In today’s increasingly digital marketplace, businesses must offer seamless, secure, and flexible payment options to stay competitive. Whether you’re a solopreneur launching an online store or a large enterprise scaling globally, choosing the right online payment services can make or break the customer experience.

This guide explores how online payment platforms have evolved, the key features to look for, and how to decide which online payment system is right for your business in 2025 and beyond.

What are Online Payment Services?

Online payment services are digital tools or infrastructure that allow businesses to accept payments over the internet. These services act as intermediaries between the customer’s payment method – credit card, debit card, bank account, digital wallet—and the merchant’s bank account.

Unlike traditional payment methods like cash or paper checks, online payments are instant, secure, and accessible around the clock. With eCommerce and mobile commerce booming, they have become the standard, not the exception.

Why Do Modern Businesses Need Online Payment Services?

The demand for online payment services stems from a few critical business needs:

- Convenience: Customers want to pay using their preferred methods, from cards to Buy Now Pay Later (BNPL).

- Speed: Transactions happen in real time, reducing waiting periods for both businesses and customers.

- Scalability: Whether you’re selling locally or internationally, the right online payment system grows with you.

- Security: Encryption, tokenization, and fraud detection tools reduce risks for merchants and consumers alike.

Beyond processing payments, many platforms offer value-added services like invoicing, recurring billing, dispute management, and analytics – giving merchants more control and insight into their cash flow.

How Do Online Payment Platforms Differ from Services?

Not all online payment platforms are created equal. Broadly, the digital payment ecosystem can be broken down into several categories:

- Payment Gateways: These serve as the bridge between a merchant’s website and their payment processor. Popular gateways include Authorize.Net, Razorpay, and PayPal.

- Payment Processors: Companies like First Data or TSYS handle the actual movement of funds between banks.

- Payment Aggregators: These bundle merchant accounts under one umbrella, making it easier for small businesses to start accepting payments. Stripe, Square, and PayU fall into this category.

- Digital Wallets: Mobile-first platforms like Apple Pay, Google Pay, and so on allow consumers to pay quickly using stored credentials.

