Table of Contents

When it comes to credit and debit card payments, merchants face a variety of costs, one of which is the interchange fee. Card schemes like Visa and Mastercard have different pricing tiers based on how “qualified” a transaction is. For instance, a transaction can qualify for the lowest interchange rate if it meets certain conditions. One key factor? The time between authorization and settlement.

For retail merchants, to secure the lowest possible interchange rate, settlement needs to happen within one day after authorization. Miss that window, and the rate might jump from 1.51% to 1.8%. That’s where this feature comes in.

What Is Auto Batch Out?

Auto Batch Out ensures your transactions are settled automatically at a designated time each day. This feature, often set up on your POS devices, can significantly reduce human errors that delay settlements and cost you extra in interchange fees.

By automating the batch-out process, you not only save on costs but also reduce the number of calls your ISO’s helpdesk receives due to payment issues, ultimately lowering Total Cost of Ownership (TCO).

The “Smartness” of Auto Batch Out

Not all auto batch out systems are created equal. For instance, if your POS terminal handles batching, there’s always a risk of failure due to power outages or hardware malfunctions. That could leave you with unsettled transactions and higher fees.

On the other hand, more advanced payment gateways host the batch at their end, reducing the risk of failure. In these cases, this feature offers extra reliability.

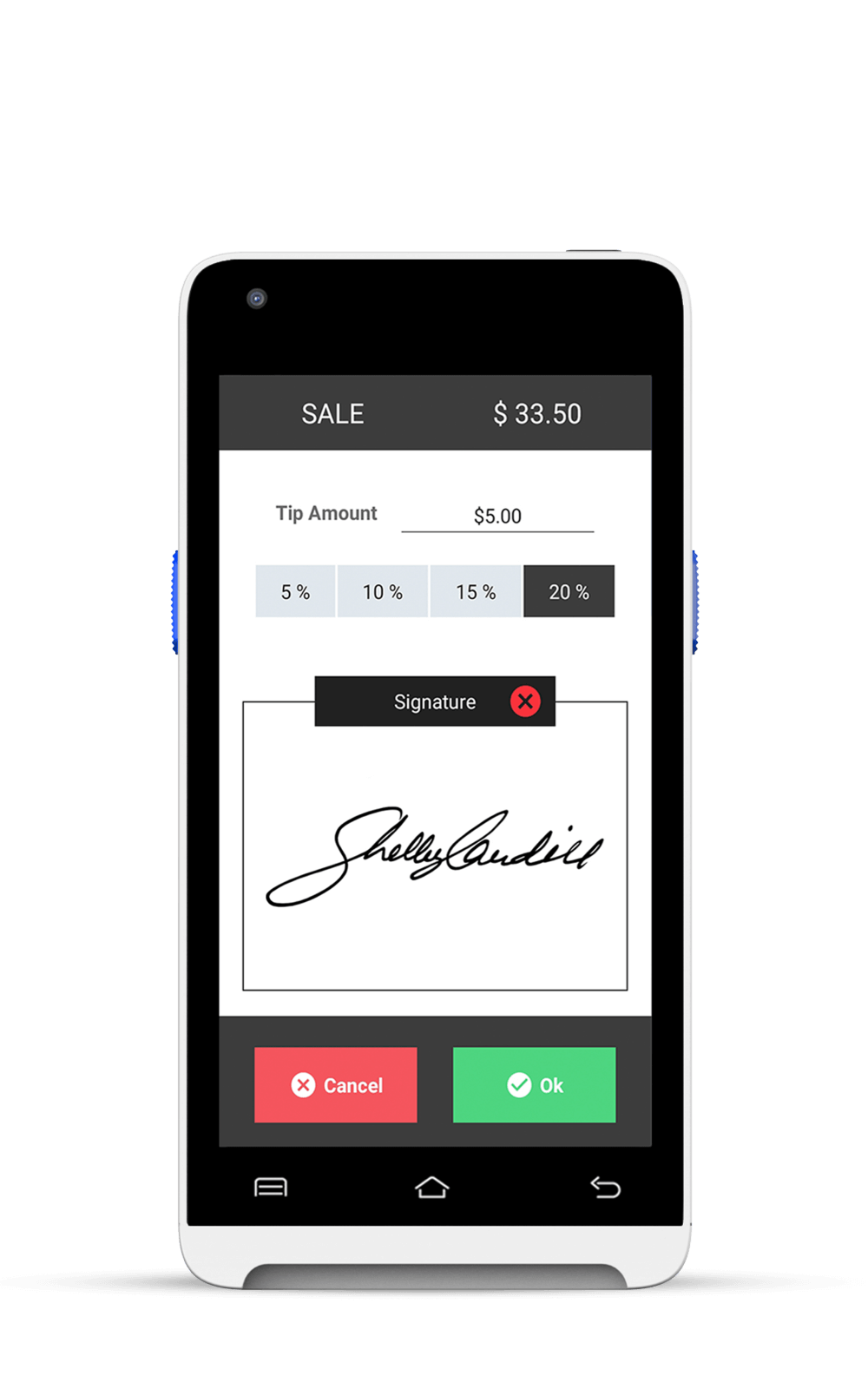

A robust auto batch solution will also give you the flexibility to manually settle transactions if you choose, while still offering an automatic fallback option to avoid penalties.

Why Does It Matter?

Delaying settlement by even a day can lead to a noticeable increase in your interchange fees. By using auto batch out, merchants don’t have to worry about manually closing out their day – it’s taken care of. And since settlements occur promptly, it helps keep your interchange fees as low as possible.

For ISOs, offering this feature can reduce the burden on customer support by eliminating errors caused by delayed batches. It’s a win-win: fewer calls from merchants, and less time troubleshooting issues that could’ve been avoided altogether.

What to Look for in an Auto Batch Solution

Not every auto batch feature is alike. Here’s what to consider before choosing:

- Reliability: Can the system handle failures like power outages or network interruptions?

- Flexibility: Does it offer both manual and automatic settlement options?

- Host-Based vs Terminal-Based: Host-based batches are more reliable, but a hybrid solution (host + terminal) gives you even more control.

- Cost Optimization: By ensuring transactions are settled on time, auto batch out helps you stay within lower interchange rates, saving money.

Before signing up for this feature, it’s worth checking out how different solutions implement auto batch out. Small details can make a big difference in how smoothly your operations run – and how much you save on interchange fees.

FAQ

1. What happens when you do not settle the batch on the same day in a POS machine?

When a batch is not settled on the same day in a point-of-sale (POS) machine, it typically results in an unsettled or pending transaction with higher interchange fees.

2. Why is Auto Batch Out considered essential for high-volume merchants?

It is essential for high-volume merchants because it streamlines the payment processing workflow by reducing manual errors, saving time, and improving cash flow visibility.

3. How can ISOs benefit from offering Auto Batch Out to merchants?

Offering this feature to merchants can benefit ISOs by increasing merchant retention, providing a seamless payment processing experience, and reducing chargebacks and disputes.

4. Can merchants still manually settle transactions with Auto Batch Out?

No, merchants cannot manually settle transactions.

5. What are the risks of relying solely on terminal-based batch processing?

Relying solely on terminal-based batch processing can pose several risks, such as limited visibility, insufficient monitoring, and data integrity.