Interested in seeing our payment products in action? Request a Demo

Payment solutions for every business type

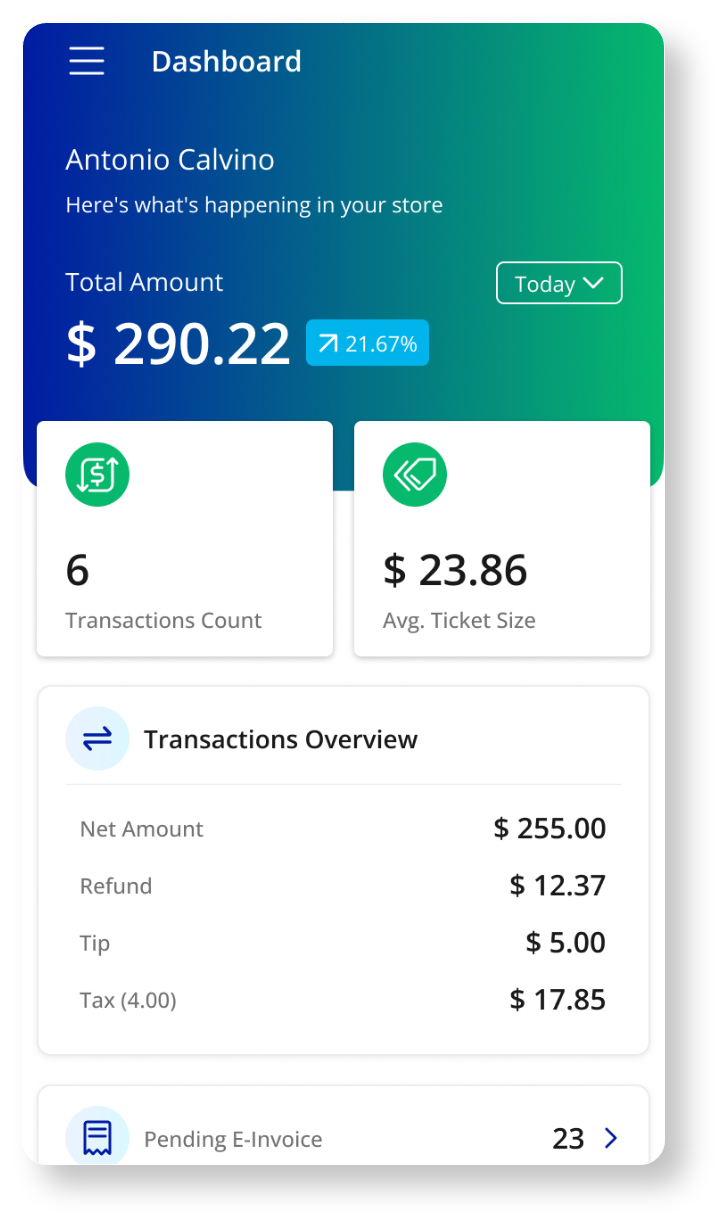

Implementing advanced payment technologies can help reduce transaction costs, minimize fraud risks, and offer valuable insights into customer purchasing behaviors. Let’s uncover the various ways effective payment solutions can grow your business.