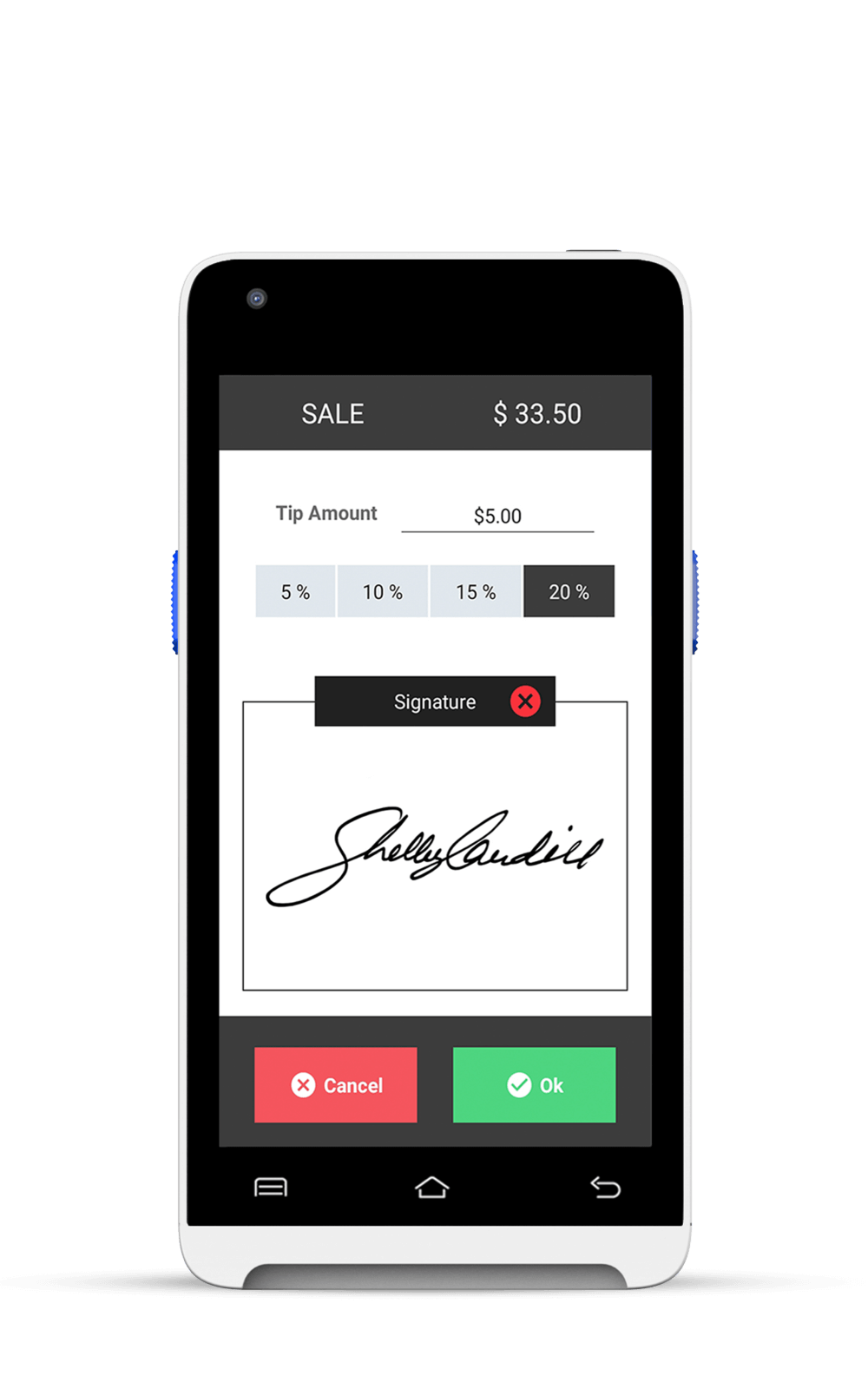

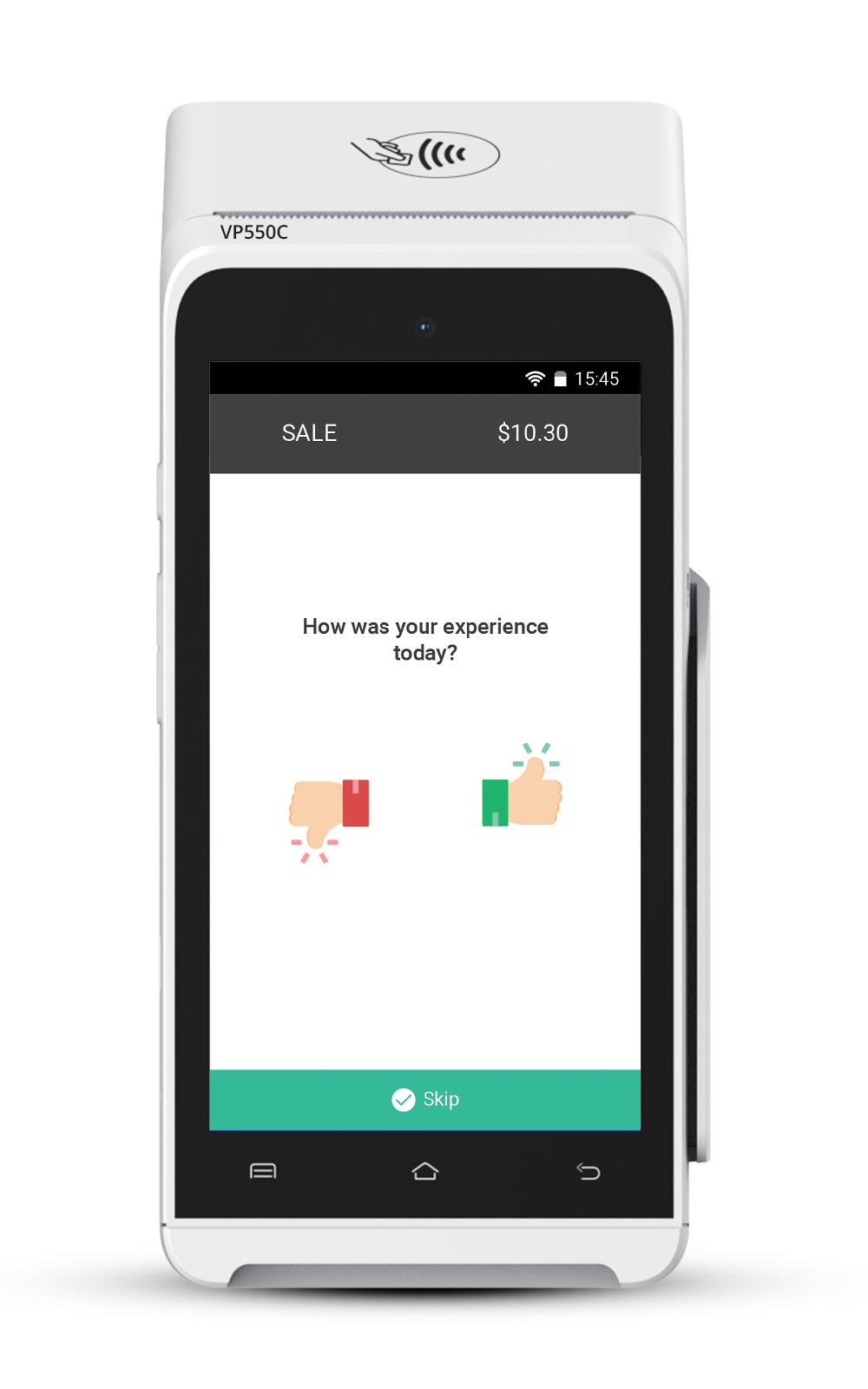

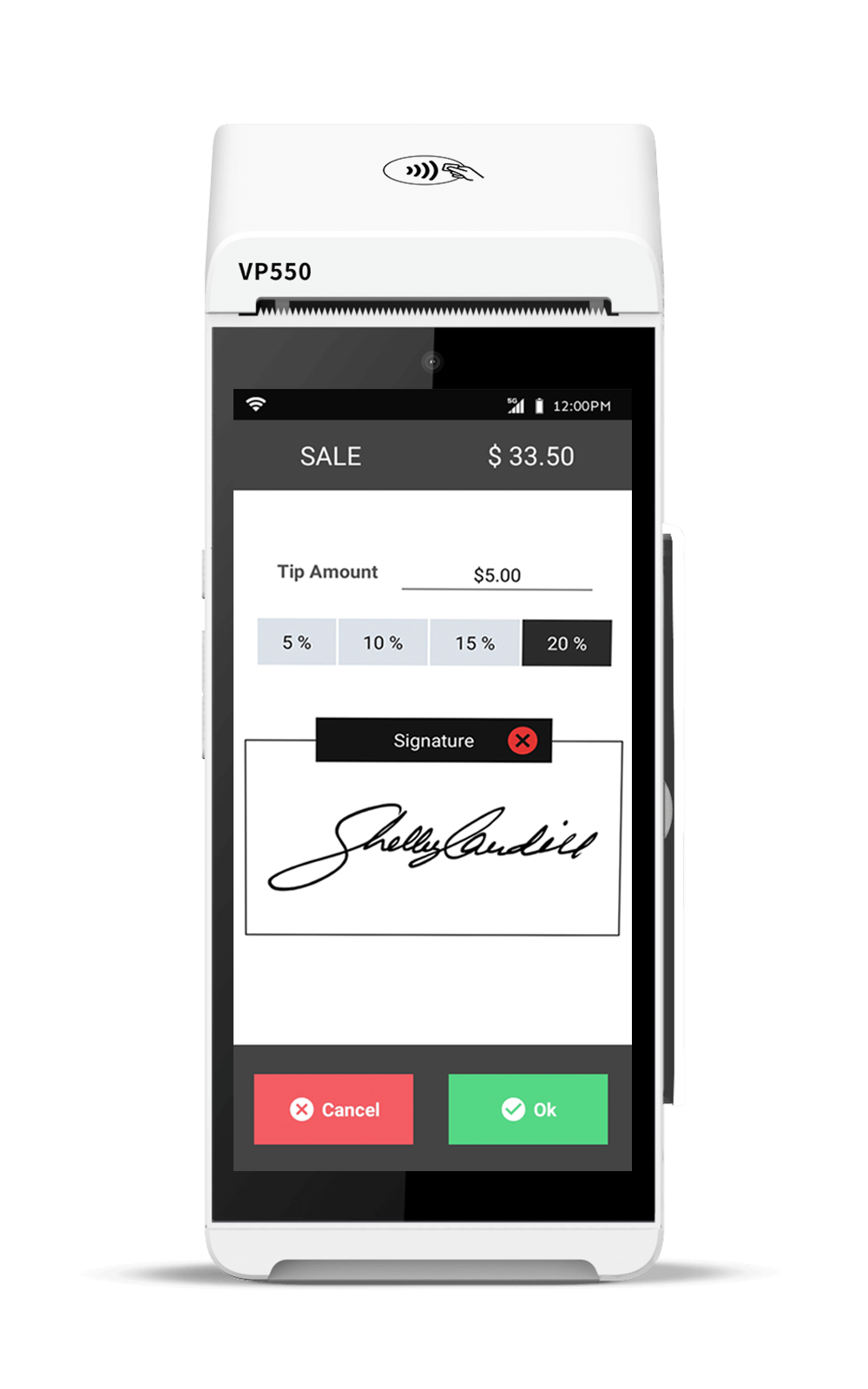

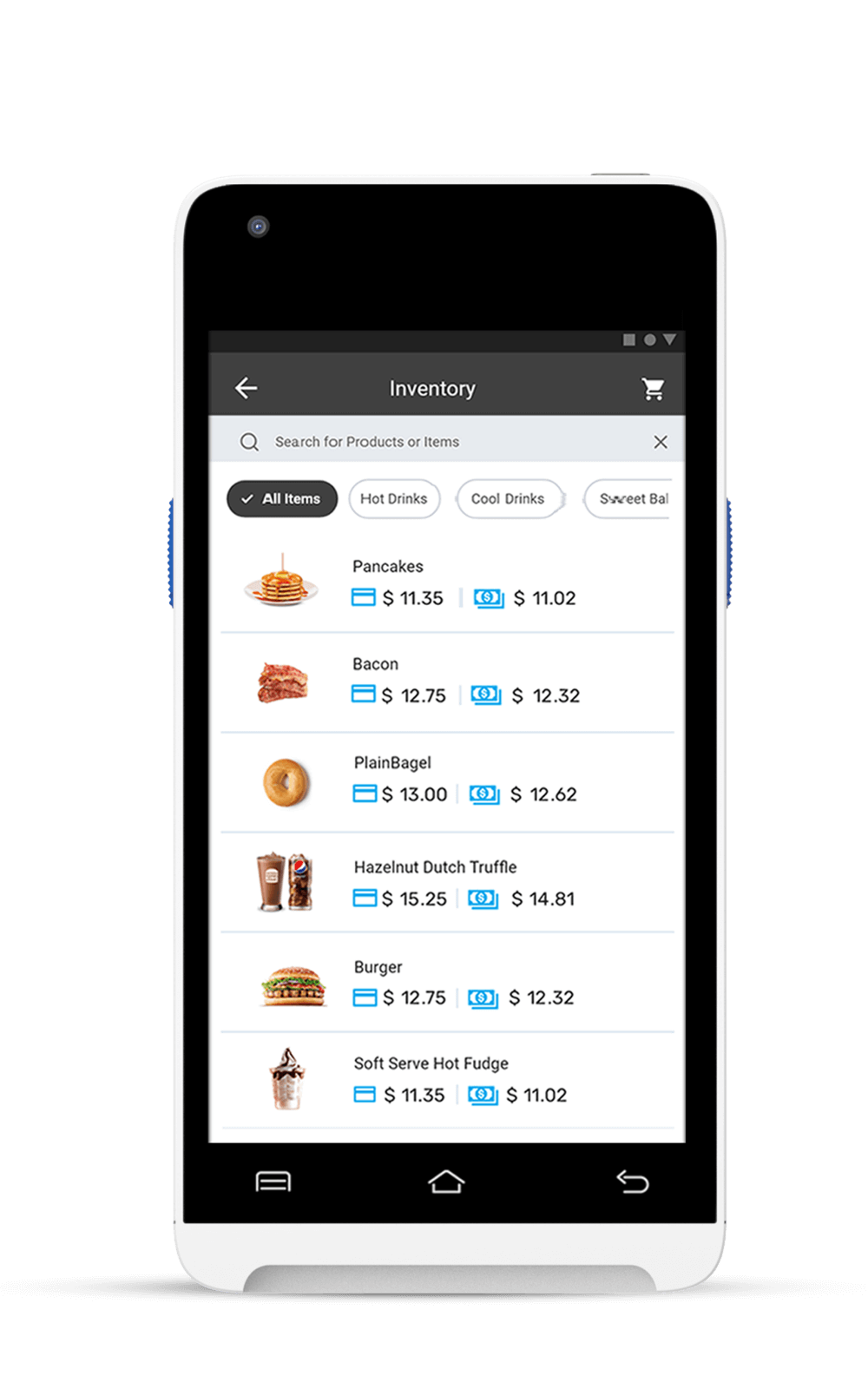

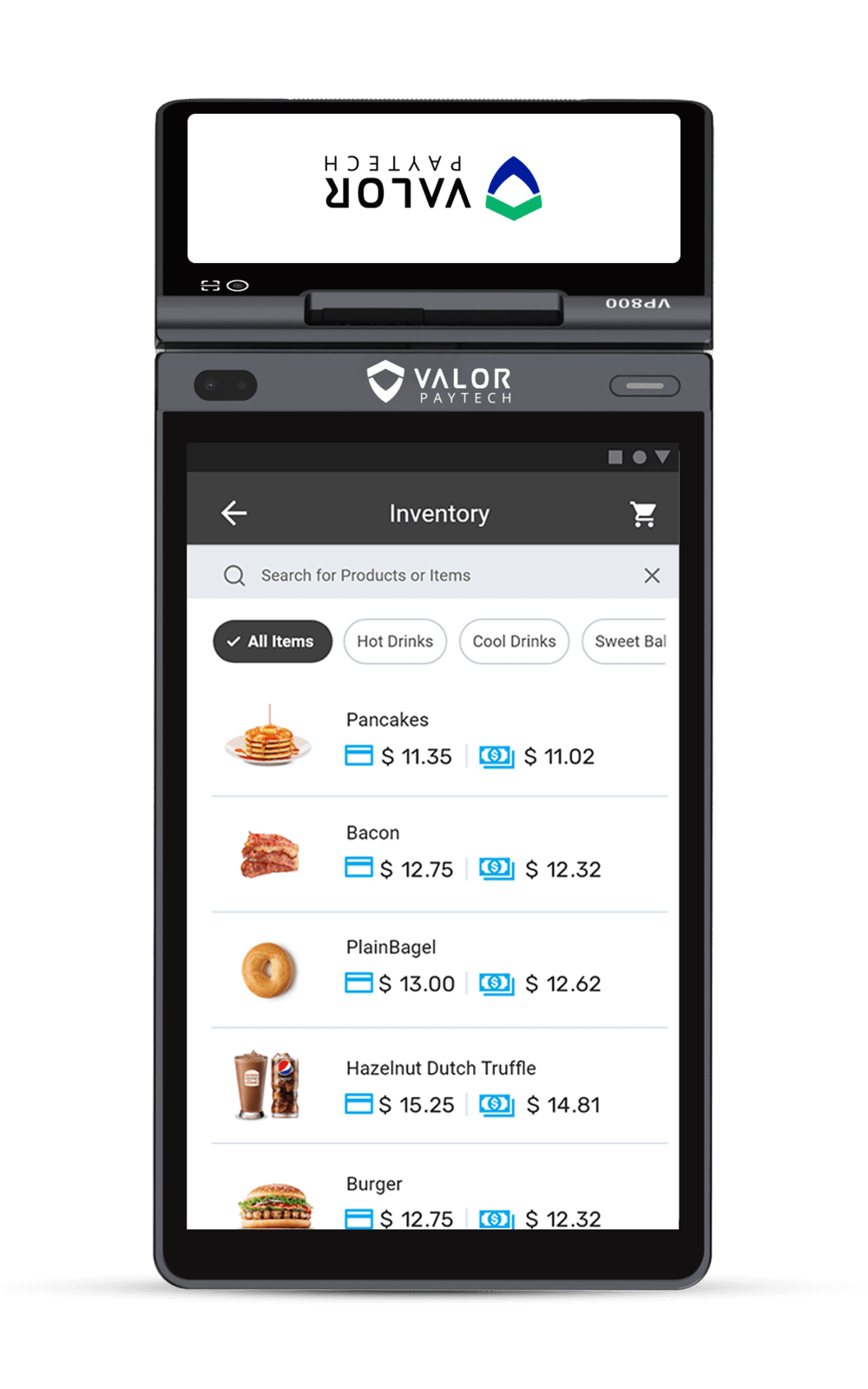

- Integrated POS devices: Solutions like Valor PayTech or Clover combine hardware and software to accept both in-person and online payments from one device.

Modern online payment platforms often combine several of these functions into a