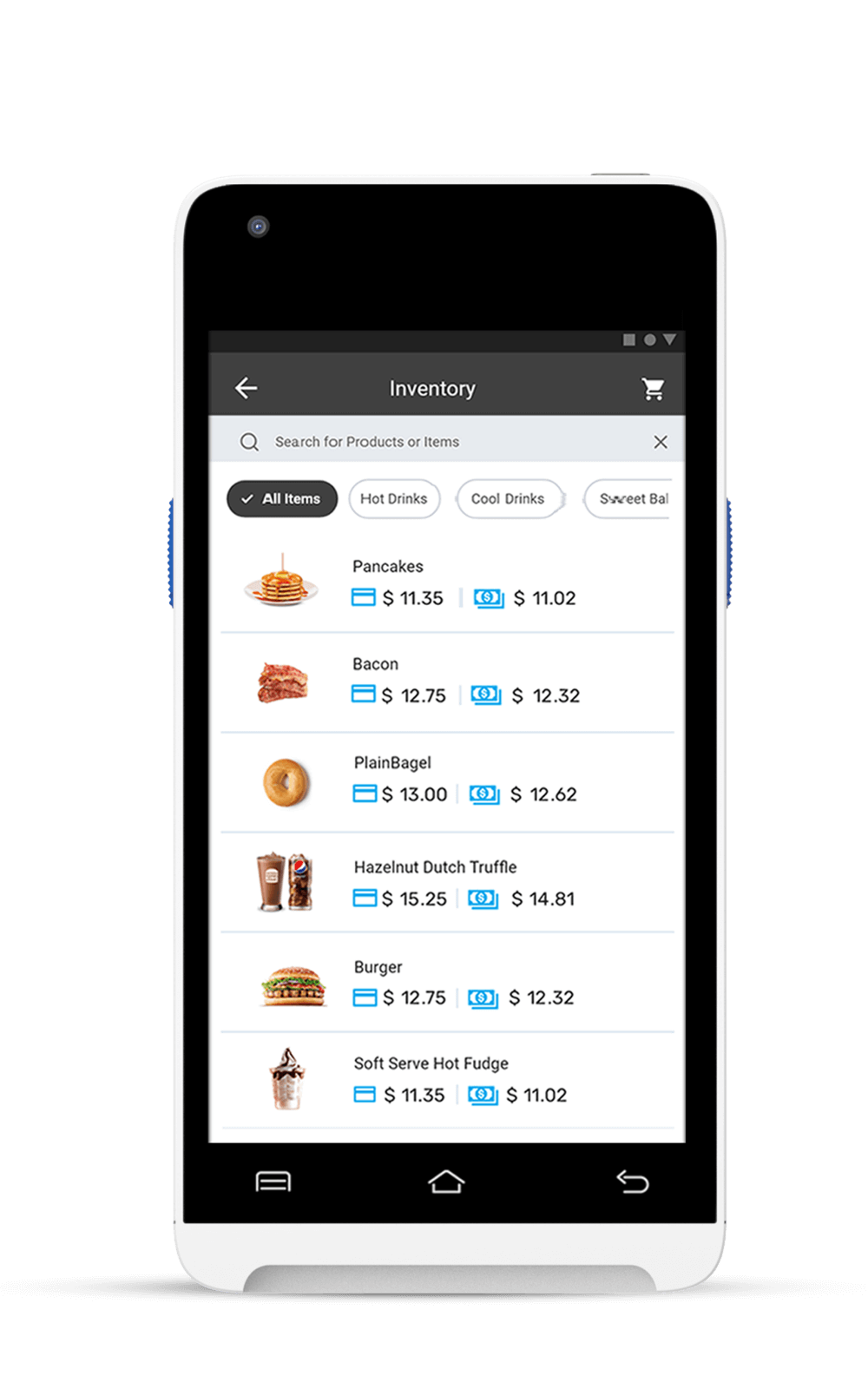

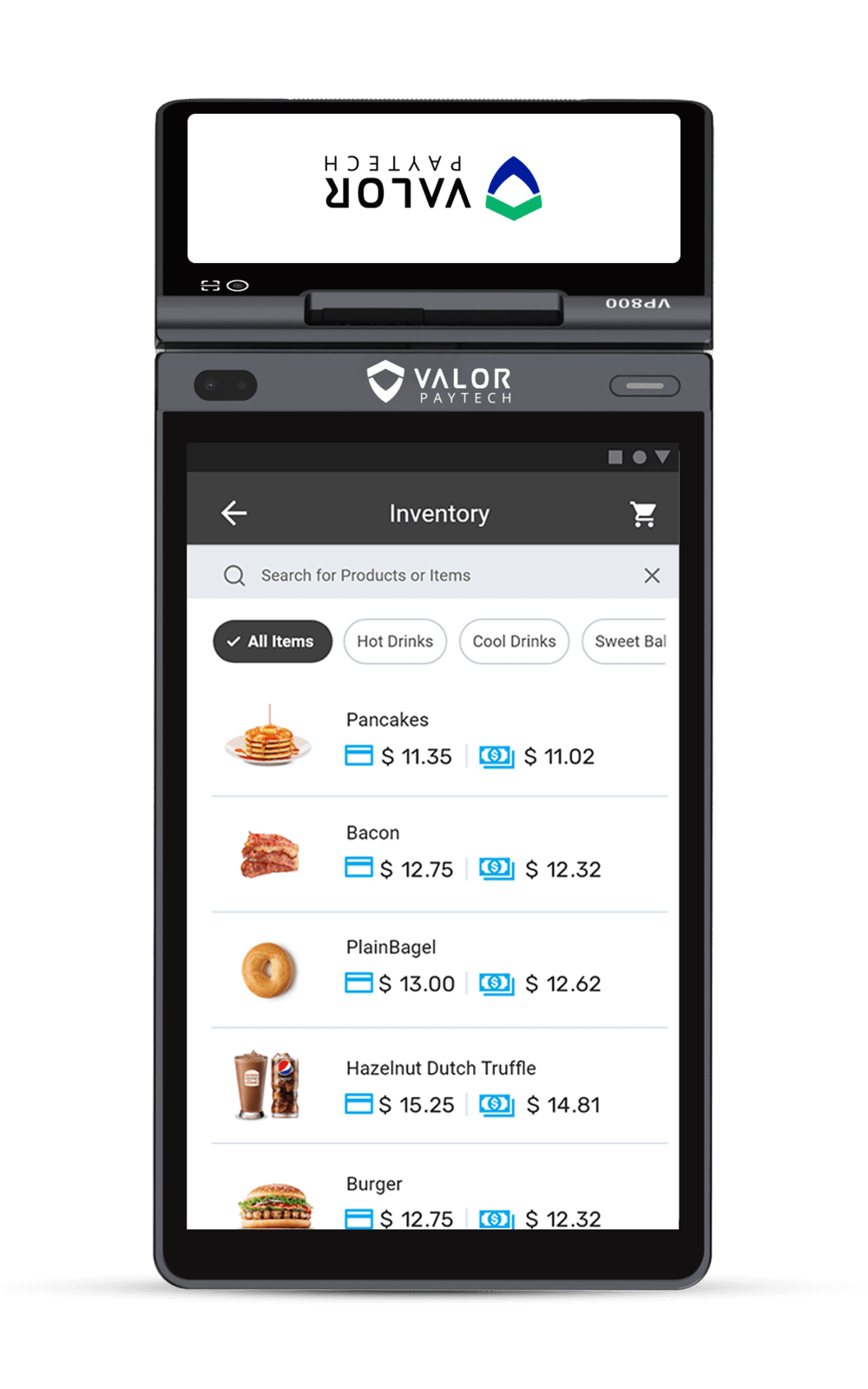

Valor PayTech Contactless Terminal Lineup (Best Overall for U.S. SMBs)

Valor’s ecosystem is built for American small and midsize businesses needing modern contactless solutions.

Top Valor Devices

- VP800 — Feature-rich countertop

- VL110 — Mobile handheld

- VL100 Pro — Advanced countertop

- RCKT — Ultra-portable card reader

Why U.S. Businesses Choose Valor:

- Fast tap-to-pay

- Inventory sync

- Customer engagement tools

- Decline recovery technology

- Virtual terminal + PayNow SMS links

- Unified reporting

Valor doesn’t just offer hardware — it offers a complete contactless payment solution.

