Have you ever encountered a moment when everything around you moves too fast and you feel lost? It’s like sitting on a bench in the 2000s, carefully counting dollar bills from your pocket, only to fast forward to today, where we impulsively tap and dip cards as we navigate a fast-paced, globalized world, juggling a takeaway brunch in one hand and a smartphone in the other. The fintech industry has been on a wild roller-coaster ride of changes over the past decades. As we’re just a few months shy of hitting the quarter-century mark since 2000, it’s surprising how few technical know-how moments we have in our daily lives. Despite tapping our cards and keeping up with the hustle and bustle of modern life, there’s a lack of understanding about the technical magic behind it all. In this blog, we want to fill in those gaps by pulling back the curtain on POS terminals, Semi-integration processes, and how they quietly shape our lives.

Ubiquity of POS terminals

In essence, a POS is a place where transactions come to life. At this point, a customer transforms goods or services into paid reality. As leaders in fintech, Valor believes it’s our social responsibility to paint a detailed picture for all industry stakeholders on how complex integrations ‘just work’ on POS technology. The ubiquitous presence of POS terminals is attributed to the remarkable communication technology known as Semi-integration.

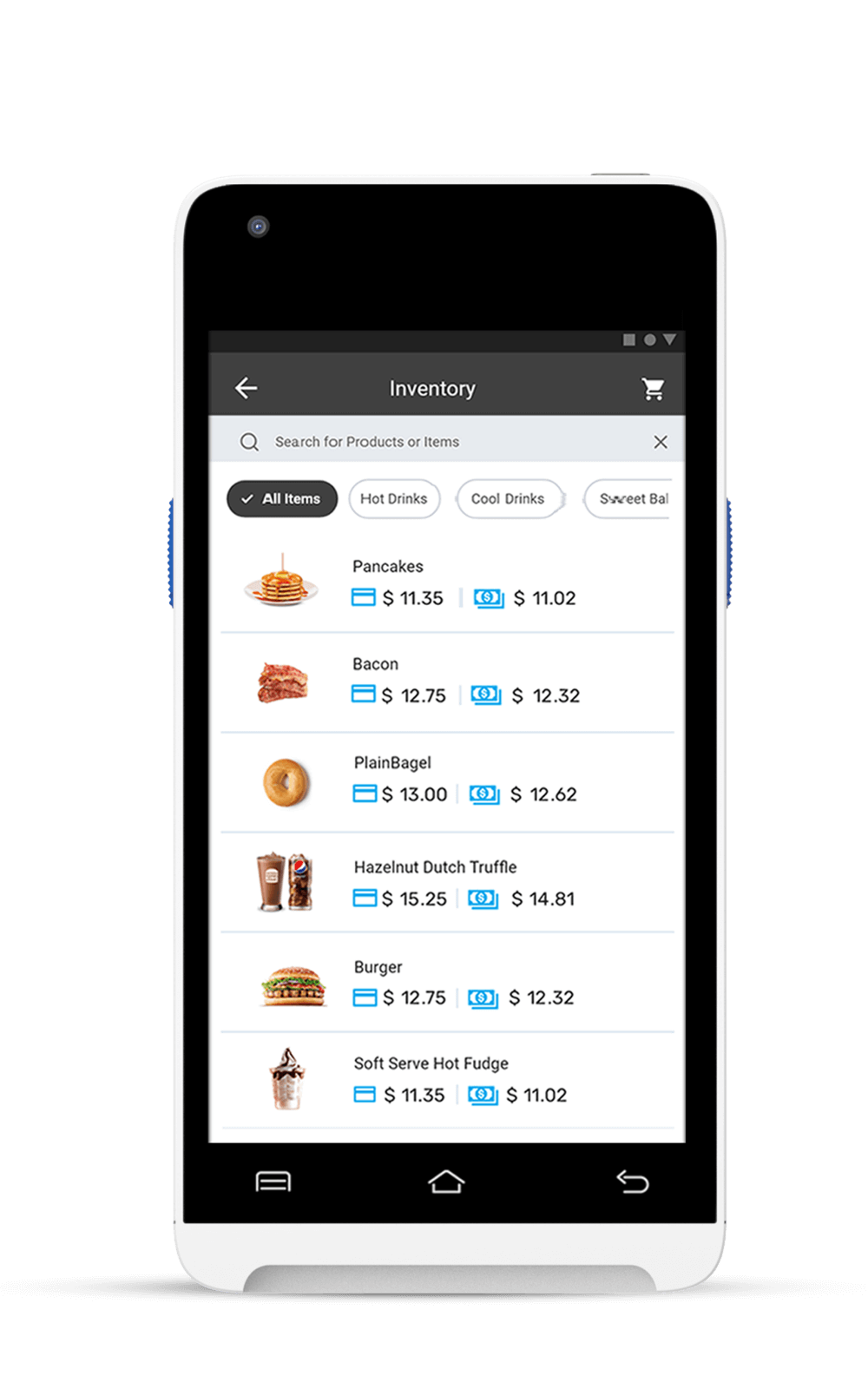

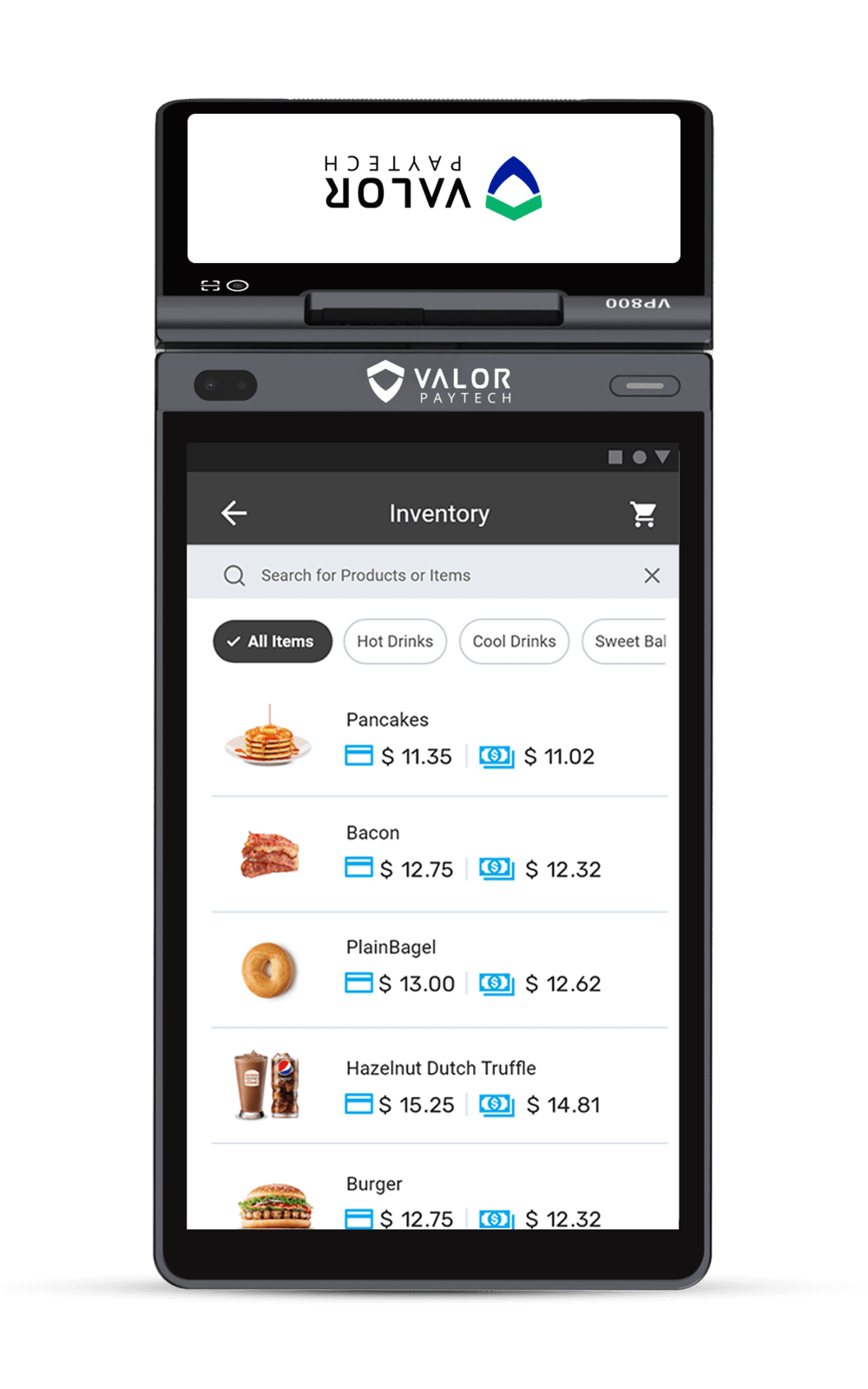

The acronym ‘POS’ or point-of-sale doesn’t necessarily confine itself to a single device. POS refers to the entire system comprising multiple devices such as POS desktops, tablets, scanners, receipt printers, smartphone applications, and credit card readers (terminals). With Semi-integration, the check-out process helps users surpass a lengthy check-out and saves time in daily activities.

