Whether you’re running a full-scale eCommerce store or offering services through your personal website, the ability to accept online payments is essential in today’s digital-first world. From credit card transactions to digital wallets, enabling seamless payment processing can improve your customer experience and boost your revenue.

In this guide, we’ll walk you through how to take online payments safely, efficiently, and in a way that works best for your business.

Why Accepting Online Payments Matters?

Gone are the days of relying solely on cash or checks. Today’s customers expect fast, flexible, and secure digital payment options. By setting up your business to receive payments online, you:

- Expand your customer reach

- Improve cash flow

- Enhance credibility and professionalism

- Automate your billing and invoicing process

What You Need to Start Accepting Online Payments

Before you can accept online payments, you’ll need three foundational elements:

- A payment processor or gateway (e.g., Valor PayTech, Stripe, Square).

- A merchant account (sometimes bundled with your processor).

- A way to accept payments – via checkout page, invoice, or link.

Other considerations include choosing supported payment types (cards, wallets, ACH), ensuring PCI compliance, and setting up transaction reporting tools.

How to Accept Credit Card Payments Online?

Accepting credit card payments online is one of the most essential parts of running a digital business. Start by choosing a PCI-compliant payment processor that supports major credit/debit cards like Visa, MasterCard, Amex, and Discover. Use hosted checkout pages, secure APIs, or plugins that seamlessly connect with your website or invoicing tool.

What to look for:

- End-to-end encryption and tokenization.

- CVV and AVS checks for fraud prevention.

- Compatibility with mobile devices.

- Transparent transaction fees.

Popular solutions include Valor PayTech, Stripe, and Authorize.net – each offering security, real-time reporting, and flexible integration options.

How to Accept Online Payments?

Step 1: Choose the Right Payment Methods

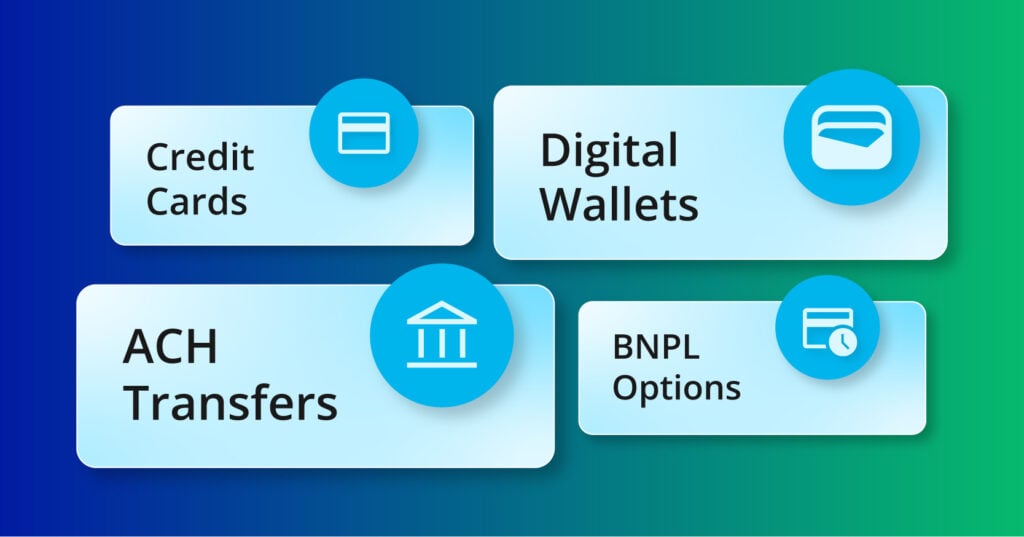

There are many ways to take online payments. The right setup depends on your business type, customer base, and where you sell. Popular online payment methods include:

1. Credit and Debit Cards:

Still the most commonly used form of online payment, credit and debit cards (like Visa, MasterCard, Amex) are essential for any digital checkout process.

2. Digital Wallets:

Payment apps like Apple Pay, Google Pay, and PayPal offer quick checkout experiences and are especially popular with mobile users.

3. Bank Transfers / ACH Payments:

For subscription services or B2B transactions, ACH (Automated Clearing House) transfers can reduce processing fees and ensure predictable revenue streams.

4. Buy Now, Pay Later (BNPL):

Many platforms allow customers to pay in instalments. BNPL options can boost conversion rates and average order value.

