In 2026, checkout experiences are faster, smarter, and more mobile than ever. Whether a customer is tapping their phone, scanning a QR code, paying through a digital wallet, or completing an invoice on their device, mobile payment solutions have become a core part of modern commerce in the United States.

Today’s consumers expect speed, convenience, and security—and mobile payments deliver all three. This guide explores the newest trends, mobile payment tools, security standards, and the best mobile payment systems for U.S. businesses in 2026.

What Are Mobile Payments?

Mobile payments refer to financial transactions completed through a smartphone, smartwatch, or tablet—without using cash or a physical card. Customers can pay by tapping, scanning, or clicking, making mobile payments one of the fastest-growing payment methods in the U.S.

Common examples include:

- NFC Tap-to-Pay

- QR Code Payments

- Digital Wallets (Apple Pay, Google Pay, Samsung Pay)

- Text-to-Pay / Pay-by-Link / PayNow links

- In-App Payments

- Mobile POS terminals

Mobile payment services are no longer optional. Customers expect businesses to offer fast, contactless, and secure ways to pay.

Why Mobile Payments Matter for Businesses in 2026

Mobile payments have evolved from a convenience into a competitive advantage. In 2026, American shoppers increasingly prefer mobile-first checkouts.

Businesses benefit through:

✔ Faster checkout times

✔ Higher customer satisfaction

✔ Acceptance of multiple payment methods

✔ Lower operational friction

✔ Better fraud protection

✔ Seamless omnichannel experiences

Whether you operate retail, food service, services, healthcare, or events—mobile payments help you close more sales, faster.

How Mobile Payments Work

While mobile payments feel instant, a secure process happens behind the scenes:

1. Payment Initiation

The customer taps, scans, or clicks a mobile payment option.

2. Authentication

Face ID, fingerprint, PIN, or device passcode confirms identity.

3. Tokenization

Actual card numbers are replaced with encrypted tokens.

4. Authorization

The issuing bank authorizes the transaction.

5. Settlement

Funds move to the merchant’s account.

This multilayered process makes mobile payments among the safest payment methods available in 2026.

Types of Mobile Payments (2026 Overview)