single, unified experience – streamlining operations and reducing setup complexity.

How Do Online Payment Systems Work?

Online payment systems work by facilitating a secure and instant transfer of money from a buyer to a merchant. Here’s the typical flow:

- The customer enters their payment details at checkout.

- The payment gateway encrypts and routes the data.

- The processor and issuing bank authenticate the transaction.

- Once approved, the funds are settled into the merchant’s account.

This entire process usually takes a few seconds—but it’s backed by layers of security and compliance.

What Are the Types of Online Payment Services?

Here are the common types of online payment services in 2025:

- Credit/Debit Card Processors

- Digital Wallets

- Instant Bank Transfers

- Buy Now Pay Later (BNPL) Services

- Mobile POS Devices

- Recurring Billing & Subscription Platforms

- Crypto Payment Gateways

- Invoice-Based Payments

Businesses often combine multiple services to offer their customers maximum flexibility.

How Do Online Payments Differ from Traditional Methods?

While traditional payment methods like cash or direct bank transfers still exist, they come with limitations – especially in the fast-paced digital economy.

| Feature | Traditional Payments | Online Payment Services |

|---|---|---|

| Speed | Delayed (1–3 days) | Instant or same-day |

| Convenience | In-person only | 24/7 global access |

| Fraud Protection | Limited | Advanced encryption & tokenization |

| Reporting & Analytics | Manual | Automated & real-time |

| Customer Experience | Slower checkout | Fast, frictionless, mobile-friendly |

The result? More businesses are migrating to a fully digital online payment system to support everything from subscriptions and eCommerce to mobile checkouts and invoicing.