Step 2: Select a Payment Processor or Gateway

A payment processor is the service that handles credit card or ACH payments on your behalf. To accept payments on your website, you’ll need a processor or gateway that integrates with your site.

Popular Payment soluions:

Stripe – Great for developers and custom integrations

Square – Ideal for small businesses and omnichannel payments

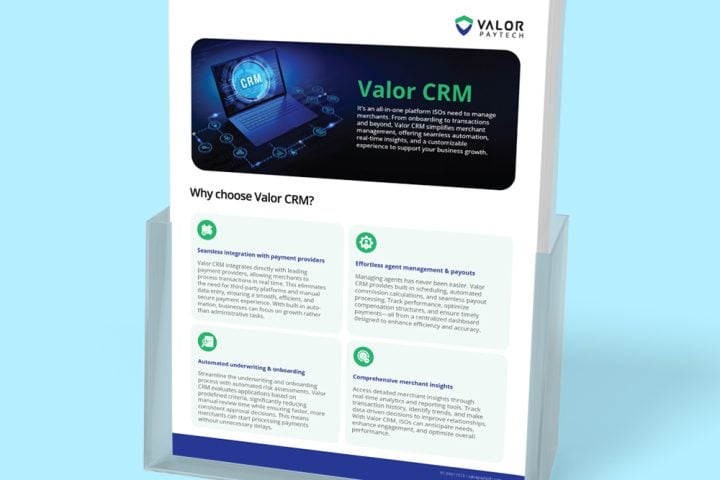

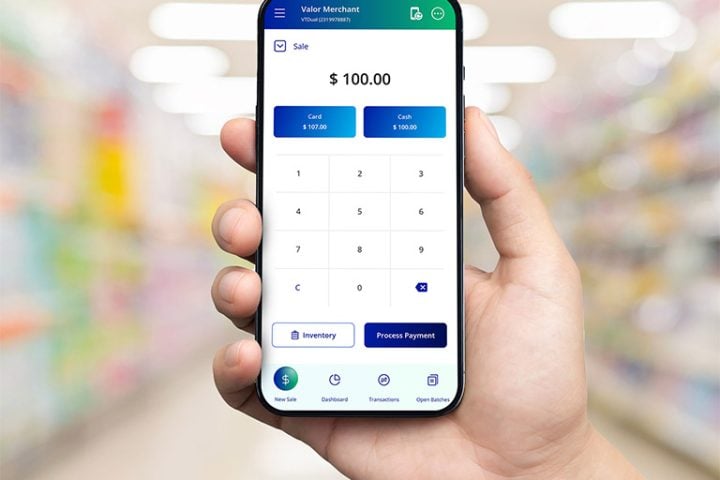

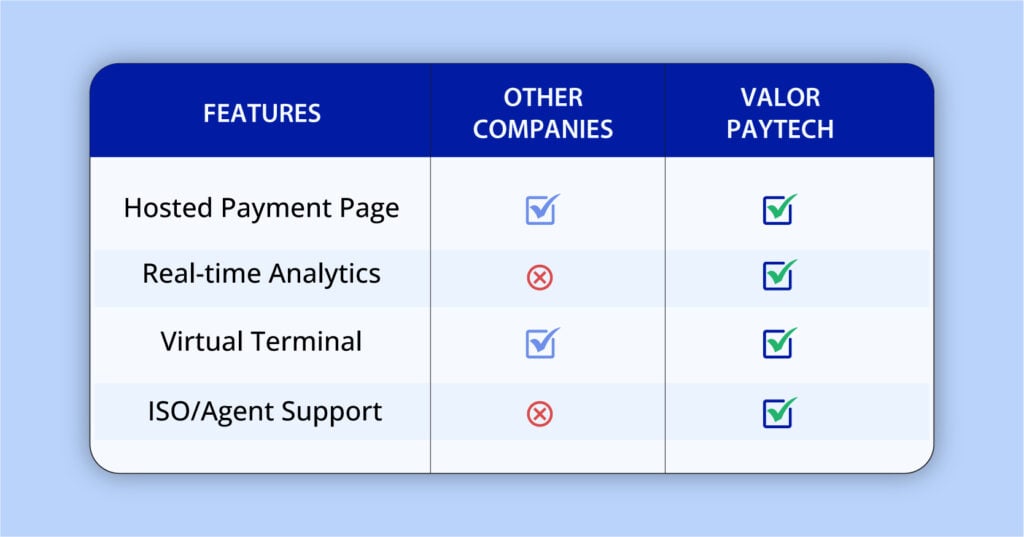

Valor PayTech – Offers unified payment solutions, including virtual terminals, online checkout, and real-time reporting

Authorize.net – Reliable gateway for traditional merchants.