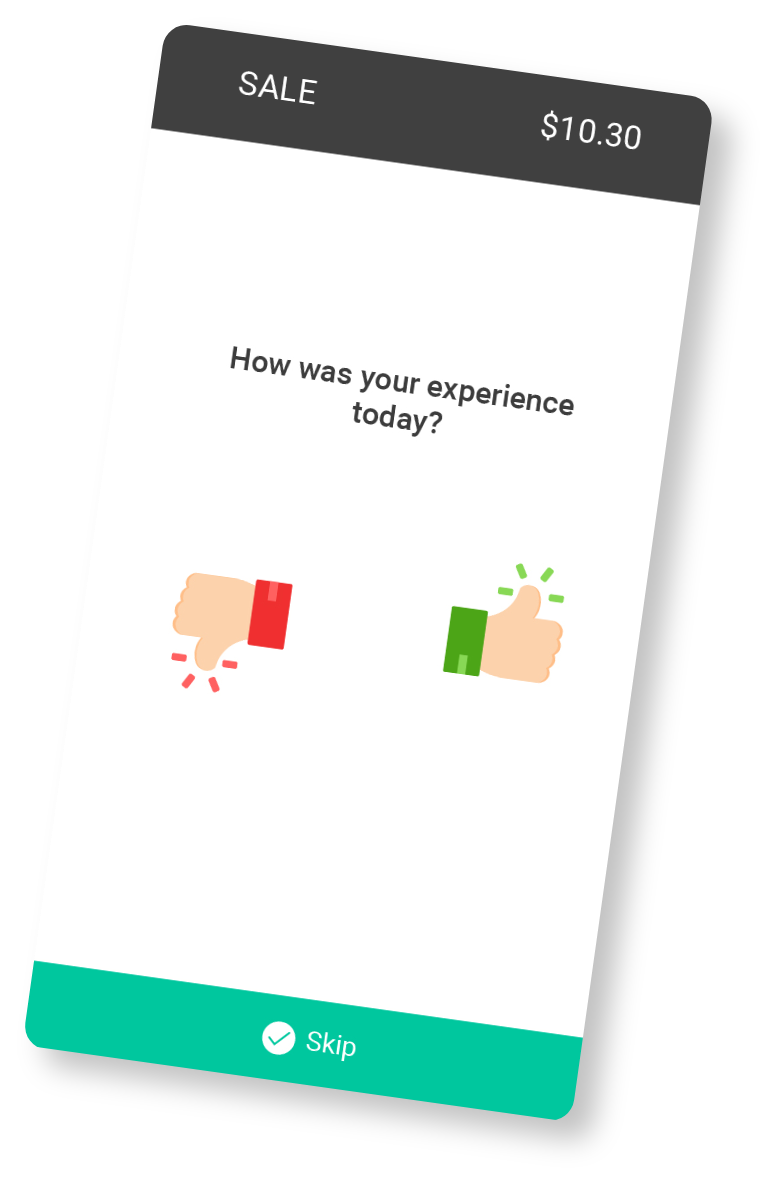

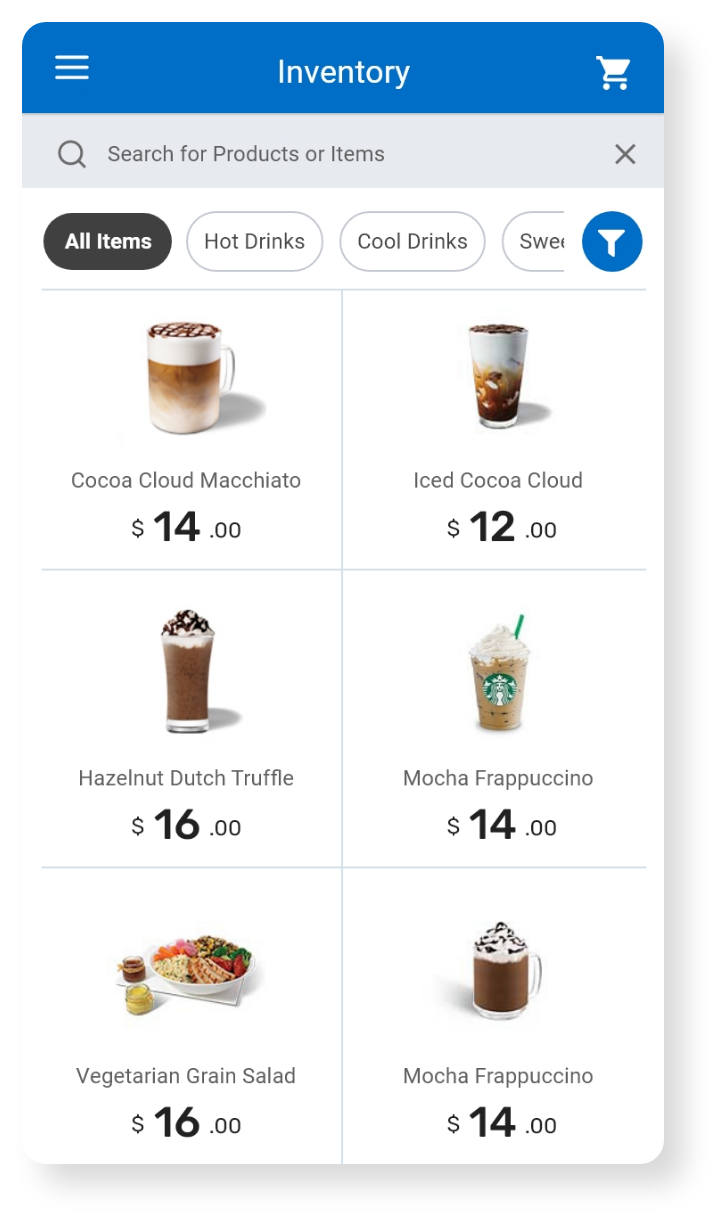

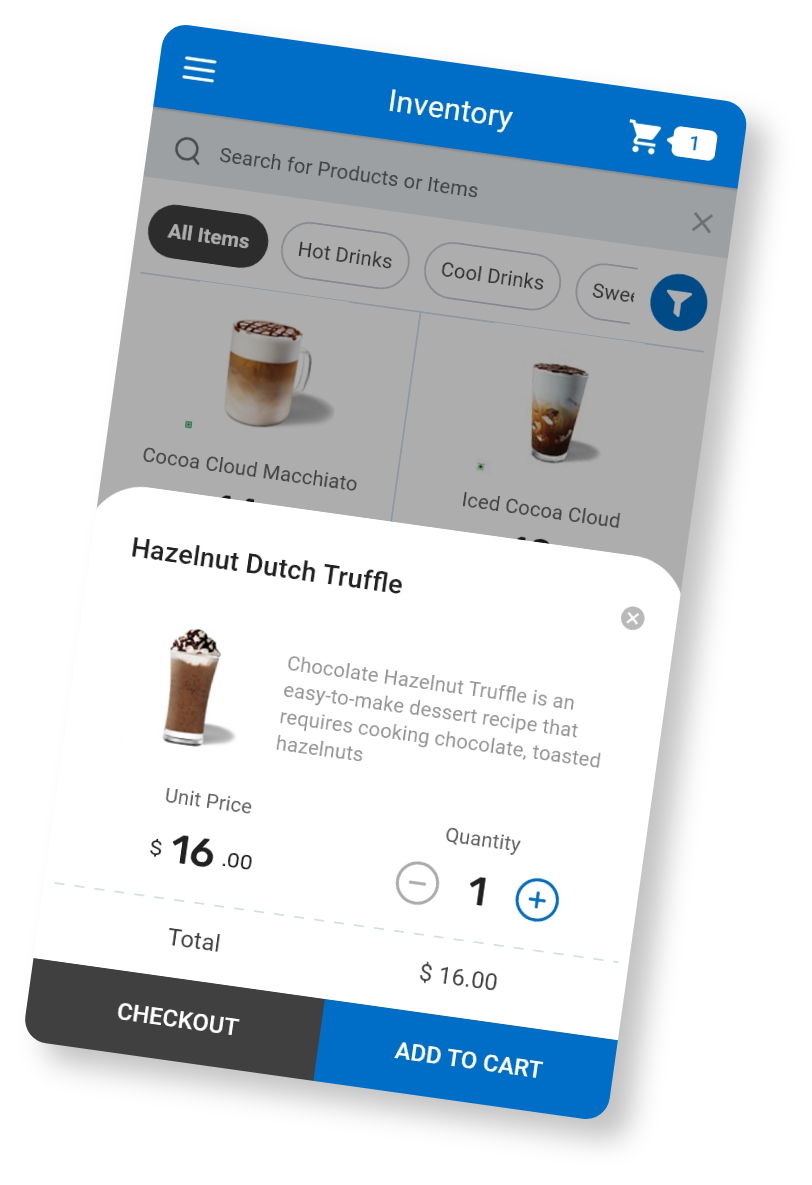

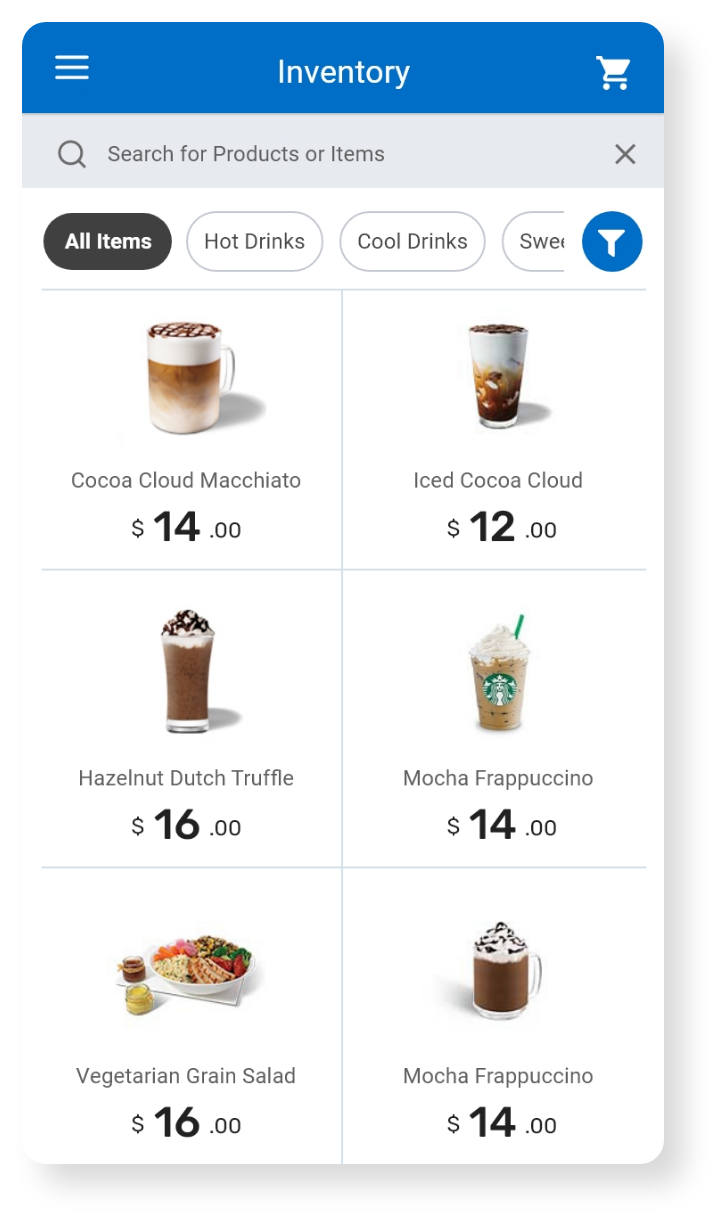

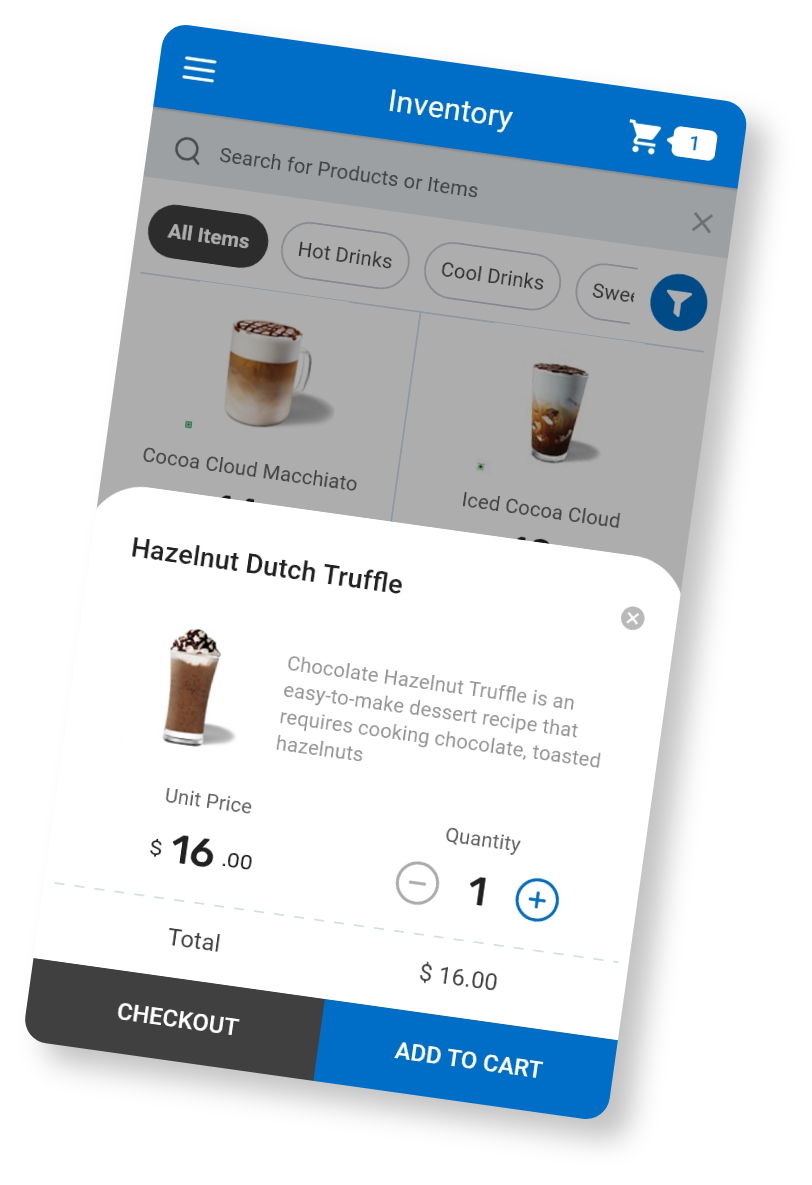

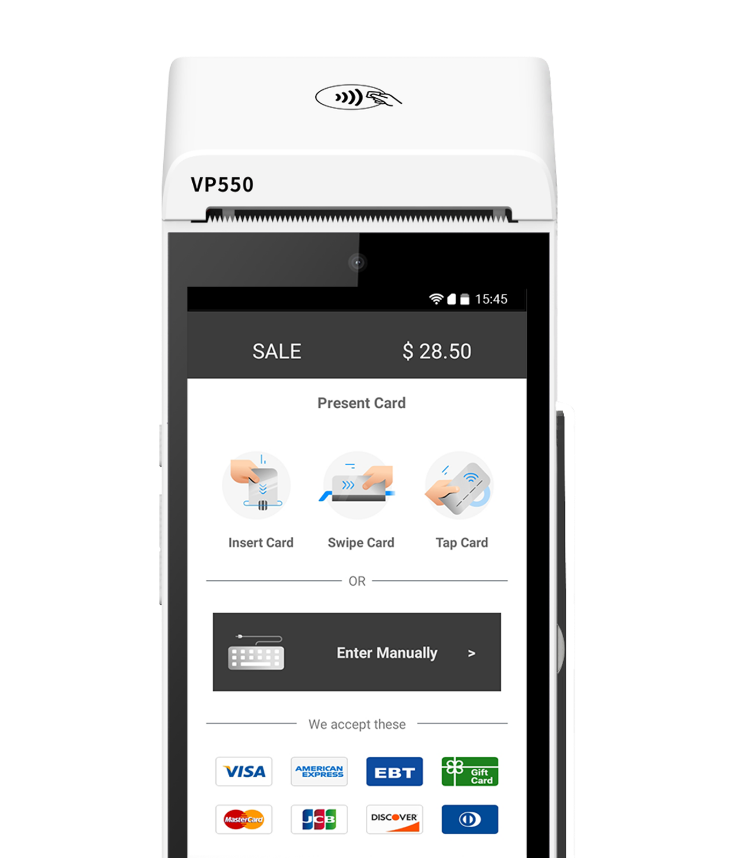

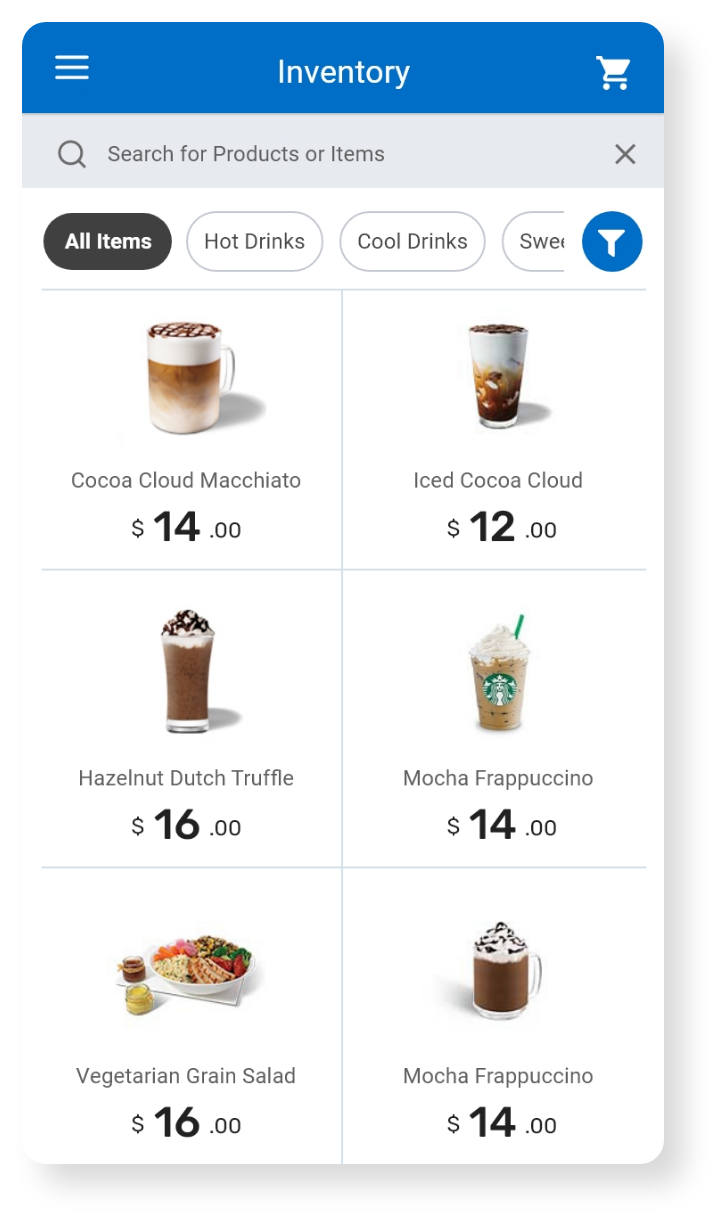

Our POS solutions are builries to connect the physical store with the digital marketplace. It enables effortless product selling and precise inventory tracking across various locations. It also harmonizes your online and offline sales channels, delivering a unified and exceptional customer shopping journey.