Tap to Pay with Phone

Tap to Pay with phone is a broader term that covers using any NFC-enabled smartphone as the payment acceptance device. This means merchants can take contactless payments on Android or iOS devices, provided their payment processor supports it.

It’s a flexible option for mobile businesses, events, and on-the-go sales, eliminating the need for traditional card readers. Customers simply hold their contactless card or digital wallet near the merchant’s phone to complete the transaction in seconds.

Tap to Pay on iPhone

Apple’s Tap to Pay on iPhone lets merchants accept in-person, contactless payments directly on their iPhone — no extra hardware needed. Customers can pay using a contactless card, Apple Pay, or any other NFC-enabled wallet.

This feature is ideal for small businesses, pop-up shops, and service providers who want a portable, low-cost payment option. All transactions are encrypted and processed securely through compatible payment apps, giving merchants a professional checkout experience without bulky terminals.

Contactless vs. Traditional Terminals — Cost, Speed & ROI

When comparing hardware products from contactless POS vs traditional POS:

- Initial Cost: Contactless-enabled devices cost slightly more upfront.

- Processing Fees: Similar, but contactless supports more payment types.

- ROI: Faster checkouts, higher customer throughput, and reduced fraud costs mean payback often happens in months.

Example: A cafe serving 200 customers/day could save 30+ minutes in checkout time — freeing staff for service and upselling.

How to Set Up and Activate a Contactless Payment Terminal

Traditional Terminals

- Slower (chip insert takes ~8–12 seconds)

- More friction

- Higher maintenance

- Less future-proof

Contactless Terminals

- 3–5 second checkout

- Safer with tokenization

- Supports mobile wallets

- Faster lines = more sales

ROI Example A café serving 200 customers/day switching to tap-to-pay saves 30+ minutes in wait time daily — which can increase revenue.

Security & Compliance for Contactless Payments

Security is one of the biggest advantages of contactless technology.

Built-in Security Layers

- EMV cryptograms (fraud resistance)

- Tokenization (no real card numbers exposed)

- Point-to-point encryption

- Biometric authentication on phones

- PCI DSS compliance

This makes tap-to-pay safer than swipe or manual entry.

Best Contactless Payment Apps in the USA (2026)

1. Google Pay — Best for Android Users

Millions of U.S. consumers prefer it.

2. Apple Pay — Best for iOS Devices

Fast, secure, biometric-protected.