When evaluating a processor, consider:

- Transaction fees

- Integration with your website platform

- Supported payment types

- Fraud protection and compliance features

Step 3: How to Set Up Your Website for Payments

To accept payments on your website, you need a checkout experience that’s secure, intuitive, and mobile-friendly. Here’s how to do it:

1. Install a Shopping Cart or Checkout Plugin

If you use platforms like Shopify, WooCommerce, Wix, or Squarespace, you can install built-in or third-party payment plugins that connect directly to your chosen processor.

2. Add a Payment Button

For service providers or freelancers, a simple “Pay Now” or “Book & Pay” button linking to a payment form or invoice can be enough.

3. Use a Hosted Payment Page

Processors like Valor PayTech allow you to generate secure, hosted payment pages that don’t require a full eCommerce store. These are great for collecting one-time or recurring payments.

Step 4: Enable Secure Payment Processing

Security is critical when handling customer data. To accept credit card payments online, your website must comply with PCI DSS (Payment Card Industry Data Security Standards).

Here are ways to protect your transactions:

- Use SSL encryption – This ensures all data exchanged on your site is secure.

- Tokenization – Replaces card info with encrypted data for recurring transactions.

- Fraud detection tools – Enable CVV checks, address verification (AVS), and 3D Secure.

- Choose PCI-compliant providers – Most modern processors (including Valor PayTech) handle compliance for you.

Step 5: Offer Mobile and Invoicing Options

If you don’t have a full website or want flexibility, you can still accept online payments in these ways:

1. Send Invoices via Email

Platforms like Valor PayTech and Square allow you to create digital invoices with embedded payment links. Customers can pay instantly via card or ACH.

2. Use Payment Links

Share a custom payment link via text, social media, or chat apps. This is perfect for remote consultations, custom orders, or one-off services.