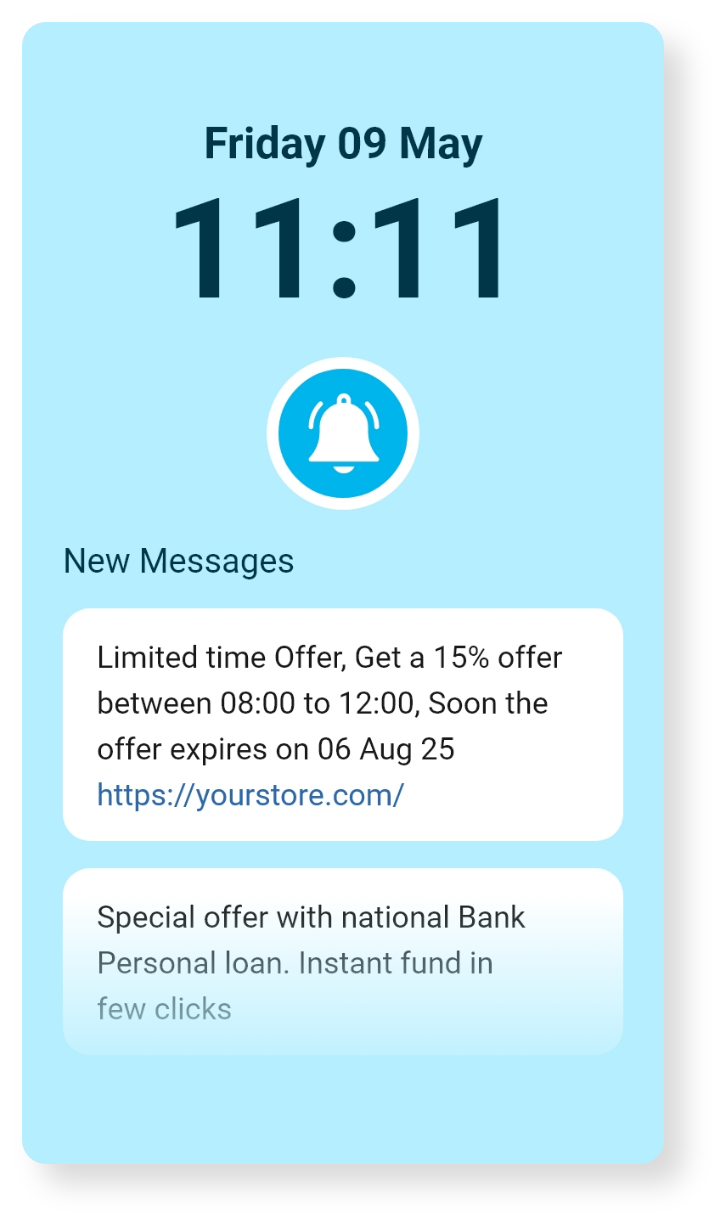

Our products and solutions have next-level capabilities – we’re a strategic partner in driving retail success. Take advantage of the Dual Pricing program and value-added services to support promotions and loyalty programs. Make data-driven decisions while customizing your offerings to meet the needs of the most valuable customers.