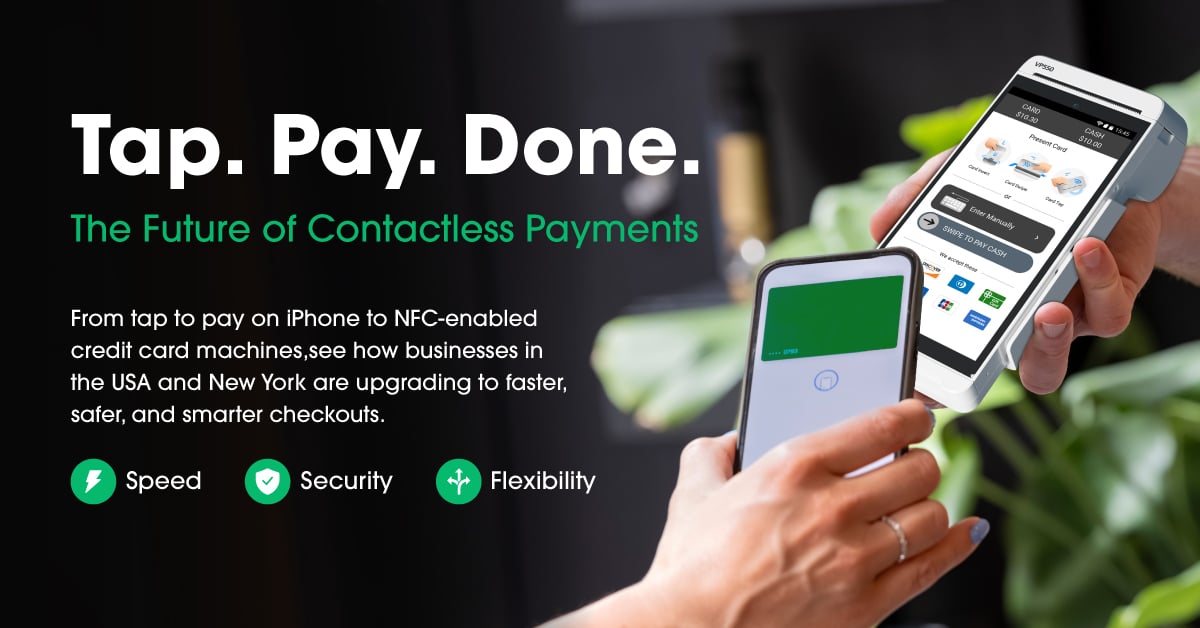

⭐ 1. NFC Tap-to-Pay

Uses Near Field Communication (NFC) technology.

Best For:

Retail, cafes, restaurants, salons, transportation

Works With:

Smartphones, smartwatches, contactless cards

Examples:

- Apple Pay

- Google Pay

- Samsung Pay

⭐ 2. QR Code Payments

Customers scan a QR code to open a payment page.

Best For:

Events, takeout restaurants, markets, service providers

Convenient when NFC is unavailable or unnecessary.

⭐ 3. Mobile Wallet Payments

Digital wallets store encrypted payment information.

Popular Wallets:

- Apple Pay

- Google Pay

- PayPal

- Venmo

These provide fast checkout—especially for mobile-first customers.

⭐ 4. Pay-By-Link / Text-to-Pay /PayNow Links

The merchant sends a payment link via:

- SMS

- Social media DMs

Customers complete the payment through their phone browser.

⭐ 5. Virtual Terminals

Merchants enter customer card information manually in a secure browser-based terminal.

Ideal for phone orders, remote billing, and service-based businesses.

Best Mobile Payment Systems in the U.S. (2026)

A great mobile payment system should offer:

✔ NFC + QR + Wallet payments

✔ Text-to-Pay

✔ Inventory & reporting

✔ PCI compliance

✔ Flexible integrations

✔ Mobile POS hardware

Top Mobile Payment Systems in 2026:

- Valor PayTech – Best all-in-one mobile & POS solution

- Square – Ideal for retail & mobile vendors

- Stripe Terminal – Strong for developers & omnichannel brands

- PayPal Zettle – Simple mobile POS for small merchants

Valor PayTech leads for businesses that want unified online + in-person + mobile solutions.

Best Mobile Payment Apps for Small Businesses (2026)

Small businesses need apps that provide:

- Easy onboarding

- Simple invoicing

- Real-time reporting

- Integrated customer profiles

- Low fees

- Mobile POS compatibility

Top Choices:

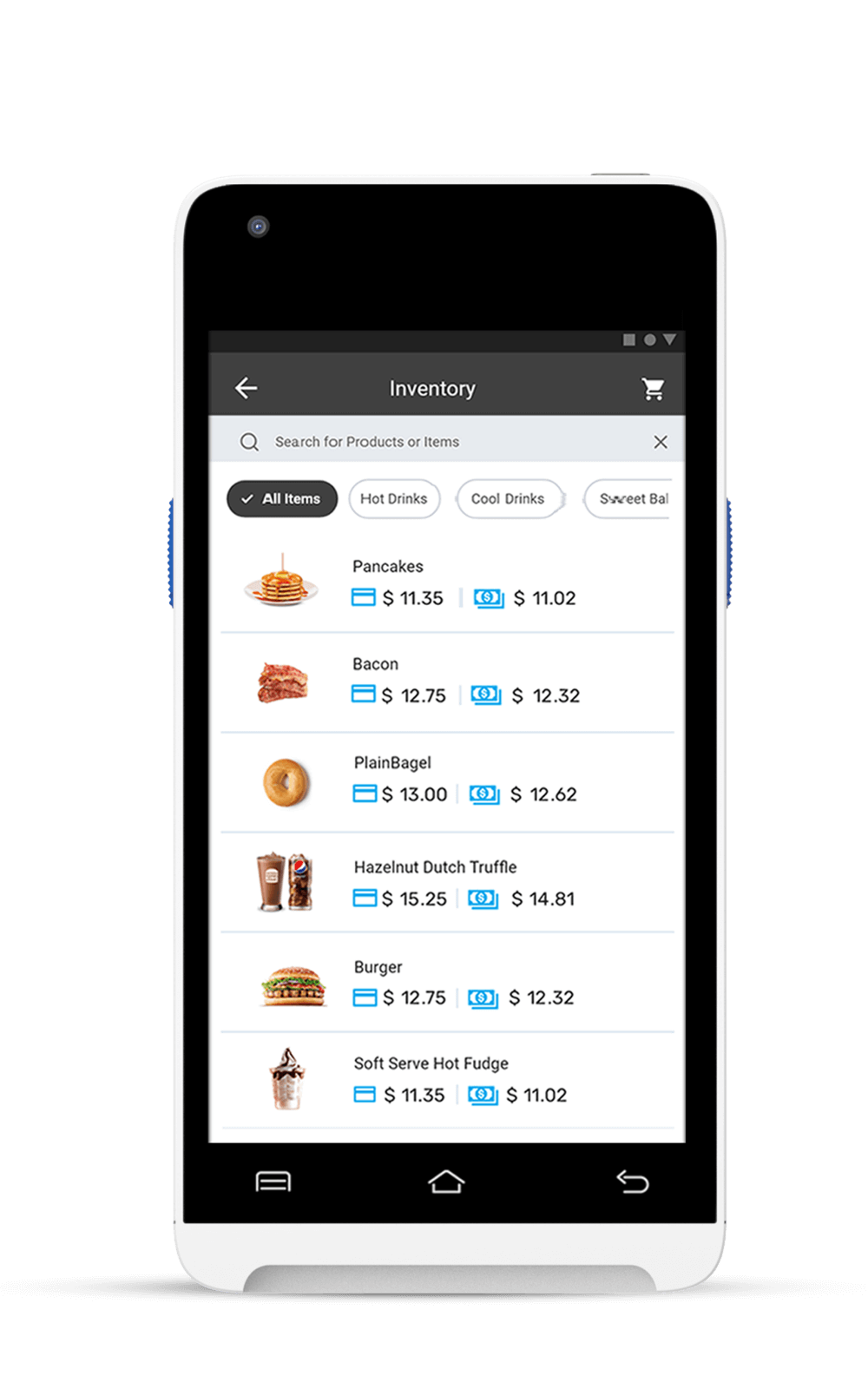

⭐ Valor PayTech App – Flexible NFC + QR + Pay-by-Link + virtual terminal

⭐ Square POS App – User-friendly, great for vendors

⭐ PayPal Zettle App – Ideal for occasional sellers

⭐ Stripe Dashboard App – Great for online-first brands

For the most complete solution, Valor PayTech provides both mobile checkout and deep reporting for business growth.

Best Contactless Payment Apps for Android (2026)

Android users rely heavily on NFC and digital wallets.

Top Android contactless apps:

- Google Pay

- Samsung Wallet

- Valor PayTech Mobile Solutions (NFC, QR, Pay-by-Link)

Valor PayTech stands out for businesses needing a secure, flexible Android-based mobile payment app.

Benefits of Accepting Mobile Payments

1. Lightning-Fast Checkout

Mobile payments reduce lines and speed up service.

2. Happier Customers

Users prefer frictionless tap-to-pay or wallet payments.

3. Increased Sales

Offering flexible payment methods reduces cart abandonment.

4. Lower PCI Scope

Tokenization reduces direct exposure to sensitive card data.

5. Modern Business Image

Mobile-first experiences are expected in 2026.

6. 24/7 Payment Flexibility

Pay-by-link and mobile invoicing allow payments anywhere.

Mobile Payment Options for Merchants

Merchants have multiple mobile-friendly tools available in 2026.