In high-traffic urban centers like New York, where speed and efficiency are non-negotiable, this streamlined process becomes critical for maintaining customer satisfaction and business momentum.

Focus on Semi-integration

Semi-integration is a checkout method that integrates payment processing and point-of-sale software into a secure and organized network configuration. It enables stores to accept Chip/EMV credit card and debit card payments while managing inventory changes, returns, voided transactions, and other payment functions. In essence, Semi-integration ensures that payment terminals are connected to retail POS software but maintains a separation between payment information transmission and other systems keeping the POS software out of compliance scope. This separation is vital for meeting Payment Card Industry Data Security Standard (PCI DSS) compliance, offering a cost-effective and compliant solution without the need for extensive investments in fully integrated systems.

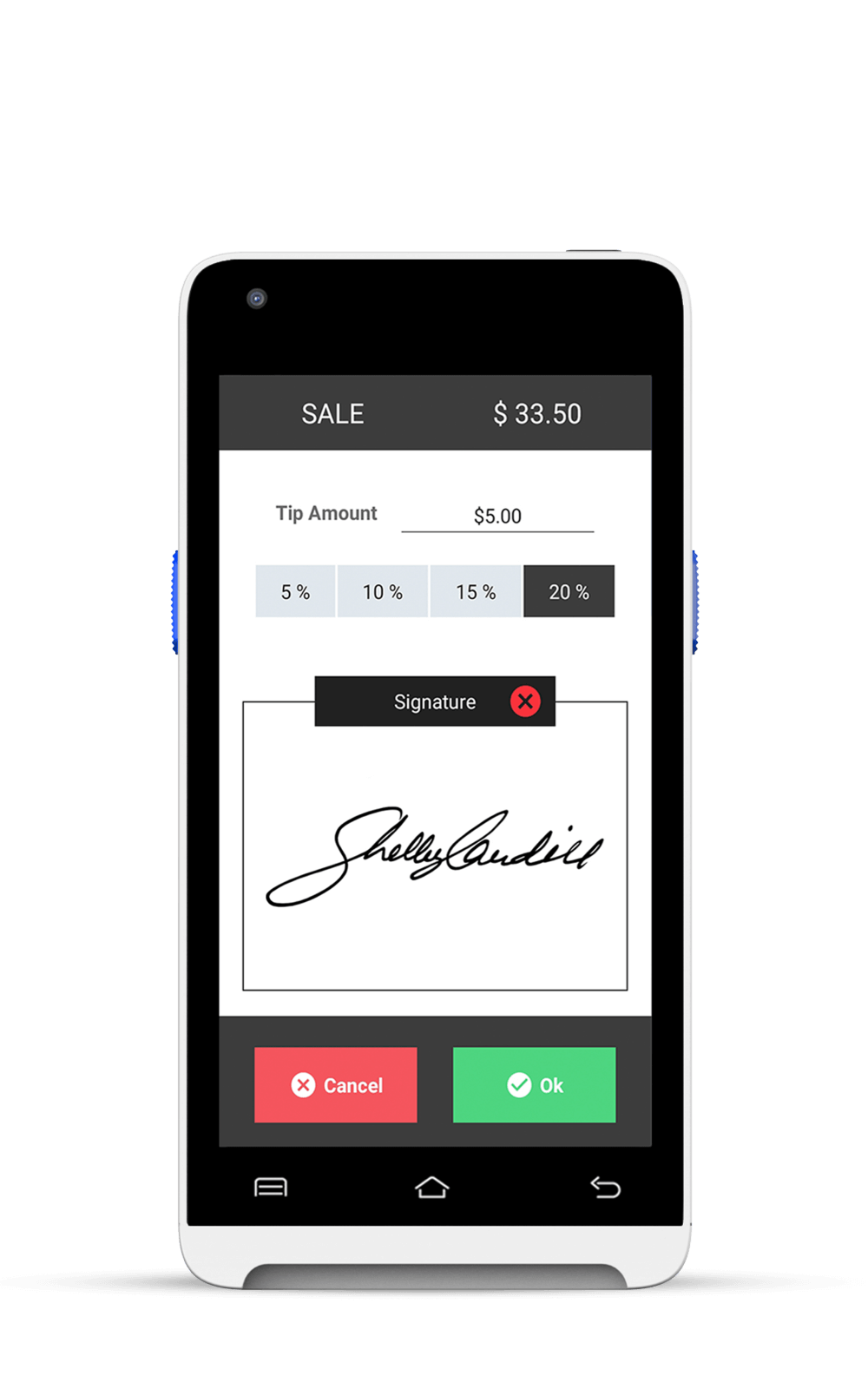

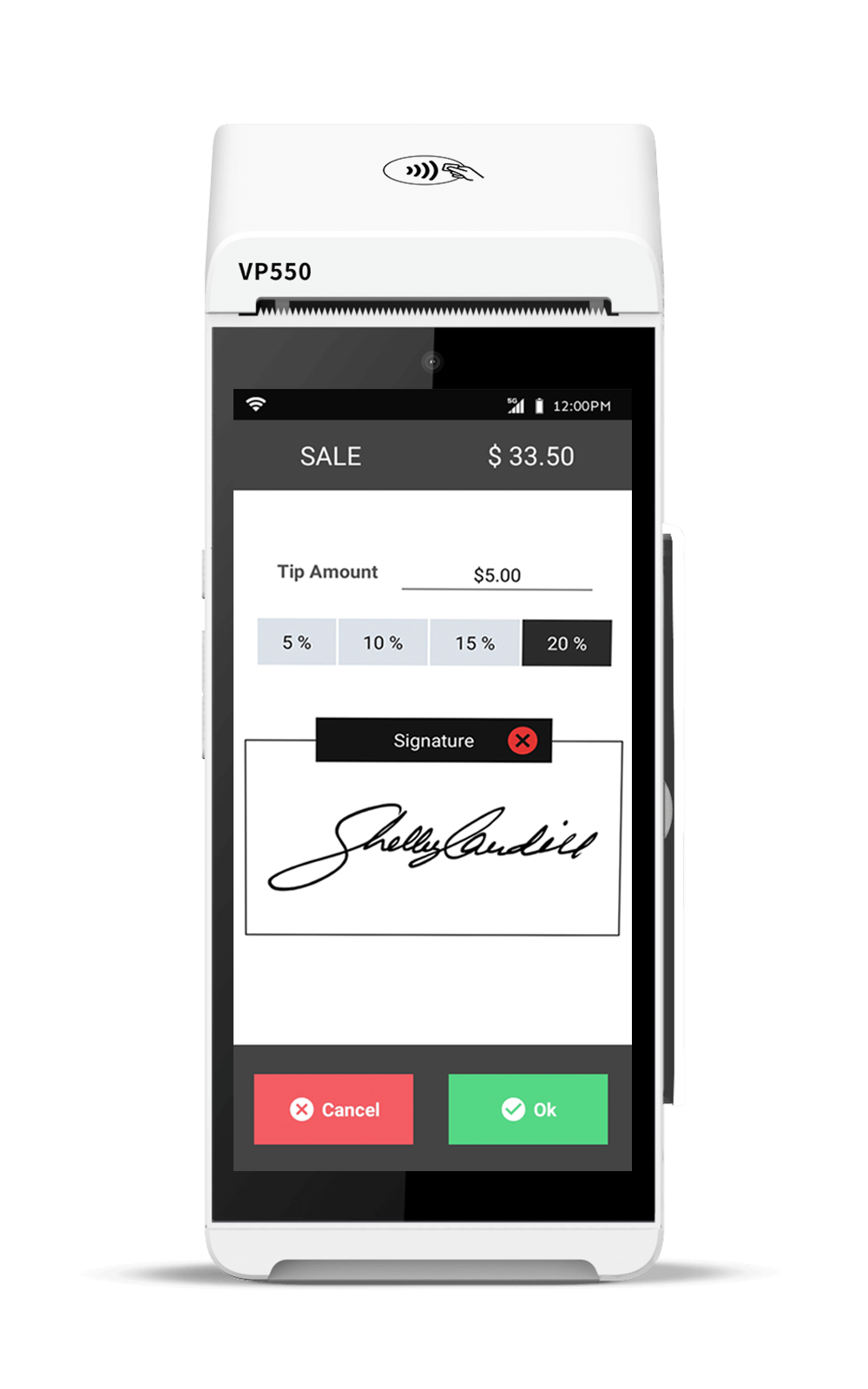

In a semi-integrated setup, the POS system kickstarts the transaction. Semi-integration is the reason why the desktop sends the data to the POS terminal, enabling the user to swipe, dip, or tap and complete the payment. The credit card details are then encrypted and securely transmitted from the payment terminal to the gateway or processor via the POS desktop, and subsequently to the acquiring bank for authorization.