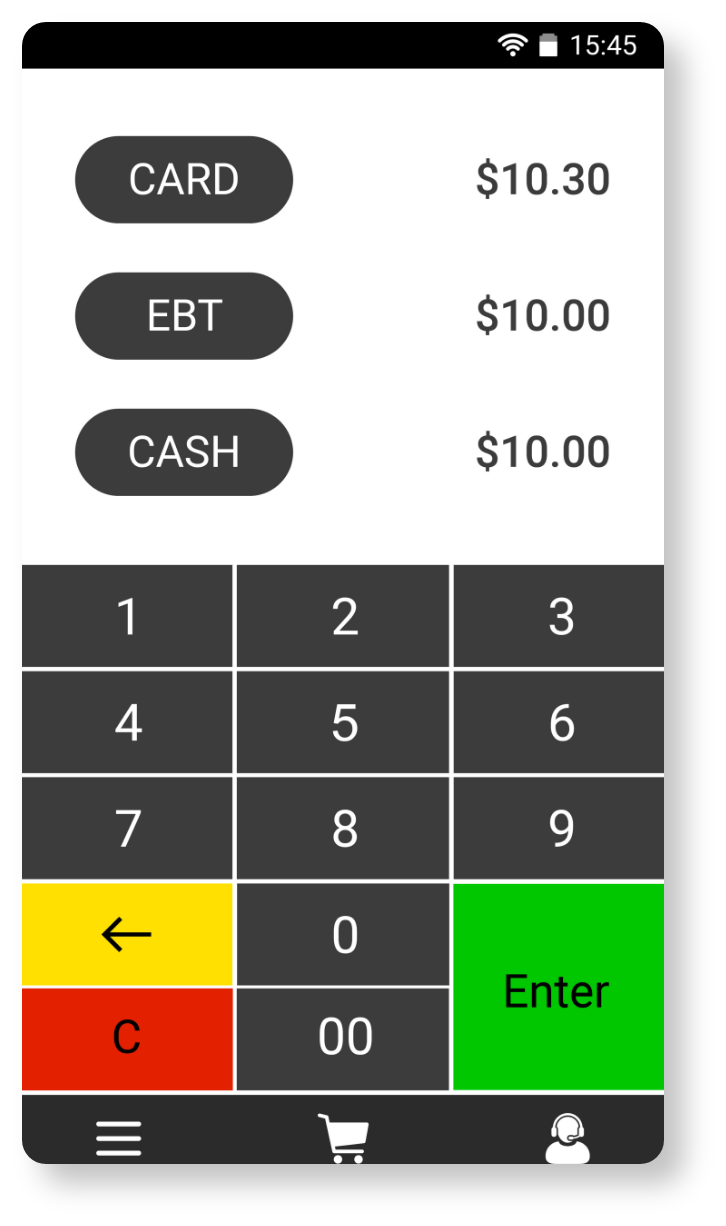

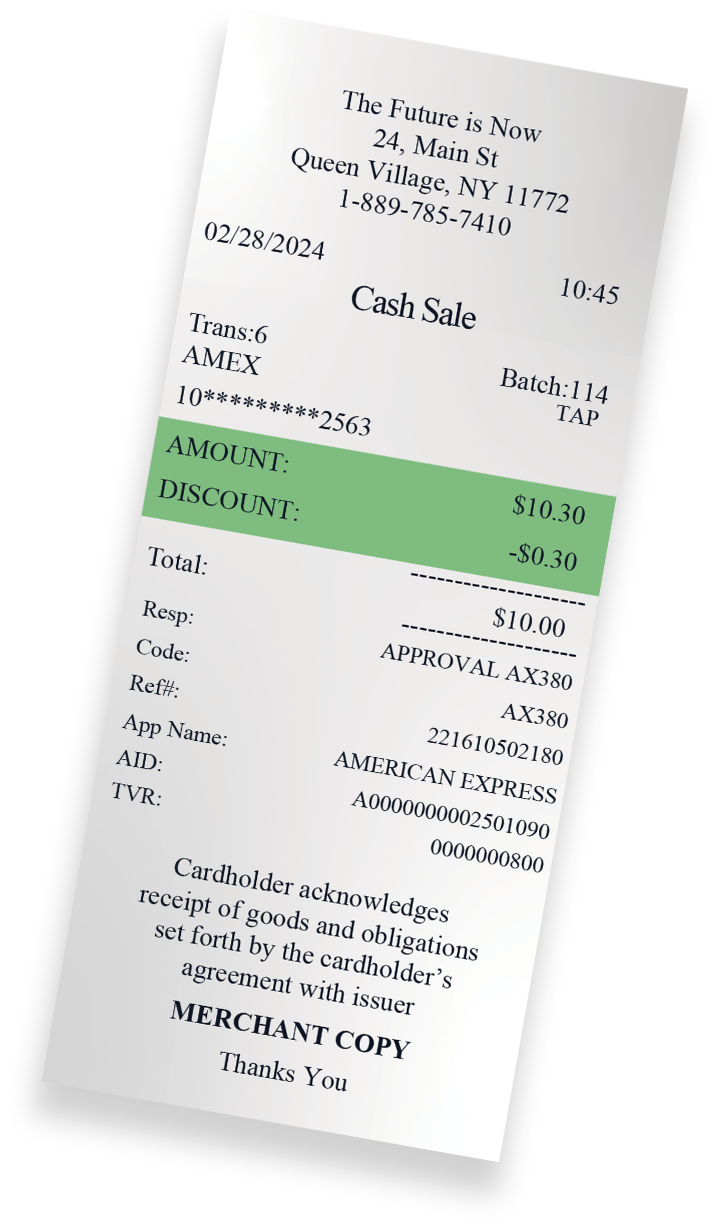

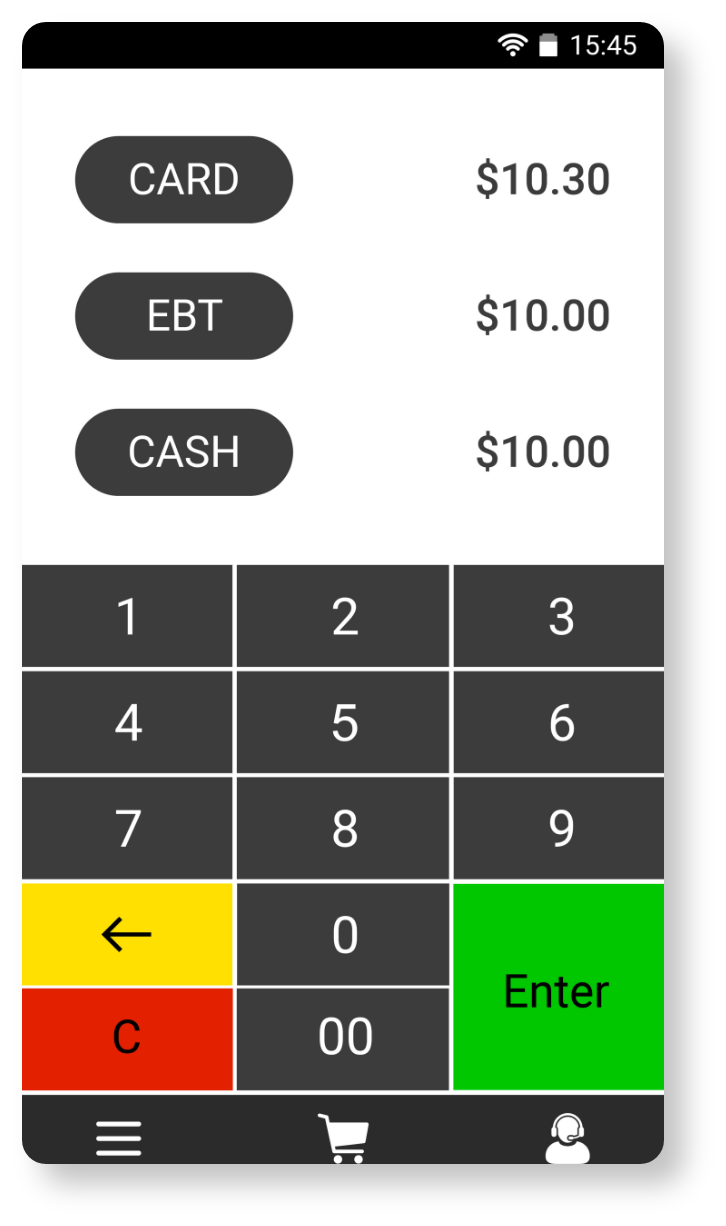

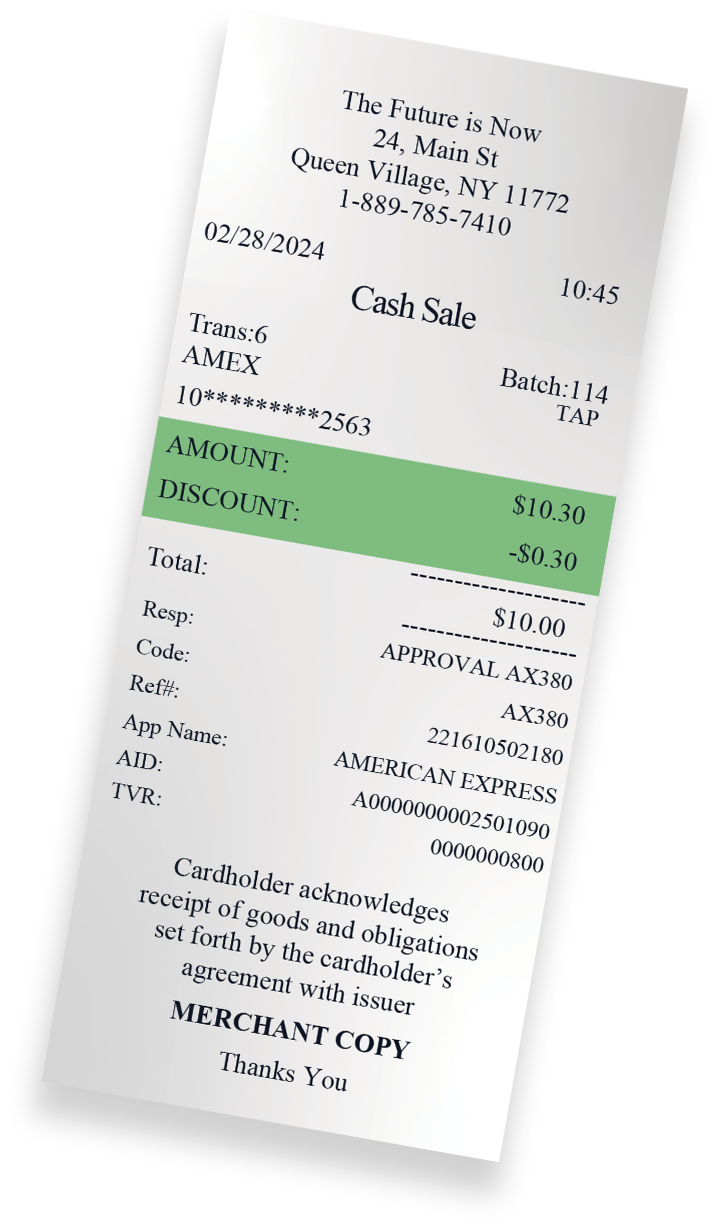

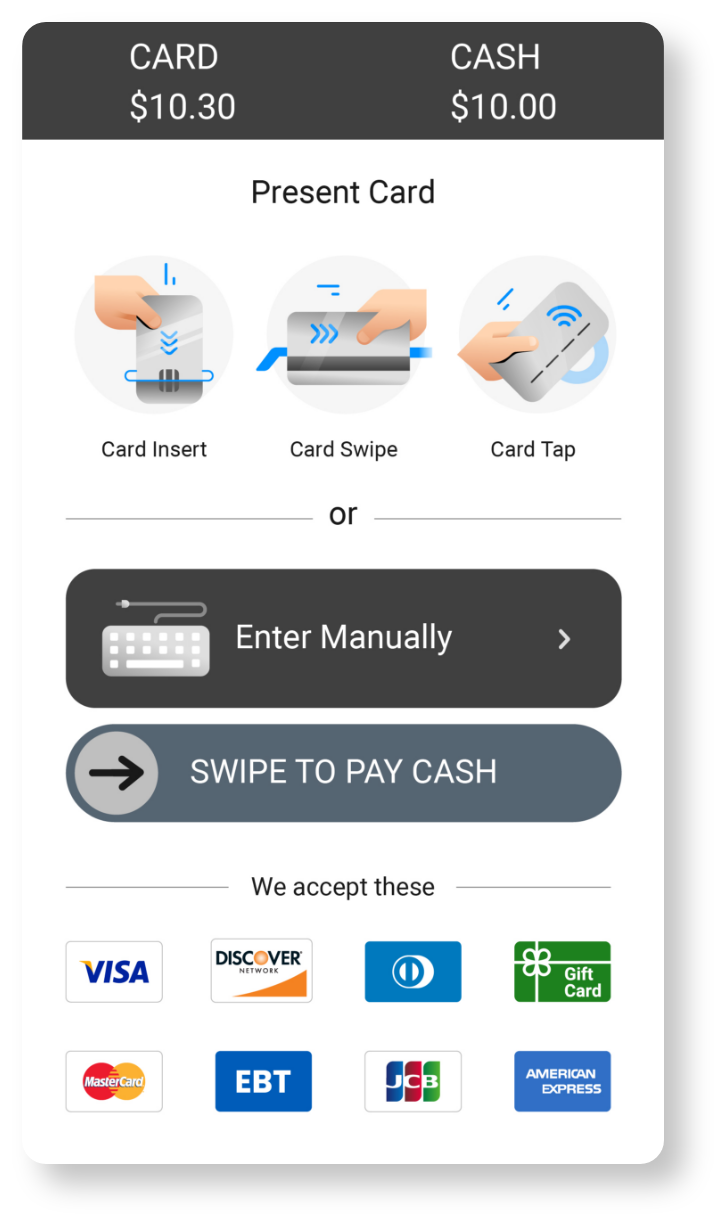

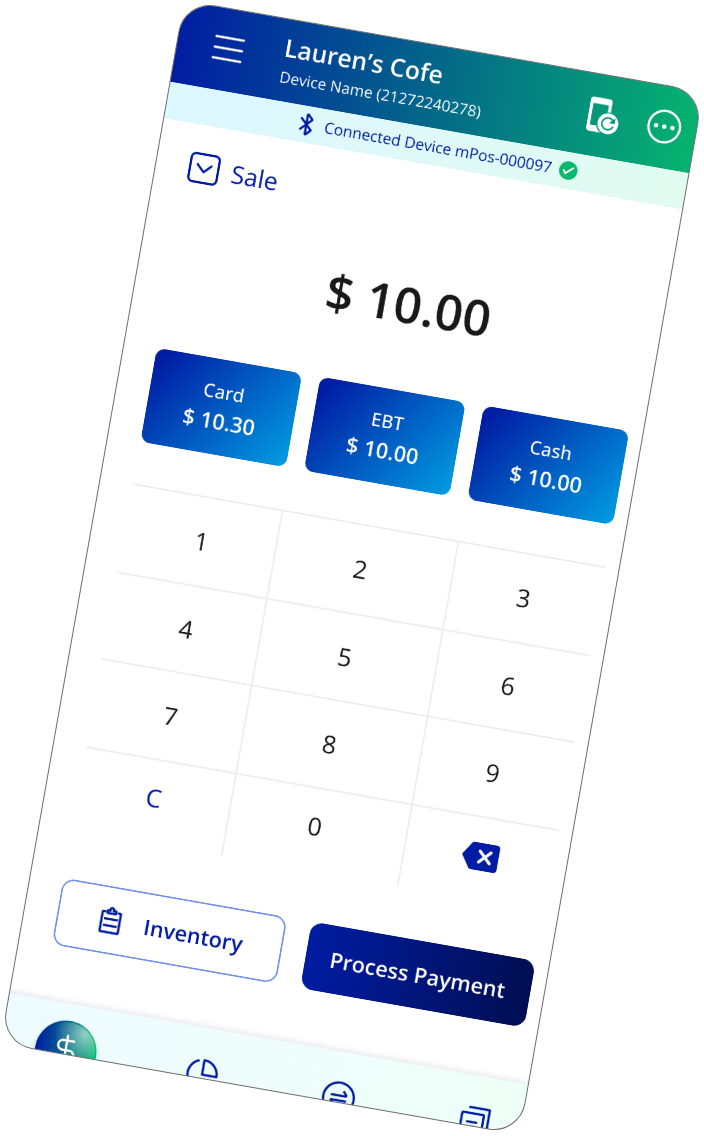

Give shoppers the freedom to choose. Our exclusive Dual Pricing feature lets customers see both cash and card prices upfront-driving transparency, building trust, and improving satisfaction while helping you manage processing costs.

Valor’s POS terminals offer safe and secure transactions with the most advanced payment technology. Restaurant payments require speed and personalized business options such as bill splitting, tip adjustment, or Dual Pricing.

Give diners the freedom to choose. With Valor’s exclusive Dual Pricing, guests see both cash and card prices upfront — no surprises. You keep control of processing costs while building transparency and trust at every table.

B2B merchants have unique needs, and our technology solutions can be customized to exceed their expectations. Partnering with us provides advanced, secure payment solutions designed to optimize operations, improve cash flow, and enhance customer experience.