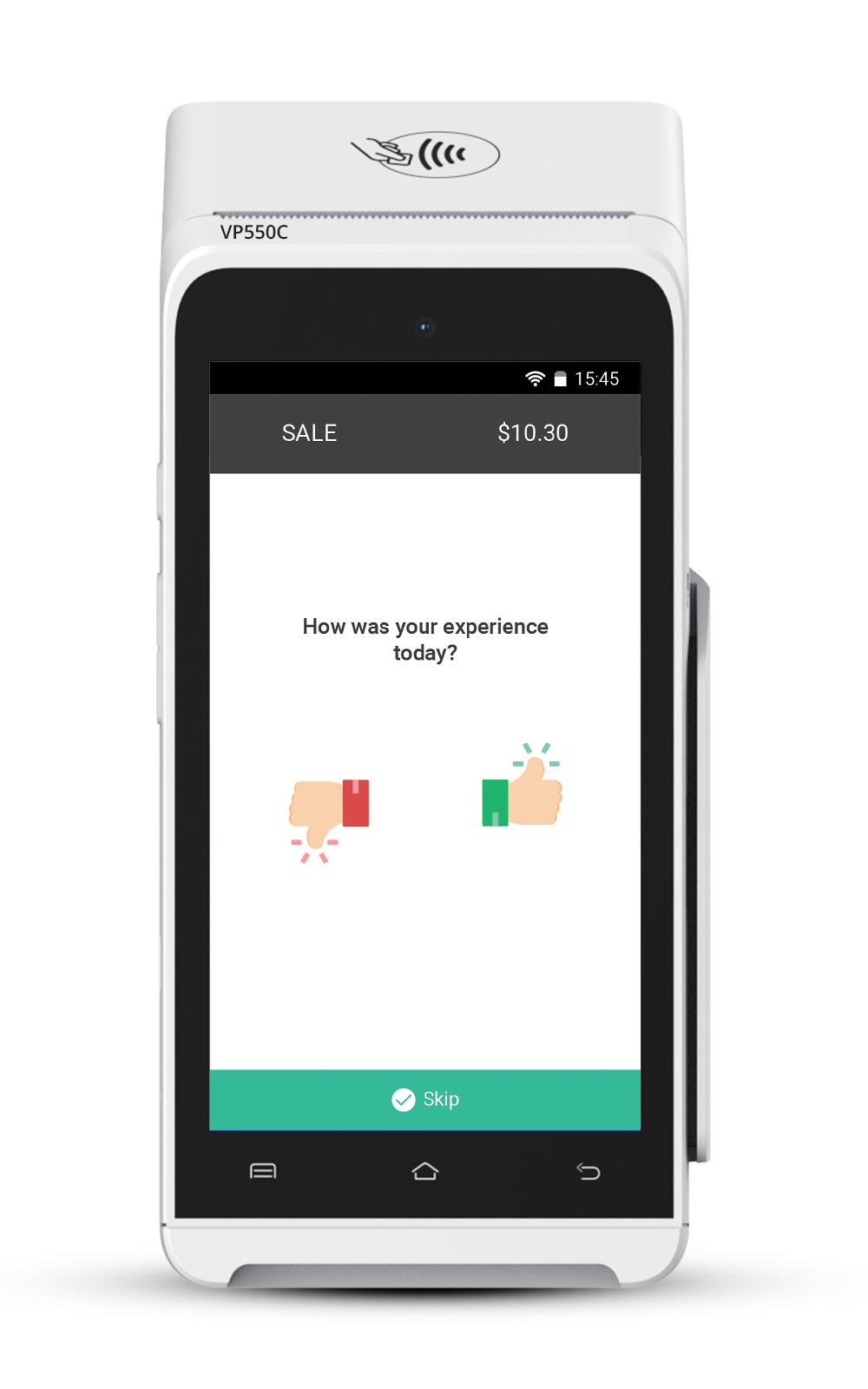

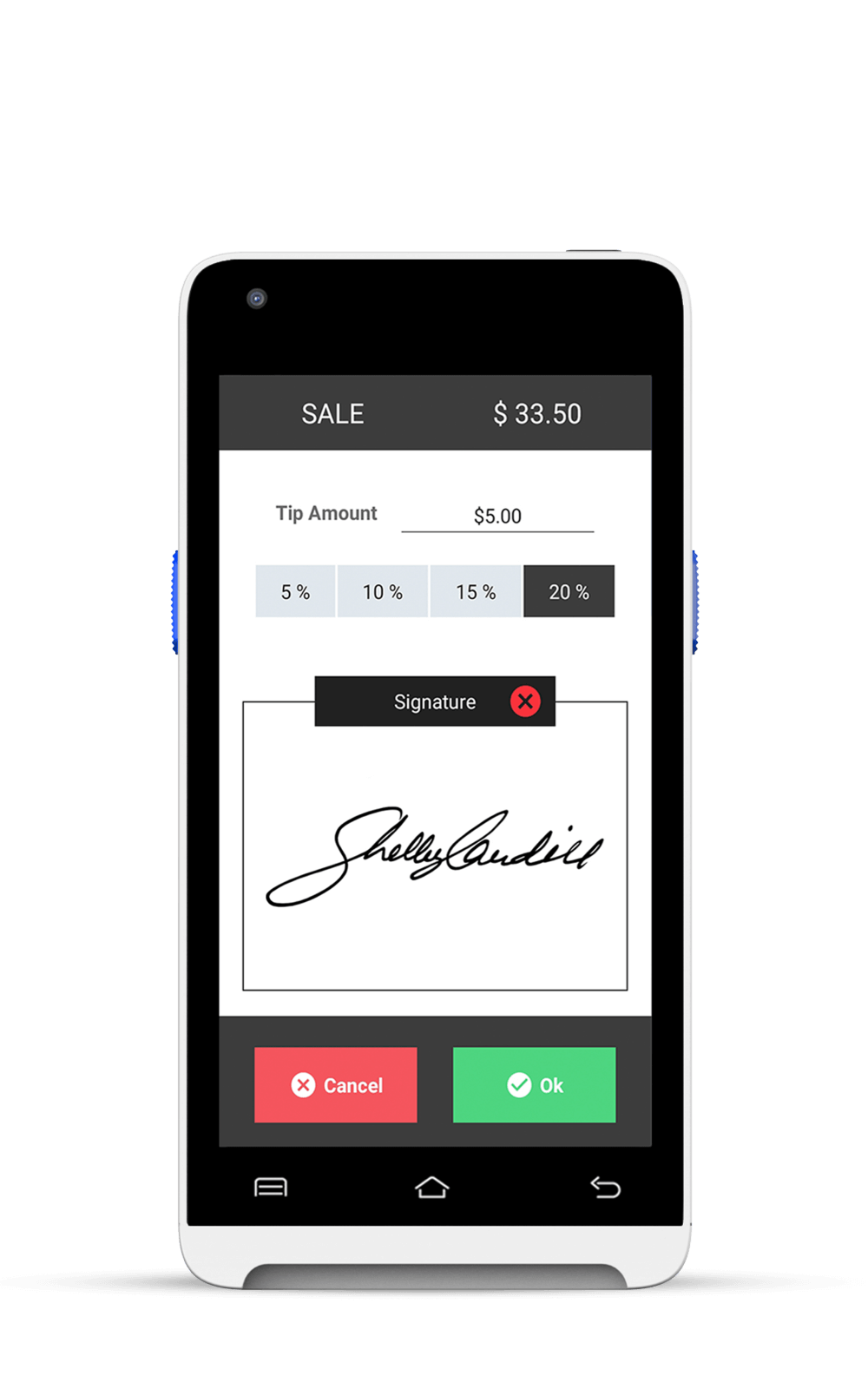

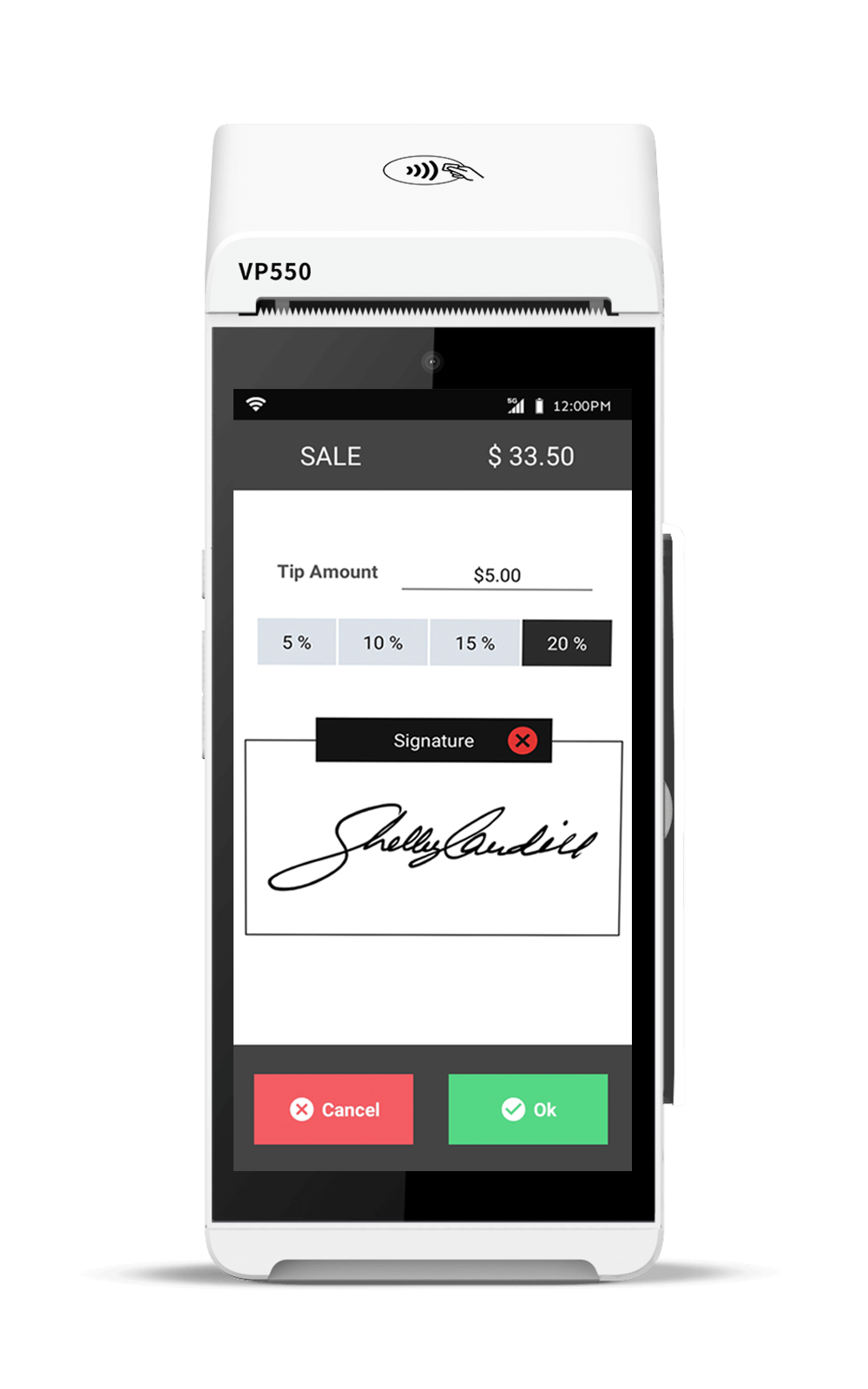

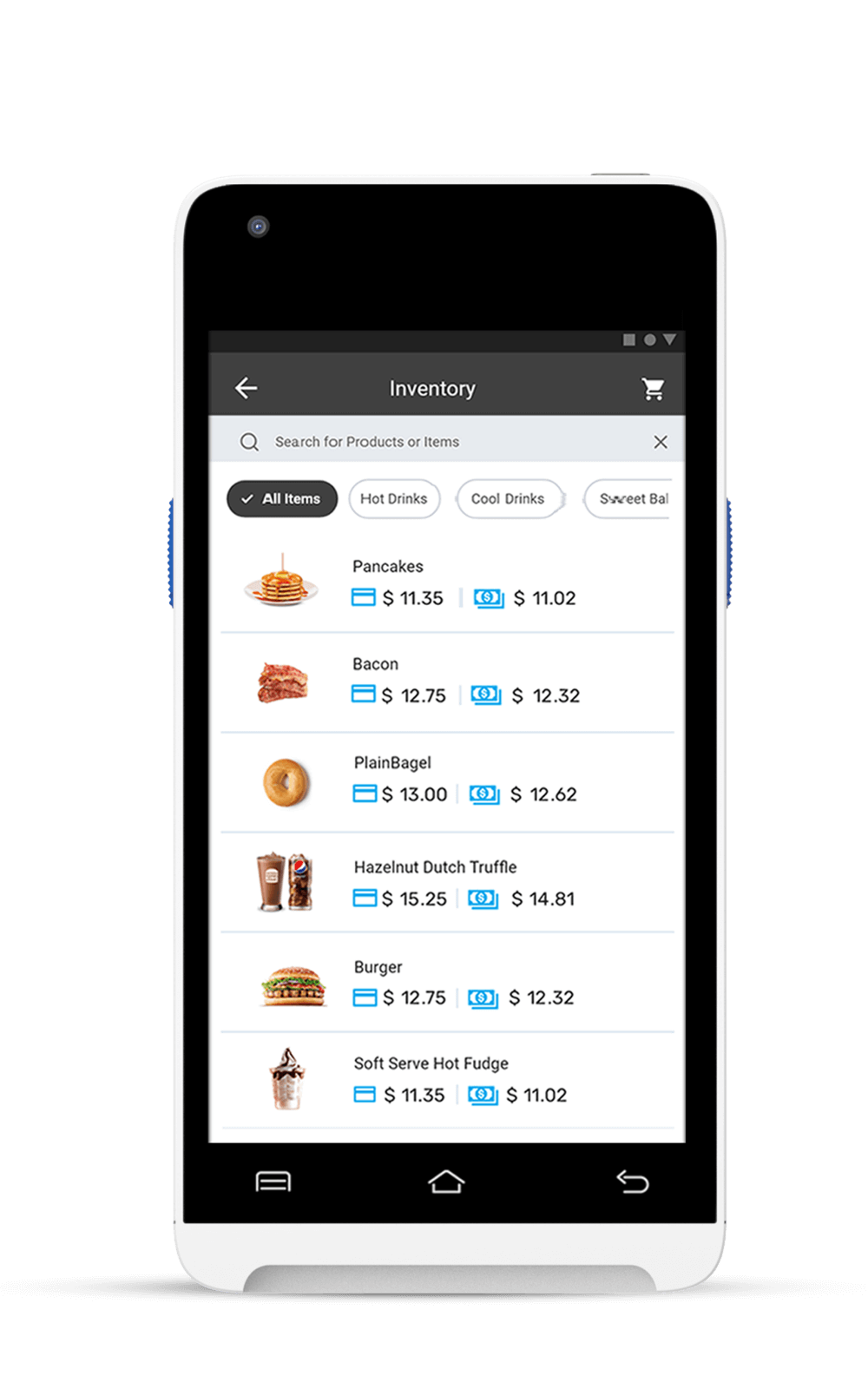

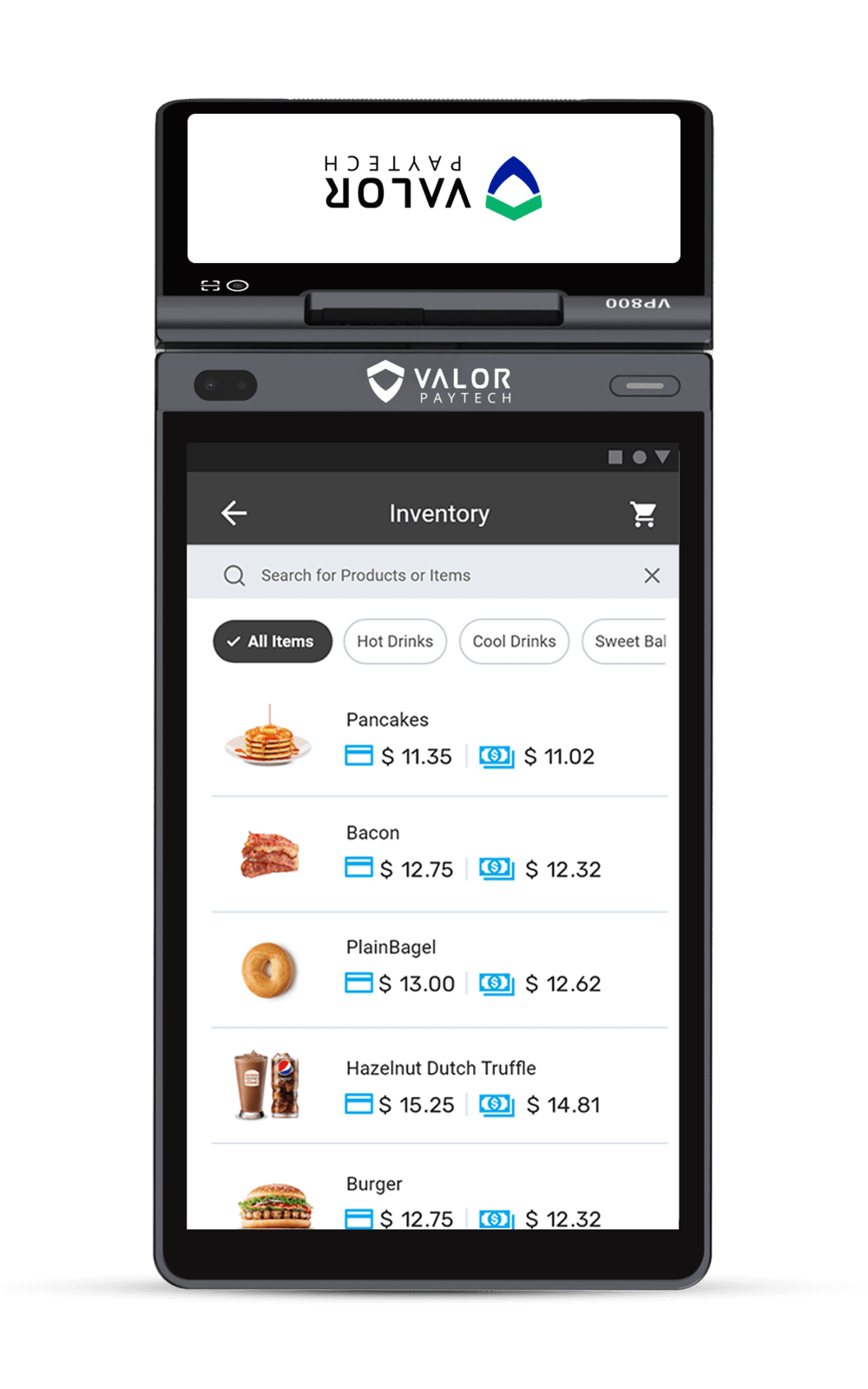

3. Virtual Terminals

With a virtual terminal, you can manually enter customer card details from any device. It’s an easy way to accept credit card payments online over the phone or email.

Step 6: Automate and Track Payments

A robust payment system doesn’t stop at the transaction. To grow your business, you need visibility and control. Look for tools that offer:

- Real-time payment tracking

- Recurring billing options

- Refund and dispute management

- Reporting dashboards

Valor PayTech, for example, offers a centralized platform for managing both in-person and online payments with detailed analytics and batch history.