Following this, the authorization status is relayed back through the processor to the terminal, which then forwards a PCI-compliant, non-sensitive response to the POS system. This response shields sensitive card data and any personally identifiable information, providing essential details like the approval code, a truncated card number, and, based on the configuration, the transaction token in a safe manner.

Why POS Semi-Integration Matters for New York Businesses?

As a behind-the-scenes powerhouse, Semi-integration has significantly influenced the payment industry. Acting as technology advocates for Independent Software Vendors (ISVs) and merchants, developers utilizing semi-integrated solutions benefit from decreased PCI compliance responsibilities, lesser programming hassle, and heightened security levels as opposed to fully integrated alternatives. Let’s zoom into the topic and explore the array of advantages it brings to the table for ISOs, ISVs, and merchants.

- One-to-many Integration

Semi-integrations help users to easily integrate one POS desktop or device with multiple POS terminals and support several processors, allowing ISVs and Independent Software Organizations (ISOs) to develop a single semi-integrated specification that can support multiple devices and processors. This provides enormous flexibility for businesses and saves time. - No costly EMV certifications

EMV certifications can be expensive and time-consuming. However, with Semi-integration, these certifications are completed by the processor and payment gateway. The most typically required is a simple device integration script or unit testing, significantly reducing costs and implementation time. - PCI PA-DSS compliance

Compliance with PCI-DSS and PA-DSS standards can be considered as the biggest benefit of this package. Since no sensitive card account data is sent to the POS application driving the semi-integrated terminal, businesses can reduce their PCI compliance scope and associated risks. - Enhanced security & customer satisfaction