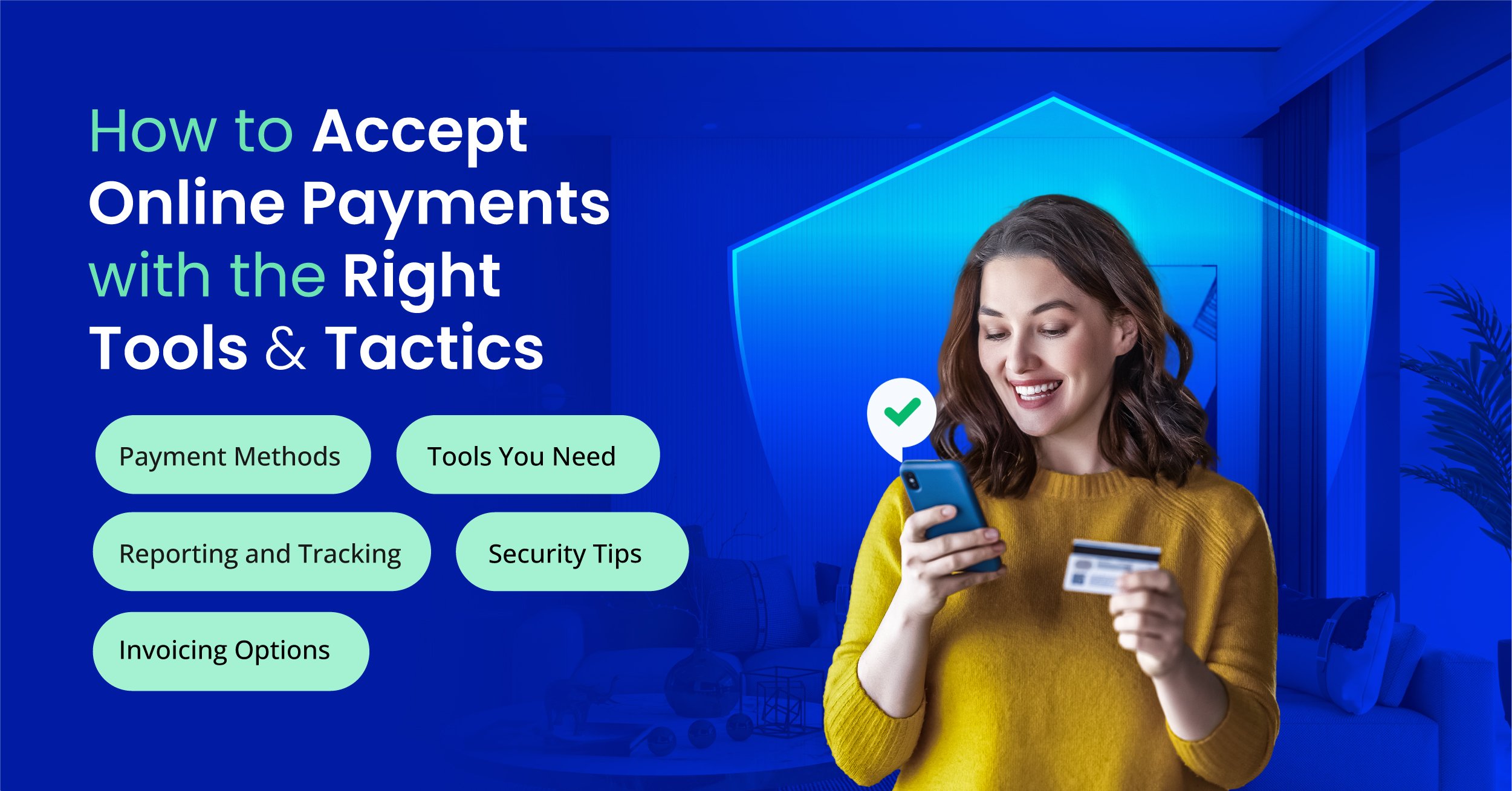

What to Look for in a Payment Service Provider?

Choosing a digital payment partner is a strategic decision. Here are a few key factors to consider when evaluating online payment services:

1. Security Standards

Make sure the provider is PCI-DSS compliant and supports tokenization, 3D Secure, and fraud detection. The best online payment platforms actively invest in cybersecurity to protect customer data.

2. Integration and Compatibility

The system should work seamlessly with your website builder (like Shopify, Wix, or WordPress), accounting software (like QuickBooks), and customer relationship tools.

3. Multi-Channel Support

Whether you’re selling online, in-store, or through a mobile app, your online payment system should offer an omnichannel experience—letting you track and manage transactions from one dashboard.

4. Transparent Pricing

Look beyond the headline rate. Ask about setup fees, monthly minimums, chargeback fees, and international transaction costs.

5. Customer Support

24/7 support is a must, especially if you’re dealing with high volumes or international sales. Some platforms also offer dedicated account managers or onboarding support.

Best online payment service providers in 2025?

Here’s a quick overview of top platforms businesses are using in 2025:

| Platform | Best For | Notable Features |

|---|---|---|

| Stripe | Developers & SaaS | Custom APIs, subscriptions, invoicing |

| PayPal | Small businesses | Buyer protection, global reach |

| Valor PayTech | ISOs & retail/eCommerce | Smart terminals, real-time reporting |

| Square | Brick-and-mortar + online | POS integration, inventory tools |

| Razorpay | Indian businesses | UPI support, local tax compliance |

| Adyen | Large enterprises | Unified commerce, global processing |

Each provider offers a different mix of functionality, pricing, and scalability. The right fit depends on your business model, geography, and technical needs.

How Secure and Compliant Are Online Payment Systems?

Top-tier payment platforms follow strict compliance frameworks, such as:

- PCI-DSS Certification

- Tokenization & Encryption

- 3D Secure Authentication

- AI-Powered Fraud Detection

- SOC 2 & GDPR Compliance (for global markets)

Merchants are also advised to enable multi-factor authentication and stay updated on regional compliance mandates.