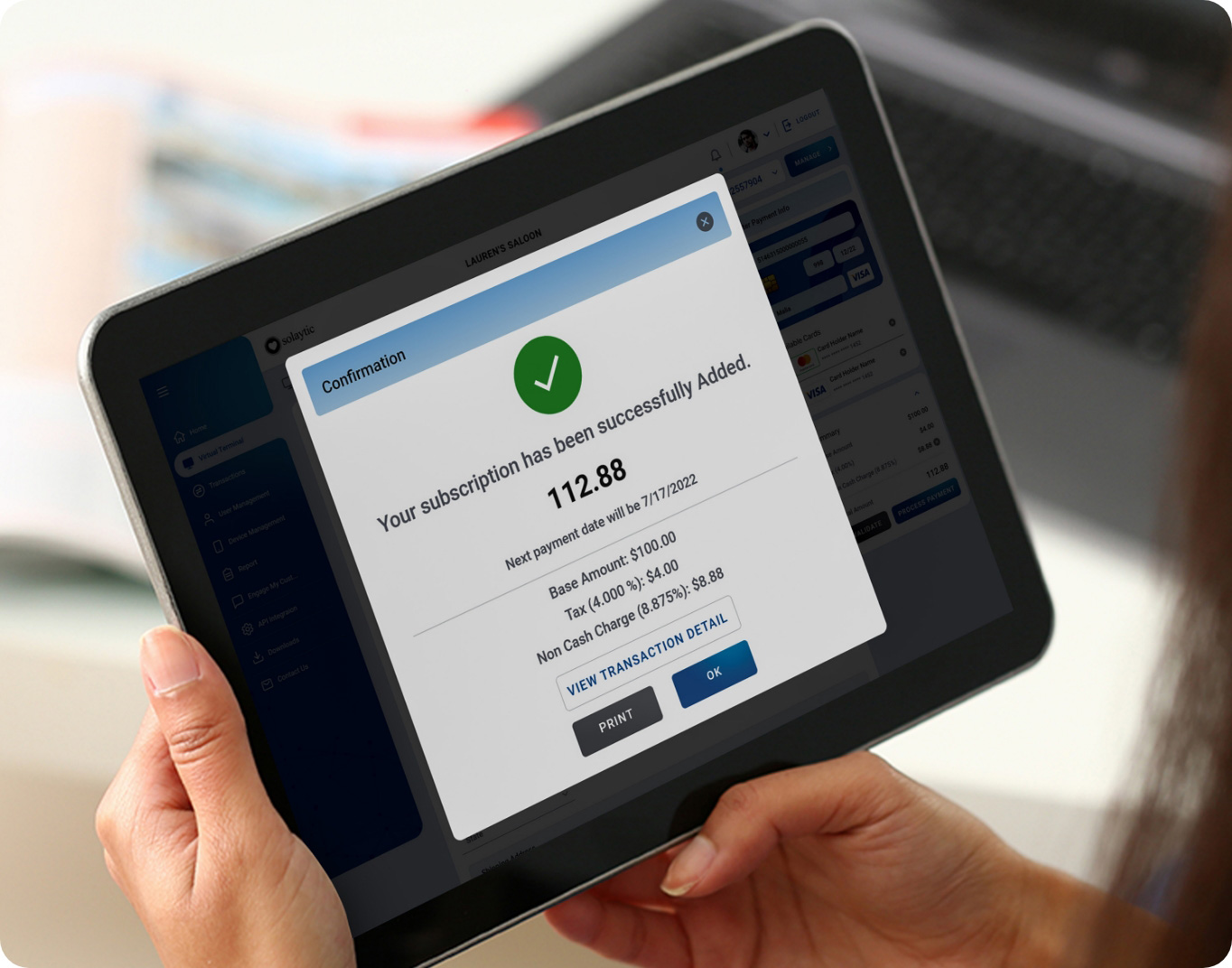

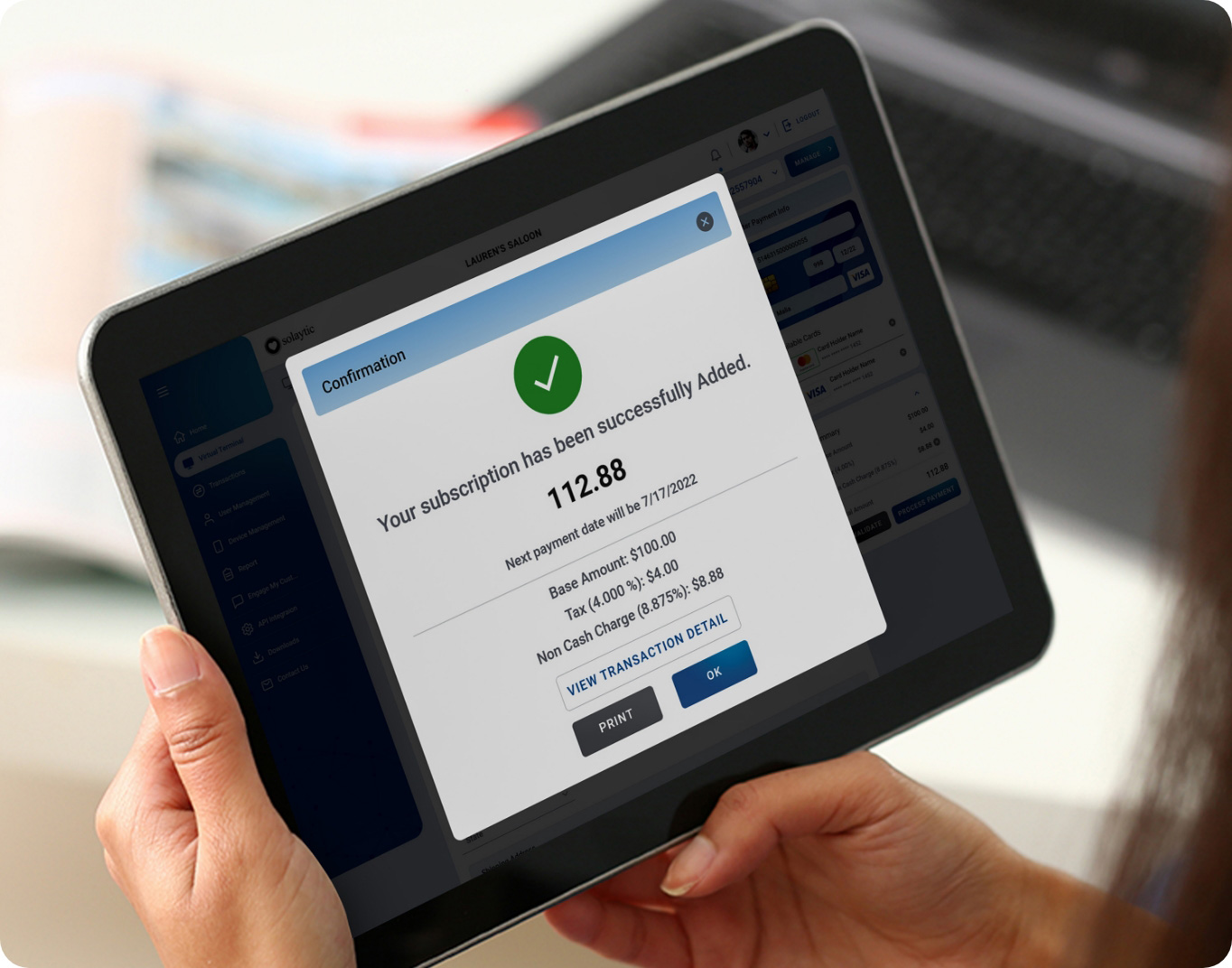

Our platform can easily handle recurring transactions, providing a secure solution for businesses that rely on subscription-based models.

The Vault provides automatic payment processing and tokenization. Our system ensures that sensitive customer information is always protected, saving merchants time and effort and giving them peace of mind.

Valor Updater maintains and updates card data, reducing card declines and enhancing the loyalty of recurring customers.

ACH transactions are also available for businesses that want to offer flexible payment options. Leverage the efficiency and security of ACH transactions with Valor PayTech. This allows for the direct, electronic transfer of funds between businesses, cutting down on processing times and reducing the risks associated with physical checks.

Merchants can save time and money by taking advantage of L2 and L3 technology.

Valor PayTech offers a range of integrations to enhance the capabilities of our POS technology. These integrations make it easier for you to manage inventory, track orders and sales, and process payments. Our marketplace technology enables B2B merchants to connect with other businesses and expand their customer base.

Our platform can easily handle recurring transactions, providing a secure solution for businesses that rely on subscription-based models.

The Vault provides automatic payment processing and tokenization. Our system ensures that sensitive customer information is always protected, saving merchants time and effort and giving them peace of mind.

Valor Updater maintains and updates card data, reducing card declines and enhancing the loyalty of recurring customers.

ACH transactions are also available for businesses that want to offer flexible payment options. Leverage the efficiency and security of ACH transactions with Valor PayTech. This allows for the direct, electronic transfer of funds between businesses, cutting down on processing times and reducing the risks associated with physical checks.

Merchants can save time and money by taking advantage of L2 and L3 technology.

Valor PayTech offers a range of integrations to enhance the capabilities of our POS technology. These integrations make it easier for you to manage inventory, track orders and sales, and process payments. Our marketplace technology enables B2B merchants to connect with other businesses and expand their customer base.

Keep your books in sync automatically. With Valor’s QuickBooks integration, every transaction flows directly into your accounting — from POS and virtual terminal payments to invoices and reports. Less manual entry, fewer errors, and real-time financial clarity.

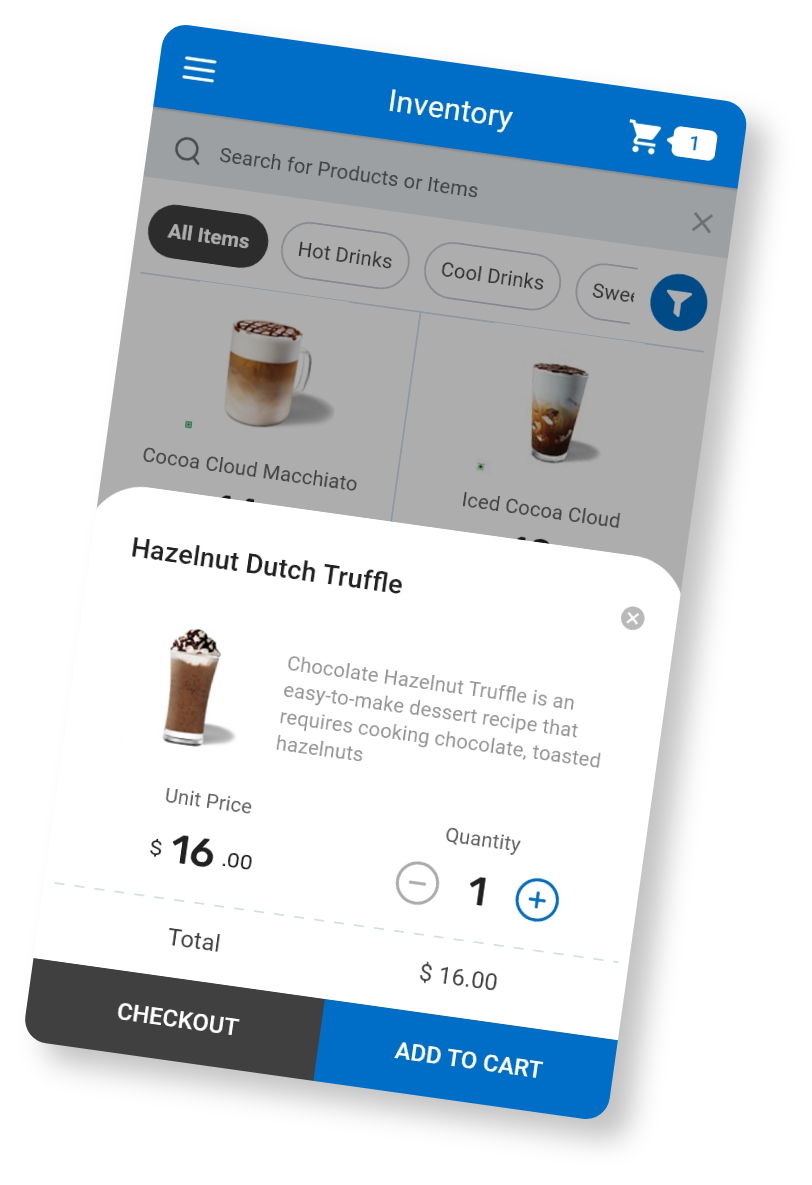

Take your B2B payments anywhere. ValorPay turns your phone into a secure POS, letting you process card payments, send invoices, or collect via QR code and text — all in English or Spanish, on both iOS and Android.

Businesses in the field or on the go need the flexibility to customize and update sale items quickly and process payments anywhere.

Valor PayTech offers a range of integrations to enhance the capabilities of our POS technology. These integrations make it easier for you to manage inventory, track orders and sales, and process payments.