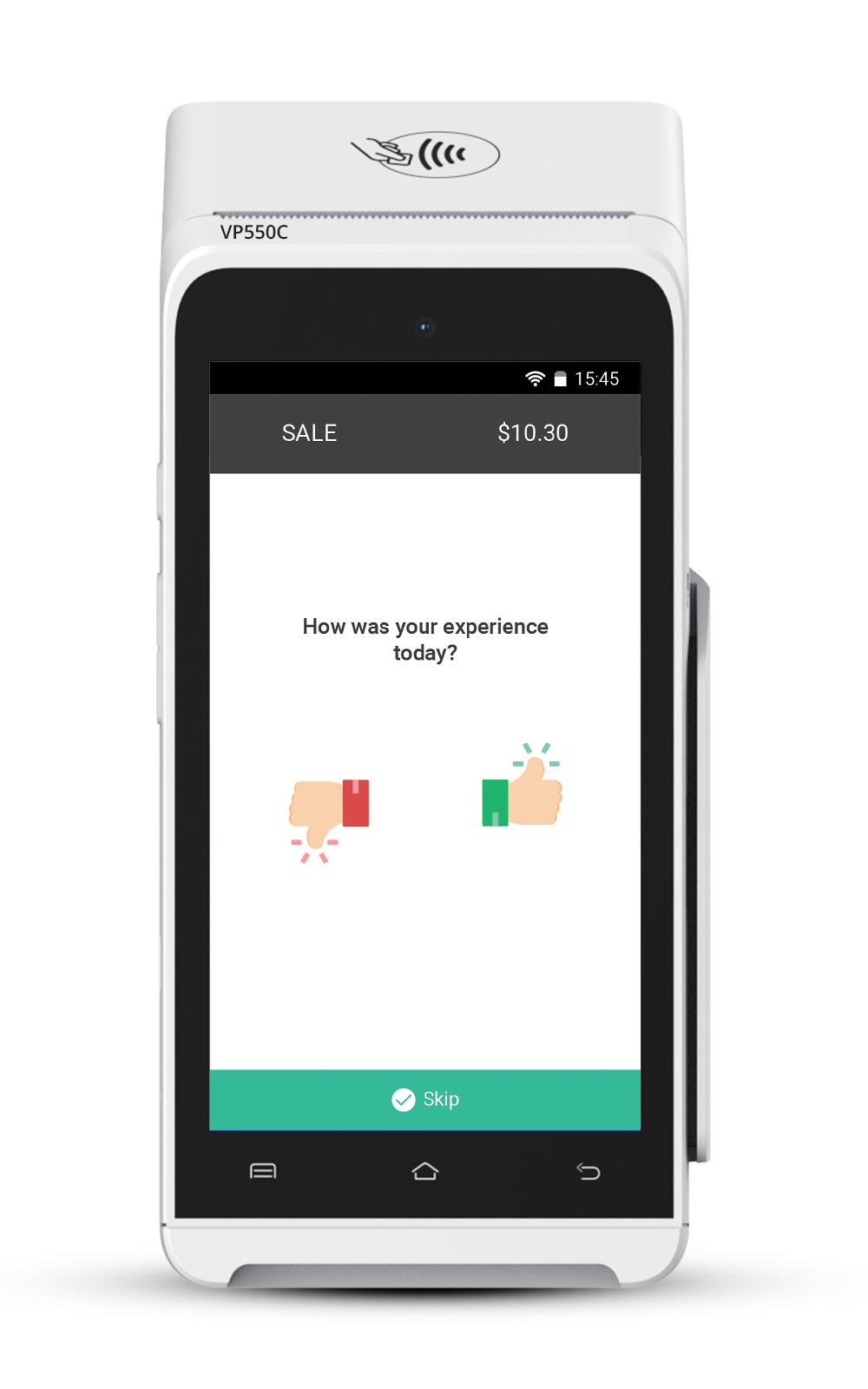

Semi-integration ensures that the payment process remains secure by keeping the sensitive data transmission separated from other systems. This means the merchant never has access to sensitive card data, and all receipt data is returned truncated from the terminal device to the POS application (Desktop) securely. This provides a control for the customer experience and thereby enhances their security and satisfaction. - Multiple connectivity

Semi-integrated devices offer various connectivity methods, including TCP/IP (wired or Wi-Fi), Serial, USB, Bluetooth, or Web Services connections between the device and the POS application. Valor Connect offers this advantage to its users by facilitating the connection between POS terminals and computers. Valor Cloud connect offers great flexibility to the users and allows businesses to prefer the most suitable connectivity method for their specific needs.

Lights, camera, integration + Valor Connect

At Valor, we’ve purposefully built multiple Semi-integration types by centralizing all POS integration types under the caring embrace of Valor Connect. This dynamic platform serves as your pathway to efficiency and simplicity, presenting three unique connection types. Cloud Integration for instant harmonization of your POS system with our secure solutions, TCP, and WebSocket.

Partners & merchants can integrate any semi-integrated POS solution with Valor devices. Combining our cloud detection software with semi-integrated POS terminals enables remote setup, eliminating expensive onsite labor costs. Valor Connect enables Virtual Terminal transactions for card not present to reroute to Valor terminals for card-present transactions. By syncing the inventory with Valor’s unified commerce Cloud platform, all connected devices update inventory in real-time during transactions.

Summing it all up

Semi-integration is a valuable solution for businesses looking to enhance their payment processing capabilities while maintaining security and compliance. Whether you are a fintech enthusiast, investor, business owner, or everyday fintech user, understanding the benefits and applications can help make informed decisions about your payment systems.

From bustling cafés in New York to nationwide franchises, semi-integrated POS systems are helping merchants scale securely without sacrificing speed or compliance.

Ready to take your payment processing to the next level? Book a call with one of our fintech experts today and discover how our solutions can help achieve secure and efficient payment processes. For more details about Valor Connect, stay tuned for our next blog post on Valor Connect & Semi-integrations!

FAQ

1. What is the difference between integrated and semi-integrated POS?

Integrated POS systems combine payment processing directly within the POS software, requiring extensive PCI compliance due to the direct handling of sensitive payment information. In contrast, semi-integrated POS systems maintain a separation between the POS and payment terminal, enhancing security and reducing compliance scope while allowing efficient transaction processing.

2. What are the benefits of using semi-integration in POS?

Semi-integrated POS systems enhance security and reduce PCI compliance burdens by keeping sensitive payment data separate from the POS application, enabling faster transactions and greater flexibility in payment processing.

3. Why is PCI compliance easier with Semi-integration?

It simplifies the PCI compliance process by mitigating the amount of sensitive data the POS software interacts with, lowering compliance costs, and enhancing overall security.

4. Can Semi-integration connect to multiple processors?

Yes, it can connect to multiple processors.

5. How does Semi-integration benefit merchants?

It provides merchants with enhanced security, simplified compliance, cost savings, and improved customer experiences, all of which contribute to more efficient and resilient retail operations.

Ready to partner with Valor PayTech?

Become a Partner Today!

Complete the form below.