2025 Trends in the Online Payment Industry

The online payment services space is evolving rapidly. Here are a few trends shaping the future of transactions:

Biometric Authentication

More platforms are incorporating fingerprint, facial recognition, or behavioral biometrics for faster, more secure checkouts.

AI-Powered Fraud Prevention

Machine learning is now being used to identify suspicious patterns in real time, reducing false declines while protecting merchants.

Voice Commerce

Voice-enabled payments are on the rise, especially in mobile shopping and smart home ecosystems.

Embedded Finance

Many platforms now offer lending, BNPL, or even insurance embedded directly into the checkout flow – streamlining the user journey.

Cross-Border Payments Made Easy

Innovations in currency conversion and settlement are reducing friction for global sellers, especially in emerging markets.

How Can Businesses Choose the Best Payment Service?

Consider these factors when choosing:

- Security Standards

- Ease of Integration

- Pricing Transparency

- Unified Support

- Customer Support Availability

- Reporting & Insights

For small businesses, ease of setup and affordability are key. For large enterprises, it’s all about scalability, automation, and global access.

Making the Right Choice for Your Business

Every business has different payment needs. A boutique fashion store may prioritize a visually integrated checkout, while a SaaS company might need recurring billing. Here’s how to narrow it down:

- For Small Businesses: Look for ease of setup, low monthly fees, and mobile support.

- For Enterprises: Focus on scalability, global reach, and advanced reporting.

- For Developers: Prioritize APIs, webhooks, and developer documentation.

- For Local Sellers: Ensure regional compliance (Tax, ID verification) and language support.

There’s no “one size fits all” in payments—but the right online payment service should make accepting money the easiest part of doing business.

Conclusion

As commerce continues its shift toward digital-first, online payment systems are no longer a luxury – they’re a necessity. Businesses that adopt the right online payment platforms can offer better customer experiences, scale faster, and stay secure in an increasingly competitive space.

Whether you’re launching a new store or upgrading your current stack, the right online payment setup can drive long-term growth, one transaction at a time.

FAQ

1. What are online payment services and how do they work?

Online payment services allow businesses to accept digital payments from customers through websites, apps, or invoices. They securely transfer funds from a buyer’s payment method (like a credit card or digital wallet) to the merchant’s account using encrypted gateways and processors.

2. What’s the difference between an online payment platform and a payment service?

A payment service typically handles the processing of transactions, while an online payment platform offers a broader set of tools—like invoicing, analytics, fraud protection, and multi-channel support. Some providers (like Stripe or Valor PayTech) offer both in a single solution.

3. How do I choose the best online payment system for my business?

Look for features that match your business needs: security standards, integration options, transaction fees, customer support, and global capabilities. Whether you're a startup or an enterprise, the best system should scale with your growth.

4. Are online payment services safe to use in 2025?

Yes - leading online payment platforms use advanced security protocols like PCI-DSS compliance, tokenization, encryption, and AI-powered fraud detection to protect both merchants and customers.

5. What are the most popular online payment services in 2025?

Popular providers include Stripe, Valor PayTech, Square, Razorpay, and Adyen. Each offers unique features for different business types, from small businesses to global enterprises.

6. Can I integrate online payment services with my existing website or app?

Yes, most modern platforms offer plug-ins or APIs compatible with website builders like Shopify, WooCommerce or custom apps.

7. What is the average cost of using an online payment platform?

Costs vary by provider but typically include transaction fees (1.5%–3.5%), setup fees, and possible monthly charges. Always review the full pricing structure.

8. Do I need a merchant account to use online payment services?

Some services require a merchant account (e.g., Authorize.Net), while others (like Stripe or PayPal) act as aggregators and don’t.

9. Are there options for recurring billing or subscriptions?

Yes - platforms like Stripe, Valor PayTech, and Razorpay offer built-in tools for managing recurring payments and subscriptions.

10. How fast do I receive payouts from online transactions?

It depends on the provider. Some offer same-day payouts; others take 1–3 business days. Faster settlement usually comes at a fee.

Ready to get started?

Become a Partner Today!

Complete the form below.