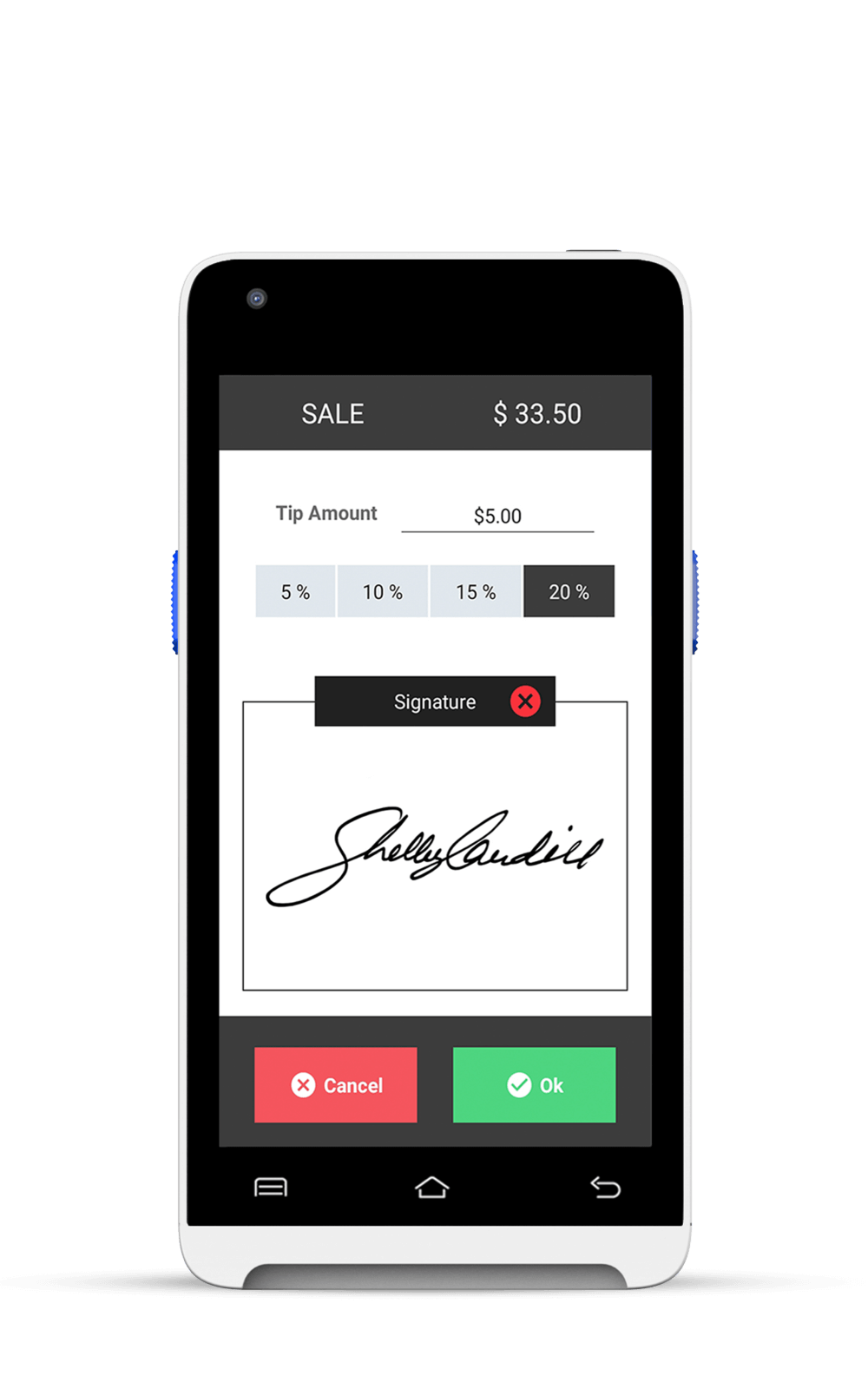

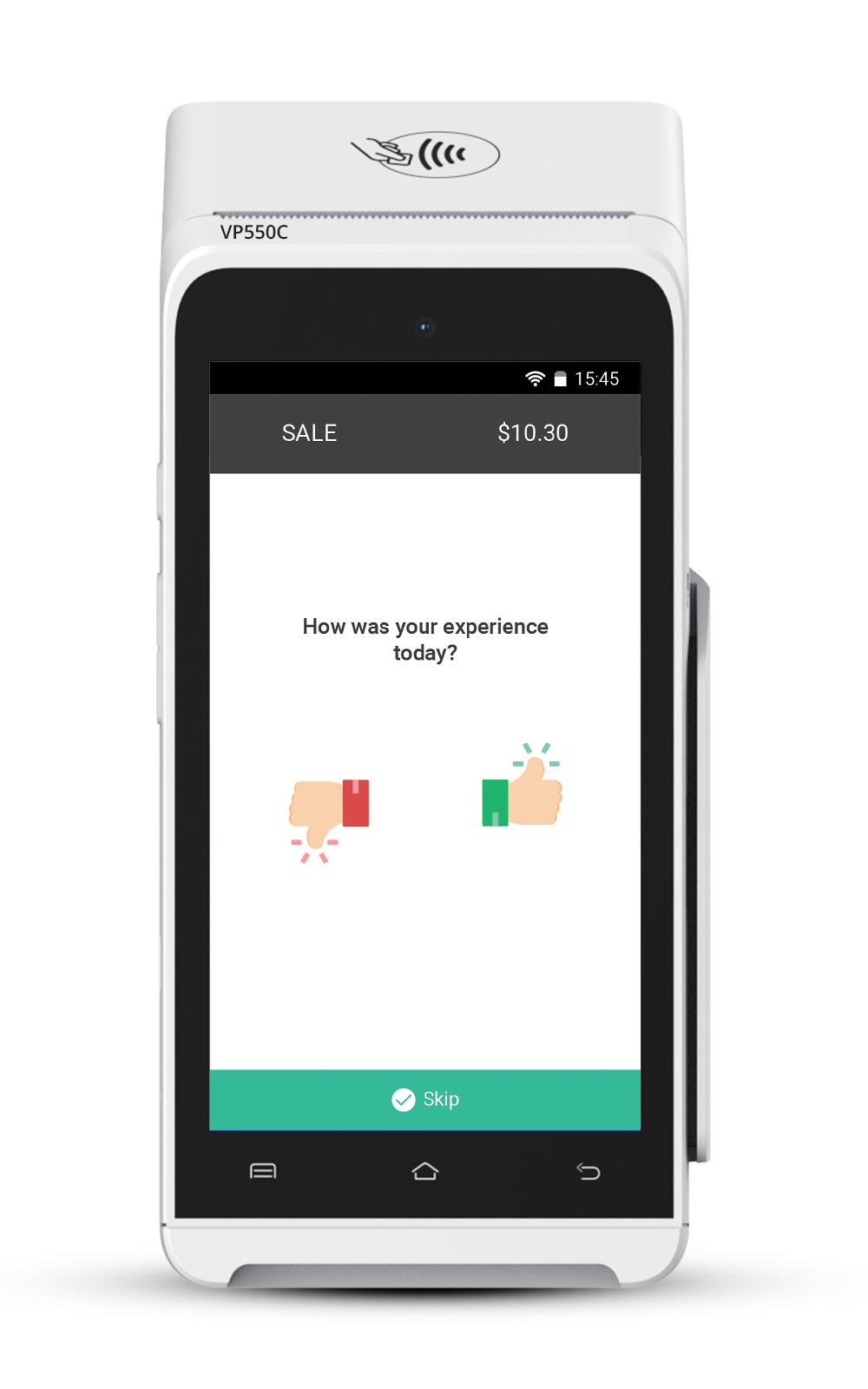

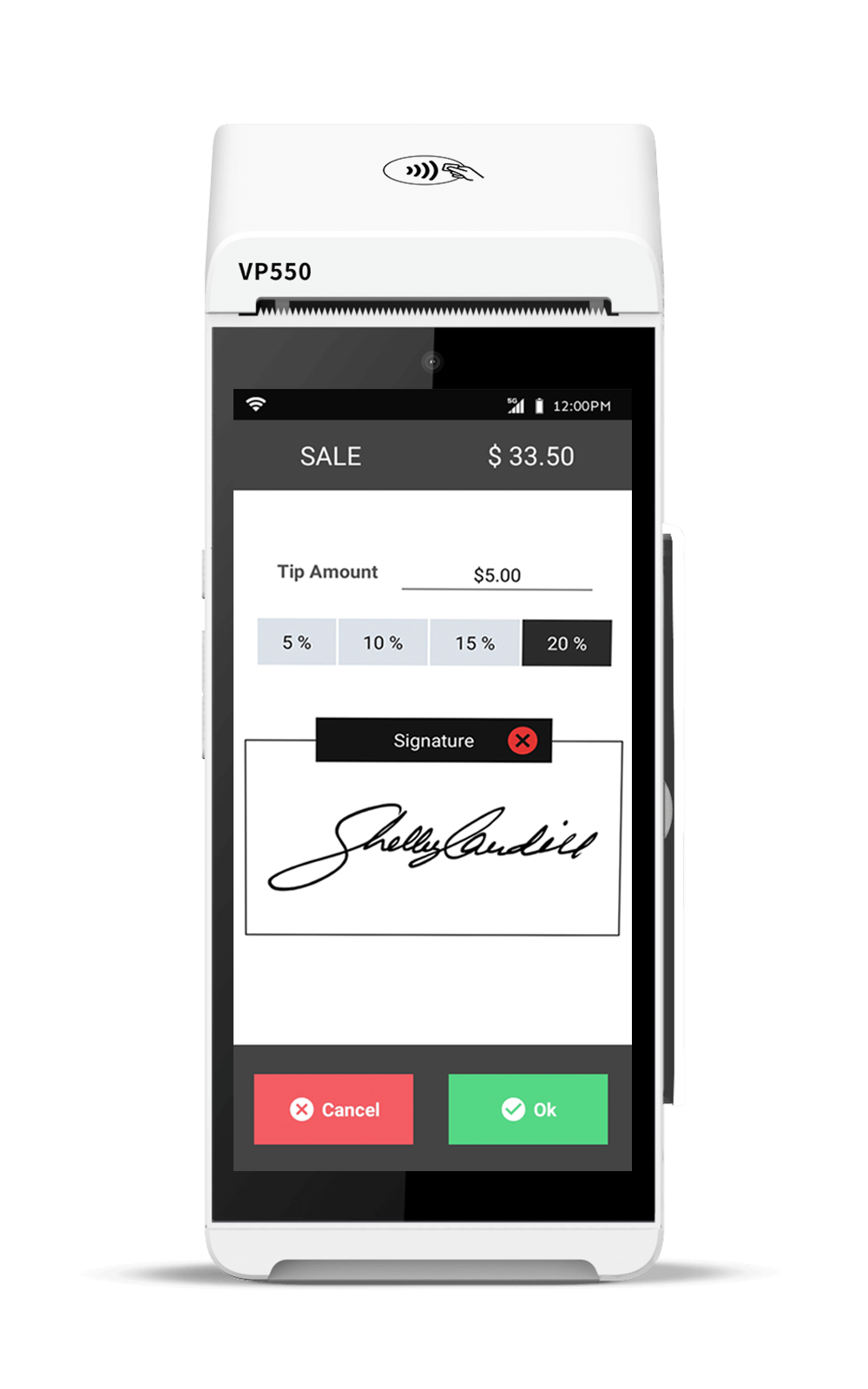

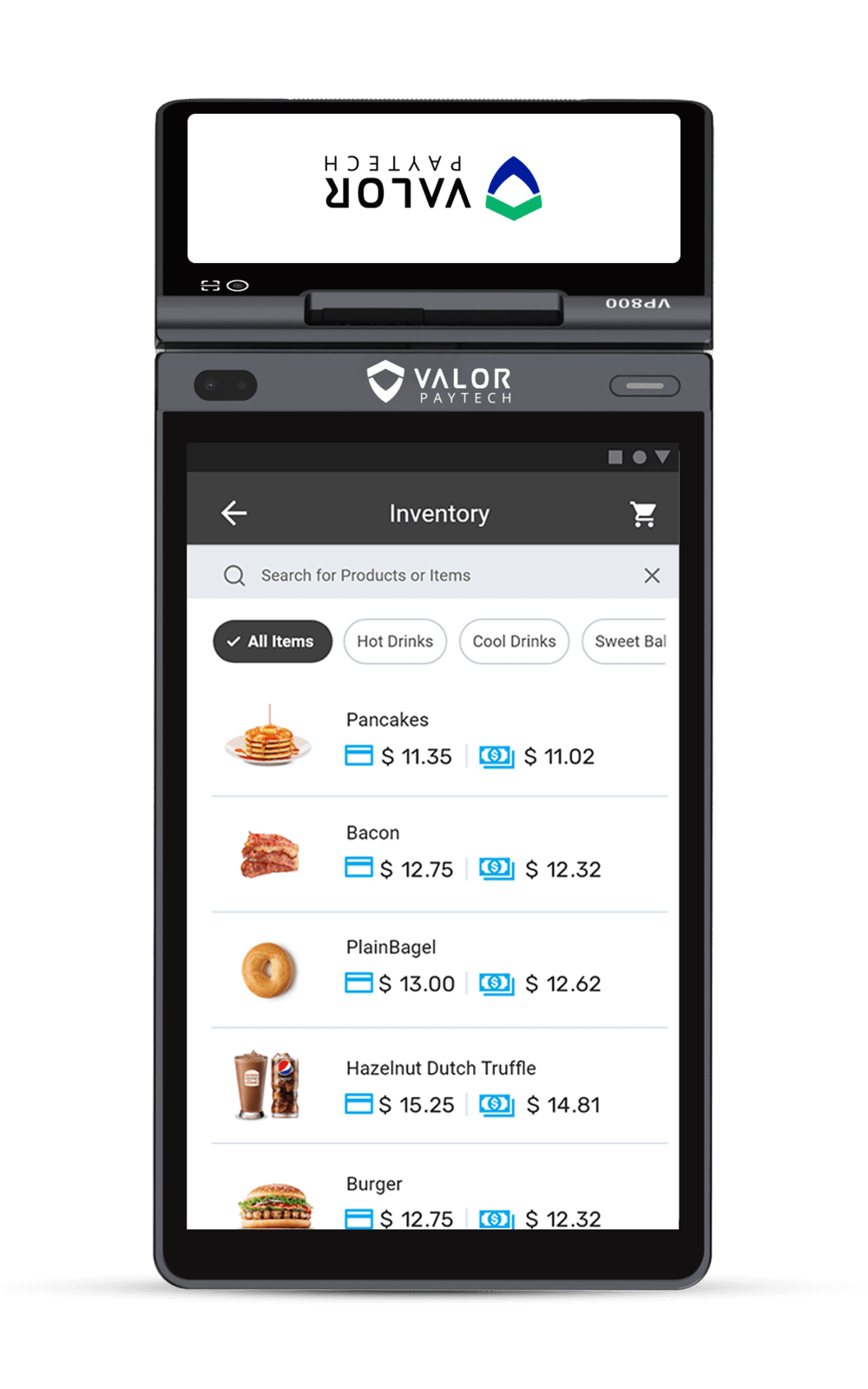

⭐ 1. Mobile POS Terminals

Smart devices like Valor VL550 & VP800 accept:

- NFC

- Chip

- Swipe

- QR payments

Perfect for retail, pop-ups, food trucks, events, salons.

⭐ 2. Virtual Terminals

Process payments from any browser—ideal for phone orders.

⭐ 3. Pay-By-Link (SMS, Email, QR)

Send invoices or quick links for instant payment.

Perfect for:

- Salons

- Healthcare

- Contractors

- Field services

- Delivery teams

⭐ 4. Mobile Card Readers

Small readers connect to phones or tablets.

Ideal for mobile businesses and on-location vendors.

Mobile Payment Adoption by Industry (2026)

Mobile payments are transforming nearly every industry:

Retail:

Tap-to-pay accelerates checkout and reduces lines.

Restaurants & Cafés:

QR ordering + mobile wallets = faster turnover.

Salons & Spas:

Text-to-pay and pre-visit payments reduce wait times.

Contractors & Field Services:

Accept credit card payments on phone at job sites.