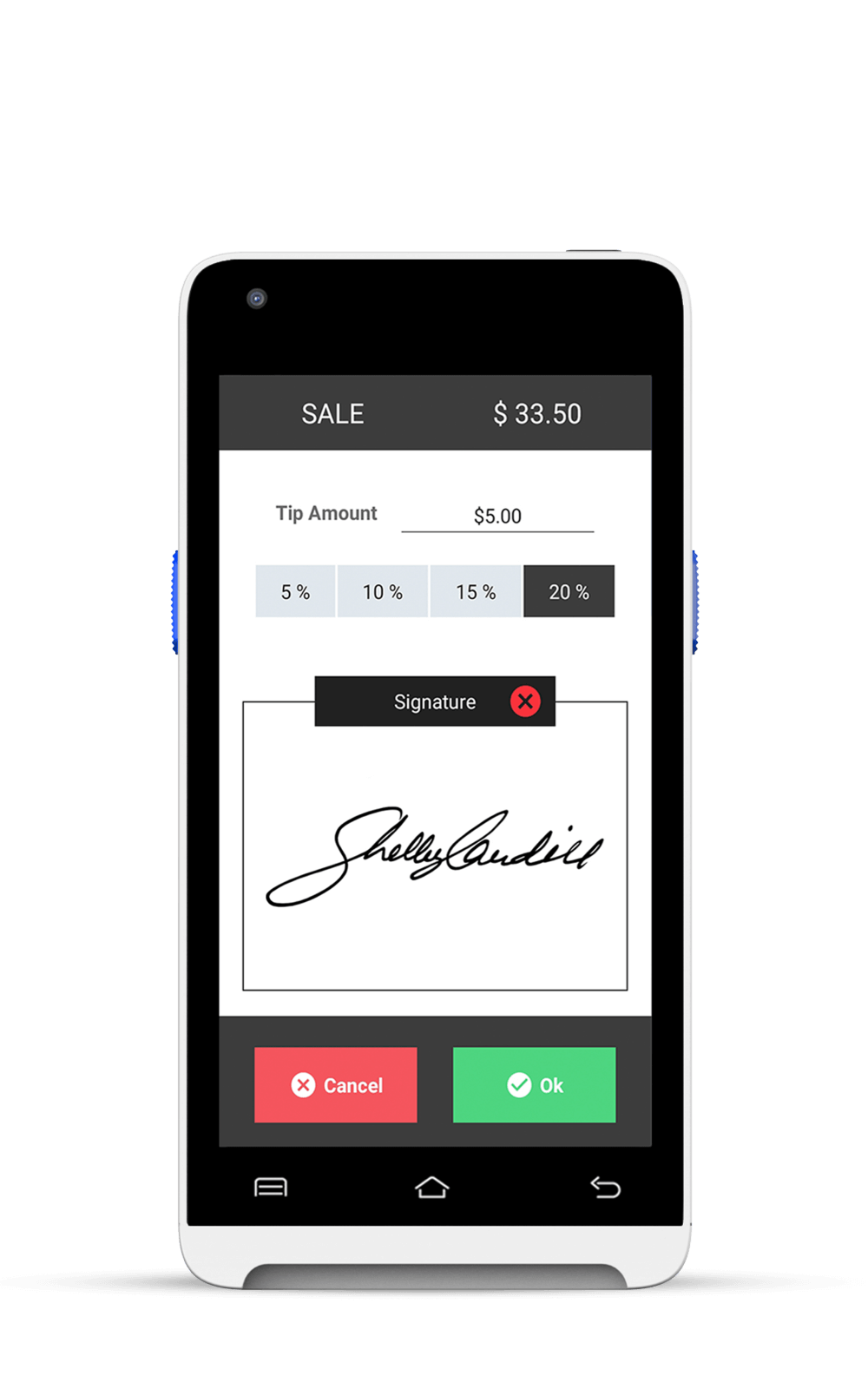

3. ValorPay Mobile POS — Best for Small Businesses

Built-in reporting, inventory, tipping, QR, SMS payments.

4. Samsung Wallet

Great for tap-to-pay on Samsung devices.