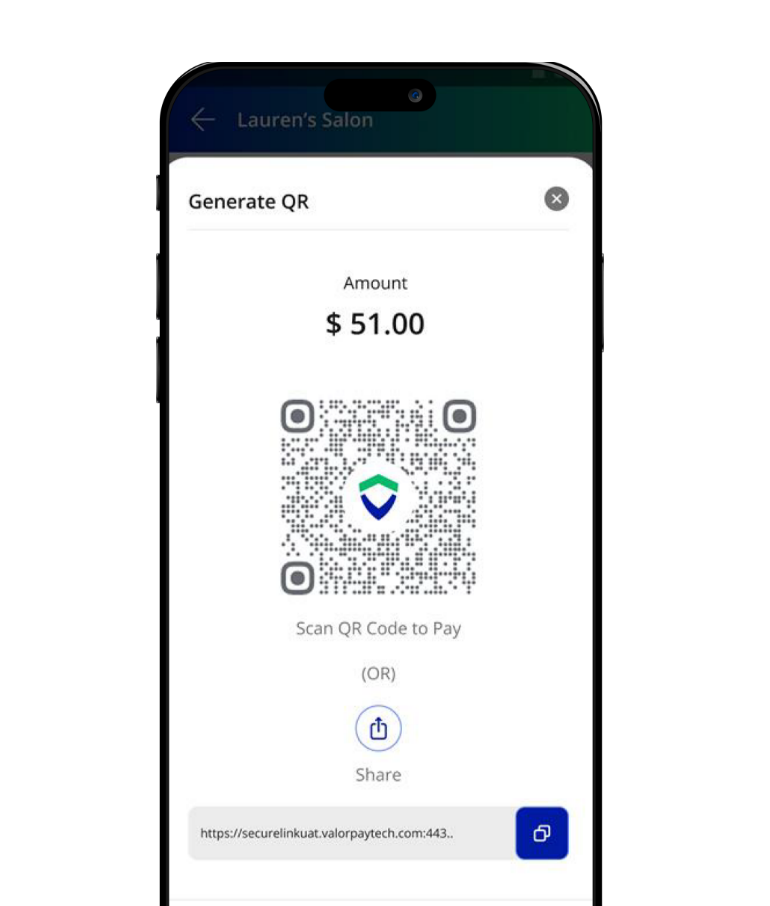

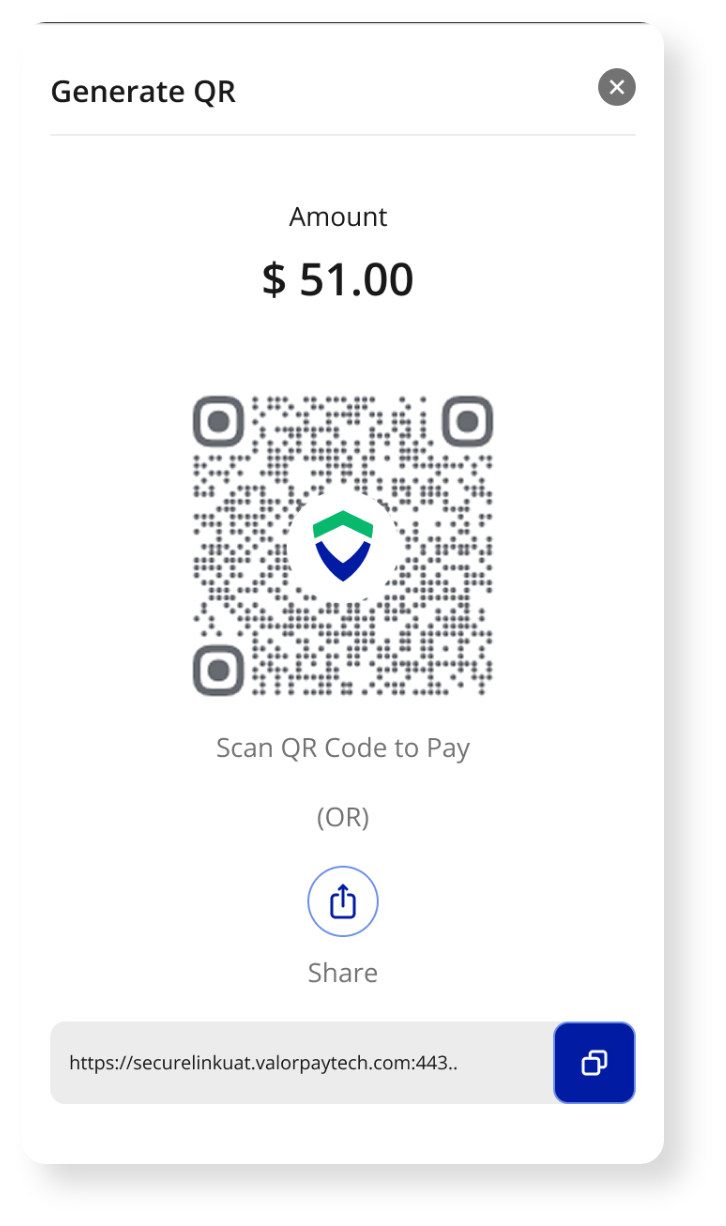

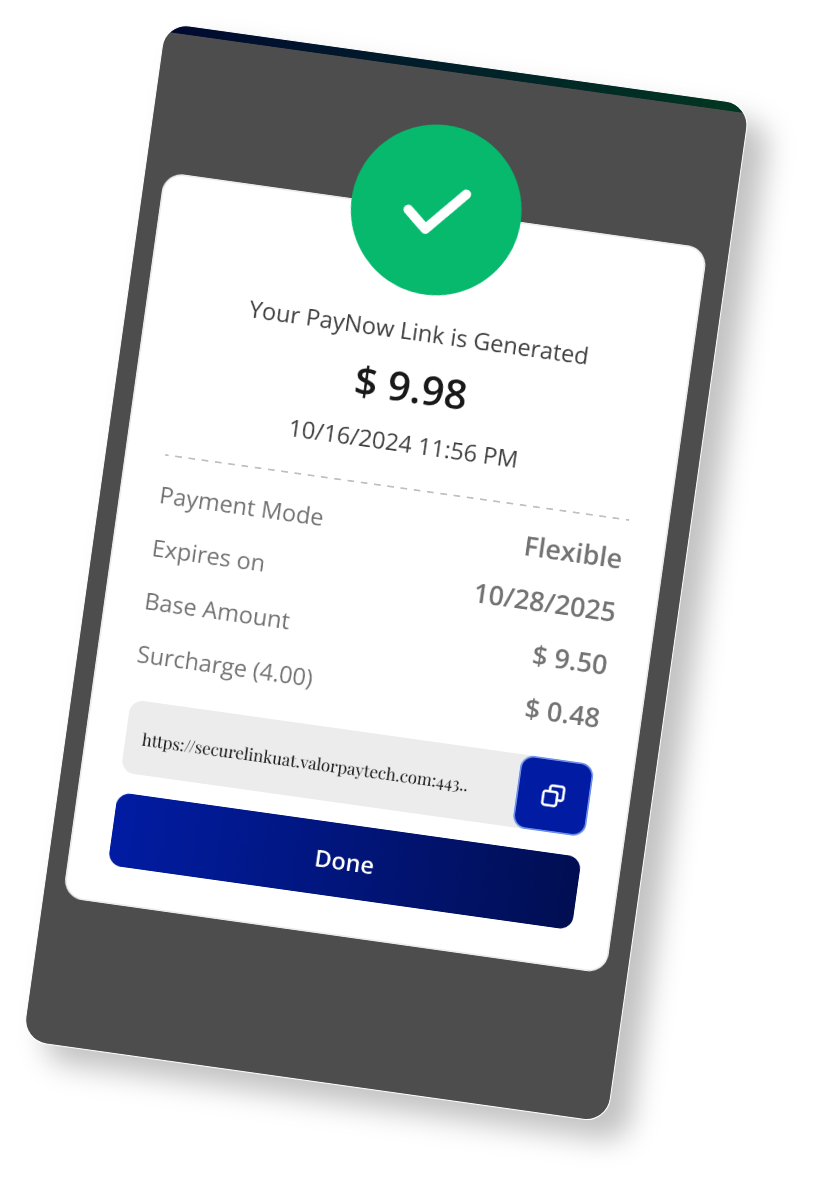

Mobility is at your fingertips. Our robust mobile solutions allow you to accept payments from your mobile device anywhere, anytime. This flexibility is invaluable for businesses operating on the go and initiating payment requests through PayNow links, SMS, or QR codes.

Keep your finances running on autopilot. With Valor’s QuickBooks integration, every payment — from on-site jobs, mobile invoices, or recurring contracts — syncs directly into your accounting. No more double entry, no missed records, just clean books and real-time financial clarity.

Stay stocked and ready for every job. Track tools, parts, and supplies in real time across teams and locations — so technicians always have what they need, waste is minimized, and projects stay on schedule.

Get paid on the spot — no delays. With Valor’s QR codes and PayNow links, technicians can send secure payment requests instantly, whether in person or remotely. Customers scan or click, pay in seconds, and you close out jobs faster while improving cash flow.

Subscribe to our newsletter and never miss any tips, tricks and examples from our experts.