Checklist: Quick Steps to Start Accepting Online Payments

- Choose a Payment Processor

- Decide on Payment Types

- Secure Your Website

- Integrate Checkout or Payment Links

- Enable Invoicing (If needed)

- Track and Manage Payments

How to Accept Payments on Your Website Easily

Whether you have a full eCommerce setup or a simple landing page, accepting payments on your website should be intuitive and fast. Start by using a platform like WooCommerce, Shopify, or Wix, which supports built-in payment integrations.

Options include:

- Embedded checkout plugins (no-code)

- Hosted payment pages for quick setup

- Payment buttons for one-time services

- Valor PayTech’s secure checkout flows

Choose a system that is mobile-optimized, PCI-compliant, and supports your preferred payment types.

What You Need to Know to Receive Online Payments Securely

Security should be your top priority when handling customer payments. From the moment a customer enters their payment details to the final transaction confirmation, every step must be protected.

Essential security features:

- SSL encryption to protect data during transmission

- PCI DSS compliance to meet industry standards

- Tokenization to replace card data with encrypted values

- 3D Secure for extra cardholder authentication

Choosing a trusted provider like Valor PayTech ensures built-in fraud detection, secure infrastructure, and peace of mind.

Accept Payments via Email, SMS, or Social Media

You don’t need a website to get paid online. If you’re a freelancer, service provider, or remote consultant, send a secure payment link directly via:

- Email (as part of a digital invoice)

- SMS or WhatsApp

- Instagram DMs or Facebook Messenger

- Direct messages on LinkedIn or Telegram

Platforms like Valor PayTech allow you to generate one-time or recurring links that your customers can pay instantly — no logins or apps required.

How to Accept Payments from Mobile Customers

With more than 70% of users shopping from mobile devices, offering smooth mobile payment options is no longer optional.

Top tools to accept mobile payments:

- ValorPay for quick checkouts

- Digital wallets (PayPal, Venmo, etc.)

- Buy Now, Pay Later (BNPL) options

- One-click checkout with saved cards/tokenized data

Ensure your checkout experience is mobile-optimized, responsive, and frictionless across all screen sizes.

Final thoughts

Learning how to accept payments on your website or through online channels doesn’t have to be overwhelming. With the right tools, processor, and setup, you can create a smooth and secure payment experience that works for both you and your customers.

Whether you’re just starting out or looking to upgrade your existing process, platforms like Valor PayTech offer all-in-one payment solutions that simplify the process and help you grow your business.

FAQ

1. What is the easiest way to accept payments online?

The easiest way is to use a payment processor like PayPal, Stripe, or Valor PayTech that offers hosted checkout pages or payment links. These require minimal setup and don’t need advanced coding or a full eCommerce site.

2. Can I accept credit card payments without a website?

Yes! You can send digital invoices, use payment links, or access a virtual terminal to manually enter card details. These methods work great for freelancers, consultants, or service-based businesses.

3. What are the costs involved in taking online payments?

Most payment processors charge a transaction fee (usually between 2.5%–3.5%) per successful payment. Additional costs may include monthly platform fees, chargeback fees, or setup costs depending on the provider.

4. How do I accept credit card payments on my website?

You can integrate a payment gateway or install a plugin that connects to your processor. For example, if you’re using WooCommerce or Shopify, you can enable Stripe or Valor PayTech for secure checkout processing.

5. Are online payments safe for my customers?

Yes - if you follow security best practices like SSL encryption, PCI compliance, and tokenization. Reputable processors handle much of this for you and offer fraud protection tools like CVV verification and address checks.

6. How long does it take to get paid from online transactions?

Payout times vary by provider but typically range from 1–3 business days. Some platforms offer instant payouts for an additional fee.

7. Can I accept recurring or subscription payments online?

Absolutely. Many platforms, including Valor PayTech, support recurring billing features that let you charge customers on a weekly, monthly, or custom basis — perfect for memberships, retainers, or subscription boxes.

8. What is a virtual terminal, and when should I use it?

A virtual terminal is a browser-based tool that lets you manually enter a customer’s card info to process a payment. It's ideal for over-the-phone or email payments — especially useful if you're not using a website.

9. Do I need to be PCI compliant?

Yes. If you accept credit card payments, PCI compliance is mandatory. However, most modern processors help simplify or manage this compliance for you.

10. What happens if a payment gets declined?

Declined payments can result from expired cards, fraud alerts, or insufficient funds. Some platforms, like Valor PayTech with FlexFactor integration, offer decline recovery features that can help recapture revenue from failed payments.

Ready to get started?

Become a Partner Today!

Complete the form below.