Best Contactless Payment Solutions by Industry

Retail

- Countertop NFC terminals

- Inventory sync

- Loyalty wallet

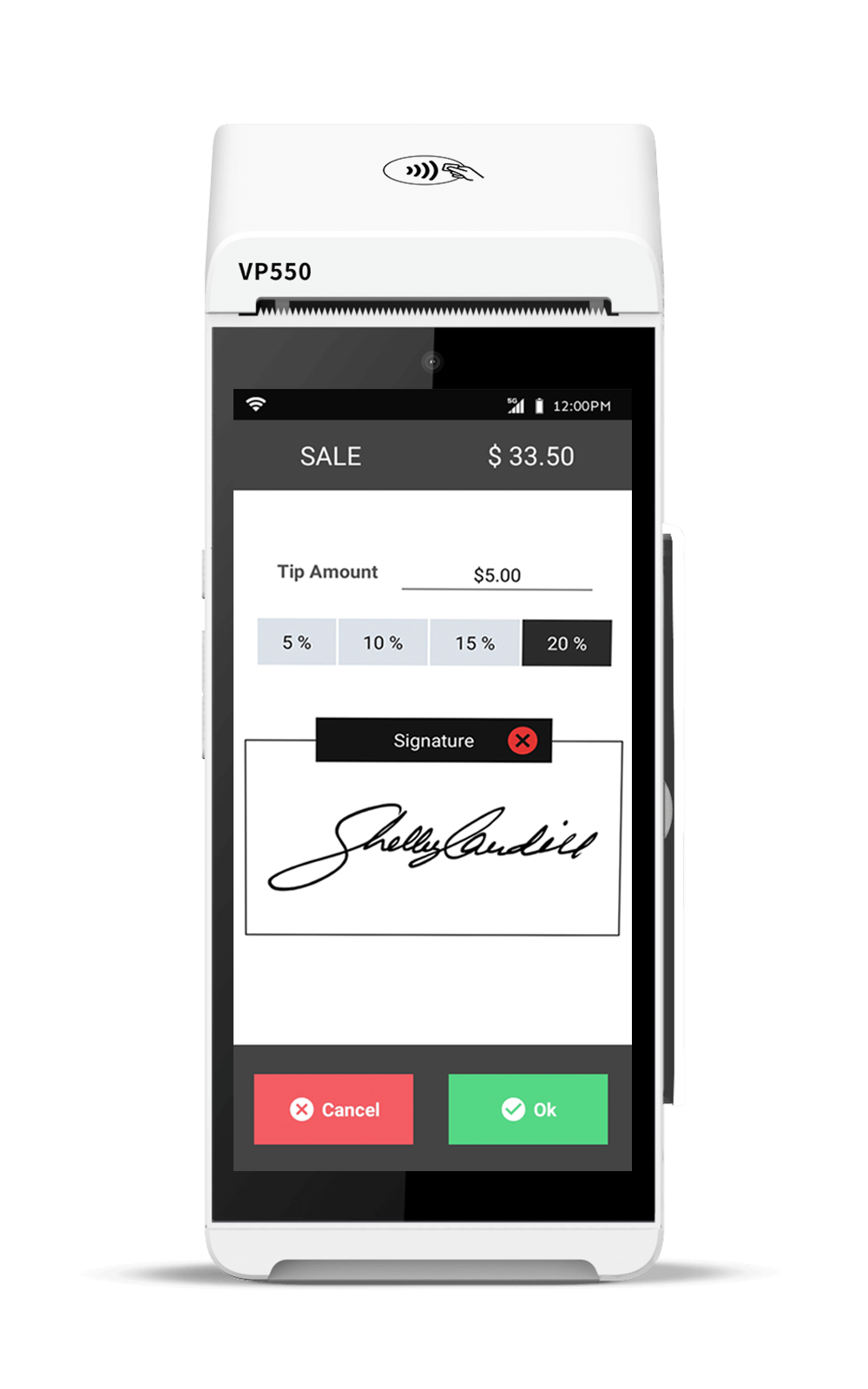

Restaurants & Cafés

- Tableside contactless terminals

- Faster turnover

- Smart tipping

Service Providers

- Mobile card readers

- Tap to Pay on Phone

- SMS invoices

Conclusion

Contactless payments are no longer optional — they’re the heart of modern checkout in the United States.

With the right NFC payment terminal, your business can:

✔ Speed up service

✔ Increase customer satisfaction

✔ Reduce fraud

✔ Future-proof your payment stack

✔ Accept tap-to-pay anywhere

Whether you’re looking for a handheld mobile POS or a countertop NFC device, Valor PayTech offers one of the strongest, most feature-rich contactless terminal lineups in the U.S.

FAQ

1. What is the cheapest contactless payment terminal in 2025?

Entry-level models like the Square Reader start under $50, though features are limited.

2. Can I accept Apple Pay without a POS machine?

Yes—SoftPOS apps let your phone act as a terminal.

3. Do contactless terminals need internet?

Yes, for real-time authorization. Some store offline transactions temporarily.

4. How secure are contactless credit card payments?

They use encryption and tokenization to protect data.

5. Can contactless payment machines accept QR codes?

Yes, most modern devices do.

6. What is the difference between NFC payment and tap to pay?

NFC is the technology; tap to pay is the action.

7. How do I connect my contactless card reader to Wi-Fi?

Use the device’s settings menu to join your network.

8. Can I use my phone as a contactless payment terminal?

Yes, with supported Tap to Phone apps.

9. Are all credit cards contactless in 2025?

Most are, but some older cards lack NFC chips.

10. Which contactless credit card machine is best for small business?

Valor VL110 for portability, Clover Flex for app integrations.

Ready to get started?

Become a Partner Today!

Complete the form below.