Healthcare:

Text invoicing and mobile forms simplify patient payments.

Consulting & Coaching:

Virtual terminals and payment links for remote clients.

Security & Compliance in Mobile Payments

Mobile payments are among the safest payment methods due to:

1. Tokenization

Card numbers are replaced with secure tokens.

2. Encryption

Data is encrypted from device to processor.

3. Biometric Authentication

Face ID and fingerprint scanning prevent misuse.

4. PCI DSS Compliance

Certified processors ensure security standards are met.

5. AI Fraud Prevention

Real-time behavioral monitoring catches suspicious activity.

With these protections, mobile payments offer enhanced security compared to traditional card swipes.

2026 Mobile Payment Trends Shaping the Industry

⭐ 1. Tap-to-Pay on Android for Merchants

Phone-as-terminal technology is exploding in the U.S.

⭐ 2. QR + NFC Hybrid Payment Experiences

Retailers now combine QR and NFC for choice and convenience.

⭐ 3. Wallet-First Commerce

Apple Pay and Google Pay dominate mobile transactions.

⭐ 4. Instant Payouts & Real-Time Settlement

Merchants want funds faster—with fewer delays.

⭐ 5. AI-Powered Security

Machine learning helps reduce fraud and false declines.

⭐ 6. Mobile Checkout in E-Commerce

One-click mobile checkout drives conversions.

How to Choose the Right Mobile Payment Solution

Evaluate:

- Payment types supported

- Hardware needs

- Android/iOS compatibility

- Fees & pricing

- Reporting tools

- Integration with POS or CRM

- Security certifications

- Offline mode availability

Businesses wanting a unified ecosystem choose Valor PayTech for mobile, online, and in-store payments.

The Future of Mobile Payments in the U.S.

Mobile payments will continue to dominate as customers prefer:

✔ Speed

✔ Convenience

✔ Digital wallets

✔ Frictionless experiences

Mobile commerce and contactless payments will become the primary way Americans pay—both online and offline.

Conclusion

Mobile payments aren’t just a modern convenience – they’re a business essential. Whether your business uses mobile POS terminals, text-to-pay solutions, QR codes, digital wallets, or in-app payments, offering mobile checkout options improves customer experience, speeds up service, and increases revenue.

With flexible tools like Valor PayTech’s mobile POS, NFC-enabled hardware, and Pay-By-Link, U.S. businesses can take payments anywhere – securely and instantly.

FAQ

1. What are mobile payments and how do they work?

Mobile payments use smartphones or wearables to complete secure transactions via NFC, QR, or payment links.

Are mobile payments safe?

Yes. Tokenization, encryption, biometrics, and PCI-compliant systems make mobile payments extremely secure.

3. What do I need to start accepting mobile payments?

A payment processor, mobile POS device or app, and NFC/QR-enabled tools.

4. Can I accept mobile payments without a physical store?

Yes—use Pay-By-Link, mobile readers, text payments, or virtual terminals.

5. What’s the best mobile payment app for small businesses?

Valor PayTech, Square POS, PayPal Zettle, and Stripe offer leading mobile apps for U.S. SMBs.

6. How do I enable NFC payments on my phone?

Android users can activate NFC in phone settings. Apple devices support NFC by default.

7. What’s the best mobile payment app for small businesses?

It depends on your needs, but apps like Valor PayTech, Square, and PayPal offer excellent features like invoicing, analytics, and mobile POS compatibility.

8. How do I integrate mobile payments into my e-commerce site?

You can use APIs or payment gateways like Stripe, Valor Pay, or Shopify Payments to add mobile-friendly options like Apple Pay or Google Pay to your checkout page.

9. Which mobile payment options are best for New York retailers?

Popular options include Valor PayTech, Square, and Apple Pay. Ensure the processor is compatible with New York sales tax and compliance regulations.

10. Are mobile payments secure for online transactions?

Yes. Look for solutions offering PCI DSS compliance, tokenization, and real-time fraud detection—like Valor PayTech’s platform with secure API and virtual terminal support.

Ready to get started?

Become a Partner Today!

Complete the form below.